Executive Summary

In his bestseller Capital in the Twenty-First Century, Thomas Piketty recommends a wealth tax as a remedy to inequality. The basic version of Piketty’s wealth taxA wealth tax is imposed on an individual’s net wealth, or the market value of their total owned assets minus liabilities. A wealth tax can be narrowly or widely defined, and depending on the definition of wealth, the base for a wealth tax can vary. would impose a taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rate of 1 percent on net worth of $1.3 million and $6.5 million and 2 percent on net worth above $6.5 million. Piketty contemplates additional tax brackets, including a bracket of 0.5 percent starting at about $260,000.

We used the Tax Foundation’s Taxes and Growth (TAG) model, augmented with wealth data from the University of Michigan’s Panel Study of Income Dynamics, to estimate how the U.S. economy would respond to Piketty’s wealth taxes.

Key Findings

- A wealth tax in the United States would reduce investment, wages, employment, incomes, and output.

- Piketty’s basic tax would depress the capital stock by 13.3 percent, decrease wages by 4.2 percent, eliminate 886,400 jobs, and reduce GDP by 4.9 percent, or about $800 billion, all for a revenue gain of less than $20 billion.

- The addition of a tax beginning at a net worth of about $260,000 would reduce capital formation by 16.5 percent, decrease wages by 5.2 percent, eliminate 1.1 million jobs, and reduce GDP by 6.1 percent (about $1 trillion annually in terms of today’s GDP), all for a revenue gain of only $62.6 billion.

- All income groups would be worse off under a wealth tax due to decreased economic activity; in the second scenario, the after-tax incomeAfter-tax income is the net amount of income available to invest, save, or consume after federal, state, and withholding taxes have been applied—your disposable income. Companies and, to a lesser extent, individuals, make economic decisions in light of how they can best maximize their earnings. loss for the top quintile would exceed 10 percent, but the losses for all lower quintiles would be in the 7 to 9 percent range.

- Unless one is willing to fight income and wealth inequality by making everyone poorer, any distributional gains from the wealth tax would come at too great a cost.

- Because of daunting administrative and enforcement problems, Piketty’s wealth tax would also be wildly impractical.

According to Thomas Piketty, a professor at the Paris School of Economics, the main economic problem in developed countries is inequality. He believes it takes precedence over other economic concerns like poverty, unemployment, or slow economic growth. In his influential book, Capital in the Twenty-First Century,[1] Piketty argues that inequality is rapidly intensifying with no end in sight. He says a solution is vital, and he claims to have found it: extremely high income tax rates on upper-income taxpayers along with a global wealth tax.

This paper uses the Tax Foundation’s Taxes and Growth model to estimate the impact on economic growth, government revenue, and the distribution of income of the wealth tax he recommends.

The U.S. government will not be enacting a wealth tax any time soon. Nevertheless, it is worth evaluating a federal wealth tax so we can better judge whether Professor Piketty’s recommendations would lead us in the correct direction. Also, as tax reform ideas are generated in the future, it would be good to know whether a wealth tax might be a constructive part of the mix or whether one should be scrupulously avoided.

The Fundamental Questions in Evaluating Piketty’s Policy Recommendations

Piketty asserts that the taxes he recommends would have multiple benefits. For starters, they would lower the income of the wealthy. In addition they would supposedly have either a benign or positive impact on economic growth, help the poor and middle class, and collect extra tax revenue so the government could expand its current, “meager”[2] social spending.

In evaluating Piketty’s policy recommendations, two questions are fundamental. One is whether his data and conclusions about inequality are correct. If inequality has not risen as much as he asserts, or is not poised to continue rising, the issue is less serious than Piketty claims, and the need for government action is less pressing. Piketty’s analysis has some strong supporters[3] but also many vigorous critics.[4] To illustrate one weakness in his analysis, consider Piketty’s assertion, “One of the most striking lessons of the Forbes rankings [of the ultra-wealthy] is that, past a certain threshold, all large fortunes, whether inherited or entrepreneurial in origin, grow at extremely high rates . . . .”[5] When Will McBride of the Tax Foundation recently examined the Forbes 400, he found that people often fall off the list; they are not blessed with superior investment returns that last forever.[6] Looking at all the people on the 1987 Forbes list, rather than a selected few, McBride calculated that their subsequent returns were, on average, about the same as those of the general population.

A second fundamental question is whether the treatment Piketty prescribes for his perceived inequality problem would be helpful or harmful. Professor Piketty claims his taxes (or, rather, what they might be used for) would benefit everyone, except perhaps the very wealthy. But is that true? Would the taxes bring the benefits he promises? Would the side effects be mild? Or would his taxes be injurious? This second question has received less attention than the first, but it is crucially important.

To help answer the second question, an earlier Tax Foundation study used the Taxes and Growth (TAG) model to estimate the economic consequences if Piketty’s proposed income tax rates were enacted in the United States—a top rate of 80 percent starting somewhere between $500,000 and $1 million, and a next-to-top rate of 50 or 60 percent starting at $200,000.[7] The Tax Foundation model predicts that Piketty’s income tax rates would have disastrous results. If the new top rates applied to capital gains and dividends along with ordinary income,[8] the model estimates that, after several years and compared to where the economy would otherwise be, the capital stock would be 42.3 percent smaller, wages would be 14.6 percent lower, 4.9 million jobs would be extinguished, and gross domestic product (GDP) would plunge 18.1 percent (a loss of $3 trillion dollars annually in terms of today’s GDP).[9] Moreover, despite the higher tax rates, government revenue would actually fall, because the economy would become so much smaller. In addition, while the higher income tax rates would not directly hit the poor and middle class, the weaker, smaller economy would. The model estimates that by the time the economy had fully adjusted, after a decade or so of anemic growth, the after-tax incomes of the poor and middle class would be 16 to 17 percent lower than if Piketty’s income tax rates were not enacted.

In the earlier study, two key sources of tax and economic data were the National Income and Product Accounts (NIPA), which the U.S. Bureau of Economic Analysis compiles, and the IRS’s Public Use File for 2008 (the latest year available), which is a large, anonymous sample of individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. records. To examine a Piketty-style wealth tax, the current study additionally draws on wealth data gathered through surveys by the University of Michigan’s Panel Study of Income Dynamics (PSID).[10] The Appendix discusses the wealth data in greater detail.

Piketty’s Call for a Comprehensive Wealth Tax

Piketty offers a variety of reasons for why he thinks a comprehensive wealth tax would be an excellent tax. His main objective is income redistribution. “[T]he ideal policy for avoiding an endless inegalitarian spiral and regaining control over the dynamics of accumulation,” he writes, “would be a progressive global tax on capital.”[11]

A wealth tax’s revenue potential also attracts Piketty. He advises that “in view of growing government needs . . . a government would have to be blind to pass up such a tempting source of revenue.”[12]

Piketty deploys several additional defenses on behalf of a comprehensive wealth tax. According to his “contributive justification,” it is difficult to adequately define the income of the wealthy, and instead of attempting to do so, “A simpler solution is to compute the [income] tax due on the basis of wealth rather than income.”[13] To be clear, Piketty is not offering to substitute the wealth tax for the income tax but is demanding that the wealthy pay both. According to his “incentive justification,” the need to come up with the money to pay the tax will give the wealthy an incentive they now supposedly lack “to seek the best possible return on one’s capital stock.”[14] Piketty does not fear that the tax will discourage saving and investment and thereby block some worthwhile investments. He assumes that savers will react by running harder to stay in place.

Piketty says another purpose of the capital tax is “to impose effective regulation on the financial and banking system in order to avoid crises.”[15] However, financial crises often result not from a lack of government regulation but from ill-advised government actions, such as running unsustainable budget deficits, printing too much money, or crafting regulations that distort financial markets.

Turning to what, specifically, is taxed, Piketty recommends that the tax base be net worth (which means assets minus debts, not merely assets); that the tax employ a broad-based measure of net worth with few exclusions; and that the tax be assessed annually. In his words:

To my mind, the objective ought to be a progressive annual tax on individual wealth—that is, on the net value of assets each person controls. For the wealthiest people on the planet, the tax would thus be based on individual net worth—the kinds of numbers published by Forbes and other magazines . . . . For the rest of us, taxable wealth would be determined by the market value of all financial assets (including bank deposits, stocks, bonds, partnerships, and other forms of participation in listed and unlisted firms) and nonfinancial assets (especially real estate), net of debt.[16]

Piketty offers a range of options regarding the rate schedule of the wealth tax. In his words again:

At what rate would it be levied? One might imagine a rate of 0 percent for net assets below 1 million euros, 1 percent between 1 and 5 million, and 2 percent above 5 million. Or one might prefer a much more steeply progressive taxA progressive tax is one where the average tax burden increases with income. High-income families pay a disproportionate share of the tax burden, while low- and middle-income taxpayers shoulder a relatively small tax burden. on the largest fortunes (for example, a rate of 5 or 10 percent on assets above 1 billion euros). There might also be advantages to having a minimal rate on modest-to-average wealth (for example, 0.1 percent below 200,000 euros and 0.5 percent between 200,000 and 1 million).[17]

Piketty’s only major concern about the viability of a comprehensive wealth tax is whether it would be enforceable. He suspects taxpayers would react vigorously and try to hide or recharacterize as much of their wealth as they could. To minimize evasion and avoidance, Piketty recommends that financial institutions be required to report much more information to governments, that governments step up tax enforcement, and that the wealth tax be imposed globally.

Regarding financial reporting, Piketty points to the U.S. government’s Foreign Account Tax Compliance Act (FATCA) as a good first step, although “insufficient.”[18] (Notwithstanding Piketty’s praise, FATCA has stirred international complaints of American heavy-handedness and bullying.[19] It has also caused enormous difficulties for Americans living abroad in finding banks willing to open accounts for them.)

As for the wealth tax being global, Piketty calls the idea “utopian” but notes that “countries wishing to move in this direction could very well do so incrementally . . . . One can see a model for this sort of approach in the recent discussions on automatic sharing of bank data between the United States and the European Union.”[20] In short, while Piketty would like the wealth tax to be global to maximize enforceability, he believes some country or group of countries could act on their own.

Piketty envisions his wealth tax coming first to Europe. Several European countries already have wealth taxes, including France with its “Solidarity Tax,” although those levies have much narrower bases than what Piketty suggests. He would almost certainly applaud, though, if the United States were to enact an annual, comprehensive wealth tax.

The Economic Effects of Piketty’s Wealth Tax

Professor Piketty suggests several possible rate schedules. We have modeled two of them (Figure 1).

| Figure 1. Two Wealth Tax Scenarios | ||

|---|---|---|

| Case Study 1 | ||

| Net Worth (dollars) | Rate | |

| From | To | |

| 0 | 1,300,000 | 0% |

| 1,300,000 | 6,500,000 | 1% |

| 6,500,000 | and over | 2% |

| Case Study 2 | ||

| Net Worth (dollars) | Rate | |

| From | To | |

| 0 | 260,000 | 0% |

| 260,000 | 1,300,000 | 0.5% |

| 1,300,000 | 6,500,000 | 1% |

| 6,500,000 | and over | 2% |

| ‘Note: Piketty lists the bracket thresholds in euros. The thresholds are converted here into dollars using purchasing power parity. | ||

Case Study 1 might be called Piketty’s basic schedule: 1 percent on net worth between 1 and 5 million euros, and 2 percent on net worth above that. We converted these ranges into dollars using purchasing power parity[21] and rounded up slightly so that the 1 percent bracket begins at $1.3 million and the 2 percent bracket begins at $6.5 million. As noted above, Piketty wants to measure net worth broadly, with as few exemptions as possible, and wants to assess the tax annually.

Case Study 2, incorporating a portion of Piketty’s recommendation for a more comprehensive wealth tax, adds a starting bracket of 0.5 percent on net worth between 200,000 and 1 million euros. Converted into dollars and slightly rounded up, the bracket runs from $260,000 to $1.3 million.

It would be enlightening also to model the 5 or 10 percent rate on billionaires about which Piketty muses. However, that would be asking too much of the data series.

The Piketty Wealth Tax Would Decrease Investment, the Number of Jobs, and the Size of the Economy

A 1 or 2 percent tax may not sound like much, but three features magnify the potential harm to the economy. First, a wealth tax of a given percent is equivalent to an income tax of a much higher percent. For example, if the pre-tax return on an asset is 8 percent, a 1 percent wealth tax on the asset would take away one-eighth of the income. That is the same tax bite as a 12.5 percent income tax rate. Second, much of people’s wealth represents holdings of equipment, structures, intellectual property, and other capital used in production. Capital formation and the jobs that go with it are extremely sensitive to expected after-tax returns. Thus, what looks like a small wealth tax may cause a large decline in capital formation and productivity. Third, Piketty wants to assess his broad-based wealth tax every year, probably in addition to all other existing taxes.[22]

Case Study 1. Wealth tax schedule: 1 percent bracket starting at $1.3 million and 2 percent bracket starting at $6.5 million

The model estimates that after the economy has adjusted to the wealth tax, the stock of private business capital will be down 13.3 percent, the wage rate will drop 4.2 percent, there will be 886,000 fewer jobs, and the economy’s total output of goods and services (GDP) will be 4.9 percent lower than otherwise. A static revenue estimate would show the federal government gaining nearly $220 billion from the new wealth tax. However, because of the negative feedback from the smaller and weaker economy, the federal government’s actual revenue gain will be less than one-tenth of that. Table 1 and Chart 1 present the results.

| Table 1. Wealth Tax: 1 Percent Bracket Starting at $1.3 Million and 2 Percent Bracket Starting at $6.3 Million | |

|---|---|

| Economic and Budget Changes Compared to Current Tax System | |

| (Billions of 2013 dollars except as noted) | |

| GDP | -4.85% |

| GDP ($ billions) | -$791.7 |

| Private business GDP | -5.03% |

| Private business stocks | -13.30% |

| Wage rate | -4.15% |

| Private business hours of work | -0.92% |

| Full-time equivalent jobs (in thousands) | -886.4 |

| Static federal revenue estimate, GDP assumed constant ($ billions) | $216.9 |

| Dynamic federal revenue estimate after GDP gain or loss ($ billions) | $18.2 |

| Weighted average service price | % Change |

| Corporate | 9.87% |

| Noncorporate | 8.73% |

| All business | 9.53% |

| Source: Tax Foundation calculations. | |

Case Study 2. Wealth tax schedule: 0.5 percent bracket starting at $260,000, 1 percent bracket starting at $1.3 million, and 2 percent bracket starting at $6.5 million

Piketty mentions the possibility of having more brackets. Case Study 2 models one of those scenarios. It adds a 0.5 percent bracket for wealth from $260,000 to $1.3 million. This scenario would greatly expand the number of people subject to the wealth tax. In much of the country, a family that owns its own home and has paid off the mortgage would possess enough net wealth to owe the tax. As shown in Table 2 and Chart 2, the model predicts that, after all adjustments, the capital stock will be 16.5 percent smaller than otherwise, wages will be 5.2 percent lower, 1.1 million jobs will be lost, and the overall economy will produce 6.1 percent less output than otherwise.

| Table 2. Wealth Tax: 0.5 Percent Bracket Starting at $260,000, 1 Percent Bracket Starting at $1.3 Million, and 2 Percent Bracket Starting at $6.3 Million | |

|---|---|

| Economic and Budget Changes Compared to Current Tax System | |

| (Billions of 2013 dollars except as noted) | |

| GDP | -6.08% |

| GDP ($ billions) | -$991.7 |

| Private business GDP | -6.31% |

| Private business stocks | -16.46% |

| Wage rate | -5.20% |

| Private business hours of work | -1.16% |

| Full-time equivalent jobs (in thousands) | -1,120 |

| Static federal revenue estimate, GDP assumed constant ($ billions) | $323.9 |

| Dynamic federal revenue estimate after GDP gain or loss ($ billions) | $62.6 |

| Weighted average service price | % Change |

| Corporate | 12.58% |

| Noncorporate | 11.13% |

| All business | 12.15% |

| Source: Tax Foundation calculations. | |

In terms of the current GDP of about $17 trillion, that is a GDP loss of nearly $1 trillion annually. Federal revenue would grow by a massive $324 billion according to a conventional, static revenue estimate, but the actual revenue gain will be only about one-fifth of that after accounting for negative revenue feedbacks from the damaged economy.

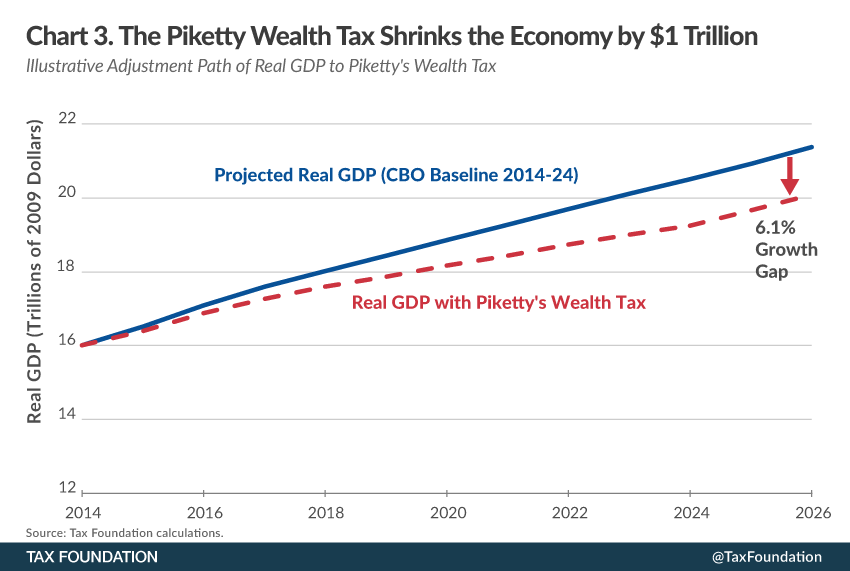

It would take several years for the economic damage to hit with full force. Initially, the economy would have almost as much plant and equipment as before and be nearly as productive. Very quickly, though, people would begin saving and investing less because of the wealth tax, with the consequence that fewer additions would be made to the capital stock, less capital would be replaced as it wore out, and productivity would suffer. Growth would slow during the adjustment, and the levels of productivity, output, and incomes would be permanently lower than otherwise after the economy had fully adjusted.

Chart 3 offers a simplified, illustrative example of the adjustment path for GDP. Each year for ten years, economic output in the example grows 0.65 percent less than otherwise. With the Congressional Budget Office (CBO) projecting average real GDP growth of about 2.45 percent annually from 2014 to 2024,[23] this would drop the average real growth rate to about 1.8 percent annually. After ten years, the annual level of GDP would be approximately 6.1 percent less than otherwise.

Distributional Effects of Piketty’s Wealth Tax

Piketty presents a wealth tax as being a well-targeted way to reduce inequality. It would supposedly take from the very rich without hurting the poor or middle class. One of the surprises of the quantitative analysis, then, is that it would make everyone poorer. Table 3 shows the distributional results.

Distribution in Case Study 1: Wealth tax starts at $1.3 million of net wealth

The static column displays the results if, implausibly, people pay no attention to the tax when deciding how much to work, save, and invest. Because people are assumed to make the same production decisions as before, the distributional changes are solely due to their wealth tax obligations. As expected, the tax hits the top 1 percent of the income distribution hardest and also has a significant impact on the rest of the top 10 percent. On average, it would reduce after-tax incomes in the top 1 percent of the income distribution by 7.1 percent and the top 10 percent by 4.5 percent.

However, the wealth tax does not stop there. It would also snare many people who regard themselves as middle class. A couple with a modest income who have saved diligently for many years could easily trigger the wealth tax. So could numerous retirees who have little current income and are primarily living off of a lifetime of accumulated savings. The tax would cut after-tax incomes of people in the 40 to 60 percent income range (the middle quintile, or fifth, of the income distribution) by an average of 0.8 percent, for example. While the top half of the income distribution would pay most of the wealth tax, the table shows that every income group in the bottom half would also owe the tax.

The next column to the right (Case Study 1’s dynamic column) presents a more realistic analysis, which takes into account the effect of the tax change on economic activity. Because the tax would discourage work and investment, it would lead to slower economic growth. With less production, every group in the economy would, on average, have less income. For the average family in the 99th percentile, the model estimates an 11.6 percent drop in after-tax income due to the economic malaise and their large wealth tax liability. For the average family in the top 10 percent, the after-tax income loss would be 8.8 percent. For families in the middle quintile of the income distribution, the estimated loss would be 5.2 percent, on average, because of both the weaker economy and a small wealth tax liability. The estimated loss for families in the bottom quintile would be 5.0 percent, primarily due to the weaker economy.

| Table 3. Distributional Analysis | ||||

|---|---|---|---|---|

| Case Study 1. Wealth Tax 1 Percent Bracket Starting at $1.3 Million and 2 Percent Bracket Starting at $6.3 Million | Case Study 2. Wealth Tax 0.5 Percent Bracket Starting at $260,000, 1 Percent Bracket Starting at $1.3 Million, and 2 Percent Bracket Starting at $6.3 Million | |||

| All Returns with Positive AGI,Decile Class | Static Aftertax AGI |

Dynamic Aftertax AGI |

Static Aftertax AGI |

|

| 0% to 20% | -0.70% | -5.00% | -1.90% | -7.30% |

| 20% to 40% | -2.50% | -6.90% | -3.70% | -9.20% |

| 40% to 60% | -0.80% | -5.20% | -2.10% | -7.70% |

| 60% to 80% | -1.40% | -5.20% | -2.70% | -8.20% |

| 80% to 100% | -3.50% | -7.80% | -4.70% | -10.10% |

| 90% to 100% | -4.50% | -8.80% | -5.60% | -10.10% |

| 95% to 100% | -5.40% | -9.70% | -6.40% | -11.80% |

| 99% to 100% | -7.10% | -11.60% | -7.50% | -13.20% |

| Total for All | -2.50% | -6.90% | -3.80% | -9.20% |

| Note: The static columns show the distributional effects of wealth tax liabilities, assuming the wealth tax has no economic growth effects. | ||||

| Note: The dynamic columns additionally show distibutional changes due to the wealth tax’s growth effects on AGI, income tax liabilities, and wealth tax liabilities. | ||||

| Source: Tax Foundation calculations. | ||||

Distribution in Case Study 2: Wealth tax starts at $260,000

Piketty considers applying his wealth tax more broadly. Instead of reserving it only for millionaires, he floats the idea of beginning it at a much lower threshold. Many more middle-income families would owe the wealth tax in that event. For example, the model estimates that even if the static assumption were correct and the economy stayed the same size as before, the after-tax incomes of families in the 40 to 60 percent income quintile would fall by 2.1 percent, on average, because of the wealth tax they would owe.

When the harm to the economy is also considered (Case Study 2’s dynamic column), the average loss of after-tax income for families in the 40 to 60 percent income quintile would climb to 7.7 percent. To be sure, after-tax incomes would fall the most for the families with the most income. When the estimate includes the tax’s economic damage (Case Study 2’s dynamic column again), the losses average 13.2 percent for the top 1 percent of the income distribution, 11.8 percent for the top 5 percent, and 11.0 percent for the top 10 percent. But everyone would lose.

The Piketty Wealth Tax Would Result in Lower Income for Everyone

Many people, including Professor Piketty, are offended that incomes and wealth are not more equal. However, would many people in the bottom half of the scale willingly sacrifice 5 to 9 percent of their income in order to trim the income of the top 1 percent by 12 or 13 percent? People with lower incomes might consider the trade especially troubling because they have little income to spare currently, many of them are young, and they hope to move up the income and wealth ladder themselves in the future.

According to a static revenue estimate, the two-bracket wealth tax would raise a huge amount of tax revenue, and the three-bracket wealth tax would collect even more. If that revenue materialized, it could fund a large increase in government programs for the poor and middle class. As noted above, however, only a small portion of the revenue would materialize. For instance, under the three-bracket wealth tax, annual GDP would drop almost $1 trillion while federal revenue would rise about $60 billion. Even if all of the $60 billion were spent on worthwhile programs for the poor and middle class (big ifs), that would be a pittance compared to the income and wealth accumulation the poor and middle class would have lost.

What Else Could Go Wrong?

This section briefly discusses several other concerns regarding Piketty’s wealth tax.

The Burden of Additional Tax Paperwork

Piketty is sanguine when discussing compliance costs. In the United States, financial institutions already send 1099 forms to the people to whom they pay interest, dividends, capital gains, and some other forms of income. Piketty says “this reporting method . . . makes the taxpayer’s life simple,” and he would have financial institutions send out annual forms listing the value of “all types of financial assets (and debts)” held with them. [24] Tax filers could enter these amounts directly on their wealth tax return. For the value of real estate, Piketty suggests taxpayers simply report the amounts shown on the property tax assessments they receive from local governments.

Piketty is correct that listing these amounts on a wealth tax return would not be difficult. Of course, it might be tedious, and the possibility of inaccurate local property taxA property tax is primarily levied on immovable property like land and buildings, as well as on tangible personal property that is movable, like vehicles and equipment. Property taxes are the single largest source of state and local revenue in the U.S. and help fund schools, roads, police, and other services. assessments could be a worry. However, if the wealth tax is to be comprehensive, the net worth computation would need to include jewelry, collectibles, expensive furniture, and other household valuables. The millions of people with holdings in non-publicly traded businesses would also face huge headaches. Itemizing and appraising valuable personal property and stakes in non-publicly traded businesses would quickly become extremely time consuming and expensive, and the valuations would be highly uncertain.

The federal estate tax, which is essentially a wealth tax assessed at death, provides a real-world benchmark. The estate taxAn estate tax is imposed on the net value of an individual’s taxable estate, after any exclusions or credits, at the time of death. The tax is paid by the estate itself before assets are distributed to heirs. form is usually not difficult to prepare if the decedent had a bank account or two, some publicly traded stocks and bonds, owned a home, and possessed nothing else of much value. The estate tax form becomes much more difficult and costly to prepare, and more likely to trigger disputes with the IRS, if asset valuations involve businesses and collectibles and are not a matter of black and white. The paperwork burden of Piketty’s wealth tax would be far worse, because it would be due every year rather than just once.

The Possibility of Tax Evasion and the Cost of Enforcement

Piketty believes that evasion will not be a large problem if there is worldwide information reporting by financial institutions. However, unless government agents start making surprise inspections of people’s homes, storage lockers, and safe deposit boxes, it is predictable that people will fail to report many personal valuables and perhaps convert some financial assets into forms that are easier to hide. As this sort of evasion becomes commonplace, it is also predictable that respect for the law will diminish and that government agents will seek increasingly intrusive enforcement tools.

These dangers largely explain why state and local governments usually limit the property taxes they impose on individuals to large, easily observed items like land, buildings, cars, and boats.[25]

The Issue of Liquidity

Some people are asset rich but cash poor. The classic case is a farming family with valuable land but not much income. Another is a successful small business owner who is temporarily reinvesting every cent to grow the business. Yet another is an elderly couple of limited means who happen to own a valuable home. People like these do not feel wealthy. They could not pay a wealth tax that could be several thousand dollars annually without financial strain, perhaps going to the bank for a loan, dipping into the small amount of cash they have, or in some cases being forced to sell their farm, small business, home, or other illiquid asset for cash.

