Facts and Figures 2021: How Does Your State Compare?

Our updated 2021 edition of Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

1 min readHow does North Dakota’s tax code compare? North Dakota has a graduated state individual income tax, with rates ranging from 1.95 percent to 2.50 percent. North Dakota has a graduated corporate income tax, with rates ranging from 1.41 percent to 4.31 percent. North Dakota also has a 5.00 percent state sales tax rate and an average combined state and local sales tax rate of 7.04 percent. North Dakota has a 0.97 percent effective property tax rate on owner-occupied housing value.

North Dakota does not have an estate tax or inheritance tax. North Dakota has a 23 cents per gallon gas tax rate and a $0.44 cigarette excise tax rate. The State of North Dakota collects $7,007 in state and local tax collections per capita. North Dakota has $12,057 in state and local debt per capita and has a 67 percent funded ratio of public pension plans. Overall, North Dakota’s tax system ranks 17th on our 2024 State Business Tax Climate Index.

Each state’s tax code is a multifaceted system with many moving parts, and North Dakota is no exception. The first step towards understanding North Dakota’s tax code is knowing the basics. How does North Dakota collect tax revenue? Click the tabs below to learn more! You can also explore our state tax maps, which are compiled from our annual publication, Facts & Figures 2024: How Does Your State Compare?

Our updated 2021 edition of Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

1 min read

Here’s each state’s estimated revenue gains or losses in 2020, alongside the state and local aid that would be allocated to each under the American Rescue Plan Act.

8 min read

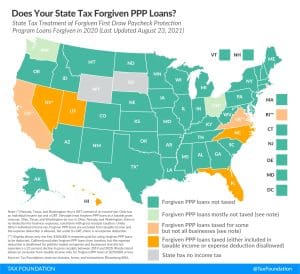

Congress chose to exempt forgiven Paycheck Protection Program (PPP) loans from federal income taxation. Many states, however, remain on track to tax them by either treating forgiven loans as taxable income, denying the deduction for expenses paid for using forgiven loans, or both.

7 min read

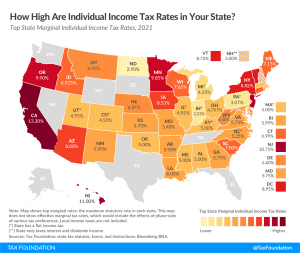

Individual income taxes are a major source of state government revenue, accounting for 37 percent of state tax collections in fiscal year (FY) 2017. Several states had notable individual income tax changes in 2020: Arizona, Arkansas, Massachusetts, Michigan, Minnesota, North Carolina, Ohio, Tennessee, Virginia, and Wisconsin.

22 min read

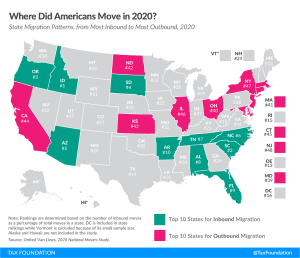

States compete with each other in a variety of ways, including in attracting (and retaining) residents. Sustained periods of inbound migration lead to (and reflect) greater economic output and growth. Prolonged periods of net outbound migration, however, can strain state coffers, contributing to revenue declines as economic activity and tax revenue follow individuals out of state.

4 min read

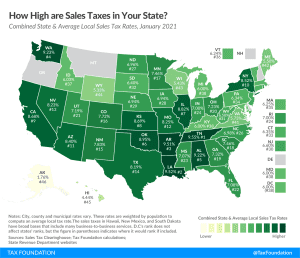

While many factors influence business location and investment decisions, sales taxes are something within lawmakers’ control that can have immediate impacts.

12 min read

The coronavirus relief package represents the second-largest recovery legislation, behind only the CARES Act, for a combined total of more than $3 trillion in support.

8 min read

On Monday, members of the bipartisan Gang of Eight negotiating an end-of-year pandemic relief package announced that they had settled on language and had divided the package into two bills: a pandemic aid package and a $160 billion state and local support package.

6 min read

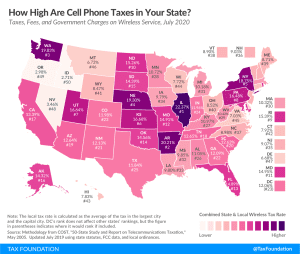

A typical American household with four phones on a “family share” wireless plan can expect to pay about $270 per year (or 22 percent of their cell phone bill) in taxes, fees, and surcharges.

36 min read