The taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. code contains more than 170 preferences that benefit individuals, varying from credits to deductions to exclusions, which were projected to cost $1.3 trillion over the last fiscal year. The tax code remains progressive after accounting for these provisions. However, certain provisions, such as itemized deductions, primarily benefit higher-income households.

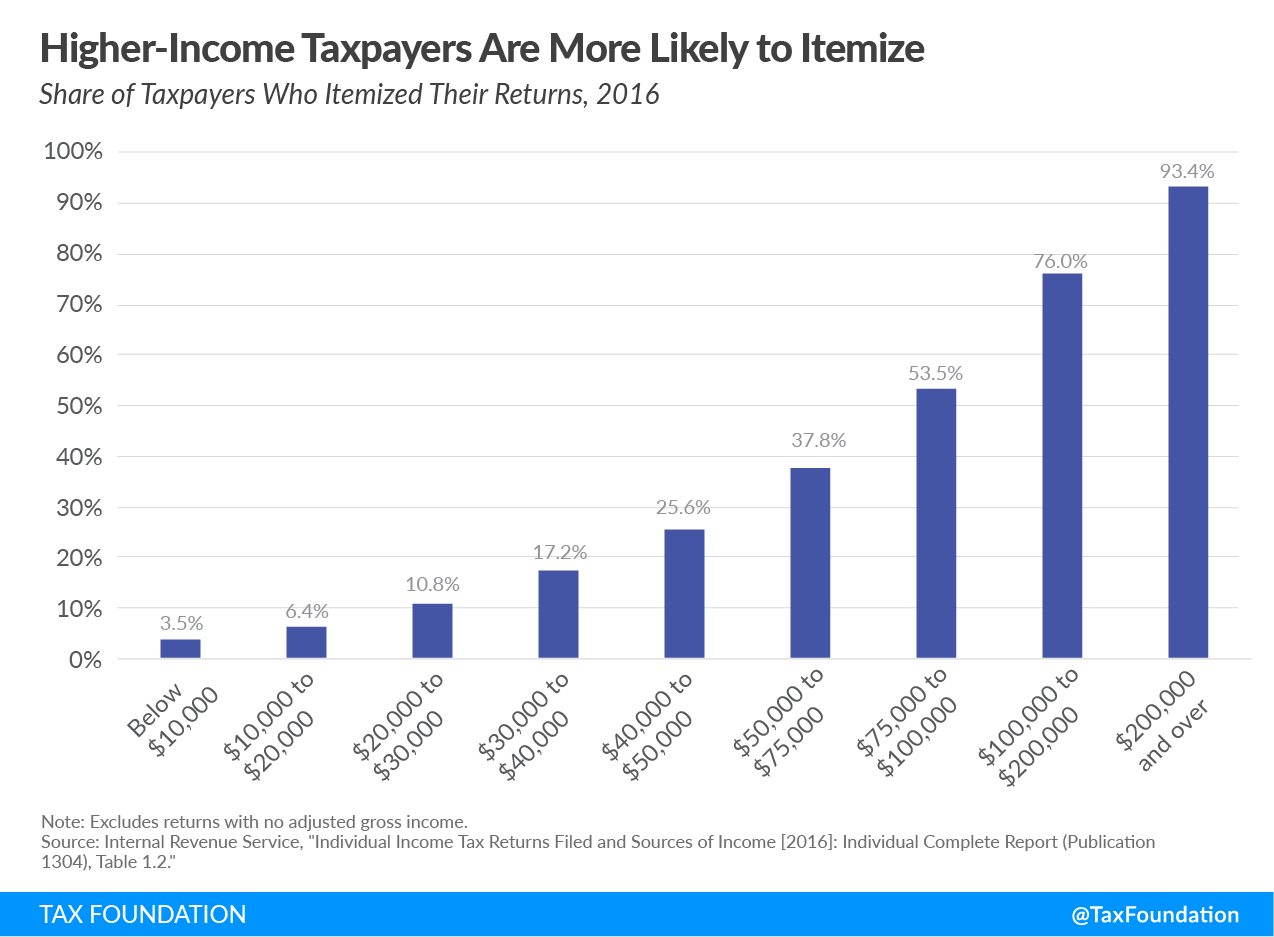

The chart below uses data from the Internal Revenue Service to examine who claimed itemized deductions in 2016. Note that this was before the Tax Cuts and Jobs Act (TCJA) made changes which limited certain itemized deductions and expanded the standard deductionThe standard deduction reduces a taxpayer’s taxable income by a set amount determined by the government. Taxpayers who take the standard deduction cannot also itemize their deductions; it serves as an alternative. .

The percentage of taxpayers who itemize increases as we move up the income scale. In 2016, barely a quarter of households with adjusted gross incomeFor individuals, gross income is the total of all income received from any source before taxes or deductions. It includes wages, salaries, tips, interest, dividends, capital gains, rental income, alimony, pensions, and other forms of income. For businesses, gross income (or gross profit) is the sum of total receipts or sales minus the cost of goods sold (COGS)—the direct costs of producing goods, including inventory and certain labor costs. (AGI) between $40,000 and $50,000 claimed itemized deductions when filing their taxes. In contrast, more than 90 percent of households making $200,000 and above itemized their deductions.

This is important because the value of deductions depends on the top tax rate a taxpayer pays. For example, a $1,000 deduction is worth $220 for someone in the 22 percent tax bracket. The same $1,000 deduction would be worth $370 to someone in the 37 percent bracket.

