Carbon Taxes in Europe, 2025

In recent years, several countries have taken measures to reduce carbon emissions, including instituting environmental regulations, emissions trading systems (ETSs), and carbon taxes.

4 min readOur dedicated excise tax experts, Adam Hoffer and Jacob Macumber-Rosin, provide leading tax policy research, analysis, and commentary of the latest proposals and trends related to excise taxes. Explore the vast and changing world of excise taxation.

In recent years, several countries have taken measures to reduce carbon emissions, including instituting environmental regulations, emissions trading systems (ETSs), and carbon taxes.

4 min read

The American Revolution was a tax revolt over the power to tax, not over tax burdens. It serves as a reminder that tax policy can have impacts (big and small) that last for centuries.

Summer has arrived, and states are beginning to implement policy changes that were enacted during this year’s legislative session (or that have delayed effective dates or are being phased in over time).

28 min read

Our experts are providing the latest details and analysis of proposed federal tax policy changes.

14 min read

Our preliminary analysis of the Senate Finance tax plan finds the major tax provisions would increase long-run GDP by 1.1 percent and reduce federal tax revenue by $4.7 trillion over the next decade.

9 min read

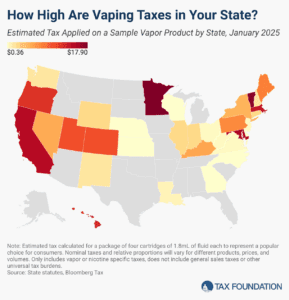

The vaping industry has grown rapidly in recent decades, becoming a well-established product category and a viable alternative to cigarettes for those trying to quit smoking. US states levy a variety of tax structures on vaping products.

7 min read

Senate Republicans have advanced legislation to extend many provisions of the 2017 Tax Cuts and Jobs Act (TCJA) alongside dozens of new provisions, following broadly similar legislation put forward by House Republicans.

7 min read

The House-passed reconciliation bill leaves out Trump’s promise to eliminate taxes on Social Security benefits, opting instead to expand the standard deduction for seniors.

The final House bill makes impressive cuts to the IRA green energy tax credits, but it does so in part by introducing more complexity.

5 min read

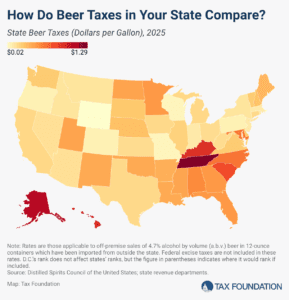

In the United States, taxes are the single most expensive ingredient in beer. The tax burden accounts for more of the final price of beer than labor and materials combined—the many different layers of applicable taxes combining to total as much as 40.8 percent of the retail price.

6 min read

The ongoing economic uncertainty from Russia’s war in Ukraine, economic recovery, supply chain disruptions, and rising interest rates have highlighted the importance of business investment.

30 min read

Our preliminary analysis finds the tax provisions increase long-run GDP by 0.8 percent and reduce federal tax revenue by $4.0 trillion from 2025 through 2034 on a conventional basis before added interest costs.

9 min read

The House-passed “One Big Beautiful Bill” includes a new 3.5 percent tax on remittances, or non-commercial transfers of money that people in the US send to people abroad.

7 min read

The tariffs amount to an average tax increase of nearly $1,200 per US household in 2025.

37 min read

Instead of doubling down on a shrinking tax base, Ohio lawmakers should instead look towards tax solutions that secure the state’s long-term fiscal health.

4 min read

From generous tax breaks to costly trade-offs, the House GOP’s One, Big, Beautiful Bill has a little of everything. It’s a sweeping attempt to extend key provisions of the 2017 Tax Cuts and Jobs Act before they expire in 2026—but what’s actually in it?

The House reconciliation bill includes numerous changes to the tax code: good, bad, and ugly. However, the new corporate alternative minimum tax, or CAMT, goes largely untouched.

4 min read

The EV fee in the reconciliation package would help the fiscal situation but would overcorrect the hole in the gas tax base EVs create. There are intermediate options, such as VMT taxes for EVs and commercial traffic or pairing flat EV fees with gas and diesel tax increases, that would be incrementally better than the reconciliation package’s approach.

7 min read

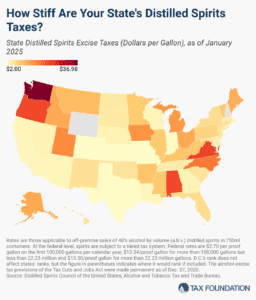

The significant disparity in tax rates across states underscores the complex tax and regulatory environment governing distilled spirits.

6 min read

Sean Bray interviewed Professor of Business Accounting and Taxation at the University of Kiel, Jost Heckemeyer, about the future of the EU tax mix. The interview shows that there is a trade-off between stability and flexibility in European tax policymaking. It also shows that there ought to be a balance between fairness and competitiveness when thinking about improving tax policy.

16 min read