Understanding business employment and taxes is essential to crafting informed taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. policies that affect businesses, their employees, and their customers. In light of policies aimed at influencing the decisions of specific companies—for example, Sen. Bernie Sanders’ (I-VT) “Stop BEZOS Act” and “Stop Walmart Act,” both proposed last year—it is especially valuable for policymakers to know how firms vary by size, employment, income, and taxes.

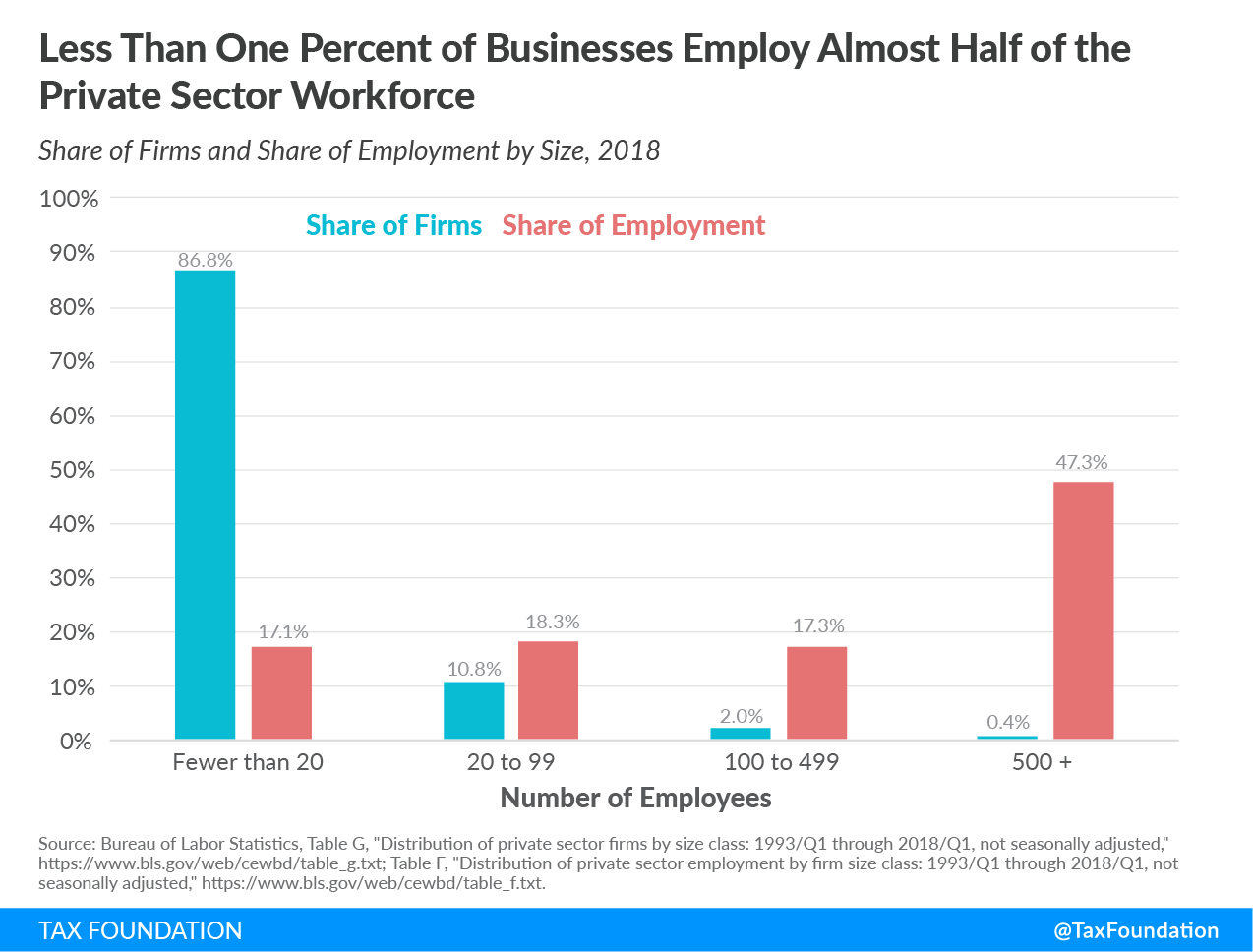

The following chart shows the share of firms and share of employment by business size in the U.S., including both C corporations and pass throughs. While firms with fewer than 20 employees make up 86.8 percent of businesses, they employ only 17.1 percent of all private sector workers. In contrast, while only 0.4 percent of all firms have 500 or more employees, this small group of businesses employs 47.3 percent of the nation’s private sector workforce.

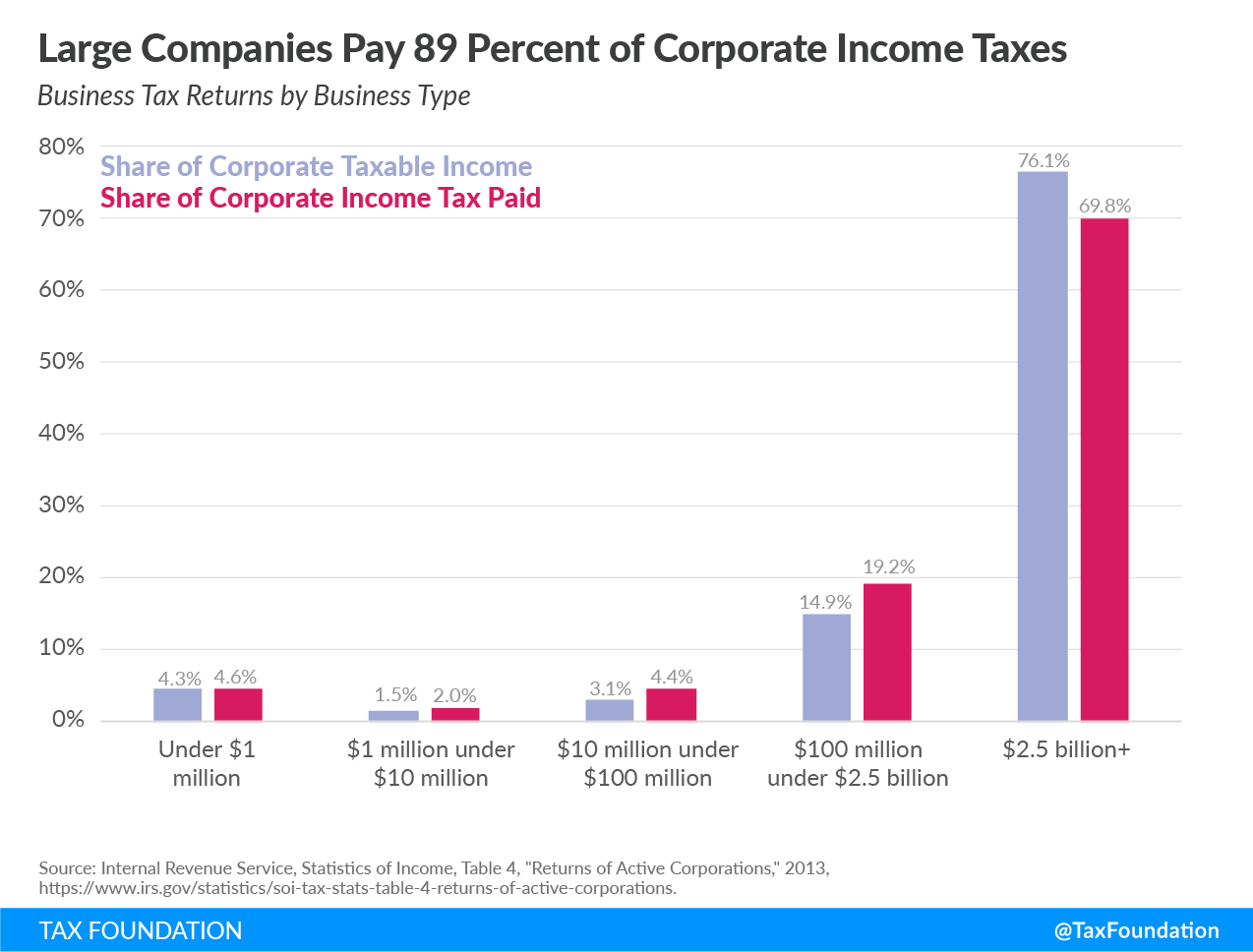

The biggest firms play a similarly important role in both earning income and paying taxes on it. The following chart shows firms’ share of taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. For both individuals and corporations, taxable income differs from—and is less than—gross income. and share of income taxes by asset size. In 2013, C corporations and pass throughs together earned approximately $1.3 trillion in taxable income and paid about $293 billion in income taxes. However, businesses with over $2.5 billion in assets paid the majority of corporate income taxes. These corporations earned 76.1 percent of corporate taxable income and paid 69.8 percent of all corporate income taxes.

As these charts illustrate, all businesses shouldn’t be thought of as identical. Most businesses in the U.S. are small, but the largest ones employ nearly half of the private sector workforce. And while firms’ share of corporate income taxes is roughly proportional to the share of taxable income for all asset sizes, the largest firms account for the majority of both taxable income and corporate income taxes. Recognizing the variation in firms by employment, income, and taxes can help policymakers design taxes that raise necessary revenue without distorting the businesses’ decisions that drive the economy.

Note: This is part of our “Business in America” blog series

- The Lowered Corporate Income Tax Rate Makes the U.S. More Competitive Abroad

- Corporate and Pass-through Business Income and Returns Since 1980

- 2017 GDP and Employment by Industry

- Pass-Through Businesses Q&A

- State Corporate Income Taxes Increase Tax Burden on Corporate Profits

- Marginal Tax Rates for Pass-through Businesses Vary by State

- Taxes on Capital Income Are More Than Just the Corporate Income Tax

- Depreciation Requires Businesses to Pay Tax on Income That Doesn’t Exist

- Not All Tax Expenditures Are Equal