The economic crisis caused by the coronavirus pandemic poses a triple challenge for tax policy in the United States. Lawmakers are tasked with crafting a policy response that will accelerate the economic recovery, reduce the mounting deficit, and protect the most vulnerable.

To assist lawmakers in navigating the challenge, and to help the American public understand the tax changes being proposed, the Tax Foundation’s Center for Federal Tax Policy modeled how 70 potential changes to the tax code would affect the U.S. economy, distribution of the tax burden, and federal revenue.

In tax policy there is an ever-present trade-off among how much revenue a tax will raise, who bears the burden of a tax, and what impact a tax will have on economic growth. Armed with the information in our new book, Options for Reforming America’s Tax Code 2.0, policymakers can debate the relative merits and trade-offs of each option to improve the tax code in a post-pandemic world.

What to Expect During the 2021 Tax Season

The IRS recently announced the extension of tax filing and payment deadlines from April 15th to May 17th to help taxpayers navigating the many tax changes amid the pandemic and give the IRS opportunity to clear its backlog of tax returns and correspondence.

7 min read

Making the Expanded Child Tax Credit Permanent Would Cost Nearly $1.6 Trillion

As the Biden administration and Congress consider making the expanded child tax credit permanent, a nearly $1.6 trillion expansion of tax code-administered benefits, they should consider financing it in a way that doesn’t create significant headwinds to economic recovery.

3 min read

TCJA Is Not GILTI of Offshoring

Many members of Congress have taken issue with the 2017 tax reform. However, the reasoning that has led some to believe that GILTI provides a path to offshoring investment and jobs is flawed.

6 min read

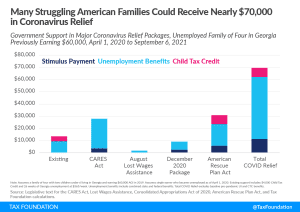

U.S. COVID-19 Relief Provided More Than $60,000 in Benefits to Many Unemployed Families

During the pandemic, an unemployment family of four previously earning $60,000 will have received $50,840 in federal and state unemployment benefits from April 1, 2020 to September 6, 2021, plus $11,400 in stimulus payments, plus $7,200 in Child Tax Credit, totaling $69,440 in combined COVID-19 relief benefits.

4 min read

Will Pennsylvania Be the First State to Motor Past the Gas Tax?

In Pennsylvania, Gov. Tom Wolf (D) has proposed phasing out the gas tax as the main funding mechanism for the state’s highway fund, and he has established a commission to recommend options for replacing it with alternative revenue sources. In a statement, the governor called the current motor fuel tax burdensome, outdated, and unreliable.

5 min read

How GILTI Are U.S. Industries?

Both the Biden campaign and some Democratic members of Congress have recommended changes to GILTI, but before doing that, policymakers should consider how GILTI’s design can have ramifications for many U.S. companies and their tax burdens.

6 min read

Tax Policy Improvements Needed to Help Industries through the Semiconductor Shortage

As lawmakers evaluate how to respond to the global semiconductor shortage, they should consider allowing full cost recovery across all types of capital investment—inventories, machinery and equipment, structures, and R&D.

4 min read

The American Rescue Plan Act Greatly Expands Benefits through the Tax Code in 2021

The major tax-related benefits in the $1.9 trillion economic relief plan are a third round of direct payments, extended unemployment insurance (UI) benefits and a $10,200 unemployment insurance income exemption for 2020, and an expansion of the Child Tax Credit.

6 min read

Wyden’s Energy Tax Proposal a Mixed Bag

As the Biden administration turns toward infrastructure, Sen. Ron Wyden (D-Or.) has suggested including reforms to the way the tax code subsidizes energy production in such a package, eliminating 44 “tax breaks” for various activities in the energy sector and replacing them with only three.

3 min read

Does the American Rescue Plan Ban State Tax Cuts?

Senate amendments to the American Rescue Plan Act prohibit using any of the $350 billion in State and Local Fiscal Recovery Funds to cut taxes, but many are concerned that states which accept the funds could be prohibited from implementing tax cuts between now and 2024—an astonishing level of federal interference in states’ fiscal affairs.

8 min read