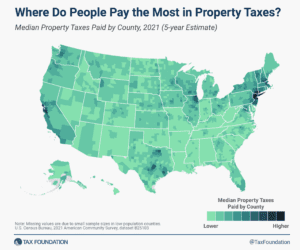

Property Taxes by State and County, 2023

Property taxes are the primary tool for financing local governments and generate a significant share of state and local revenues.

6 min read

Property taxes are the primary tool for financing local governments and generate a significant share of state and local revenues.

6 min read

The Spanish election results are moving the country away from pro-growth tax reforms while launching the government’s tax agenda, and the agenda of the Spanish presidency of the Council of the European Union, into uncertainty.

7 min read

Policymakers at all levels of government should avoid the pitfalls of incentives. Instead, they should focus on creating a more efficient, neutral, and structurally sound tax code to the benefit of all types of business investment.

6 min read

Congress should recognize that Pillar Two has significant U.S.-specific downsides, but also that it cannot unilaterally stop Pillar Two from taking effect. Instead, it should carefully consider a policy response for the next Congress, when a variety of forces are likely to compel it to act.

7 min read

Politicians often bemoan the trade deficit, but their disdain for this economic statistic is largely misplaced. The trade deficit reflects deeper choices about how we use our money, and reducing it may require lowering our standard of living.

4 min read

Recharacterizing a rather simple repayment transaction as a tax rebate is concerning, not just for sound tax policy, but also for the future of public-private financing partnerships.

4 min read

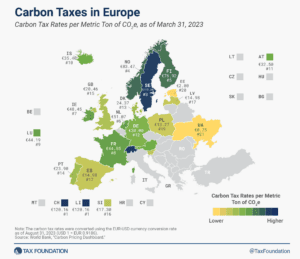

In recent years, several countries have taken measures to reduce carbon emissions, including instituting environmental regulations, emissions trading systems, and carbon taxes. In 1990, Finland was the world’s first country to introduce a carbon tax.

4 min read

What can Former President Trump’s previous tariff efforts—specifically the safeguards he authorized on imported washing machines in 2018—tell us about his most recent proposal for a 10 percent tariff on all imports?

6 min read

A major case pending before the U.S. Supreme Court (Moore v. United States) is calling into question provisions on large portions of the U.S. tax base which could quickly become legally uncertain, putting significant revenue at stake.

7 min read

A growing international tax agreement known as Pillar Two presents two new threats to the US tax base: potential lost revenue and limitations on Congress’s ability to set its own tax policy.

39 min read

Bermuda, long celebrated for its pristine beaches and offshore financial services, is embarking on a journey to recalibrate its tax mix. Spurred by the OECD’s Pillar Two initiative, the island will introduce its first-ever corporate income tax in 2025.

4 min read

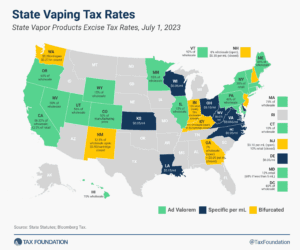

If the policy goal of taxing cigarettes is to encourage cessation, vapor taxation must be considered a part of that policy design.

3 min read

Former President Donald Trump’s proposed 10 percent tariff would raise taxes on American consumers by more than $300 billion a year—a tax increase rivaling the ones proposed by President Biden.

4 min read

The early evidence indicates that making a “good return greater” through Opportunity Zone tax incentives is an ineffective and poorly targeted way to raise the living standards of low-income residents.

6 min read

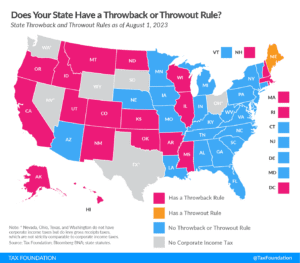

As more and more states move away from throwback or throwout rules, those states that still impose these rules are becoming less attractive for businesses, which are incentivized to relocate their sales activities to non-throwback states.

6 min read

The potential for alternative tobacco products to save lives is clear and well established. The framework described in this paper uses a scientific approach to tax strategy that will both reduce harm and create a reliable revenue stream for public expenditures.

17 min read

The Small Business Jobs Act would improve the tax treatment of investment but the proposal stops short of full expensing, leaving room for improvement.

3 min read

For many Italian banks, there hasn’t been a significant “windfall” to tax. The profit margins of Italian banks have been lower compared to other industries for the past two decades.

5 min read

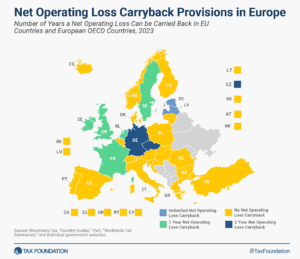

Carryover tax provisions help businesses “smooth” their risk and income, making the tax code more neutral across investments and over time.

3 min read

Moving from one athletic conference to another can mean millions in additional revenue sharing from lucrative broadcasting contracts and other revenue streams, all tax-free.

6 min read