Key Findings

- The Trump administration and Republican lawmakers are exploring proposals to index capital gains to inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. .

- Under a proposal to index capital gains, a portion of gains would be exempt from taxation.

- According to the TaxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. Foundation General Equilibrium Model, indexing capital gains to inflation would increase the long-run size of the economy by 0.11 percent. Wages would be 0.08 percent higher, the capital stock would be 0.26 percent larger, and there would be an additional 21,800 full-time equivalent jobs.

- Indexing capital gains to inflation would reduce federal revenue by $178 billion over the next decade on a conventional basis. Additional economic growth will offset some of that cost, leading to a net dynamic revenue loss of $148 billion over the next decade.

- Indexing capital gains to inflation would increase after-tax incomes by 0.2 percent on average for all taxpayers while making the tax code slightly less progressive overall. The largest increase in after-tax incomeAfter-tax income is the net amount of income available to invest, save, or consume after federal, state, and withholding taxes have been applied—your disposable income. Companies and, to a lesser extent, individuals, make economic decisions in light of how they can best maximize their earnings. would go to the top 1 percent with an increase of 0.83 percent.

- On a dynamic basis, after-tax incomes for all taxpayers would increase by at least 0.14 percent due to the larger economy in the long run.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeIntroduction

Republican lawmakers and the Trump administration have reintroduced the idea of adjusting the basis of capital gains to inflation. The Trump administration is exploring ways to enact capital gains indexing through executive order, but they have not outlined how they would structure the policy. Recently, Senators Ted Cruz (R-TX) and James Inhofe (R-OK) have introduced legislation that would index certain capital gains to inflation.[1]

Proposals to index capital gains can vary, but generally they allow individuals to gross up the basis of their assets when calculating their capital gains to account for changes in the price level over time. For example, if an individual purchased an asset for $100 in January 1, 2000 and sold that asset for $200 on July 1, 2018, the nominal capital gain would be $100. However, inflation over that period increased the price level by 49 percent. Under an indexing proposal, the individual would be able to gross up the basis of $100 by the total inflation during that period to $149. As a result, the individual would only be taxed on $51 instead of the full $100.

| Current Law | Indexing | |

|---|---|---|

| Purchase Price | $100 | $100 |

| Basis Adjustment | N/A | 1.49 |

| Adjusted Basis | N/A | $149 |

| Sale Price | $200 | $200 |

| Capital Gain | $100 | $51 |

| Tax (20%) | $20.00 | $10.20 |

Economic Impact

According to the Tax Foundation General Equilibrium Model,[2] indexing capital gains to inflation would increase the long-run size of the economy by 0.11 percent, which is equivalent to about $22 billion in 2018. This provision would primarily boost output by reducing the service price of capital, which would increase the incentive to invest in the United States. We estimate that the service price of capital would be 0.15 percent lower under this proposal. The capital stock would be 0.26 percent larger and the larger capital stock would boost labor productivity leading to 0.08 percent higher wages.

|

Source: Tax Foundation General Equilibrium Model, March 2018 |

|

| Gross Domestic Product (GDP) | +0.11% |

| Wages | +0.08% |

| Capital Stock | +0.26% |

| Full-Time Equivalent Jobs | 21,800 |

| Service Price of Capital | -0.15% |

The economic impact is somewhat modest for three reasons. First, it is true that a capital gains taxA capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate income taxes, frequently resulting in double taxation. These taxes create a bias against saving, leading to a lower level of national income by encouraging present consumption over investment. cut reduces the cost of capital and will create an additional incentive to invest in the United States. However, the incentive is provided to U.S. savers, not firms. The distinction is important because the business income tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. is different than that of the tax base for individual capital income. In addition, a portion of U.S. savers do not face the capital gains tax at all because they hold their assets in retirement accounts such as Roth IRAs and 401(k)s.[3]

Second, it is unlikely that a large realization of locked-up gains will have any meaningful impact on long-run growth. It is true that indexation will create a large incentive to realize gains, freeing up capital. However, the current pool of saving available to businesses is not limited to domestic saving and is large.[4] Companies that want to pursue projects can readily borrow from lenders both inside and outside of the United States. It is unlikely financial constraints are preventing profitable projects from being pursued by firms.

Lastly, the effective capital gains tax rate is already relatively low compared to the effective tax rate on other sources of capital income such as dividends and interest. This is mainly because individuals can delay realizing their capital gains, which reduces the present value of the tax burden.

Revenue Impact

We estimate that indexing capital gains to inflation would reduce federal revenue by $177.9 billion over the next decade on a conventional basis. The revenue loss would be relatively small in the first few years. This is due to the strong realization effect when the effective tax rate on capital gains is reduced and individuals sell capital assets. In the first year, we estimate that indexing will only reduce revenue by $4.5 billion. In later years of the budget window the realization effect declines, but still remains strong, and the cost increases to more than $20 billion each year.

On a dynamic basis, the revenue loss would be slightly lower at $148.3 billion over the next ten years. The increase in output due to the lower cost of capital would boost incomes, which would boost payroll revenue and slightly offset individual income tax revenue losses. However, the total dynamic feedback would be modest at $29.6 billion.

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2019-2028 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

|

Source: Tax Foundation General Equilibrium Model, March 2018 |

|||||||||||

| Conventional Estimate | -$4.5 | -$8.7 | -$12.4 | -$16.3 | -$20.7 | -$21.5 | -$22.6 | -$22.3 | -$23.6 | -$25.2 | -$177.9 |

| Dynamic Revenue | $0.5 | $1.0 | $1.5 | $2.1 | $2.6 | $3.2 | $3.5 | $4.5 | $5.3 | $5.5 | $29.6 |

| Total Dynamic Revenue Estimate | -$4.0 | -$7.7 | -$10.9 | -$14.3 | -$18.1 | -$18.3 | -$19.1 | -$17.7 | -$18.3 | -$19.7 | -$148.3 |

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeDistributional Impact

Indexing capital gains to inflation would make the federal tax code less progressive. On average, taxpayers would see an increase in after-tax income of 0.21 percent on a conventional basis. Taxpayers in the bottom four quintiles would see the smallest increase in after-tax income of between 0.02 and 0.04 percent. In contrast, taxpayers in the top 1 percent would see the largest increase in after-tax income of 0.83 percent.

On a dynamic basis, all taxpayers would see slightly larger increases in after-tax income due to the slightly larger economy. The boost in after-tax income for taxpayers in every income group would be roughly 0.33 percent on average. Across all income groups, after-tax incomes would increase by at least 0.14 percent.

| Percent Change in After-Tax Income | ||

|---|---|---|

|

Source: Tax Foundation General Equilibrium Model, March 2018 |

||

| 0% to 20% | 0.03% | 0.15% |

| 20% to 40% | 0.02% | 0.14% |

| 40% to 60% | 0.04% | 0.16% |

| 60% to 80% | 0.04% | 0.16% |

| 80% to 90% | 0.05% | 0.17% |

| 90% to 95% | 0.09% | 0.21% |

| 95% to 99% | 0.19% | 0.31% |

| 99% to 100% | 0.83% | 0.95% |

| TOTAL | 0.21% | 0.33% |

Conclusion

The Trump administration and lawmakers in Congress are considering proposals to index the basis of capital gains to inflation. We estimate that if this proposal were enacted, long-run GDP would increase by 0.11 percent, boosting wages by 0.08 percent and increasing the capital stock by 0.26 percent. On a conventional basis, revenue would decline by $178 billion between 2019 and 2028 and would decline by $148 billion over the same period when accounting for the slightly larger economy. Indexing capital gains would result in a 0.2 percent increase in after-tax income on a conventional basis and 0.33 percent on a dynamic basis, on average, while making the tax code less progressive overall.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeMethodology

We use the Tax Foundation General Equilibrium Tax Model[5] to estimate the impact of tax policies. The model can produce both conventional and dynamic revenue estimates of tax policy. The model can also produce estimates of how policies impact measures of economic performance such as GDP, wages, employment, the capital stock, investment, consumption, saving, and the trade deficit. Lastly, it can produce estimates of how different tax policy impacts the distribution of the federal tax burden.

Policy Assumptions

In modeling this policy, we assumed that the law would allow individuals to adjust the basis of all capital gains reported on Schedule D for inflation. We also assumed that this provision would apply both retroactively and prospectively, meaning that assets purchased before and after the passage of this law would benefit from the inflation adjustment. Gains would be indexed to inflation, but nominal losses would not be. We assume that, consistent with Senator Cruz’s proposal, capital gains would be indexed to the GDP price deflator.[6]

Revenue Estimation

To estimate the revenue impact of indexing capital gains on inflation we used Internal Revenue Service (IRS) data to impute holding periods.[7] According to 2012 IRS data on reported capital gains, the average holding period (weighted by gains) was approximately ten years in 2012. Using the GDP deflator, we estimated that about 33 percent of capital gains would be exempt from taxation under this proposal.

Impact on Realizations

Capital gains are only taxed upon realization. As such, individuals can choose when to realize and pay the tax. Individuals’ realizations behavior tends to be very sensitive to the rate of tax and previous research suggests the individuals respond significantly to changes in capital gains taxation. According to the Joint Committee on Taxation, the elasticity of realizations to the tax rate is high.[8] They estimate that in the short run the elasticity is as high as -1.1 and in the long run as high as -0.7. This means that for a 1 percent increase in the tax rate on capital gains, realizations fall by between 0.7 percent and 1.1 percent. In our estimate, we assume that the elasticity is -1.1 in the first year and increases by 0.1 each year until it hits the long-run elasticity of -0.7.

Economic effect

The taxation of capital gains impacts long-run output by reducing the after-tax rate of return on investment. For corporate investments, the individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. on capital gains represents a second layer of tax on corporate equity investment. Taxable shareholders first face the corporate income tax on their investments and then the capital gains tax when they sell their share for a gain. The higher overall tax burden due to the capital gains tax increases the required rate of return for investments. Marginal investments, those that may just break even after tax, are less likely to be pursued, leading to smaller overall capital stock.

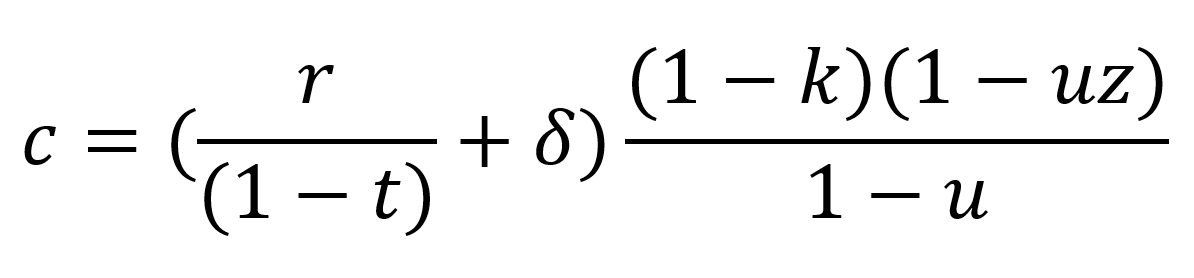

We estimate the impact of the capital gains tax with service price of capital. This measures what the pretax rate of return needs to be on a given investment to satisfy investors, after all taxes are paid. A corporate investment for which the shareholder faces the individual income tax can be written as:

where c is the service price of capital, r is the discount rate, δ is the rate of physical depreciation on the asset, k is an investment tax credit, z is the present value of the depreciationDepreciation is a measurement of the “useful life” of a business asset, such as machinery or a factory, to determine the multiyear period over which the cost of that asset can be deducted from taxable income. Instead of allowing businesses to deduct the cost of investments immediately (i.e., full expensing), depreciation requires deductions to be taken over time, reducing their value and discouraging investment. deduction on one dollar’s investment, and u is the corporate tax rate and t is the individual income tax rate on corporate income (dividends and capital gains). r, or the expected pretax rate of return for an investor, is grossed up by the individual income tax on corporate income: r / (1-t). This represents the fact that the pretax rate of return needs to be higher in the presence of a capital gains tax in order for the investor to receive an after-tax return sufficient to justify an investment.

In calculating the effective capital gains tax rate under current law and under indexing, we assume an average holding period of ten years, a real return of 7 percent, and an expected inflation rate of 2 percent. We assume that the GDP deflator grows roughly in line with expected inflation and fully offsets inflation. This implies that indexing reduces the effective tax rate by about 12 percent.

Modeling Uncertainty

There is a degree of uncertainty in our economic and revenue estimates. Our revenue estimates are based on the most up-to-date data on capital gains holding periods from the IRS (2012). Holding periods from 2012 tax returns may not reflect what they are like today or may be in the future. This is especially the case for 2012 when the Bush tax cuts were scheduled to expire and increase the capital gains tax rate to 20 percent. This policy cliff likely accelerated realizations in 2012 and resulted in shorter holding periods than normal. If we assumed longer holding periods, the revenue loss would have been greater.

The economic and revenue impact also depends a great deal on the specifics of the policy and how taxpayers react. Our estimate assumes that capital gains would be indexed to the GDP deflator. However, other measures of inflation could result in a smaller or larger revenue loss. The revenue loss could also be larger or smaller depending on which assets are included and how losses are treated. The revenue loss would also be smaller if the proposal only impacted assets purchased after enactment, rather than all assets.[9] Our estimate assumes taxpayers respond to the lower capital gains tax rate by realizing more gains, offsetting much of the cost. But if taxpayers respond differently than what we expect then the revenue loss may be more or less than we estimate.

The economic projections assume that the policy is permanent, and taxpayers expect it to be permanent. It is possible that if this policy were enacted through regulation, rather than legislation, it would introduce policy uncertainty that would reduce the positive economic impact. Individuals may expect that a future administration could quickly reverse this policy as easily as the policy was enacted. We also assumed that the marginal investor is a weighted average of taxable and nontaxable shareholders. If we assumed that the marginal investor is fully taxable the economic effect would be slightly larger.

Lastly, other estimates of indexing capital gains to inflation assume that there is a limited amount of saving available to the United States to fund new investment opportunities when taxes on investment are reduced, and that when the federal budget deficit increases, the amount of available saving for private investment is “crowded out” by government borrowing, which reduces the long-run size of the U.S. economy. While past empirical work has found evidence of crowd-out, the estimated impact is usually small. Furthermore, global savings remains high, which may explain why interest rates remain low despite rising budget deficits. We assume that global saving is available to assist in the expansion of U.S. investment, and that a modest deficit increase will not meaningfully crowd out private investment in the United States.

Notes

[1] S.2688 – Capital Gains Inflation Relief Act of 2018, https://www.congress.gov/bill/115th-congress/senate-bill/2688.

[2] Stephen J. Entin, Huaqun Li, and Kyle Pomerleau, “Overview of the Tax Foundation’s General Equilibrium Model: April 2018 Update,” Tax Foundation, /wp-content/uploads/2018/04/TaxFoundaton_General-Equilibrium-Model-Overview1.pdf.

[3] According to Federal Reserve Data, approximately 55 percent of the U.S. capital stock is owned by foreigners or U.S. savers with assets in retirement accounts. See Huaqun Li, “Measuring Marginal Tax Rates on Capital Assets,” Tax Foundation, Dec. 12, 2017, https://taxfoundation.org/measuring-marginal-tax-rate-capital-assets/.

[4] According to World Bank Data, global gross domestic saving was approximately 25 percent of world GDP in 2015 or $20 trillion.

[5] Stephen J. Entin, Huaqun Li, and Kyle Pomerleau, “Overview of the Tax Foundation’s General Equilibrium Model: April 2018 Update.”

[6] S. 2688 – Capital Gains Inflation Relief Act of 2018.

[7] Internal Revenue Service, “Statistics of Income Tax Stats, Short-term and Long-term Capital Asset Transactions; Asset Type and Length of Time Held;” 2012, https://www.irs.gov/statistics/soi-tax-stats-sales-of-capital-assets-reported-on-individual-tax-returns.

[8] Joint Committee on Taxation, “Explanation of Methodology Used To Estimate Proposals Affecting The Taxation Of Income From Capital Gains,” March 27, 1990, https://www.jct.gov/publications.html?func=startdown&id=3157.

[9] Ibid. One estimate implies that this would reduce the cost by about 50 percent without impacting the economic benefit.

Share this article