Kentucky’s 2019 regular legislative session ended Thursday without progress on infrastructure funding. House Bill 517, a comprehensive infrastructure funding bill, died without a vote. Similar legislation was introduced in 2018 but likewise did not receive a vote.

House Bill 517 would have increased the gas tax by 10 cents per gallon (cpg), created a new electric vehicle highway user fee of $175 (tied to the price of gas), and increased license plate renewal fees from $11.50 to $22 for passenger vehicles and from $9 to $15 for motorcycles, among other changes. If enacted, this legislation would have generated nearly $500 million in additional annual revenue for the Road Fund. However, with 2019 being an off-budget year for Kentucky, new taxes and spending would require supermajority approval in order to pass.

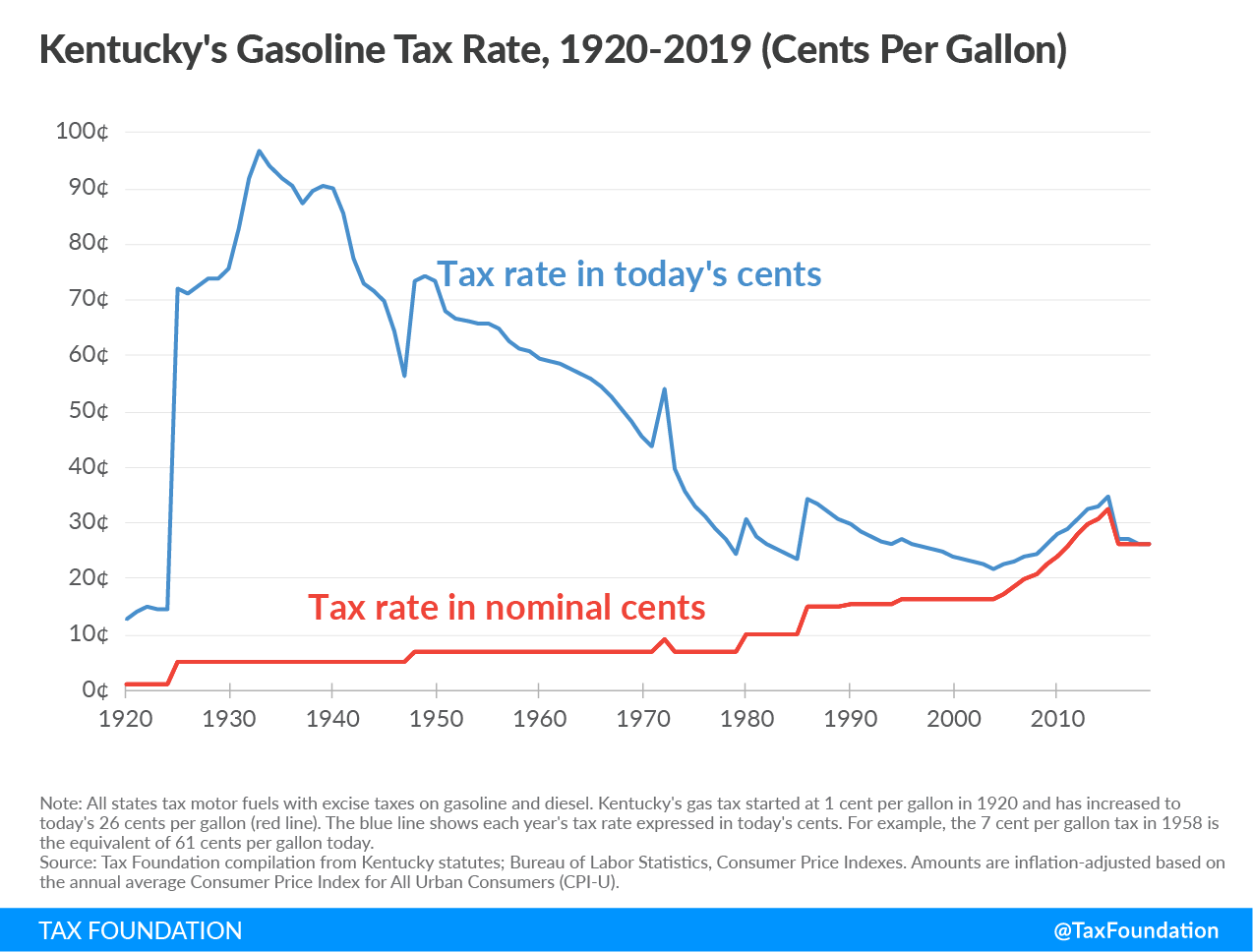

Like many states, Kentucky faces a backlog of road maintenance and construction projects, and existing transportation taxes and user fees are failing to keep pace with funding needs. One reason for this is the value of the gas tax has eroded over time as rate increases have failed to keep pace with inflation.

When Kentucky became the fifth state to adopt a gas taxA gas tax is commonly used to describe the variety of taxes levied on gasoline at both the federal and state levels, to provide funds for highway repair and maintenance, as well as for other government infrastructure projects. These taxes are levied in a few ways, including per-gallon excise taxes, excise taxes imposed on wholesalers, and general sales taxes that apply to the purchase of gasoline. in 1920, the taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. was 1 cpg. Today, the state-levied gas tax is 26 cpg (including excise taxes of 24.6 cpg and a 1.4 cpg tax for underground fuel storage). Kentucky’s statutory gas tax rate has been raised infrequently during its nearly one century in existence, and the tax is not indexed for inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. . As a result, the gas tax has lost much of its value over time. In 1967, for example, Kentucky’s gas tax had double the purchasing power it has today.

Another factor contributing to Kentucky’s gas tax erosion is that the Bluegrass State is one of only 12 states tying its gas tax rate to the price of gas. Under Kentucky’s variable-rate gas tax structure, the state adjusts its gas tax on a quarterly basis according to changes in the average wholesale price (AWP) of gas. When gas prices fall, so does the state’s gas tax rate. When gas prices rise, the tax rate rises, but it is capped such that it may not increase by more than 10 percent per year.

Some argue tying tax rates to the price of gas helps gas taxes keep pace with inflation, but inflation is just one small factor impacting gas prices. The price of oil is notoriously volatile, with gas prices constantly fluctuating based on changes in supply and demand, weather, geopolitics, and a variety of other factors. As such, when gas prices drop, Kentucky’s gas tax rate and collections also fall, and the Road Fund takes an unexpected hit. This issue came to the forefront when gas prices fell sharply in 2015, bringing Kentucky’s gas tax rate down by about 6.5 cpg between 2015 and 2016. To prevent the tax rate from dropping further, Kentucky lawmakers in 2015 adopted a tax “floor” of 26 cpg, where the gas tax currently stands.

Variable-rate gas taxes not only make gas tax collections more volatile but also weaken the link between road usage and taxes paid. Generally speaking, gas taxes, tolls, and other similar transportation user taxes and fees adhere relatively well to the benefit principle, or the idea in public finance that taxes paid should relate to benefits received. However, variable-rate gas taxes inject a new variable into the mix: the wholesale price of gas. This weakens the relationship between taxes paid and benefits received, as drivers will end up contributing less to the Road Fund not because they drove less, but because the wholesale price of gas fell.

Should Kentucky policymakers choose to revisit infrastructure funding in a future legislative session, it would be worthwhile to consider how a rate increase would help recoup the gas tax’s lost value, and how indexing the gas tax for inflation might be a better long-term solution than tying the tax rate to the wholesale gas price.

Share this article