The practical difficulties mentioned in this section, as well as others, shed light on why many nations that once imposed wealth taxes, among them Austria, Denmark, Germany, Sweden, and Finland, have since repealed their wealth taxes, and why no nation has, on a long-term basis, imposed a comprehensive annual wealth tax. For example, although France levies a wealth tax, it is not comprehensive. Indeed, Piketty complains there are so many deductions and exemptions that “the wealthiest individuals in France largely avoid paying the wealth tax.”[26]

A Constitutional Barrier

The U.S. Constitution limits the federal government’s power to impose direct taxes. Article I, Section 9, Clause 4 states, “No Capitation, or other direct, Tax shall be laid, unless in Proportion to the Census or enumeration herein before directed to be taken.” Article I, Section 2, Clause 3 contains a similar admonition. These provisions require a federal direct taxA direct tax is levied on individuals and organizations and is not expected to be passed on to another payer (unlike indirect taxes such as sales and excise taxes), though economic incidence can still fall upon others. Often with a direct tax, such as the individual income tax, tax rates increase as the taxpayer’s ability to pay, or financial resources, increases, resulting in what is called a progressive tax. Article 1, Section 9, of the US Constitution requires direct taxes to be apportioned by state population, though the 16th Amendment establishes that income taxes are not subject to this requirement. to collect the same amount in two states if the states have the same number of people.

In Pollock v. Farmers’ Loan & Trust Co. (1895), the U.S. Supreme Court invalidated an early federal income tax, finding that it was a direct tax and violated the apportionment requirement. To remove this constitutional barrier, Congress and the states responded with the Sixteenth Amendment which explicitly repeals the apportionmentApportionment is the determination of the percentage of a business’s profits subject to a given jurisdiction’s corporate income tax or other business tax. US states apportion business profits based on some combination of the percentage of company property, payroll, and sales located within their borders. requirement in the case of the income tax.

The Sixteenth Amendment does not discuss wealth taxes. Since most legal scholars classify wealth taxes as direct taxes and since a federal wealth tax would by its nature take more from people in rich states than poor states, a federal wealth tax may be ruled unconstitutional unless Congress and the states first pass a constitutional amendment allowing it.[27]

Conclusion

In Capital in the Twenty-First Century, Thomas Piketty declares that higher tax rates on the wealthy are the path to a fairer and more prosperous future. A key element of his program is a comprehensive wealth tax. This paper has modeled the growth and distributional effects of a broad-based, Piketty-style wealth tax.

Piketty’s claim of fairness is subjective and of prosperity is surely wrong. The wealth tax would cause large declines in investment, employment, wages, and national output. The nation as a whole would be poorer. The Tax Foundation model estimates that the GDP loss, expressed in terms of the 2013 economy, would be about $800 billion annually under a two-tier wealth tax of 1 and 2 percent. The estimated loss would rise to about $1 trillion annually if a half-percent bracket on smaller wealth holders were also imposed.

A distributional analysis reveals that the loss of after-tax income would be greatest at the top of the income scale but that families at all income levels would suffer. Some people with low current incomes, such as many retirees, would be hurt, because they have saved enough to be subject to the wealth tax, but most of the losses for the poor and middle class would occur because the wealth tax would lead to fewer jobs, lower wages, and a diminished supply of goods and services. In short, Piketty’s wealth tax would reduce income and wealth inequality, but at the cost of making everyone significantly poorer.

In addition to the large, negative growth effects, the broad-based wealth tax that Piketty recommends may not be practical because it would place huge compliance costs on many households and be difficult to enforce. These problems would not go away even if the wealth tax were global.

Appendix

The Logic of the Tax Foundation’s Taxes and Growth Model

Taxes have a major impact on economic growth, because people respond to incentives. If a tax change reduces the after-tax reward at the margin for working and investing, people will supply less labor and capital (equipment, structures, and intellectual property) in the production process. Fewer production inputs will lead to less output and a smaller economy. Conversely, if taxes take a smaller bite at the margin, people will supply more labor and capital in production, resulting in faster growth and a larger economy. Empirical evidence indicates that labor is moderately sensitive to after-tax rewards and capital is extremely sensitive.

With these points in mind, the model calculates by how much (if at all) a proposed tax change would alter average and marginal tax rates. From that, it estimates the adjustments people would make in the quantities of labor and capital they supply in the production process and then estimates the impact on the economy after people have fully adjusted.[28] The model also provides a static revenue score for the proposed tax change and a revenue estimate that takes economic feedbacks into account. If a tax change causes a large movement in marginal tax rates, the static and dynamic revenue scores can be very different.

Wealth Data for Calculating the Tax’s Impact on Average and Marginal Tax Rates

In the earlier paper that estimated the economic effects if the U.S. government were to establish top income tax bracketsA tax bracket is the range of incomes taxed at given rates, which typically differ depending on filing status. In a progressive individual or corporate income tax system, rates rise as income increases. There are seven federal individual income tax brackets; the federal corporate income tax system is flat. of 50-60 percent and 80 percent based on Piketty’s advice, we calculated the resulting changes in people’s income taxes using a sample of almost 140,000 anonymous income tax records (the IRS 2008 Public Use File). No data source of comparable quality exists for wealth. Here we describes several possible sources of wealth data and the pros and cons of each.

Estimating people’s liabilities under a comprehensive wealth tax requires knowledge of the total amount of wealth and its distribution across the population. The two main ways for investigators to gather the required wealth information are by analyzing tax data and through surveys. If you are dealing with only a small number of people and they are in the public eye, a third way is to have skilled researchers prepare an estimate for each person or family under consideration by perusing public records, conducting interviews, and making educated guesses. This is essentially how Forbes produces its 400 list.

The IRS Statistics of Income Division (SOI) is currently the best source for U.S. wealth estimates derived from tax data. SOI obtains highly detailed knowledge from estate tax returns about decedents’ wealth. SOI then uses mortality tables to deduce how many people in the total U.S. population have similar wealth. (If you know how likely a person of a given age, sex, and certain other characteristics is to die, you can calculate quite accurately how many people with similar characteristics are in the total population.) SOI’s most recent personal wealth estimates are for 2007.[29]

The strengths of this approach are that it is based on a large sample of wealthy individuals (17,821 in 2007), and that it reflects information that executors assembled with great care when preparing estate tax returns about the values of decedents’ assets and liabilities.

Because the estate tax’s exempt amount was $2 million in 2007, however, the SOI data provides little information about people with less than $2 million in personal wealth. This is a serious weakness here, since Piketty would begin assessing his wealth tax at $1 million, or perhaps much less. Another weakness for our purposes is that SOI’s wealth data pertains to individuals, whereas Piketty’s tax would probably apply to family units, at least in the case of married couples. For these reasons, this study turned to wealth information based on survey data.

Three of the main sources for wealth data developed from interviews are the Federal Reserve’s Flow of Funds, the Census Bureau’s Survey of Income and Program Participation (SIPP), and the University of Michigan’s Panel Study of Income Dynamics (PSID).

In this study, we relied on family net worth data generated by a long-running, highly respected survey operating out of the University of Michigan called the Panel Study of Income Dynamics (PSID).[30] PSID generously makes its data publicly available, and the family wealth numbers we employed are from the 2011 wave of interviews (latest available).[31] The file contains 8,907 family records.

We computed Piketty’s wealth tax for each family in the file and further computed the effect of the wealth tax on each family’s average and marginal tax rates. Following PSID’s instructions, we then weighted the families by another series so the results would be reasonably representative of the U.S. population.[32]

A weakness of the survey approach is that most surveys contain relatively few extremely wealthy families. Of the 8,907 family records in the PSID file, about 1,550 have a net worth of at least $250,000, but only about 400 have a net worth of at least $1 million. These small numbers are a caution to treat the wealth tax computations as approximations, not as precise to the last decimal point. Another weakness of the survey approach is that if the value of an asset is uncertain, a person will have a monetary incentive to value it lower on a tax return than in a survey. That is, respondents will tend to state their best guesses on surveys but be motivated to report the lowest legally defensible numbers on tax returns. Consequently, survey results may overstate taxable net worth and, hence, potential wealth tax liabilities.

This study also uses PSID data on family incomes and the number of persons in each family.[33] In conjunction with the other files, they allow us to sort families by income[34] and then add up the amounts of net wealth and wealth tax liability in each income range.

[1] Thomas Piketty, Capital in the Twenty-First Century (Arthur Goldhammer trans., Harvard University Press 2014).

[2] Id. at 513.

[3] See, e.g., Paul Krugman, Why We’re in a New Gilded Age, New York Review of Books, May 8, 2014, http://www.nybooks.com/articles/archives/2014/may/08/thomas-piketty-new-gilded-age; Robert Reich, How to Shrink Inequality, Robert Reich Blog, May 12, 2014, http://robertreich.org/post/85532751265.

[4] For a small sample of the criticisms, see Alan Reynolds, Has U.S. Income Inequality Really Increased?, Cato Institute Policy Analysis No. 586 (Jan. 8, 2007), http://object.cato.org/sites/cato.org/files/pubs/pdf/pa586.pdf; Odran Bonnet, Pierre-Henri Bono, Guillaume Chapelle, & Étienne Wasmer, Does housing capital contribute to inequality? A comment on Thomas Piketty’s Capital in the 21st Century (Sciences Po Economics Discussion paper 2014-07, Apr. 17, 2014), http://spire.sciencespo.fr/hdl:/2441/30nstiku669glbr66l6n7mc2oq/resources/2014-07.pdf; Abby McCloskey, No, it’s not the end of capitalism. An alternative to Thomas Piketty’s ‘terrifying’ future, AEI Ideas Blog, Apr. 15, 2014, http://www.aei-ideas.org/2014/04/no-its-not-the-end-of-capitalism-a-conservative-response-to-piketty; Laurence Kotlikoff, Will The Rich Always Get Richer?, Forbes, May 15, 2014, http://www.forbes.com/sites/kotlikoff/2014/05/15/will-the-rich-always-get-richer.

[5] Piketty, supra note 1, at 439.

[6] William McBride, Thomas Piketty’s False Depiction of Wealth in America, Tax Foundation Special Report No. 223 (Aug. 4, 2014), https://taxfoundation.org/article/thomas-piketty-s-false-depiction-wealth-america.

[7] Michael Schuyler, What Would Piketty’s 80 Percent Tax Rate Do to the U.S. Economy?, Tax Foundation Special Report No. 221 (July 28, 2014), https://taxfoundation.org/article/what-would-piketty-s-80-percent-tax-rate-do-us-economy.

[8] Piketty does not say explicitly how he would treat capital gains and dividends. But given his desire to use taxes to reduce inequality and the fact that capital is owned unequally, it is plausible that he would want capital gains and dividends to be taxed at least as heavily as ordinary income.

[9] See Schuyler, supra note 7.

