The economic crisis caused by the coronavirus pandemic poses a triple challenge for tax policy in the United States. Lawmakers are tasked with crafting a policy response that will accelerate the economic recovery, reduce the mounting deficit, and protect the most vulnerable.

To assist lawmakers in navigating the challenge, and to help the American public understand the tax changes being proposed, the Tax Foundation’s Center for Federal Tax Policy modeled how 70 potential changes to the tax code would affect the U.S. economy, distribution of the tax burden, and federal revenue.

In tax policy there is an ever-present trade-off among how much revenue a tax will raise, who bears the burden of a tax, and what impact a tax will have on economic growth. Armed with the information in our new book, Options for Reforming America’s Tax Code 2.0, policymakers can debate the relative merits and trade-offs of each option to improve the tax code in a post-pandemic world.

Smoking High Excise Taxes on Vapor Products Could Be Coming to West Virginia

West Virginians would face extraordinarily high taxes on vapor products in state if Senate Bill 68 becomes law. The bill would increase taxes on liquid used in vapor products from 7.5 cents per milliliter (ml) to $1 per ml—an increase of over 1,300 percent.

3 min read

Pandemic-Era Unemployment Compensations Could Generate $78 Billion in Income Tax Collections

Approximately $78 billion might be owed in federal and state income taxes on the unemployment compensation payments made since the pandemic began.

3 min read

Marginal Tax Rates on Labor Income Under the Democratic House Ways and Means Child Tax Credit Proposal

The coronavirus relief legislation passed out of the House Ways and Means Committee would significantly expand the child tax credit for 2021, from its current $2,000 maximum to a fully refundable $3,600 for children 6 and under and $3,000 for children over 6.

4 min read

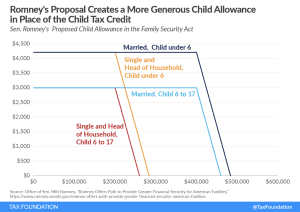

Marginal Tax Rates on Labor Income Under Sen. Mitt Romney’s Family Security Act

Sen. Mitt Romney’s Family Security Act would replace the Child Tax Credit with a monthly child allowance administered by the Social Security Administration, making the benefit more generous and accessible to low-income households without earned income.

4 min read

Join Us for a Free “State Tax Policy Boot Camp”

The Tax Foundation’s “State Tax Policy Boot Camp,” is ideal for anyone interested in gaining a better understanding of state taxation.

2 min read

An “Interest”ing Tax Hike in the COVID-19 Relief Proposal

As the House Ways and Means Committee continues working on the latest round of fiscal relief amid the pandemic, one curious provision in the legislation is a tax hike on multinational companies. One section of the legislation would repeal a provision in current law that allows U.S. multinationals to choose to allocate their interest costs on a worldwide basis (more on that in a moment).

4 min read

House Ways and Means Committee Takes First Steps Toward Additional Coronavirus Relief Legislation

The House Ways and Means Committee measures would further extend the relief measures created by the CARES Act and the Consolidated Appropriations Act of 2021, and would go further by significantly expanding existing tax credits and making changes to the international tax system.

7 min read

Tax-A-Rama in Maryland

The potential override of Gov. Larry Hogan’s (R) veto of a digital advertising tax (HB732) looms large over the current legislative session in Maryland, though it is only one of many tax proposals under consideration in the state.

7 min read

Congressional Democrats Propose Expanding Child Tax Credit as Monthly Payment for Pandemic Relief

House Ways and Means Democrats recently released a proposal to expand the child tax credit for one year as part of President Biden’s larger $1.9 trillion economic relief package.

5 min read

Sen. Romney’s Child Tax Reform Proposal Aims to Expand the Social Safety Net and Simplify Tax Credits

Sen. Mitt Romney (R-UT) recently proposed the Family Security Act, which features a new, more generous child allowance for families with children while reforming other sources of aid for low-income individuals.

5 min read