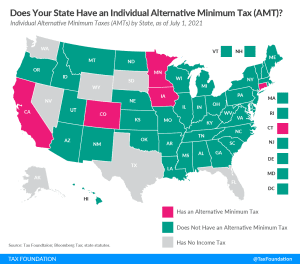

Does Your State Have an Individual Alternative Minimum Tax (AMT)?

The original goal of AMTs—to prevent deductions from eliminating income tax liability altogether—can be accomplished best by simplifying the existing tax structure, not by creating an alternative tax which adds complexity and lacks transparency and neutrality.

2 min read