When politicians need to generate revenue for new and existing programs, they often suggest increasing taxes on the wealthiest earners, such as increasing taxes on capital gains. Increasing taxes on capital gains is one way policymakers can generate revenue, but doing so could also negatively impact saving.

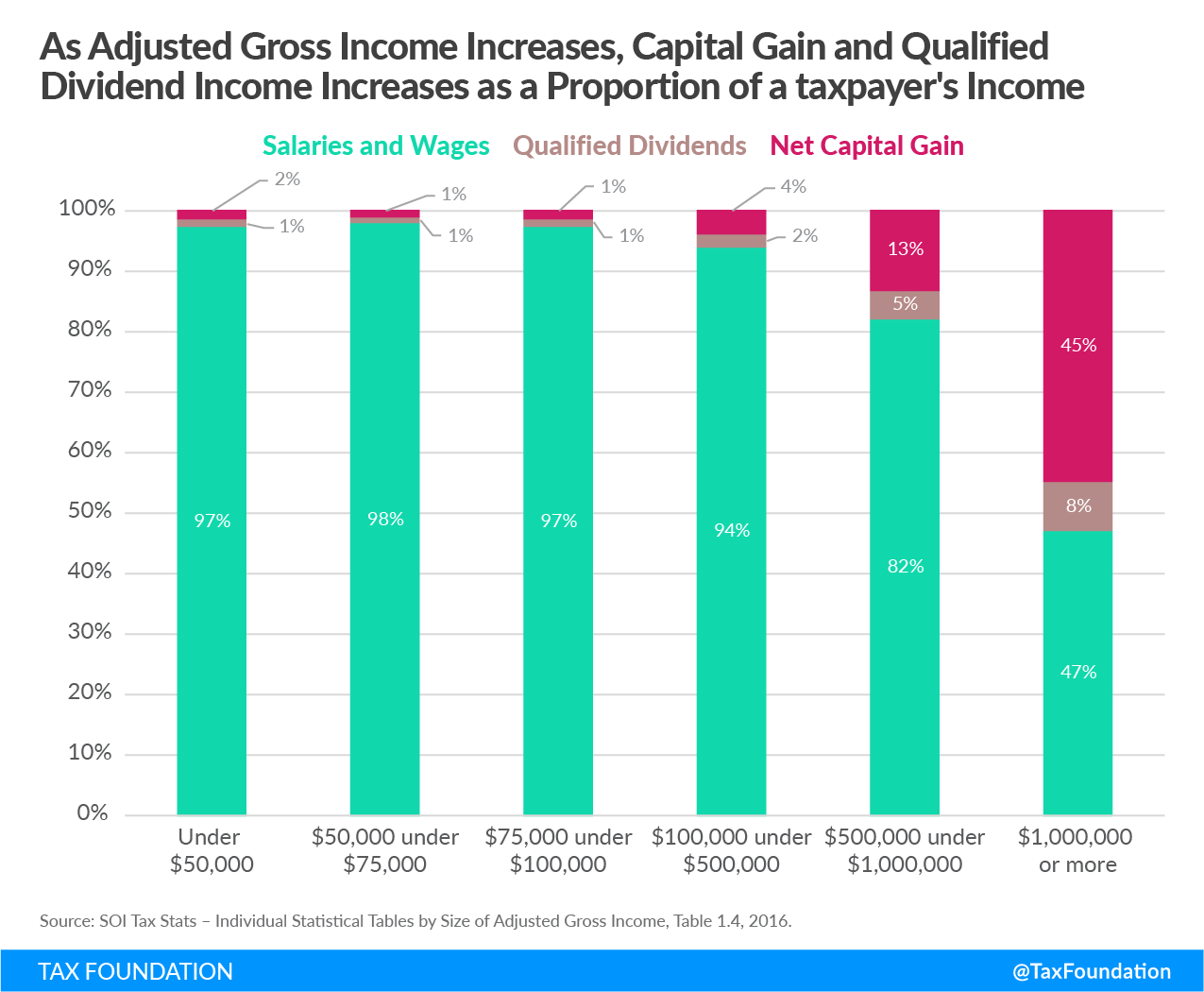

Data from the Statistics of Income division of the Internal Revenue Service shows that wealthier individuals tend to have more income in the form of capital gains and qualified dividends than less wealthy taxpayers (see Figure 1). For taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. year 2016, as a taxpayer’s income increased, salaries and wages became smaller portions of a taxpayer’s income while income from capital gains and qualified dividends increased.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeThough taxation of capital gains did generate approximately $124 billion in revenue for the federal government in 2016 , primarily from wealthier taxpayers, several tax expenditures limit how much revenue policymakers can generate from capital gains.

For one, long-term capital gains are taxed at lower rates than ordinary income. Assets held for less than a year are taxed at ordinary income tax rates while assets held for longer than a year are taxed at lower rates. Currently, the highest rate for long-term capital gains is 23.8 percent, compared to a top rate of 40.8 percent on short-term capital gains (37 percent top marginal income tax rate plus the 3.8 percent net investment income tax). Importantly, some dividends, referred to as qualified dividends, are also taxed at these lower rates.

Taxpayers are also allowed to defer capital gains, meaning they can choose when they realize capital gains and pay tax on that income, which allows them to reduce their tax liability. For instance, taxpayers can choose to realize a gain in a year when they have less income, possibly allowing them to avoid higher marginal income tax rates. Even on its own, deferral reduces the present value of the tax burden associated with a capital gain.

Finally, step-up in basis allows a deceased taxpayer to pass property to an heir without incurring capital gains taxA capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate income taxes, frequently resulting in double taxation. These taxes create a bias against saving, leading to a lower level of national income by encouraging present consumption over investment. liability on any appreciation in the property’s value that occurred during their life. This policy increases the basis of property transferred to an heir to its fair market value, meaning any appreciation in the property’s value that occurred during the decedent’s lifetime goes untaxed.

Limiting these tax expenditures associated with capital gains—either by limiting the ability of taxpayers to defer gains, or curtailing step-up in basisThe step-up in basis provision adjusts the value, or “cost basis,” of an inherited asset (stocks, bonds, real estate, etc.) when it is passed on, after death. This eliminates the capital gains tax owed by the recipient, reducing the heir’s tax liability. The cost basis receives a “step-up” to its fair market value, or the price at which the good would be sold or purchased in a fair market. — would likely generate revenue. But doing so would also discourage saving.

The preferential treatment of long-term capital gains is partially justified because it compensates taxpayers for the relatively high tax burden our tax code places on saving. For taxpayers, any income that is saved in an investment is post-tax income, or the income left after paying income and payroll taxes. Taxes on capital gains are a second tax on this saving, and these taxes bias the tax code in favor of consumption, which is taxed only once. Increasing the rate would further discourage taxpayers from saving and encourage consumption.

Likewise, eliminating step-up in basis would increase the tax burden on property passed from a decedent to an heir by taxing capital gains within that property. Since the total value of property passed to an heir is already taxed by the estate taxAn estate tax is imposed on the net value of an individual’s taxable estate, after any exclusions or credits, at the time of death. The tax is paid by the estate itself before assets are distributed to heirs. , the policies combined could discourage investment in property that could be passed along at death.

Increasing taxes on capital gains creates a trade-off which policymakers must confront. Though these taxes would raise some revenue, they could also negatively impact the economy. Any changes to capital gains taxation need to weigh revenue generation against these economic effects.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe