All Content

New Evidence on Territorial Taxation

6 min read

Sources of Government Revenue in the OECD, 2020

OECD countries have on average become more reliant on consumption taxes and less reliant on individual income taxes. These policy changes matter, considering that consumption-based taxes raise revenue with less economic damage and distortionary effects than taxes on income.

13 min read

Analysis of Democratic Presidential Candidates Corporate Income Tax Proposals

2020 Democratic presidential candidates have proposed various changes to the corporate income tax, which includes increasing the rate, ranging from 25 percent to 35 percent, imposing a corporate surtax or a minimum tax, and lengthening depreciation schedules.

17 min read

How Controlled Foreign Corporation Rules Look Around the World: Germany

Germany has had a Controlled Foreign Corporation (CFC) regime since 1972, when the German Foreign Transactions Tax Act was enacted. Under the German regime, a CFC is a foreign company where its capital or voting rights are either directly or indirectly majority-owned by German residents at the end of its fiscal year.

6 min read

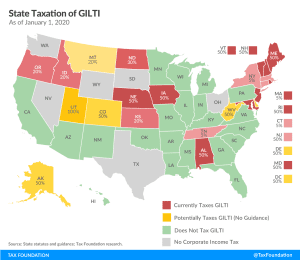

Kansas, Nebraska, and Utah Lawmakers Pursue “Not GILTI” Verdicts

Taxing GILTI puts states at a competitive disadvantage compared to their peers—all for a tax that makes very little sense at the state level, and which legislators never sought in the first place.

5 min read

Toomey Introduces Legislation to Make Bonus Depreciation Permanent and Fix the Retail Glitch

Making 100 percent bonus depreciation permanent avoids the uncertainty associated with the phaseout of a powerful pro-growth policy and would provide a cost-effective boost to long-run economic output, wages, and employment in the United States.

2 min read

Facts and Figures 2020: How Does Your State Compare?

Our updated 2020 edition of Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

1 min read

Banning Flavored Tobacco Could Have Unintended Consequences

The prospect of a ban on flavored tobacco and nicotine products highlights the complications of contradictory tax and regulatory policy, the instability of excise taxes that go beyond pricing in the cost of externalities, and the public risks of driving consumers into the black market through excessive taxation or regulation.

6 min read

The White House Budget Highlights the Need to Extend Pro-Growth TCJA Business Tax Provisions

Full expensing, if made permanent, would be one of the most cost-effective ways to increase growth as it would produce about 4.5 times more GDP growth per dollar of revenue than making the law’s individual tax provisions permanent, according to our analysis.

3 min read

Bracing for Impact

Though they are limited by both data and assumptions, the OECD will face similar limitations. As policymakers work to fine-tune the proposals under both Pillar 1 and 2 the impact assessment should be a critical part of that discussion.

6 min read

Analysis of Democratic Presidential Candidate Payroll Tax Proposals

Several 2020 Democratic presidential candidates have proposed changes to federal payroll tax rates and the Social Security payroll tax wage base to raise revenue and maintain solvency for major federal entitlement programs.

24 min read