The economic crisis caused by the coronavirus pandemic poses a triple challenge for tax policy in the United States. Lawmakers are tasked with crafting a policy response that will accelerate the economic recovery, reduce the mounting deficit, and protect the most vulnerable.

To assist lawmakers in navigating the challenge, and to help the American public understand the tax changes being proposed, the Tax Foundation’s Center for Federal Tax Policy modeled how 70 potential changes to the tax code would affect the U.S. economy, distribution of the tax burden, and federal revenue.

In tax policy there is an ever-present trade-off among how much revenue a tax will raise, who bears the burden of a tax, and what impact a tax will have on economic growth. Armed with the information in our new book, Options for Reforming America’s Tax Code 2.0, policymakers can debate the relative merits and trade-offs of each option to improve the tax code in a post-pandemic world.

Renewed Calls for Severance Taxes on Bottled Spring Water

Amid a debate over water extraction from Florida’s springs, Florida Sen. Annette Taddeo (D) has introduced a bill (SB 562) which, if enacted, would establish an excise tax on water extraction beginning July 1.

4 min read

Changes to the Tax Base Matter When Evaluating the Impact of Tax Reforms

A new study illustrates how overlooking an important element of the tax system—the structure of the tax base—can lead to an incomplete understanding of how tax reform impacts the economy.

4 min read

Brits to Prepare for Tax Reforms

Tax hikes or spending cuts implemented early in the year might undermine the desirable rapid recovery of the economy. The UK should focus on implementing tax reforms that have the potential to stimulate economic recovery by supporting business investment and employment while increasing its international tax competitiveness.

4 min read

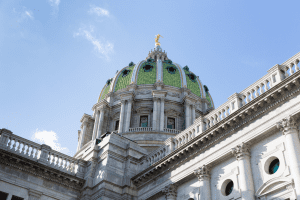

A $6 Billion Tax Increase Proposal in Pennsylvania Would Yield the Nation’s Highest Combined Flat-Rate Income Taxes

Under the budget introduced by Gov. Tom Wolf, Pennsylvania’s flat personal income tax rate would increase by 46 percent, partially offset by an outsized increase in the poverty credit, which would see a family of four eligible for partial relief due to poverty until they reached $100,000 in taxable income—four times the poverty line.

6 min read

Alabama Passes Tax Reform Aimed at Throwback, GILTI, and More

Learn more about the recent Alabama tax reform measures (House Bill 170), which combines pandemic-era tax policy responses with broader tax policy reforms.

4 min read

Sugar Taxes Back on the Menu

At least four states—Connecticut, Hawaii, New York, and Washington—are considering statewide excise taxes on sugary drinks this year.

4 min read

Smoking High Excise Taxes on Vapor Products Could Be Coming to West Virginia

West Virginians would face extraordinarily high taxes on vapor products in state if Senate Bill 68 becomes law. The bill would increase taxes on liquid used in vapor products from 7.5 cents per milliliter (ml) to $1 per ml—an increase of over 1,300 percent.

3 min read

Pandemic-Era Unemployment Compensations Could Generate $78 Billion in Income Tax Collections

Approximately $78 billion might be owed in federal and state income taxes on the unemployment compensation payments made since the pandemic began.

3 min read

Marginal Tax Rates on Labor Income Under the Democratic House Ways and Means Child Tax Credit Proposal

The coronavirus relief legislation passed out of the House Ways and Means Committee would significantly expand the child tax credit for 2021, from its current $2,000 maximum to a fully refundable $3,600 for children 6 and under and $3,000 for children over 6.

4 min read

Marginal Tax Rates on Labor Income Under Sen. Mitt Romney’s Family Security Act

Sen. Mitt Romney’s Family Security Act would replace the Child Tax Credit with a monthly child allowance administered by the Social Security Administration, making the benefit more generous and accessible to low-income households without earned income.

4 min read