Table of Contents

Key Findings

- TaxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. preferences for research and development (R&D) spending and income earned from patented innovations are common among countries in the Organisation for Economic Co-Operation and Development (OECD).

- Tax policies can reduce the tax cost of investing in innovative activities by providing special deductions, tax credits for R&D expenses, or setting a lower tax rate on income from patented innovations.

- Among the 37 OECD countries, 20 have special deduction rules for R&D costs, 18 have an R&D tax creditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income rather than the taxpayer’s tax bill directly. , and 19 have a patent boxA patent box—also referred to as intellectual property (IP) regime—taxes business income earned from IP at a rate below the statutory corporate income tax rate, aiming to encourage local research and development. Many patent boxes around the world have undergone substantial reforms due to profit shifting concerns. .

- Only Estonia and Sweden do not have any of the three tax preferences and instead have competitive and broadly neutral approaches to taxing business income.

- Tax preferences for innovation are non-neutral and can be complex to comply with and administer; policymakers should instead opt for broadly neutral tax policies in the context of a general environment that is supportive of innovation.

Introduction

Despite the coronavirus pandemic’s immense health and economic challenges, the crisis has also revealed the incredible value of innovation. The speed at which multiple vaccines have been developed using novel technologies has been astounding. Tech platforms and networks have scaled up to keep people connected to jobs and education services in ways that would not have been possible even a decade ago.

Innovation is a key driver of productivity and value in the global economy. Throughout history, waves of innovations have led to significant leaps in economic growth and to higher living standards.

The fruits of innovation often lead policymakers to direct government resources to supporting research. Sometimes these efforts are housed within government agencies, and sometimes policy tools are directed to leverage research done by private companies. In 2019, average public and private research and development (R&D) spending in the 37 countries in the Organisation for Economic Co-operation and Development (OECD) was 2.4 percent of GDP.[1]

Governments regularly use tax policy to provide resources and incentives for research done by businesses. Tax policy influences business investment decisions because taxes drive a wedge between the gross and after-tax profits from an investment. Many tax systems around the world are designed to incentivize R&D spending and patented innovations by shrinking the tax wedge on investment in those products.

There is wide variation in these policies across OECD countries. Some countries have sizable tax subsidies for R&D spending, while others have designed their tax systems to support business investment in general (rather than defined types of R&D spending). Several countries, especially in Europe, have tax policies that reduce the tax rate on profits from patents, software, and other intangible assets, known as patent boxes.

The economic evidence on the value of these policies is mixed. R&D tax credits can stimulate increased R&D spending, but whether and how those policies support technological breakthroughs is less clear. They may result in companies shifting activity from one jurisdiction to another. A similar effect can be seen with patent boxes, where cross-border relocation effects have been salient in the past while impacts on innovation are smaller.

This paper surveys R&D tax policies in countries across the OECD and reviews the economic evidence of those policies. Estonia and Sweden stand out from the rest of the OECD countries because they do not provide these types of tax incentives. Instead, they have broadly neutral and competitive tax systems that allow businesses to recoup losses or deduct investment costs.

Rather than provide narrow tax subsidies for R&D or patented innovations, policymakers should design tax rules that support business investment in general.

R&D Tax Incentives for Innovation

There are three typical tax tools used to incentivize spending on R&D and develop patented innovations. Two of the incentives are tied to R&D spending by companies. These include special R&D expense deductions and tax credits based on R&D spending. The third incentive provides a tax benefit based on profits from an innovation.

Special deductions for R&D expenses allow companies to deduct more than the value of their R&D costs when calculating taxable profits.[2] An R&D tax credit can be based on the amount of R&D costs and used to reduce a company’s tax liability. Patent boxes are a profit-based tax incentive for innovations and apply a reduced corporate tax rate to profits from patents and similar intellectual property.

To understand how these three types of incentives work, it is useful to think of an example of a business that is doing R&D and profiting from patented innovations. Table 1 provides such an example. For all scenarios, the company has $5 in R&D costs which produce a patentable invention that the company then monetizes. The company has $35 in other costs. The invention leads to $50 in revenues for a $10 profit. Before calculating taxes, the company has a 20 percent profit margin.

In the first scenario, the company is in a country with a 20 percent corporate tax rate and no special incentives apply. The company would owe $2 in taxes and have an after-tax profit of $8 for a 16 percent after-tax profit margin.

In the second scenario, the company benefits from a 100 percent super-deduction for R&D costs. This means the company will be able to deduct the $5 in R&D costs twice for a total deduction of $10 and a resulting taxable profit of $5. At a 20 percent corporate tax rate, the taxes owed will be $1, leaving $9 in after-tax profit and an 18 percent after-tax profit margin.

In the third scenario, a 20 percent tax credit for R&D costs is available. The company’s tax bill of $2 as in the first scenario would be reduced by $1, which is 20 percent of the company’s R&D costs. Again, the $1 tax bill would leave $9 in after-tax profit.

In the fourth scenario, the company benefits from a patent box that allows profits from patented innovations to be taxed at half the corporate tax rate. Instead of the 20 percent rate applying to the company’s $10 in profits before tax, a 10 percent rate would apply. The company’s tax bill would be $1, leaving $9 in after-tax profit.

| Facts About the Company | |

|---|---|

| R&D Costs | $5 |

| Other Costs | $35 |

| Revenues | $50 |

| Profit before tax | $10 |

| Profit margin before tax (Profit ÷ Revenues) | 20% |

| Scenario 1: No tax preference for R&D | |

| Taxable Profit | $10 |

| Tax (Corporate rate of 20%) | $2 |

| Profit (after tax) | $8 |

| Profit margin (after tax); (Profit after tax ÷ Revenues) | 16% |

| Scenario 2: Super-deduction for R&D Costs | |

| R&D Super-deduction (100%) | $5 |

| Taxable Profit | $5 |

| Tax (Corporate rate of 20%) | $1 |

| Profit (after tax) | $9 |

| Profit margin (after tax); (Profit after tax ÷ Revenues) | 18% |

| Scenario 3: R&D Tax Credit | |

| Taxable Profit | $10 |

| Tax (Corporate rate of 20%) | $2 |

| Tax Credit (20% credit on R&D costs) | $1 |

| Profit (after tax) | $9 |

| Profit margin (after tax); (Profit after tax ÷ Revenues) | 18% |

| Scenario 4: Patent Box | |

| Taxable Profit | $10 |

| Tax (Patent Box rate of 10%) | $1 |

| Profit (after tax) | $9 |

| Profit margin (after tax); (Profit after tax ÷ Revenues) | 18% |

| Source: Author’s calculations. | |

All three policies result in the same after-tax outcome in the example, but they do not all incentivize the same behavior. The R&D super-deductionA super-deduction is a tax deduction that permits businesses to deduct more than 100 percent of their eligible expenses from their taxable income. As such, the super-deduction is effectively a subsidy for certain costs. This policy sometimes applies to capital costs or research and development (R&D) spending. and tax credit incentivize the company to do more R&D spending while the patent box incentivizes the company to produce more patentable innovations or earn more profits from patents. More patents may mean more R&D, but it could also mean patenting every possible innovation on the off chance it will be profitable.

Because companies would spend money on R&D even without tax preferences, these policies can create windfalls. Companies might receive tax benefits for spending money they would spend anyway. Similarly, if a company has already developed dozens of new technologies, but it has not yet taken the time (or incurred the costs) of patenting them, then a patent box can create a tax windfall for those preexisting innovations.[3]

Before exploring the economic evidence on the impact of these policies, it is worth looking at the various forms these tax preferences take among OECD countries.

R&D Tax Subsidies for Innovation in OECD Countries

Among the 37 OECD countries, 20 countries have special deduction rules for R&D costs, 18 have a tax credit for R&D, and 19 countries have a patent box. The policies vary in their definitions of R&D costs, deduction amounts, credit rates, and eligibility rules.[4]

Three OECD countries (Belgium, Ireland, and the UK) have versions of all three policies in their tax systems. Only Estonia and Sweden do not have any of the three policies.

Tax Preferences for R&D Expenses

Of the 20 countries with special rules for deducting R&D costs, the narrowest provision is in Canada, which simply provides immediate full deductions in the year in which costs are incurred and a one-year carryforward of unused deductible expenses. The most generous provision for R&D deductions is in Lithuania, which allows companies to deduct 300 percent of eligible R&D expenses.

For the 18 OECD countries with R&D tax credits, the most generous credit rate is in Australia.

Companies in Australia with less than AUD $20 million (USD $13.8 million) in total revenue can qualify for a 43.5 percent refundable tax credit for eligible expenses. Refundable tax credits can be paid out to taxpayers if the credit amount exceeds total tax liability. Larger companies in Australia with revenues above the AUD $20 million threshold are eligible for a 38.5 percent non-refundable tax creditA refundable tax credit can be used to generate a federal tax refund larger than the amount of tax paid throughout the year. In other words, a refundable tax credit creates the possibility of a negative federal tax liability. An example of a refundable tax credit is the Earned Income Tax Credit (EITC). . Both the refundable and non-refundable credits are applicable to a maximum of AUD $100 million (USD $69 million) per R&D entity.

The least generous credit rate among OECD countries with R&D tax credits is in the United Kingdom, which provides a 13 percent tax credit on qualifying R&D spending.

Countries have different definitions of eligible expenses and uses for tax credits. Germany’s 25 percent tax credit only applies to salaries and wages associated with R&D. In Ireland, companies can choose to pay out R&D tax credits to certain employees involved in R&D rather than offsetting a company’s corporate tax bill.

In some countries, expenses are only eligible for special tax treatment if a business is located in a special geographic tax zone or investing in certain technologies. For example, the costs of research in the Jeju Science Park in South Korea are eligible for a 30 percent tax credit and 100 percent deduction for foreign investment costs. Japan provides both a 30 percent additional depreciation rate for fixed assets and a 15 percent tax credit for acquisition costs of 5G telecommunication facilities.

Additionally, five countries only apply R&D tax benefits to incremental R&D expenses. If a company spent $1,000 on R&D in 2020 and will spend $1,200 in 2021, only the additional $200 would qualify for an incremental credit. This design is meant to incentivize companies to continually increase their focus on R&D rather than gain tax benefits without increasing R&D spending. The countries that target incremental R&D expenses include the Czech Republic, Mexico, Portugal, Spain, and the United States.

For example, Mexico’s 30 percent R&D tax credit only applies to incremental investments and expenditures relative to the average eligible spending over the prior three years. The R&D tax credit in the United States is also based on incremental R&D spending relative to a historic period (generally 1984-1988) or above an average amount of R&D spending.

Applying tax credits to incremental spending helps to alleviate the windfall effect of providing benefits to businesses for R&D spending they would be making regardless of a tax preference.

Measuring Tax Subsidies for R&D Spending

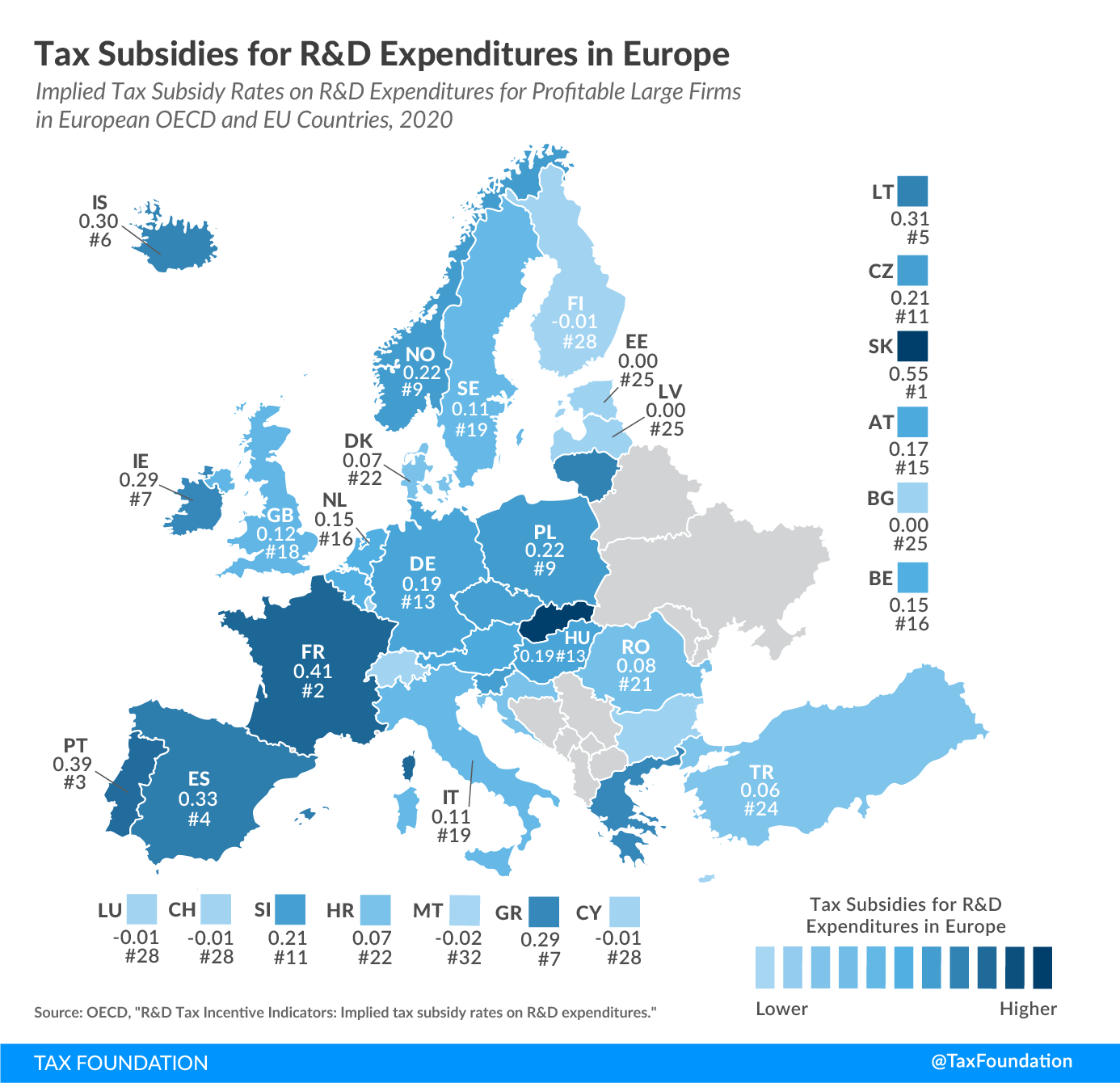

The OECD measures the tax benefits of policies like special deductions and tax credits for R&D spending. They calculate the implied tax subsidy rates on R&D spending for profitable and loss-making firms and for large and small firms. This measure captures the value of preferential tax treatment of R&D by modelling the tax benefits for certain types of companies.[5]

Countries that allow immediate deduction of R&D costs but no other tax benefits will see a value of 0. However, the larger the specific tax subsidy, the higher the implied tax subsidy rate. If the implied tax subsidy rate is 0.5, that means that additional R&D spending receives a 50 percent tax benefit relative to immediate deduction of R&D costs.

According to this measure, among countries with R&D preferences, the most generous R&D tax benefits for large firms are in the Slovak Republic (0.55 for profitable firms, 0.43 for loss-making) while the least generous provisions for large firms are in Korea (0.02 for profitable and loss-making firms).

When it comes to small firms, Colombia (0.68 for profitable firms, 0.51 for loss-making) provides the most generous support while Mexico (0.06 for profitable firms, 0.05 for loss-making) provides the least generous support among countries with tax preferences for R&D spending.

| OECD Average | Most Generous | Least Generous | |

|---|---|---|---|

| Large, profitable firms | 0.17 | Slovak Republic, 0.55 | South Korea, 0.02 |

| Large, loss-making firms | 0.14 | Slovak Republic, 0.43 | South Korea, 0.02 |

| Small, profitable firms | 0.21 | Colombia, 0.68 | Mexico, 0.06 |

| Small, loss-making firms | 0.18 | Colombia, 0.51 | Mexico, 0.05 |

| Source: OECD, “Implied Tax Subsidy Rates on R&D Expenditures,” 2020, https://stats.oecd.org/Index.aspx?DataSetCode=RDSUB. | |||

The OECD implied tax subsidy rate is an annual measure going back to 2003. In 2003, the average implied tax subsidy rate for large, profitable firms was 0.07.[6] In 2020, the average was 0.17, showing a general increase in tax subsidies for R&D.

