For the fourth year in a row, a comprehensive infrastructure funding reform bill has been introduced in Kentucky, with the centerpiece being a gas tax increase of 10 cents per gallon (cpg). Like many states, Kentucky faces a backlog of road maintenance and construction projects, and existing transportation taxes and user fees are failing to keep pace with funding needs.

As introduced, House Bill 561 would increase Kentucky’s base gas tax rate from 24.6 to 34.6 cpg, indexed annually for inflation. The bill would also create a new electric vehicle highway user feeA user fee is a charge imposed by the government for the primary purpose of covering the cost of providing a service, directly raising funds from the people who benefit from the particular public good or service being provided. A user fee is not a tax, though some taxes may be labeled as user fees or closely resemble them. of $150 (adjusted annually along with inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. adjustments to the gas taxA gas tax is commonly used to describe the variety of taxes levied on gasoline at both the federal and state levels, to provide funds for highway repair and maintenance, as well as for other government infrastructure projects. These taxes are levied in a few ways, including per-gallon excise taxes, excise taxes imposed on wholesalers, and general sales taxes that apply to the purchase of gasoline. ) and an annual highway preservation fee of $35 or $40 for certain noncommercial fuel-efficient vehicles, including hybrids. Additionally, this bill would increase select other highway user fees, including license plate renewal fees, which would increase from $11.50 to $22 for passenger vehicles and from $9 to $15 for motorcycles.

As of this writing, a fiscal note for House Bill 561 is not publicly available, but similar proposals introduced in the past would have generated approximately $500 million in additional revenue for the Road Fund. As 2021 is an off-budget year for Kentucky, this year’s 30-day legislative session must adjourn by March 30, and any taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. or spending increases will require a three-fifths supermajority in both chambers in order to pass.

