Oregon is moving closer to enacting a new gross receipts tax to support public education funding. The Joint Committee on Student Success is holding public hearings on House Bill 3427, which outlines improvements to the state’s public education system. Revenue from the proposed gross receipts tax would support the Student Success Fund, which is the funding mechanism for public education improvements.

The amendment to House Bill 3427 outlines the proposed Corporate Activity TaxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. and the reduction in personal income tax rates. The first three brackets will be reduced by 0.25 percentage points, while the top bracket starting at taxable income over $125,000 will remain at 9.9 percent. This change will be effective for the 2020 tax year.

| Tax Bracket | 2019 Tax Rate | Proposed Tax Bracket | Proposed Tax Rate |

|---|---|---|---|

| Taxable income over $0 | 5.0% | Taxable income over $0 | 4.75% |

| Taxable income over $3,550 | 7.0% | Taxable income over $2,000 | 6.75% |

| Taxable income over $8,900 | 9.0% | Taxable income over $5,000 | 8.75% |

| Taxable income over $125,000 | 9.9% | Taxable income over $125,000 | 9.9% |

The Corporate Activity Tax would tax business receipts received “in the regular course of the person’s trade of business, without deduction for expenses incurred by the trade or business,” but also exempts certain types of business receipts, such as dividends received and interest income. These forms of income are exempt because this would incorporate the returns from investment into the tax base, when policymakers are trying to tax receipts from the sale of goods and services in Oregon.

Business receipts from the wholesale or retail sale of motor fuel, cigarettes and tobacco products, alcohol, and groceries also would be exempt from the Corporate Activity Tax. Motor fuel oil, cigarettes, tobacco, and alcohol have industry-specific tax regimes in Oregon. Groceries were made exempt to reduce the expected harm the tax would impose on low-income Oregonians.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeThe Corporate Activity Tax would be assessed on business receipts sourced in Oregon on a destination basis. For intangible property, for example, the business receipt from the transaction would be considered taxable if the intangible property is delivered to a consumer in Oregon. Business receipts sourced from outside the state are exempt from the tax. Oregon’s Department of Revenue (DOR) may create regulations to provide more guidelines on sourcing for complicated tax situations.

DOR will require any business to register with it if they collect business receipts of at least $500,000. Businesses with less than $1 million in receipts would pay a flat $250 tax, while those with more would be taxed at a 0.49 percent rate for receipts in excess of the $1 million threshold.

The proposal conforms to how the federal government accounts for business receipts, labor costs, and the cost of business inputs. Business inputs include the cost of goods sold and the cost of businesses held in inventory. Labor costs include salary, wages, and benefits paid on behalf of the employee. Additionally, subsidiary and affiliated firms would be consolidated for the purposes of the tax, and transactions between these firms would not be subject to the Corporate Activity Tax.

Before businesses can take the 25 percent deduction against business receipts for the cost of business inputs or labor costs, they must apportion these costs based on Oregon’s single sales factor. Put simply, this means that firms operating in states in addition to Oregon must use the ratio of Oregon sales to their total sales nationwide and multiply it by their labor costs or cost of business inputs. This ensures that the costs that firms deduct from their business receipts are related to goods or services sold in Oregon and not other states.

House Bill 3427 would preempt localities from creating new taxes on business receipts. This preemption would be effective as of March 1, 2019, which would grandfather in the 1 percent gross receipts tax enacted by Portland in late 2018.