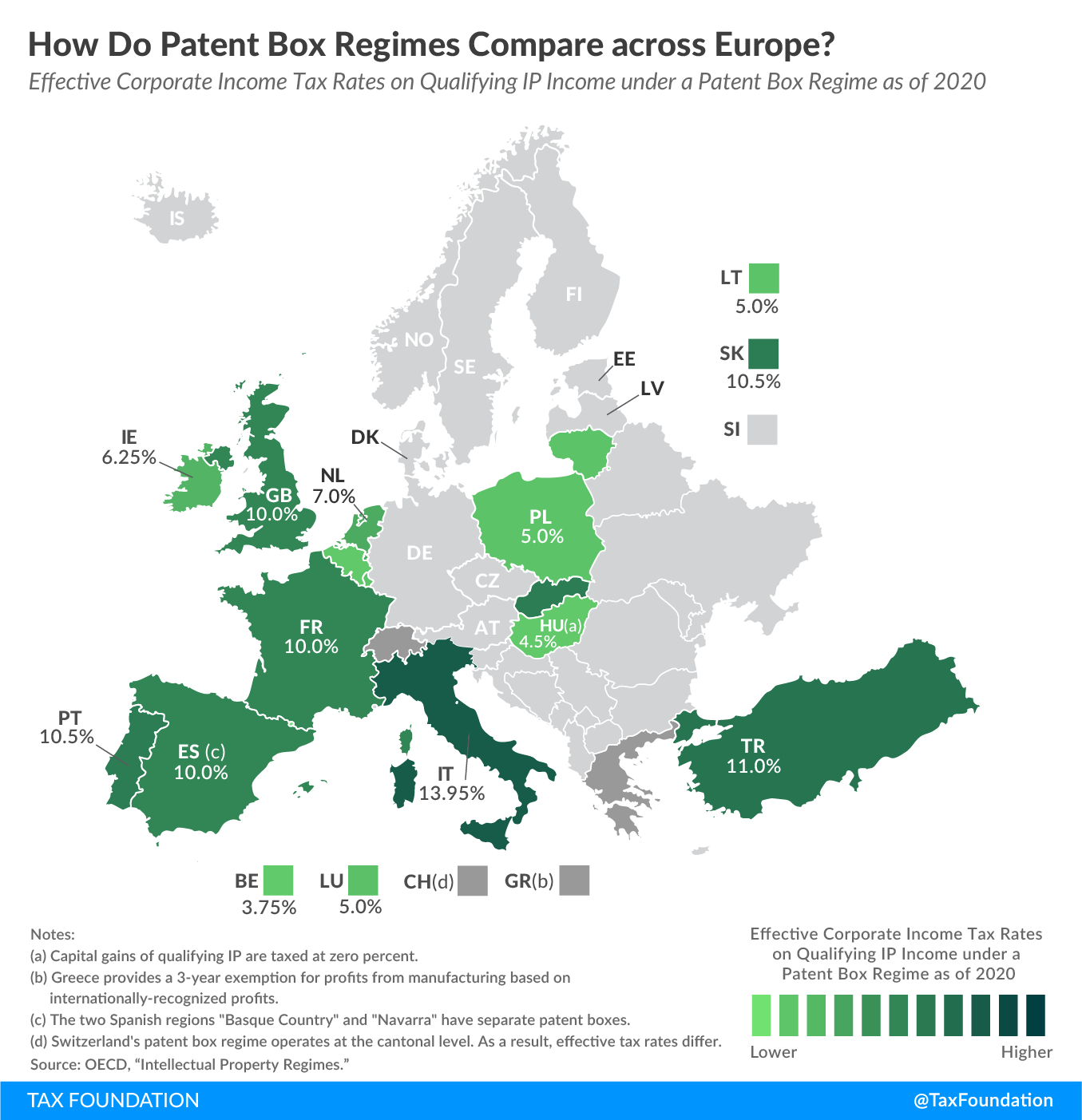

Patent Boxes in OECD Countries

Among the 37 OECD countries, 19 have a patent box scheme. Patent boxes allow income from certain types of intellectual property (IP) to be taxed at a rate lower than the main corporate tax rate. The lowest patent box rate is in Belgium, which provides an 85 percent deduction for income related to eligible IP. Because the Belgian corporate tax rate is 25 percent, the deduction results in a 3.75 percent tax rate on that income.

Although the policies are different than normal nationwide provisions, Turkey has a particularly generous 100 percent exemption from corporate tax if new technologies are developed in certain Technology Development Zones. Otherwise, a 50 percent exemption on sale or leasing of certain patents can apply, resulting in an 11 percent tax rate on that income.

The country with the highest patent box rate is Italy, which provides an exemption for 50 percent of qualifying IP income. Because the Italian combined corporate tax rate is 27.9 percent, the exemption results in a 13.95 percent rate on that income.

Countries differ in how they apply these reduced rates. In some cases, the patent box rate applies broadly to patents, software, and other types of IP, as in Ireland and Israel. In the U.S., only IP income related to sales to foreign entities qualifies for the 37.5 percent deduction which results in a 13.13 percent tax rate.

The Impacts of Tax Preferences on Innovation

Tax preferences for R&D and innovation are common around the world. The goal of these policies is for businesses to invest in research that leads to high-value innovations. By reducing the tax costs of those investments, policymakers believe that more innovations would be developed than in the absence of the policy.

While it is impossible to measure how much R&D spending or patenting activity there should be, it is clear from many studies that these tax preferences lead to more R&D spending and patenting. Measuring how much value is added to the economy due to those extra inventions or R&D activities is more difficult.

While it may seem that both higher R&D spending and more patentable innovations are desirable, it is possible that firms will simply recategorize other spending into R&D spending or seek ways to patent lots of innovations on the off chance that some of those innovations might yield profits.

A 2015 survey by economist Bettina Becker identified near unanimous agreement in studies that R&D credits lead to more R&D spending.[7] A 2019 review of R&D policies by economist Nicholas Bloom and his coauthors suggests that a 10 percent reduction in the tax cost of R&D spending translates to a 10 percent long-run increase in R&D.[8] However, they also report evidence that firms will reclassify other costs to benefit from R&D tax preferences.

Over time, higher R&D spending (partially subsidized through the tax system) can translate to valuable innovations. This is clear from a study by economist Antoine Dechezleprêtre and his coauthors from 2016.[9] Their study examined an R&D tax subsidy in the UK and found the policy led to higher spending on R&D and valuable new patents.

Patent boxes have been found to have different impacts than R&D subsidies.

Research from 2015 by economist Sebastien Bradley and his coauthors shows that patent boxes lead to a 3 percent increase in patenting activity for every 1 percentage-point reduction in the relevant tax rate.[10] They also find that the increase in patent activity is not necessarily driven by new innovations, but rather by ensuring profits from existing innovations can benefit from the reduced tax rate.

Research published in 2018 by economist Fabian Gaessler and his coauthors finds a small effect on patent activity, but that patent box legislation does not induce overall invention.[11]

More recent unpublished research from economist Ron Davies and his coauthors shows that the novelty of patent applications to the European Patent Office has been influenced by patent boxes.[12] They find that it takes time for firms to adjust to utilize patent box rates, suggesting that firms are investing in new research activities to produce innovations subject to the lower tax rates.

Cross-border Shifting and Beggar-Thy-Neighbor Effects

One curious aspect of these policies, beyond their incentives for new R&D spending or new patenting activities, is that they also influence where those activities occur. Rather than spurring new R&D activity or patenting, the policies work like beggar-thy-neighbor programs, simply influencing where innovation happens.

Recent research from economist Bodo Knoll and his coauthors finds companies that increase R&D activities in response to a new R&D tax credit in one country offset that activity with reductions in other countries.[13]

Other research published in 2014 from economist Rachel Griffith and her coauthors shows patent boxes lead companies to shift patents to jurisdictions with lower tax rates.[14] If you develop a patent in a country with a 30 percent corporate tax rate, but another country has a patent box with a 10 percent tax rate, shifting the patent to the lower tax jurisdiction makes sense.

In response to this shifting activity, particularly in view of patent boxes, countries have implemented requirements that R&D and other relevant activities occur in the same jurisdiction as the patents receiving special tax treatment. As part of the OECD’s Base Erosion and Profit ShiftingProfit shifting is when multinational companies reduce their tax burden by moving the location of their profits from high-tax countries to low-tax jurisdictions and tax havens. Project, countries have adopted the “Modified Nexus Approach for IP Regimes.”[15] Now, rather than benefiting from patent box rates regardless of where R&D activities are located, companies must have R&D activities in the same jurisdiction as where their IP is owned to benefit from patent box rates.

One study by economist Kartikeya Singh and his coauthors provides a theoretical framework for analyzing the impact of the new nexus requirements for patent boxes.[16] Their model suggests that due to the new nexus requirements, more IP would be left in high-tax jurisdictions alongside existing R&D efforts rather than relocated to low-tax jurisdictions. However, it is possible that, over time, companies could relocate R&D employees and activities from high-tax jurisdictions to the countries that have lower tax rates on IP.

A Neutral Tax Policy Approach to Business Investment

As mentioned, neither Sweden nor Estonia has special deductions or tax credits for R&D or a patent box. It is safe to say that policymakers in these countries care about innovation and R&D; however, they have taken a different approach on tax policy than other OECD countries.

Particularly in Sweden, the government provides significant funds for business R&D spending. In 2017, the Swedish government financed 0.113 percent of GDP of business R&D spending, nearly double the OECD average of 0.06 percent of GDP. The Estonian government financed 0.027 percent of GDP.

Sweden ranks highly in the amount of R&D spending per-capita among EU countries. According to 2017 data, Sweden was second among countries in Europe (behind Switzerland) with €1,615 ($1,841) in R&D spending per capita.[18]

While Estonia ranks much lower on that metric (just €213 [$242] in R&D spending per capita), the Estonian government has made clear policy choices against providing special tax preferences. Instead, Estonia has implemented the most neutral and competitive tax system among OECD countries by only taxing businesses on profits when they are distributed to shareholders.[19]

Both Estonia and Sweden have taken an approach to business taxation that other countries should consider, especially in the context of R&D and innovation.

Sweden allows business losses to be carried forward indefinitely with no limits. This means that profits from research projects with huge upfront costs (and often uncertain outcomes) will not get taxed until profits exceed those losses. This allows the business to bear the risk of that innovation without concern for a tax bill until a successful product reaches the market.

Sweden is also among just 10 OECD countries that have no limits on loss carryforwards.

Estonia essentially provides unlimited loss carryforwards as well because its corporate tax is designed to only tax profits distributed to shareholders. This means that profits can be reinvested without being taxed. Shareholders will require a return on their investment at some point, and that is when Estonia’s 20 percent corporate tax rate applies.

While governments may desire higher levels of investment that lead to innovation, it is often unclear whether a particular policy design will lead to the intended impact. As mentioned, a new patent box or R&D tax credit could simply mean that businesses relocate their research activities rather than increase overall innovation; however, the evidence shows there is some positive R&D impact of these policies.

Adopting policies like R&D tax subsidies and patent boxes come with trade-offs. There are complexities in defining eligible expenses, auditing those activities, and of course the revenue forgone through the special provisions. A report by Pamela Sommers, a professional services senior manager with Thomson Reuters, argues that in the U.S. it is “not uncommon for a company to leave 10% to 30% of its credit unclaimed due to the expense and difficulty of effectively documenting it.”[20]

This sort of compliance burden can mean that only companies that have the resources to monitor and claim R&D expenses will be the main beneficiaries. In a similar vein, the most recent data on the UK’s patent box shows large businesses claimed upwards of 90 percent of the tax relief in tax year 2017-18.[21] Comparatively, UK companies within the small and medium-sized tax subsidy scheme accounted for 28 percent of expenditures claimed for R&D tax subsidies in 2017-18.[22]

Certainly, larger companies will have more resources to commit to R&D and the legal process of patenting innovations with or without special tax preferences. But policymakers should consider whether the sort of incentive structure with these compliance costs makes special tax preferences worthwhile when a simpler, more neutral approach could also support costly and uncertain research projects.

Conclusion

Tax policy is just one tool among many to influence R&D activities and innovation. To the extent that taxes can influence investment in innovation, it is questionable whether complex benefits are the best policy approach.

The economic evidence shows that tax preferences do increase R&D spending and patenting activities. However, studies also show how these policies encourage relocation of innovative activities from one country to another, limiting the overall impact from an international perspective.

Among OECD countries, only Estonia and Sweden do not have special deductions for R&D costs, an R&D tax credit, or a patent box. However, the commonplace nature of these policies should not suggest that the approach of other countries is unquestionable.

Rather than directing resources strictly toward certain eligible R&D activities and patented innovations using tax subsidies, policymakers should adopt broadly neutral tax systems which allow investment costs to be fully deducted and losses to be carried forward without limits. At a minimum, tax policy should not be contradictory with limits on losses or other investment costs alongside subsidies for R&D spending.

The incentives for businesses to take on risks with the potential for significant profits will remain regardless of special preferences for innovative activities. Governments should create an environment that is favorable to innovation that reaches beyond tax, with support for academic institutions, basic research, and protections of rights associated with intellectual property rather than relying on preferential tax treatment.

Even in a year when the benefits of innovation are so clearly displayed by companies in industries such as pharmaceuticals and information technology, policymakers should consider replacing targeted tax preferences with a tax system that is more neutral and competitive overall.

Appendix

| Country | R&D Special Deductions | R&D Tax Credit |

|---|---|---|

| Australia | No special regime. | Refundable tax credit of 43.5% on R&D spending for firms with less than AUD 20 million in total revenue and 38.5% non-refundable tax credit for companies with at least AUD 20 million in total revenue. The tax credit is limited to the first AUD 100 million (AUD 150 million as of July 1, 2021) of eligible R&D spending. |

| Austria | Eligible R&D expenses are entitled to a 14% premium. (R&D expenses x 1.14 = R&D expense deduction). | No special regime. |

| Belgium | Qualifying investments in patents and R&D can receive a one-time deduction of 13.5% of the value of the investment in addition to normal tax depreciation. For environmentally friendly investments, the special deduction is 20.5%. This benefit cannot be combined with the patents and R&D tax credit. | A refundable tax credit for patents and R&D of 13.5% or 20.5% (for environmentally friendly investments). |

| Canada | Full deduction for qualifying R&D expenses in the year they are incurred and one year of carryforward of deductions. | A refundable investment tax credit of 35% is available for the first CAN 3 million of eligible R&D spending in Canada. The R&D tax credit is not available for capital expenditures. Certain payroll expenses (limited to 10% of salary and wages) associated with R&D activities are eligible for the tax credit. |

