The economic crisis caused by the coronavirus pandemic poses a triple challenge for tax policy in the United States. Lawmakers are tasked with crafting a policy response that will accelerate the economic recovery, reduce the mounting deficit, and protect the most vulnerable.

To assist lawmakers in navigating the challenge, and to help the American public understand the tax changes being proposed, the Tax Foundation’s Center for Federal Tax Policy modeled how 70 potential changes to the tax code would affect the U.S. economy, distribution of the tax burden, and federal revenue.

In tax policy there is an ever-present trade-off among how much revenue a tax will raise, who bears the burden of a tax, and what impact a tax will have on economic growth. Armed with the information in our new book, Options for Reforming America’s Tax Code 2.0, policymakers can debate the relative merits and trade-offs of each option to improve the tax code in a post-pandemic world.

Reviewing Options to Raise Tax Revenue and the Trade-offs for Economic Growth and Progressivity

There’s a useful contrast between two revenue options related to President Biden’s infrastructure push. The president’s American Jobs Plan includes a proposal to raise the corporate tax rate to 28 percent. Meanwhile, historically, the gas tax is the main revenue source for transportation funding.

8 min read

These States Will Pay You to Move. Does That Strategy Make Sense?

State and local tax policy have always mattered, but the rise of remote work is bringing tax burdens and economic competitiveness to the forefront. It is a development that states cannot afford to ignore.

5 min read

Tax Policy in the First 100 Days of the Biden Administration

In his first 100 days as president, Joe Biden has proposed more than a dozen significant changes to the U.S. tax code that would raise upwards of $3 trillion in revenue and reduce incentives to invest, save, and work in the United States.

4 min read

Kansas Lawmakers to Consider Veto Override on Tax Reform Bill

Kansas has the revenue cushion it needs to provide tax relief to individuals and businesses and improve the structure of its tax code in the process. These pro-growth reforms would not only help taxpayers amid the pandemic but would also promote economic recovery and growth in a state that is lagging behind its competitors.

7 min read

Louisiana Aims at Comprehensive Tax Reform

While many of the tax proposals work in tandem, some conflicts continue to exist. If lawmakers were able to repeal federal deductibility, reduce income tax rates, finish the job on inventory taxation, and phase out the capital stock tax, this would represent a marked improvement in the state’s tax climate, eliminating several of the most uncompetitive features of the current code.

6 min read

Providing Full Cost Recovery for Investment and Lowering Taxes on Firms Are Best Options for Boosting Growth

As policymakers consider tax options to boost the U.S. economy’s long-run economic growth, they should consider reforms that would increase growth the most while minimizing forgone tax revenue.

4 min read

Biden’s Proposed Capital Gains Tax Rate Would be Highest for Many in a Century

The Biden administration is proposing to tax long-term capital gains at ordinary income rates for high earners, which will bring the top federal rate to highs not seen since the 1920s.

2 min read

Excluding GILTI and Reducing the Corporate Tax Rate Would Improve Nebraska’s Economic Competitiveness

Excluding Global Intangible Low-Taxed Income (GILTI) from taxation and reducing the state’s top marginal corporate rate would improve the state’s economic competitiveness and are among the top income tax modernization priorities Nebraska policymakers ought to consider.

4 min read

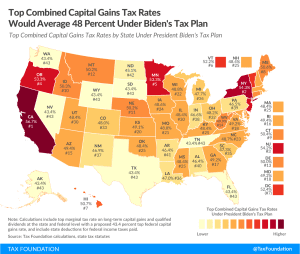

Top Combined Capital Gains Tax Rates Would Average 48 Percent Under Biden’s Tax Plan

The top federal rate on capital gains would be 43.4 percent under Biden’s tax plan (when including the net investment income tax). Rates would be even higher in many U.S. states due to state and local capital gains taxes, leading to a combined average rate of over 48 percent compared to about 29 percent under current law.

3 min read

Comparing the Trade-offs of Carbon Taxes and Corporate Income Taxes

President Biden’s choice to fund new spending programs with increased corporate taxes comes with trade-offs for American output and incomes.

3 min read