[10] University of Michigan, Institute for Social Research, Survey Research Center, Panel Study of Income Dynamics, http://psidonline.isr.umich.edu.

[11] Piketty, supra note 1, at 471.

[12] Id. Elsewhere in his book, Piketty describes the wealth tax’s revenue as “a fairly modest supplement to the other revenue streams on which the modern social state depends: a few points of national income (three or four at most—still nothing to sneeze at).” Id. at 518. In these passages, Piketty gives the impression that policy should be based on what is tempting as opposed to what is efficacious, much like a diet of chocolate doughnuts or cakes.

[13] Id. at 524, 526.

[14] Id.

[15] Id. at 518.

[16] Id. at 516-517.

[17] Id. at 517.

[18] Id. at 523.

[19] See, e.g., Douglas Todd, Fear and contempt rise in Canada over Uncle Sam’s tax crackdown, Vancouver Sun, Aug. 15, 2014, http://blogs.vancouversun.com/2014/08/15/u-s-persons-in-canada-see-uncle-sam-as-bully-for-one-way-tax-crackdown.

[20] Piketty, supra note 1, at 515-516.

[21] Purchasing power parity seeks to convert different national currencies into units of equivalent purchasing power. The OECD estimates 1 euro had the same purchasing power as $1.2875 in 2013. See Organization for Economic Cooperation and Development, Purchasing Power Parities (PPPs) Data, http://www.oecd.org/std/purchasingpowerparitiespppsdata.htm.) Another way to convert euros into dollars would be with exchange rates. Two disadvantages of using exchange rates are that they are highly volatile, and that they do not reflect the relative values across nations of goods and services that are not internationally traded.

[22] In an online technical appendix, Piketty suggests a more expansive wealth tax than he mentions in the book itself. See Thomas Piketty, Technical appendix of the book «Capital in the twenty-first century» (July 18, 2014) at 77, http://piketty.pse.ens.fr/files/capital21c/en/Piketty2014TechnicalAppendix.pdf. Under Piketty’s “variant b”, tax rates would be 0.1 percent starting with the first euro of net worth, 0.5 percent starting at 200,000 euros, 1 percent starting at 1 million euros, 2 percent starting at 5 million euros, 5 percent starting at 20 million euros, and 10 percent starting at 100 million euros. Notice that the tax rates which Piketty says in the book might apply to billionaires would now commence at 20 million euros. Piketty suggests using some of variant b’s revenue to replace other wealth taxes, including property taxes. This study does not attempt to model Piketty’s variant b. Compared to what this study does model, the 5 and 10 percent rates would worsen the economic damage but the replacement of existing property taxes, if actually carried out, would lessen the harm. Also, while the 0.1 percent rate would collect little revenue, it would increase tax paperwork for millions of families.

[23] Congressional Budget Office, An Update to the Budget and Economic Outlook: 2014 to 2024 (Aug. 27, 2014) at 66, http://cbo.gov/publication/45653.

[24] Piketty, supra note 1, at 520-521.

[25] Many states impose so-called personal property taxes, but, despite the name, those are business taxes and do not apply to household belongings. See Joyce Errecart, Ed Gerrish, & Scott Drenkard, States Moving Away From Taxes on Tangible Personal Property, Tax Foundation Background Paper No. 63 (Oct. 2012), https://taxfoundation.org/sites/default/files/docs/bp63.pdf.

[26] Piketty, supra note 1, at 644.

[27] The law would view state and local property taxes as direct taxes, but they do not violate the U.S. Constitution, because its apportionment requirement only applies to federal taxes. One might wonder why the federal estate tax does not run afoul of the apportionment requirement for federal direct taxes. It is getting into the legal weeds, but the answer seems to be that the courts regard the estate tax as an indirect tax, not a direct tax, because it is triggered by an event, namely death.

[28] For a fuller discussion of the model, see Michael Schuyler, What Would Piketty’s 80 Percent Tax Rate Do to the U.S. Economy?, Tax Foundation Special Report No. 221 (July 28, 2014), https://taxfoundation.org/article/what-would-piketty-s-80-percent-tax-rate-do-us-economy (see especially the appendix).

[29] Brian Raub & Joseph Newcomb, Personal Wealth, 2007, Statistics of Income Bulletin (Winter 2012), http://www.irs.gov/file_source/pub/irs-soi/12pwwinbulwealth07.pdf. For links to additional material, see Internal Revenue Service, SOI Tax Stats – Personal Wealth Statistics, http://www.irs.gov/uac/SOI-Tax-Stats-Personal-Wealth-Statistics.

[30] University of Michigan, Institute for Social Research, Survey Research Center, Panel Study of Income Dynamics, Public use, http://simba.isr.umich.edu/data/data.aspx.

[31] PSID identifies the data file we used as: ER52394 IMP WEALTH W/ EQUITY (WEALTH2) 11. Its measure of family wealth includes home equity and subtracts out net debt.

[32] PSID identifies the weighting file as: ER52436 2011 CORE/IMMIGRANT FAM WEIGHT NUMBER 1. As a check, the post-weighting distribution of family net wealth was compared with the distribution of household net worth that the Census Bureau reports in its survey. See Census Bureau, Net Worth and Asset Ownership of Households: 2011, http://www.census.gov/people/wealth/files/Wealth_Tables_2011.xlsx. Reassuringly, the two distributions are fairly close.

[33] PSID identifies the files as: ER52343 TOTAL FAMILY INCOME-2010 and ER47316 # IN FU, respectively.

[34] Following a common practice, family incomes are adjusted for family size by dividing family income by the square root of family size.