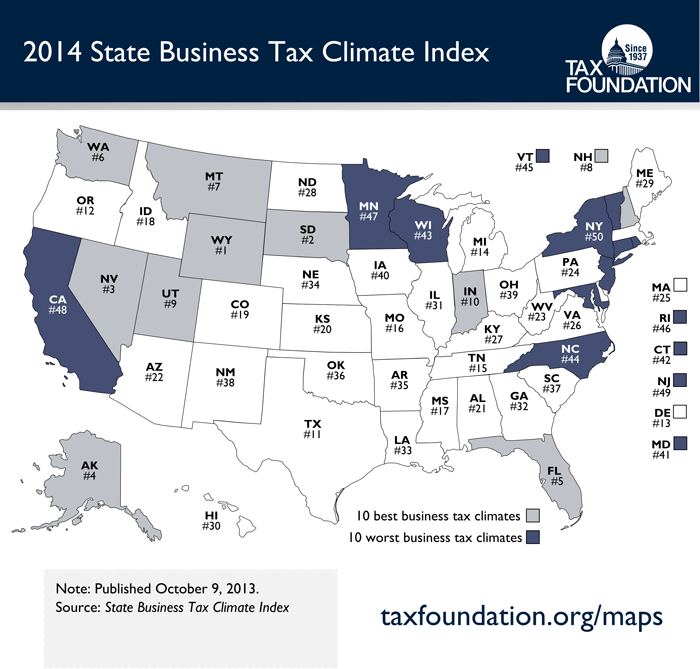

Last week, the TaxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. Foundation released the 2014 State Business Tax Climate Index. Below is a map illustrating the states' rankings and how they compare to their neighbors.

All maps and other graphics may be published and re-posted with credit to the Tax Foundation.

(Click on map to enlarge it. Click here for previous maps.)

The State Business Tax Climate Index enables business leaders, government policymakers, and taxpayers to gauge how their states’ tax systems compare.

The absence of a major tax is a dominant factor in vaulting many of these ten states to the top of the rankings. Property taxes and unemployment insurance taxes are levied in every state, but there are several states that do without one or more of the major taxes: the corporate tax, the individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. , or the sales tax. Wyoming, Nevada, and South Dakota have no corporate or individual income tax; Alaska has no individual income or state-level sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. ; Florida has no individual income tax; and New Hampshire and Montana have no sales tax.

But this does not mean that a state cannot rank in the top ten while still levying all the major taxes. Indiana, which ousted Texas from the top ten this year (see p. 5 of the report), and Utah have all the major tax types, but levy them with low rates on broad bases.

The states in the bottom 10 suffer from the same afflictions: complex, non-neutral taxes with comparatively high rates.

While not reflected in this year’s edition, a great testament to the Index’s value is its use as a success metric for comprehensive reforms passed this year in North Carolina. While the state remains ranked 44th for this edition, it will move to as high as 17th as these reforms take effect in coming years.

Minnesota, by contrast, enacted a package of tax changes that reduce the state’s competitiveness, including a retroactive hike in the individual income tax rate. Since last year, they have dropped from 45th to 47th place. New York and New Jersey are in a virtual tie for last place, and any change next year could change their positions. Other major changes are noted in the blue boxes throughout this report.

The 2014 Index represents the tax climate of each state as of July 1, 2013, the first day of the standard 2014 state fiscal year.

Share this article