| Chile | No special regime. | A 35% tax credit for payments made on certified R&D projects. The tax credit is limited to 15,000 UTM. (1 UTM = 51 CLP). |

| Colombia | Immediate deduction for full cost of investments in eligible R&D projects up to a maximum cap of COP 1 trillion and a per-project cap of COP 90 billion. | Qualifying investments in R&D projects are eligible for a credit of 25% of the investment cost. The credit cannot exceed 25% of income tax liability. |

| Czech Republic | Immediate deduction for full cost eligible R&D expenses in the year those costs are incurred. An additional 10% deduction is based on the increase of R&D expenses over the prior taxable period. | No special regime. |

| Denmark |

The super-deduction for R&D costs is 105% of eligible expenses for 2021-22. It will increase to 108% for 2023-25 and to 110% in 2026. Loss-making businesses can apply for a payment equal to the tax value of the negative income related to R&D. Negative taxable income x the corporate tax rate (22%) = tax value of negative income. |

No special regime. |

| Estonia | No special regime. | No special regime. |

| Finland | Expenses for contracts with eligible research organizations qualify for an additional 50% deduction. This policy is currently in place for 2021-25. The additional deduction is capped at EUR 500,000 per year. | No special regime. |

| France | No special regime. | An R&D tax credit equal to 30% of eligible expenses up to EUR 100 million and 5% of expenses above EUR 100 million. Excess tax credits can by carried forward for three years; unused credits can be refunded to the taxpayer. |

| Germany | No special regime. | A tax credit for 25% of R&D costs including salaries and wages associated with the eligible R&D activities. The creditable amount is capped at EUR 1 million per year. |

| Greece | An additional deduction of 100% of eligible R&D expenses is available for the year in which the costs are incurred. Certain equipment related to R&D activities can be depreciated at a 40% rate. | No special regime. |

| Hungary | Numerous tax preferences for R&D activities including a double deduction for R&D costs and a development tax allowance for an investment of at least HUF 100 million. | No special regime. |

| Iceland | Qualifying companies can apply for a special deduction of 20% of expenses on certain projects. The deduction cannot exceed ISK 300 million per year. For purchased R&D services, the maximum is ISK 450 million. | No special regime. |

| Ireland | A 12.5 percent deduction for R&D spending is available in addition to the R&D credit. The combination of the deduction and the credit amount to a 37.5% reduction in corporate tax. | A 25% credit for qualifying R&D expenses and a separate credit for construction or refurbishment of a qualifying building for R&D. For the building to qualify, 35% must be used for R&D purposes (measured over a four-year period). The credit is 25% of the expense on the construction or refurbishment of the building. R&D credits can also be transferred to “key employees” who spend at least 50% of their work on eligible R&D activities. |

| Israel | No special regime. | No special regime. |

| Italy | No special regime. | An R&D tax credit equal to 20% of eligible expenses up to EUR 4 million. Investments in technology innovation can receive a 10% credit up to EUR 2 million or 15% for ecological or digital innovation projects. |

| Japan | No special regime. | The R&D credit is related to the change in R&D expenses as a share of total expenses. The tax credit rate ranges from 6 to 14%. The credit is limited to 25% of corporate tax liability. |

| Latvia | No special regime. | Various tax benefits for eligible start-up companies. Benefits are subject to a maximum of EUR 200,000 over three years. |

| Lithuania | A 300% deduction for R&D costs. | No special regime. |

| Luxembourg | No special regime. | No special regime. |

| Mexico | No special regime. | 30% credit for qualified incremental investments for R&D. Excess credits can be carried forward for up to 10 years. |

| Netherlands | No special regime. | Tax relief for R&D offsets wage taxes and accrues to employers for employees doing eligible R&D duties. The relief can be 40% for the first EUR 350,000 and 16% for R&D costs beyond EUR 350,000. |

| New Zealand | No special regime. | A 15% credit for eligible R&D spending is available on expenditure between NZD 50,000 and NZD 120 million. The credit is refundable in some circumstances. Loss-making businesses that spend substantial amounts on R&D can cash out their losses related to R&D spending. The refund is the lesser of * 28% of the net loss for the year * 28% of total R&D spending in the year; or * 28% of 1.5 times total R&D labor spending. For the 2020-21 income year, the refund cap is NZL 560,000. |

| Norway | A special allowance of up to 20% of R&D expenses with a limit of NOK 25 million (20% of which is NOK 5 million). If the taxpayer does not have taxable income, they can receive a cash refund for the excess of the deduction in the following year. | No special regime. |

| Poland | R&D expenses are eligible for a 100% deduction in the year they are incurred. Excess deductions can be carried forward over six years. | No special regime. |

| Portugal | A 32.5% deduction for R&D expenses and a 50% deduction for expenses that exceed the average amount spent in the prior two years, up to a limit of EUR 1.5 million. | No special regime. |

| Slovakia | A super-deduction of 200% of eligible R&D expenses. | No special regime. |

| Slovenia | Eligible R&D expenses qualify for a 100% investment allowance. The deduction cannot reduce a taxpayer’s taxable income by more than 63%. | No special regime. |

| South Korea | No special regime. | Several tax credits may apply including a 30% tax credit for R&D expenses in developing qualifying technologies. |

| Spain | No special regime. | A tax credit for 25% of eligible R&D expenses. A 42% credit rate applies to expenses that exceed the average R&D spending of the two previous years. Payroll costs for R&D can be credited at a 17% rate. An 8% credit can be applied to expenses for fixed tangible assets (except for buildings) and intangible assets for R&D activities. |

| Sweden | No special regime. | No special regime. |

| Switzerland | Cantons have the option to allow a 150% deduction for eligible R&D spending. Total tax relief (R&D credit and patent box relief) cannot exceed 70% of taxable profit. | No special regime. |

| Turkey | Multiple investment incentives for technology companies. A basic 100% deduction for R&D spending and an additional 50% deduction if certain R&D expenses increase by 20% over the previous year’s level. The additional deduction applies to the excess amount. | No special regime. |

| United Kingdom | Small companies can deduct 230% of qualifying R&D costs. The deduction can be converted to a cash payment (at a rate of GBP 33.35 for each GBP 100 of qualifying spending). Small companies are defined as having less than 500 employees, annual revenues less than €100 million, or a balance sheet less than €86 million. | Large companies are eligible for a 13% credit for qualifying R&D spending. Large companies are defined as having more than 500 employees, annual revenues over €100 million, or a balance sheet over €86 million. |

| United States | No special regime. | A 20% credit for qualifying R&D spending. An alternative calculation uses a 14% credit rate. Deductions for R&D spending must be offset by the amount of R&D credits. |

| Source: Bloomberg Tax, “Country Guides,” accessed Feb. 2021, https://www.bloomberglaw.com/product/tax/toc_view_menu/3380; PwC, “Worldwide Tax Summaries,” accessed Feb. 2021, https://www.taxsummaries.pwc.com/; OECD, “Intellectual Property Regimes,” accessed Feb. 2021, https://www.qdd.oecd.org/data/IP_Regimes; and EY, “Worldwide R&D Incentives Reference Guide 2020,” https://www.ey.com/en_gl/tax-guides/worldwide-r-and-d-incentives-reference-guide-2020. | ||

| Country | Summary of Regime | Qualifying IP Assets (an X shows the asset qualifies) | Tax Rate under Patent Box Regime | Statutory Corporate Income Tax Rate | ||

|---|---|---|---|---|---|---|

| Patents | Software | Other | ||||

| Australia | No special regime. | — | — | — | — | 30% |

| Austria | No special regime. | — | — | — | — | 25% |

| Belgium | An 85 percent deduction from corporate income for qualifying income related to IP. The corporate income tax rate is 25%, so the deduction results in a 3.75% tax rate on qualifying IP income. | X | X | — | 3.75% | 25% |

| Canada | No special regime. | — | — | — | — | 26.5% |

| Chile | No special regime. | — | — | — | — | 25% |

| Colombia | No special regime. | — | — | — | — | 32% |

| Czech Republic | No special regime. | — | — | — | — | 19% |

| Denmark | No special regime. | — | — | — | — | 22% |

| Estonia | No special regime. | — | — | — | — | 20% |

| Finland | No special regime. | — | — | — | — | 20% |

| France | A reduced rate of 10% applies to profits from IP rights. | X | X | — | 10% | 28.4% |

| Germany | No special regime. | — | — | — | — | 30% |

| Greece | Three-year exemption for profits from the sale of self-manufactured goods based on an internationally recognized patent. | X | — | — | Three-year exemption, 0% | 24% |

| Hungary | 50% of the profit from royalties from qualifying IP is exempt from corporate income tax up to 50% of the profit before tax. The corporate tax rate is 9% so the effective rate on IP royalties is 4.5%. | X | X | — | 4.50% | 9% |

| Iceland | No special regime. | — | — | — | — | 20% |

| Ireland | The Knowledge Development Box provides a tax rate of 6.25% for profits from qualifying assets. | X | X | X | 6.25% | 12.5% |

| Israel | Preferred Technology Enterprises can face a lower corporate tax rate of 7.5% or 12% on qualified IP developed in Israel. | X | X | X | 7.25% or 12% | 23% |

| Italy | The patent box exempts 50% of the income from qualifying IP. | X | X | — | 13.95% | 27.9% |

| Japan | No special regime. | — | — | — | — | 29.7% |

| Latvia | No special regime. | — | — | — | — | 20% |

| Lithuania | A 5% tax rate applies to profits from qualifying IP. | X | X | — | 5% | 15% |

| Luxembourg | An 80% exemption from corporate taxes applies to income from qualifying IP. Qualifying assets also receive a full exemption from Luxembourg’s net wealth tax. | X | X | — | 4.99% | 24.94% |

| Mexico | No special regime. | — | — | — | — | 30% |

| Netherlands | Income from qualifying IP is taxed at 9%, an increase from the prior rate of 7%. | X | X | X | 7% | 25% |

| New Zealand | No special regime. | — | — | — | — | 28% |

| Norway | No special regime. | — | — | — | — | 22% |

| Poland | The tax rate on qualifying IP is 5%. | X | X | — | 5% | 19% |

| Portugal | A 50% exemption from income from qualifying IP. | X | — | — | 10.50% | 21% |

| Slovakia | A 50% exemption from income from qualifying IP. | X | X | — | 10.50% | 21% |

| Slovenia | No special regime. | — | — | — | — | 19% |

| South Korea | Special tax rate on transferring or licensing qualifying assets for small and medium-sized businesses. The transfer must be to another Korean company. | X | X | — | 50% of relevant corporate tax rate for a transfer; 25% for a license. | Tax rates are progressive from 10% to 25%. |

| Spain | A 60% exemption for qualifying IP income. | X | X | — | 10% | 25% |

| Sweden | No special regime. | — | — | — | — | 21.40% |

| Switzerland | An IP regime applies at the cantonal level. Up to 90% of qualifying IP income can be exempt from cantonal taxes. | X | — | — | Varies from canton to canton, up to a 90% exemption from corporate tax. | Varies from canton to canton; 11.9% to 21.6%. |

| Turkey | Technology developed in certain designated zones can face a 100% exemption from corporate taxes. Otherwise a 50% exemption for income from sale or lease of patents may apply. | X | — | — | 0% or 11% | 22% |

| United Kingdom | Income from qualifying IP faces a tax rate of 10%. | X | — | — | 10% | 19% |

| United States | An 37.5% deduction applies to income from exports related to qualifying IP. | X | X | X | 13.13% | Federal rate is 21%; combined with state-level corporate taxes, the rate is 25.8%. |

| Bloomberg Tax, “Country Guides,” accessed Feb. 2020, https://www.bloomberglaw.com/product/tax/toc_view_menu/3380; PwC, “Worldwide Tax Summaries,” accessed Feb. 2020, https://www.taxsummaries.pwc.com/; OECD, “Intellectual Property Regimes,” accessed Feb. 2020, https://www.qdd.oecd.org/data/IP_Regimes, and EY, “Worldwide R&D Incentives Reference Guide 2020,” https://www.ey.com/en_gl/tax-guides/worldwide-r-and-d-incentives-reference-guide-2020. | ||||||

[1] Organisation for Economic Co-operation and Development, “Gross domestic spending on R&D,”, https://www.data.oecd.org/rd/gross-domestic-spending-on-r-d.htm.

[2] In some instances, the special deductions for R&D expenses are referred to as super-deductions.

[3] For a thorough discussion of windfall effects in the context of the U.S. R&D tax credit see GAO, “The Research Tax Credit’s Design and Administration Can Be Improved,” Report to the Committee on Finance, U.S. Senate, November 2009, https://www.gao.gov/assets/300/298173.pdf.

[4] See the Appendix for tables with information on each OECD country. These statistics and the country information in this section are based on the author’s research using Bloomberg Tax, “Country Guides,” https://www.bloomberglaw.com/product/tax/toc_view_menu/3380; PwC, “Worldwide Tax Summaries,” https://www.taxsummaries.pwc.com/; OECD, “Intellectual Property Regimes,” https://www.qdd.oecd.org/data/IP_Regimes; and EY, “Worldwide R&D Incentives Reference Guide 2020,” https://www.ey.com/en_gl/tax-guides/worldwide-r-and-d-incentives-reference-guide-2020.

[5] The measured differences in tax subsidies for profitable and loss-making firms is due to refunds and carryover provisions in the preference design that some countries use. See OECD, “OECD R&D Tax Incentive Database: General and Country-specific Notes,” 2020, http://www.oecd.org/sti/rd-tax-stats-bindex-notes.pdf.

[6] The 2003 average covers 35 OECD countries. Data is not available for Greece and Turkey for that year.

[7] Bettina Becker, “Public R&D Policies and Private R&D Investment: A Survey of the Empirical Evidence,” Journal of Economic Surveys 29:5 (December 2015): 917–42, https://doi.org/10.1111/joes.12074.

[8] Nicholas Bloom, John Van Reenen, and Heidi Williams, “A Toolkit of Policies to Promote Innovation,” Journal of Economic Perspectives 33:3 (Summer 2019): 163–84, https://doi.org/10.1257/jep.33.3.163.

[9] Antoine Dechezleprêtre et al., “Do Tax Incentives for Research Increase Firm Innovation? An RD Design for R&D,” National Bureau of Economic Research, July 2016, https://doi.org/10.3386/w22405.

[10] Sebastien Bradley, Estelle Dauchy, and Leslie Robinson, “Cross-Country Evidence on the Preliminary Effects of Patent Box Regimes on Patent Activity and Ownership,” National Tax Journal 68:4 (December 2015): 1047–72, https://doi.org/10.17310/ntj.2015.4.07.

[11] Fabian Gaessler, Bronwyn H. Hall, and Dietmar Harhoff, “Should There Be Lower Taxes on Patent Income?” Institute for Fiscal Studies, July 2018, https://www.ifs.org.uk/uploads/publications/wps/WP201819.pdf.

[12] Ronald B. Davies, Ryan Hynes, and Dieter F. Kogler, “Patent Boxes and the Success Rate of Applications,” unpublished manuscript, Feb. 18, 2021. For a brief discussion of the research, see YouTube, “Reforming Tax Expenditures in Europe: Corporate Income Taxes, Feb. 12, 2021, https://www.youtube/ZVktclPzFis?t=2579.

[13] Bodo Knoll et al., “Cross-Border Effects of R&D Tax Incentives,” Social Science Research Network, Oct. 11, 2019, https://doi.org/10.2139/ssrn.3484384.

[14] Rachel Griffith, Helen Miller, and Martin O’Connell, “Ownership of Intellectual Property and Corporate Taxation,” Journal of Public Economics 112 (April 2014): 12–23, https://doi.org/10.1016/j.jpubeco.2014.01.009.

[15] OECD, “Action 5: Agreement on Modified Nexus Approach for IP Regimes,” OECD/G20 Base Erosion and Profit Shifting Project, 2015, https://www.oecd.org/ctp/beps-action-5-agreement-on-modified-nexus-approach-for-ip-regimes.pdf

[16] Kartikeya Singh, Cody Kallen, and Aparna Mathur, “Substance Requirements in the International Taxation of Intangible Capital — a Double Edged Sword?” American Enterprise Institute, Nov. 13, 2019, https://www.aei.org/research-products/working-paper/substance-requirements-in-the-international-taxation-of-intangible-capital-a-double-edged-sword/.

[17] OECD, “R&D Tax ExpenditureTax expenditures are departures from a “normal” tax code that lower the tax burden of individuals or businesses through an exemption, deduction, credit, or preferential rate. However, defining which tax expenditures grant special benefits to certain groups of people or types of economic activity is not always straightforward. and Direct Government Funding of BERD,” accessed Mar. 5, 2021, https://stats.oecd.org/Index.aspx?DataSetCode=RDSUB.

[18] Eurostat, “Intramural R&D expenditure (GERD) by sectors of performance and NUTS 2 regions,” accessed Feb. 25, 2021, https://www.ec.europa.eu/eurostat/databrowser/view/RD_E_GERDREG/bookmark/map?lang=en&bookmarkId=ce94b173-4f41-4f96-9f03-e72cce94af44.

[19] Daniel Bunn and Elke Asen, International Tax Competitiveness Index 2020, Tax Foundation, Oct. 14, 2020, https://www.taxfoundation.org/publications/international-tax-competitiveness-index/.

[20] Pamela Sommers, “The Ripple Effects of an R&D Tax Credit Study’s Real Costs,” Thomson Reuters, accessed Mar. 5, 2021, https://www.tax.thomsonreuters.com/site/wp-content/pdf/r&d-tax-credit-manager/RD_Tax_Credit_Studys_Real_Costs.pdf.

[21] Large businesses include those with more than €50 million in annual revenues or total assets of more than €43 million, and more than 250 employees. See HM Revenue & Customs, “Patent Box reliefs statistics: Patent Box Statistics Tables September 2020, Table 1: Patent Box data by company size, 2017-18,” Sept. 30, 2020, https://www.gov.uk/government/statistics/patent-box-reliefs-statistics.

[22] Small and medium-sized companies are defined as having fewer than 500 employees, annual revenues less than €100 million or a balance sheet less than €86 million, so there is some overlap between the patent box statistics definition of “large companies” and the R&D tax subsidy statistics of “small and medium-sized entities.” See HM Revenue & Customs, “Corporate Tax: Research and Development Tax Credits: Combined Tables 2020, Table RD4: R&D expenditure used to claim R&D tax credits by scheme and financial year, 2000-01 to 2018-19 (£ million),” Sept. 30, 2020, https://www.gov.uk/government/statistics/corporate-tax-research-and-development-tax-credit.

Share this article