The economic crisis caused by the coronavirus pandemic poses a triple challenge for tax policy in the United States. Lawmakers are tasked with crafting a policy response that will accelerate the economic recovery, reduce the mounting deficit, and protect the most vulnerable.

To assist lawmakers in navigating the challenge, and to help the American public understand the tax changes being proposed, the Tax Foundation’s Center for Federal Tax Policy modeled how 70 potential changes to the tax code would affect the U.S. economy, distribution of the tax burden, and federal revenue.

In tax policy there is an ever-present trade-off among how much revenue a tax will raise, who bears the burden of a tax, and what impact a tax will have on economic growth. Armed with the information in our new book, Options for Reforming America’s Tax Code 2.0, policymakers can debate the relative merits and trade-offs of each option to improve the tax code in a post-pandemic world.

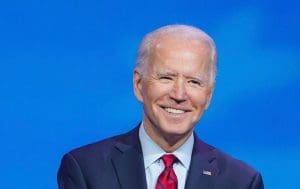

President Biden’s Infrastructure Plan Raises Taxes on U.S. Production

An increase in the federal corporate tax rate to 28 percent would raise the U.S. federal-state combined tax rate to 32.34 percent, higher than every country in the OECD, the G7, and all our major trade partners and competitors including China.

6 min read

CBO Study: Benefits of Biden’s $2 Trillion Infrastructure Plan Won’t Outweigh $2 Trillion Tax Hike

The economics is clear: If Biden wants to maximize the economic benefits of his $3 trillion in new infrastructure spending, he should cut $3 trillion in other government spending to pay for it.

7 min read

ARPA Allocates $2 Billion to Nonexistent County Governments

The government of Hartford County, Connecticut is in line to receive $173 million in local aid under the American Rescue Plan Act (ARPA). There’s only one problem: the government of Hartford County doesn’t exist, nor do any of Connecticut’s other counties have county-level government despite being allocated a collective $691 million under the bill.

4 min read

A CEO Tax Is the Wrong Way to Help Workers

In an effort to rein in perceived excesses in executive compensation, Sen. Bernie Sanders (I-VT) and other co-sponsors have proposed to increase a company’s corporate income tax rate progressively based on the difference between median worker pay and CEO pay.

4 min read

Evaluating West Virginia Income Tax Repeal Plans

States which forgo income taxes have seen population and economic growth vastly outstripping their peers, and a post-pandemic culture that is friendlier to remote work will greatly enhance tax competition.

71 min read

Are Excise Taxes on Beverages a Good Substitute for Income Taxes?

Policymakers should be very cautious about relying too heavily on excise tax increases to pay down tax reductions elsewhere. Ideally, revenue offsets would come from more stable, broader-based revenue sources.

4 min read

Congressional Budget Office and Tax Foundation Modeling Show That Some Tax Hikes Are More Damaging Than Others

Some tax hikes are more damaging than others, according to Congressional Budget Office (CBO) and new Tax Foundation economic modeling.

5 min read

How the CARES Act Shifted the Composition of Tax Expenditures Towards Individuals

The increase in expenditures associated with COVID-19 relief is another illustration of using the tax code to administer social spending.

3 min read

A Neutral Tax Code Counts Unemployment Compensation as Taxable Income

Since 1987, unemployment compensation benefits have been subject to federal income tax and, in most states, to state income tax. According to the Congressional Research Service, such treatment—including unemployment compensation benefits in taxable income—is common across industrial nations.

4 min read

The EU Determined to Reform the Business Tax

The EU recently launched a consultation to reform the business tax system, which will outline the priorities for corporate taxation over the coming years to meet the needs of a globalized economy that struggles to recover from the consequences of the COVID-19 crisis. It will also set EU actions regarding the ongoing international discussion on the taxation of the digital economy and a global minimum tax.

3 min read