The Minnesota House of Representatives and Senate have each passed an infrastructure funding bill, but the two chambers have very different ideas of how to generate additional revenue for road and bridge repairs. The sticking point? Whether to increase the excise tax on gas.

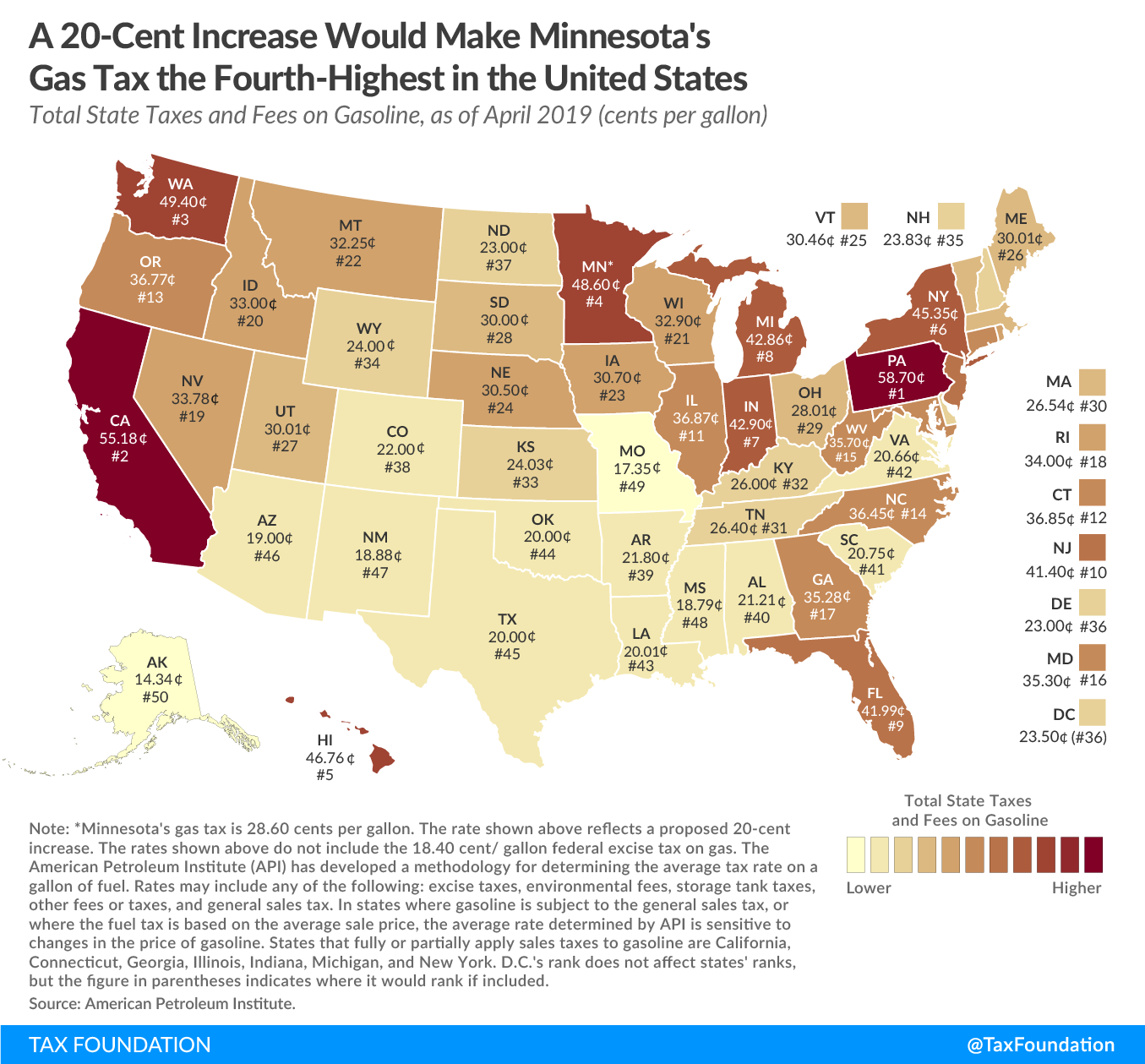

Currently, Minnesota’s gas taxA gas tax is commonly used to describe the variety of taxes levied on gasoline at both the federal and state levels, to provide funds for highway repair and maintenance, as well as for other government infrastructure projects. These taxes are levied in a few ways, including per-gallon excise taxes, excise taxes imposed on wholesalers, and general sales taxes that apply to the purchase of gasoline. is 28.6 cents per gallon (cpg), the 29th highest in the country. The keystone of the House bill, House File 1555, is a 20-cent gas taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. increase, phased in over four years. After the phase-in is complete, this bill would index the gas tax for inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. on an annual basis. While slightly less aggressive than the two-year phase-in proposed by Governor Tim Walz (DFL) in his fiscal year (FY) 2020-2021 biennial budget, the House proposal has met resistance from Senate Republicans. If increased to 48.6 cpg, Minnesota’s gas tax would become the fourth-highest in the country.

In addition to increasing the gas tax, House File 1555 would increase the Motor Vehicle Sales Tax rate from 6.5 to 6.875 percent, increase the motor vehicle registration tax rate from 1.25 to 1.5 percent of the car’s base value, and adjust the depreciation schedule used to determine a vehicle’s base value (making it less generous than under current law).

As an alternative, the Senate passed an amended version of the House bill with language from Senate File 1093. This bill would avoid a gas tax increase by instead increasing the electric vehicle surcharge from $75 to $200, creating a hybrid vehicle surcharge of $100, and transferring revenue from the general fund to the Trunk Highway Fund.

The House refused to concur with the Senate amendment, and a conference committee is being formed to reconcile differences between the bills. As the conference committee looks for a path forward, policymakers will first need to determine how much new revenue for infrastructure is warranted, as the House and Senate bills have different revenue targets. When it comes to how that revenue is raised, user taxes and fees remain the key.

In general, gas taxes, as well as electric and hybrid vehicle user fees, are all good sources of revenue for infrastructure (compared to alternative tax types), as they adhere relatively well to the benefit principle, or the idea in public finance that taxes paid should relate to benefits received. Indexing the gas tax for inflation can help the tax better keep pace with the real costs of road upkeep without having to rely so heavily on periodic, sharp spikes in the statutory gas tax rate. Finally, like all final products and services for personal consumption, cars ought to be subject to the state sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. , with general sales tax revenue dedicated to the general fund. While transfers from the general fund to the transportation fund are commonplace in many states, they weaken the link between taxes paid and benefits received. Where transportation user taxes and fees are available, general fund transfers ought to be avoided.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe