The Family Security Act, recently proposed by Sen. Mitt Romney (R-UT), would replace the Child Tax Credit (CTC) with a monthly child allowance administered by the Social Security Administration, making the benefit more generous and accessible to low-income households without earned income. The goal of the proposal is to reduce child poverty while simplifying existing social benefits provided through the taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. code. When evaluating this proposal, policymakers should consider both the change in benefits and the impact on marginal tax rates, which measures the tax rate faced by workers when earning an additional dollar of income.

Romney’s proposal would also reform the Earned Income Tax Credit (EITC) by simplifying dependent-related benefits, providing $1,000 to single filers and $2,000 for joint filers, with an additional $1,000 for filers with dependents. The EITC under current law provides benefits based on income level and number of dependents, creating complexity in the tax code. The EITC’s phase-in and phaseout rates are also reduced compared to current law.

The proposal eliminates the Child and Dependent Care Credit (CDCTC), head of household filing status, and deduction for state and local taxes (SALT). Beyond the tax code, Temporary Aid for Needy Families (TANF) is also repealed.

While it is important to consider changes in benefits for households under the proposal, it is also important to evaluate how the proposal will change the marginal tax rates for labor income compared to current law. Marginal tax rates show the effective tax rate applied to earning one more dollar of income, and they can differ from the statutory tax rate. Examining marginal rates can show the incentives workers face and how policies influence overall labor supply.

Marginal tax rates are driven by the graduated income tax schedule, payroll taxA payroll tax is a tax paid on the wages and salaries of employees to finance social insurance programs like Social Security, Medicare, and unemployment insurance. Payroll taxes are social insurance taxes that comprise 24.8 percent of combined federal, state, and local government revenue, the second largest source of that combined tax revenue. rates, and refundable tax credits like the CTC and EITC. Both credits phase in and phase out over a range of income, which helps minimize large spikes in marginal tax rates. However, it also creates multiple points where marginal rates change dramatically as income rises. By examining marginal tax rates, we can see how the tax code will treat an additional dollar of earned income under the Family Security Act compared to current law.

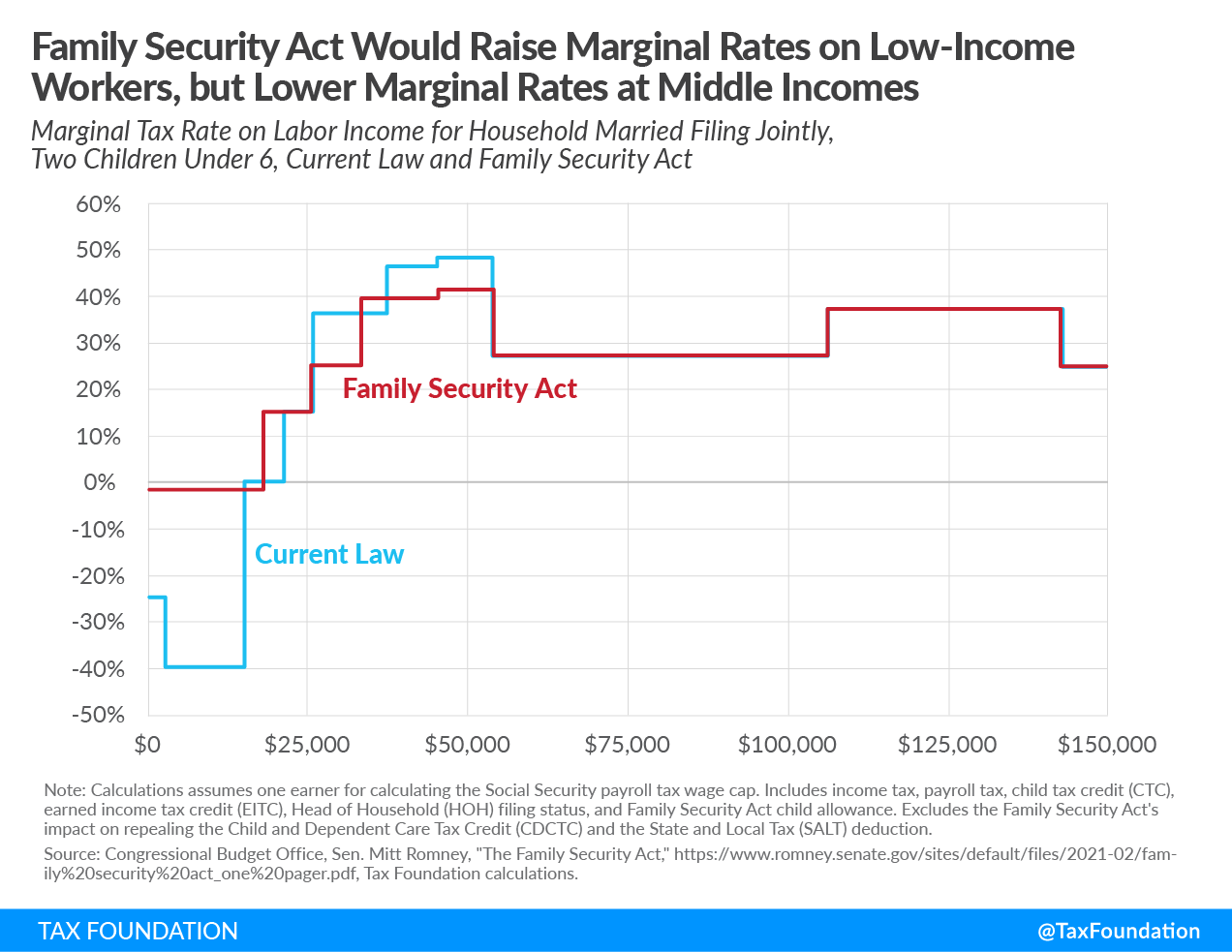

Take, for example, a married household filing jointly with two children under the age of 6. At low levels of income, households would see a comparative increase in marginal tax rates under the proposal because the child allowance is no longer phasing in as income is earned and the EITC phases in and out at a slower rate (see Figure 1).

At higher levels of income, the Family Security Act tends to apply lower marginal rates for this household, as the reformed EITC has a lower phaseout rate. The more generous CTC phases out over a longer range of income beginning above $400,000, creating a 5 percentage-point increase in the marginal tax rateThe marginal tax rate is the amount of additional tax paid for every additional dollar earned as income. The average tax rate is the total tax paid divided by total income earned. A 10 percent marginal tax rate means that 10 cents of every next dollar earned would be taken as tax. .

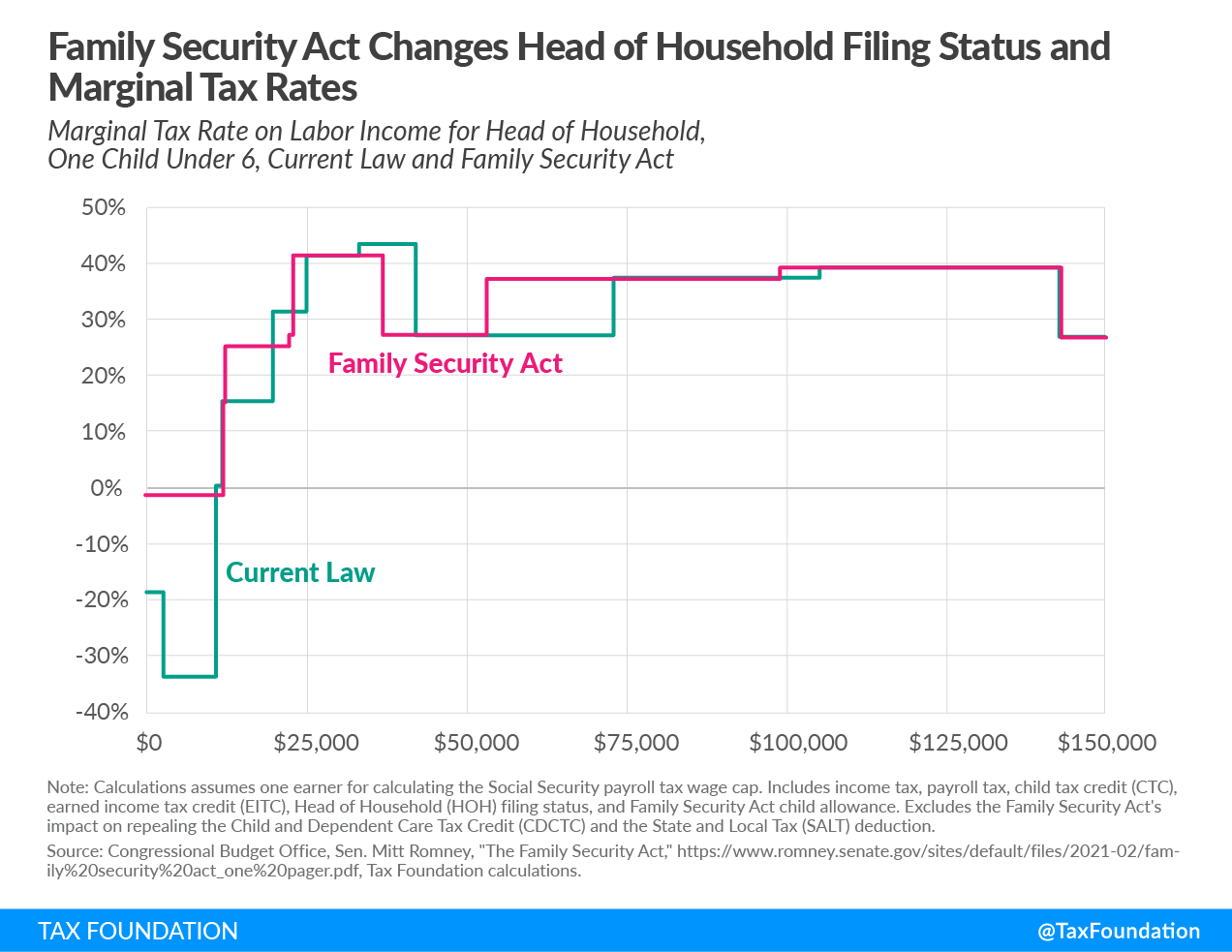

The proposal eliminates the head of household filing status, which impacts marginal tax rates for households that would normally use that filing status. Instead, filers would file as single, using a rate schedule that raises statutory rates at lower levels of income compared to the head of household rate schedule (see Figure 2).

Part of the loss of head of household filing status is offset by the changes to the EITC at lower levels of income, while those earning over $53,000 will see higher marginal tax rates than under current law until about $105,000 in income.

For both joint filers and heads of household with children, the biggest change in marginal tax rates occurs at low levels of income. This is because the child allowance does not phase in with income, and the EITC phase-in rate is lower. The increase in marginal rates at the bottom of the income spectrum is one reason why some argue that the Romney proposal could reduce work incentives, though the magnitude of the effect is debated by scholars and policy experts.

While much of the attention has been on the proposal’s child allowance and how it would boost benefits, marginal rates on labor income should also be considered as they impact incentives to enter and stay in the workforce and increase labor supply at different levels of income. These are among the several trade-offs policymakers should consider when changing social policy in the tax code.

Share this article