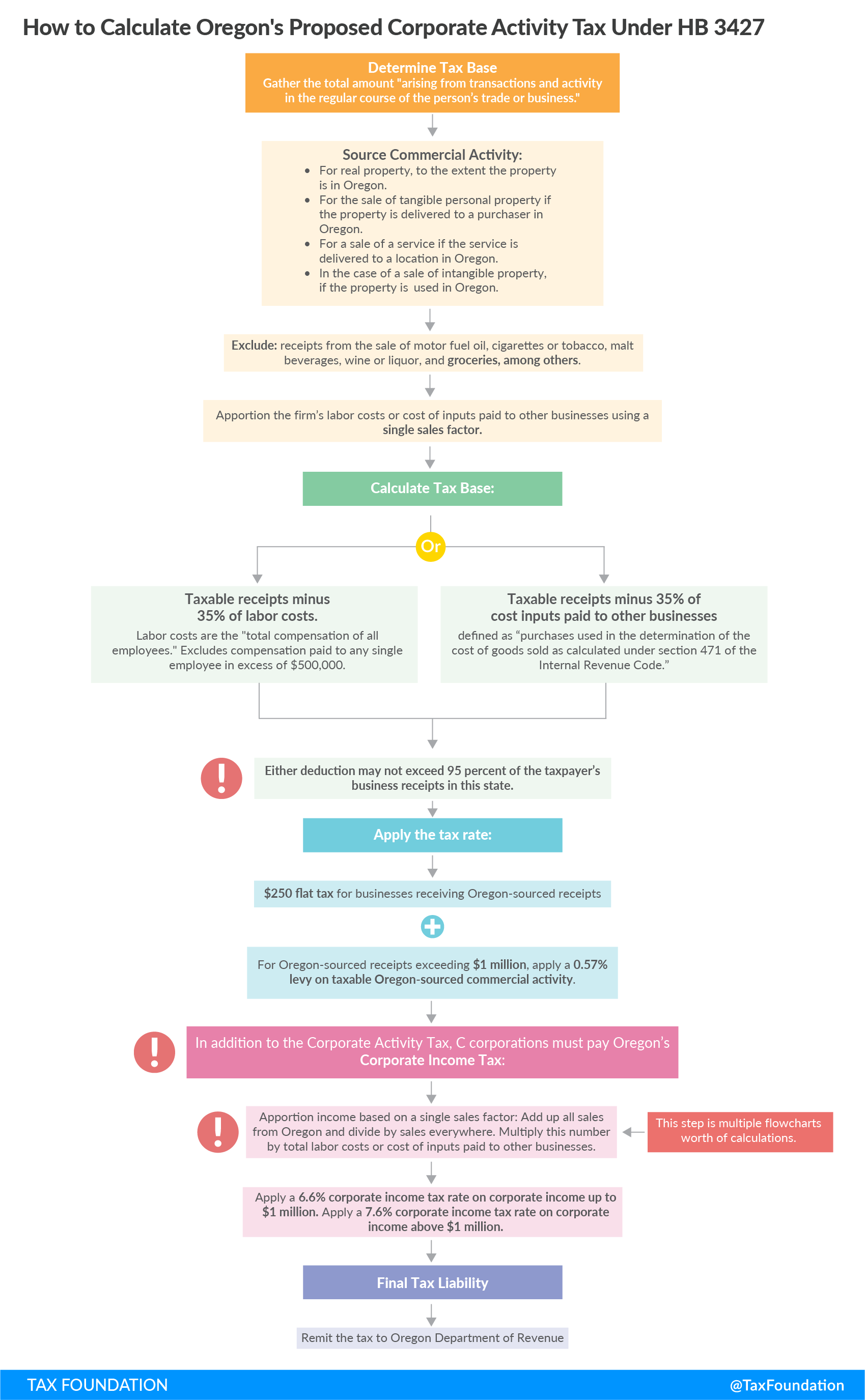

As the figure below illustrates, the process of calculating, filing, and remitting the proposed tax will create complexity for businesses operating in Oregon. The partial relief businesses get from the 25 percent deduction for labor costs or the cost of business inputs is made up for by the complexity of the tax. In addition to the proposed Corporate Activity Tax, Oregon C corporations will need to calculate and remit the state corporate income tax. This would make Oregon the second state in the country to levy a statewide gross receipts taxGross receipts taxes are applied to a company’s gross sales, without deductions for a firm’s business expenses, like compensation, costs of goods sold, and overhead costs. Unlike a sales tax, a gross receipts tax is assessed on businesses and applies to transactions at every stage of the production process, leading to tax pyramiding. in addition to a state corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. , joining Delaware.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeThe Corporate Activity Tax would harm Oregon’s business tax environment. Oregon is currently ranked 7th overall in our 2019 State Business Tax Climate Index (SBTCI). Oregon’s lack of a state sales tax and relatively well-structured property tax puts the state’s business tax environment in the top 10 in the country. If Oregon levies the Corporate Activity Tax, we project that Oregon will fall from 7th to 12th overall on the SBTCI, and from 30th to 49th in corporate taxes, just behind Delaware.

| Oregon Index Rank | Current Rank (2019) | New Rank if Corporate Activity Tax is Implemented |

|---|---|---|

|

Overall Rank |

7th | 12th |

|

Corporate Tax Rank |

30th | 49th |

Low-income households will be hardest hit from the tax, as they will not be able to benefit from the individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. rate reductions. These households often have little to no tax liability but will pay higher prices for goods and services. Oregon’s Legislative Revenue Office (LRO) estimates that the households with incomes below about $20,500 will see their incomes decline by $85 annually on average. While this may not seem like a large amount for higher-income households, this income may be critical for low-income Oregonians to make ends meet.

Gross receipts taxes like this proposal are economically harmful and inefficient methods of raising revenue. At the minimum, a refundable tax creditA refundable tax credit can be used to generate a federal tax refund larger than the amount of tax paid throughout the year. In other words, a refundable tax credit creates the possibility of a negative federal tax liability. An example of a refundable tax credit is the Earned Income Tax Credit (EITC). targeted at low-income households would help reduce the regressive nature of the tax. Ideally, policymakers should restructure the tax to exempt business inputs through a value-added tax. This would produce fewer price increases and less harm for low-income households, all while raising the revenue needed to improve public education.

Share this article