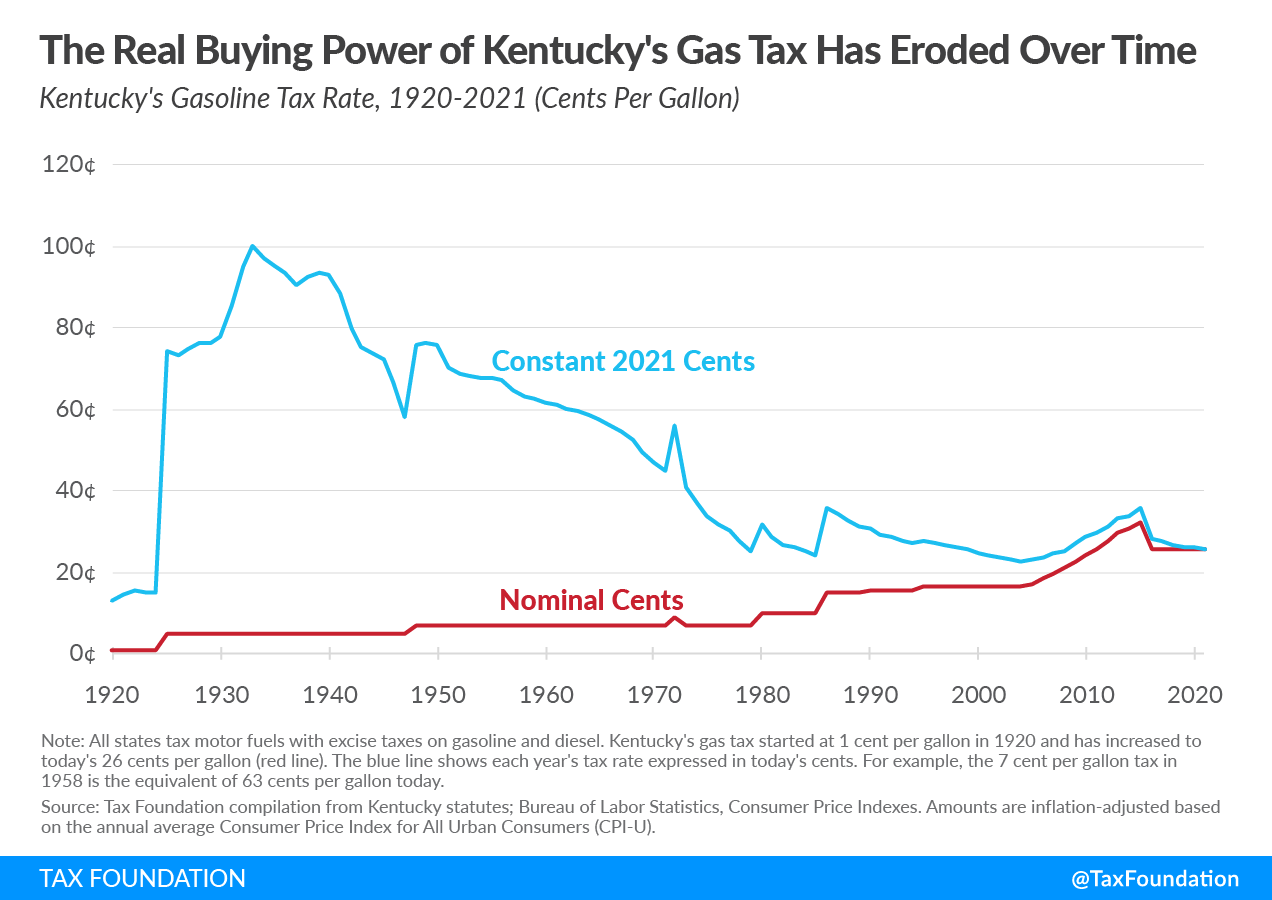

Currently, Kentucky’s gas and license taxes generate enough revenue to cover only 38.3 percent of state and local road spending needs. One reason for this is the value of the gas tax has eroded over time as rate increases have failed to keep pace with inflation.

When Kentucky became the fifth state to adopt a gas tax in 1920, the tax was 1 cpg. Today, the state-levied gas tax is 9 percent of the average wholesale price of gas, subject to a “floor” that has kept the rate from dropping below its current total rate of 26 cpg. (The 26 cpg total rate includes the base rate of 24.6 cpg and a 1.4 cpg tax for underground fuel storage). Kentucky’s statutory gas tax rate has been raised infrequently during its century in existence, and the tax is not indexed for inflation. As a result, the gas tax has lost much of its value over time. Today, Kentucky’s gas tax has half the buying power it had in 1968 and only one-quarter of what it had at its peak.

Another factor contributing to Kentucky’s gas tax erosion is that the Bluegrass State is one of only 11 states tying its gas tax rate to the price of gas. Under Kentucky’s variable-rate gas tax structure, the state adjusts its gas tax on a quarterly basis according to changes in the average wholesale price (AWP) of gas. When gas prices fall, so does the state’s gas tax rate. When gas prices rise, the tax rate rises, but it is capped such that it may not increase by more than 10 percent per year.

Some argue tying tax rates to the price of gas helps gas taxes keep pace with inflation, but inflation is just one small factor impacting gas prices. The price of oil is notoriously volatile, with gas prices constantly fluctuating based on changes in supply and demand, weather, geopolitics, and a variety of other factors. As such, when gas prices drop, Kentucky’s gas tax rate and collections also fall, and the Road Fund takes an unexpected hit. This issue came to the forefront when gas prices fell sharply in 2015, bringing Kentucky’s gas tax rate down by about 6.5 cpg between 2015 and 2016. To prevent the tax rate from dropping further, Kentucky lawmakers in 2015 adopted a tax “floor” of 26 cpg, where the gas tax currently stands.

Variable-rate gas taxes not only make gas tax collections more volatile but also weaken the link between road usage and taxes paid. Generally speaking, gas taxes, tolls, and other similar transportation user taxes and fees adhere relatively well to the benefit principle, or the idea in public finance that taxes paid should relate to benefits received. Variable-rate gas taxes, however, inject a new variable into the mix: the wholesale price of gas. This weakens the relationship between taxes paid and benefits received, as drivers end up contributing less to the Road Fund not because they drove less, but because the wholesale price of gas fell.

Before Kentucky’s 2021 legislative session ends this month, policymakers have the chance to consider increasing the gas tax rate to help recoup a small fraction of the buying power it has lost over time, and to index the tax for inflation to make it a more reliable source of infrastructure funding in the future.

Note: This post was updated on March 10th to clarify that the base gas tax rate would increase from 24.6 to 34.6 cpg, in addition to the existing 1.4 cpg tax for underground fuel storage.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe