Second only to property taxes and tied with individual income taxes, sales taxes are one of the largest sources of state and local taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. revenue, accounting for 23.5 percent of total U.S. state and local tax collections in fiscal year 2015 (the latest data available; see Facts and Figures Table 8).

While most states levy a statewide sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. and allow the collection of separate sales taxes at the local level, four states levy neither a state nor a local sales tax: Delaware, Montana, New Hampshire, and Oregon (see Facts and Figures Table 19). Meanwhile, eight states levy a sales tax at the state, but not the local, level: Connecticut, Indiana, Kentucky, Maine, Maryland, Massachusetts, Michigan, and Rhode Island. Alaska is the only state that collects local, but not state, sales taxes.

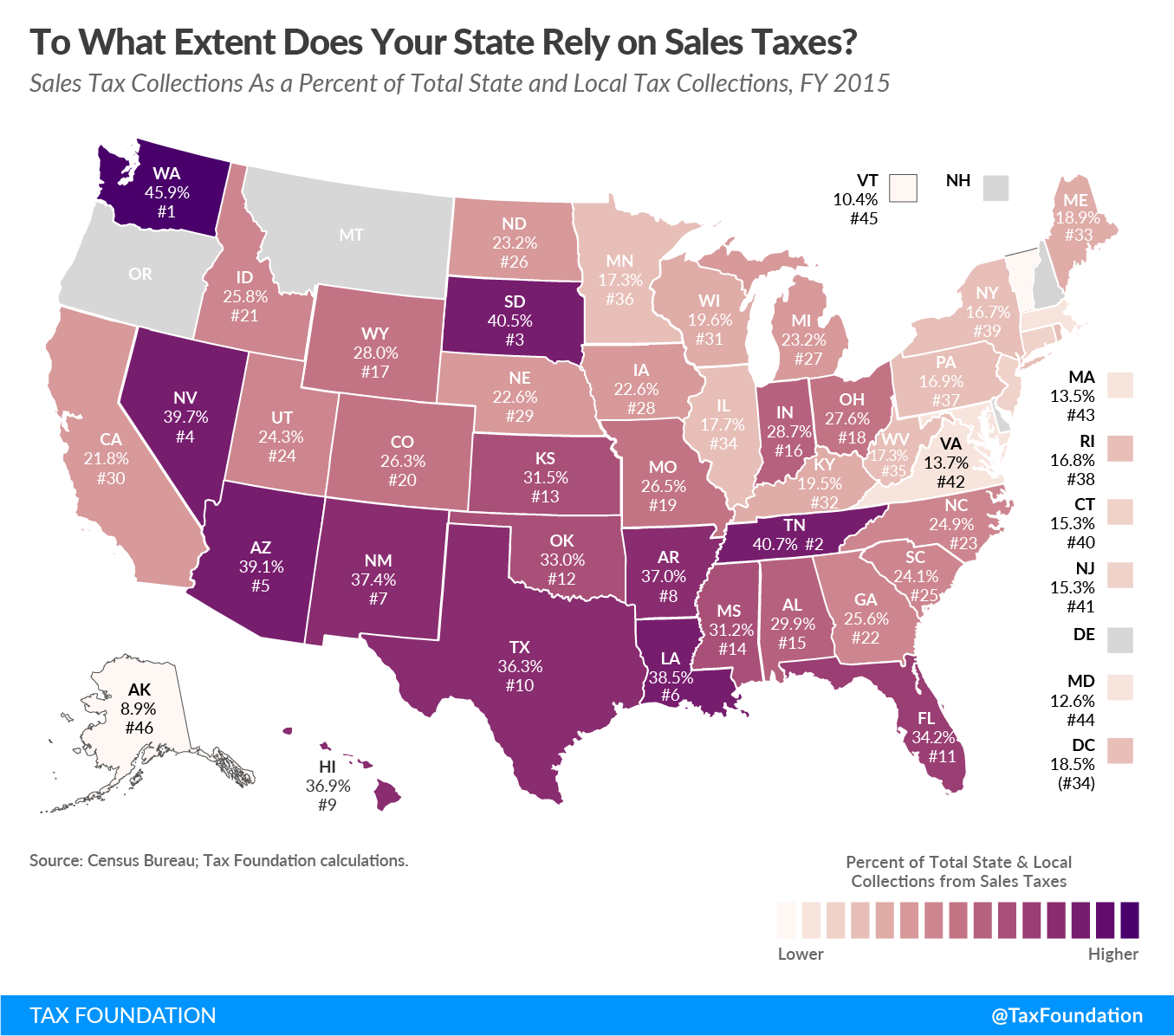

Today’s map highlights the extent to which sales taxes are responsible for tax revenue generation in each state. Washington – lacking both a corporate and an individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. but levying the harmful gross receipts taxA gross receipts tax, also known as a turnover tax, is applied to a company’s gross sales, without deductions for a firm’s business expenses, like costs of goods sold and compensation. Unlike a sales tax, a gross receipts tax is assessed on businesses and apply to business-to-business transactions in addition to final consumer purchases, leading to tax pyramiding. on businesses – relies the most on sales tax revenue, which accounts for 45.9 percent of total tax collections. Tennessee, which does not tax wage income and is currently phasing out its tax on investment income, has the second highest reliance on sales taxes (40.7 percent of state and local tax collections). South Dakota is the third most reliant on sales tax revenue, with 40.5 percent of tax collections attributable to sales taxes. (South Dakota does not collect individual or corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. es.)

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeSales tax reliance by states can be bounded by many factors. States that border low-sales tax or no-sales tax jurisdictions often struggle to levy high rates lest consumers shop across the border.

Another consideration is the tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. : the transactions that are subject to the sales tax. Public finance experts generally argue that a sales tax should apply to all final consumption, including goods and services. However, in practice, many states fall short of this ideal due to historical accident or willful exemption of certain classes of goods for political reasons.

One thing to look out for in the near future is how the application of the U.S. Supreme Court’s recent decision in South Dakota v. WayfairSouth Dakota v. Wayfair was a 2018 U.S. Supreme Court decision eliminating the requirement that a seller have physical presence in the taxing state to be able to collect and remit sales taxes to that state. It expanded states’ abilities to collect sales taxes from e-commerce and other remote transactions. will impact state reliance on sales taxes. The Court’s decision that states may subject online purchases to sales tax will have a broadening effect on state sales tax bases and could increase their attractiveness. Still, some significant base-narrowers exist in many states, as lawmakers continue to carve out exemptions for groceries, prescription medications, and other purchases. The best solution to maintain a sales tax that acts as a robust collector of funds for government services continues to be to tax all final consumption at one low rate.

Note: This is the first in a four-part map series in which we will examine the primary sources of state and local tax collections.