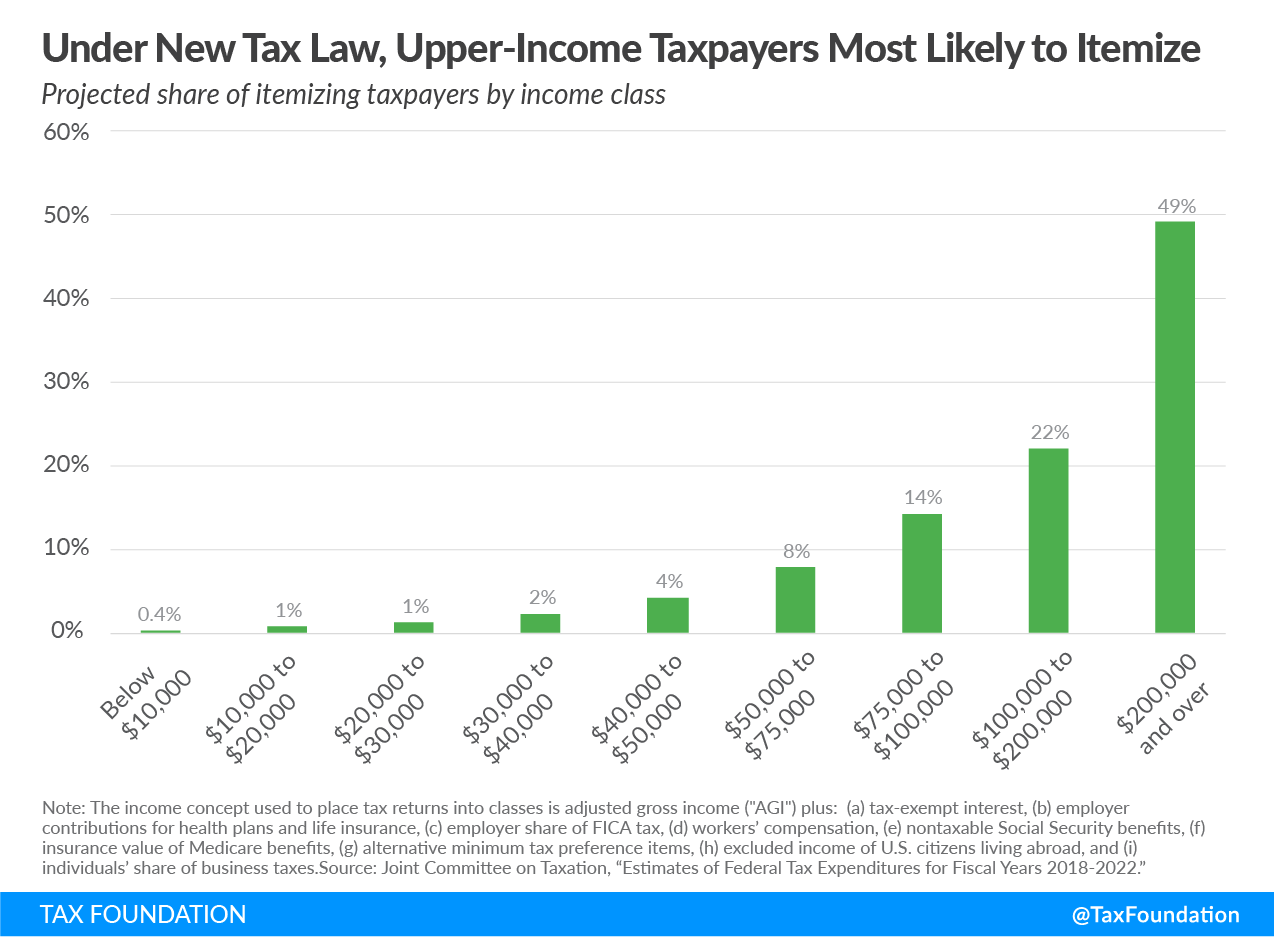

In the coming years, fewer taxpayers will itemize their deductions, instead opting to take the TCJA’s newly expanded standard deduction. The Joint Committee on Taxation (JCT) estimated that the number of filers who itemize would fall from 46.5 million in 2017 to just over 18 million in 2018, the year the changes took effect.

The JCT has also projected that the benefit of itemized deductions will increasingly flow to higher-income taxpayers. Projections for 2018 show that just 8 percent of filers making between $50,000 and $75,000 will itemize, compared to nearly half of taxpayers making $200,000 and over. Comparing the 2016 data with these 2018 data shows that, as mentioned above, changes in the TCJA will lead to fewer taxpayers claiming itemized deductions, and that those who continue to itemize will be higher-income households.

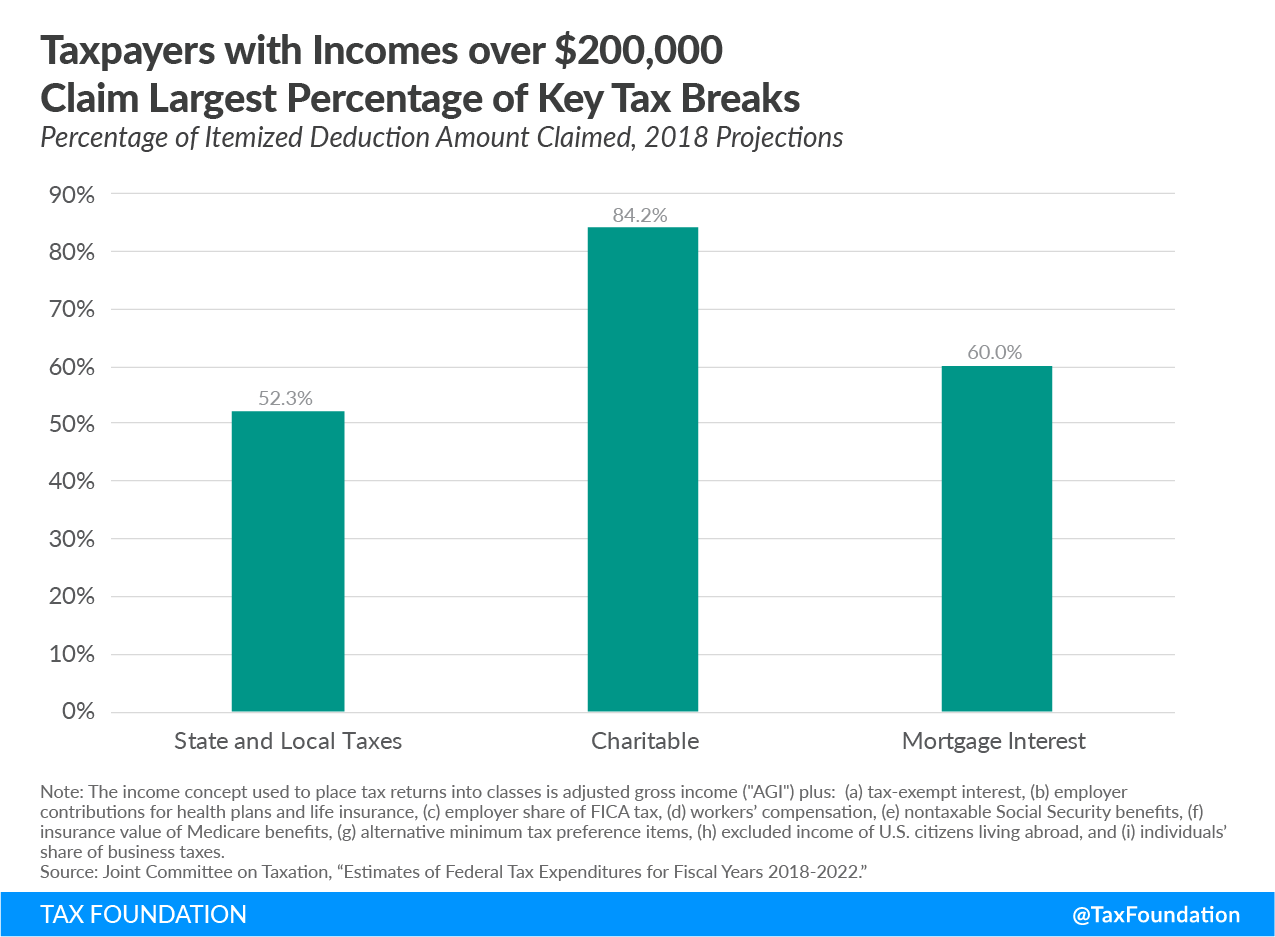

In 2018, the mortgage interest deduction was estimated to cost $33.7 billion, the deduction for state and local taxes paid $43.1 billion, and the charitable contributions deduction $40.6 billion. Though lawmakers have enacted limitations to reduce the value of tax deductions, taxpayers earning more than $200,000 still claim a disproportionately large share of certain key tax breaks.

According to the JCT, high-income taxpayers will claim 52 percent of the state and local tax deductionA tax deduction allows taxpayers to subtract certain deductible expenses and other items to reduce how much of their income is taxed, which reduces how much tax they owe. For individuals, some deductions are available to all taxpayers, while others are reserved only for taxpayers who itemize. For businesses, most business expenses are fully and immediately deductible in the year they occur, but others, particularly for capital investment and research and development (R&D), must be deducted over time. , 84 percent of the charitable donation deduction, and 60 percent of the mortgage interest deductionThe mortgage interest deduction is an itemized deduction for interest paid on home mortgages. It reduces households’ taxable incomes and, consequently, their total taxes paid. The Tax Cuts and Jobs Act (TCJA) reduced the amount of principal and limited the types of loans that qualify for the deduction. .

While the tax code contains preferences that benefit lower- and middle-income households, such as the earned income credit and the child tax creditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income rather than the taxpayer’s tax bill directly. , others, like itemized deductions, primarily benefit high-income households. Even so, the overall burden of the individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. remains progressive.

Note: This is part of our “Putting a Face on America’s Tax Returns” blog series

- America Already Has a Progressive Tax System

- Income Taxes on the Top 0.1 Percent Weren’t Much Higher in the 1950s

- The Composition of Federal Revenue Has Changed Over Time

- The Top 1 Percent’s Tax Rates Over Time

- How Do Transfers and Progressive Taxes Affect the Distribution of Income?

- A Growing Percentage of Americans Have Zero Income Tax Liability