The economic crisis caused by the coronavirus pandemic poses a triple challenge for tax policy in the United States. Lawmakers are tasked with crafting a policy response that will accelerate the economic recovery, reduce the mounting deficit, and protect the most vulnerable.

To assist lawmakers in navigating the challenge, and to help the American public understand the tax changes being proposed, the Tax Foundation’s Center for Federal Tax Policy modeled how 70 potential changes to the tax code would affect the U.S. economy, distribution of the tax burden, and federal revenue.

In tax policy there is an ever-present trade-off among how much revenue a tax will raise, who bears the burden of a tax, and what impact a tax will have on economic growth. Armed with the information in our new book, Options for Reforming America’s Tax Code 2.0, policymakers can debate the relative merits and trade-offs of each option to improve the tax code in a post-pandemic world.

Tracking 2021 Election Results: State Tax Ballot Measures

Through 10 ballot measures across four states—Colorado, Louisiana, Texas, and Washington—voters will decide significant questions of state tax policy.

7 min read

Austria’s Budget Comes with Tax Cuts and Carbon Levies

Austria should not shy from lowering the corporate income tax rate sooner or even implementing a more ambitious tax reform to improve its tax competitiveness and contribute to greater economic growth.

3 min read

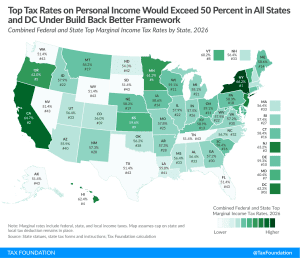

Top Tax Rate on Personal Income Would Be Highest in OECD under New Build Back Better Framework

Under the latest iteration of the House Build Back Better Act (BBBA), the average top tax rate on personal income would reach 57.4 percent, giving the U.S. the highest rate in the Organisation for Economic Co-operation and Development (OECD).

2 min read

Federal Deductibility Is Distorting Tax Liability in Six States

The intentions behind federal deductibility are undoubtedly pro-taxpayer. Unfortunately, that is not what happens in practice. Tax liability is not reduced. It is distorted.

7 min read

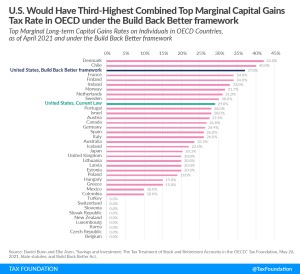

Proposed Top Combined Marginal Capital Gains Tax Rate Would Be Third-Highest in OECD

Under the new Build Back Better framework, the United States would tax capital gains at the third-highest top marginal rate among rich nations, averaging nearly 37 percent.

1 min read

Lawmakers Consider Untested and Complex Policies to Fund Reconciliation Bill

Congress is debating new ways to raise revenue that would make the tax code more complex and more difficult to administer. The new proposals—imposing an alternative minimum tax on corporate book income, applying an excise tax on stock buybacks, and, at one point this week, a tax on unrealized capital gains for billionaires—are unreliable and highly complex ways to raise revenue.

10 min read

Fixing Tax Treatment of Capital Investments Could Improve Supply Chain Resiliency

While taxes are not at the root of supply chain disruptions, improvements to the tax code could make supply chains more resilient in the future.

3 min read

New Study Shows Tax Policy Has Strong Effects on Innovation

When examining how tax policy impacts the economy, researchers typically look at labor supply and investment responses. One other channel through which taxes impact the economy has been less studied: innovation.

3 min read

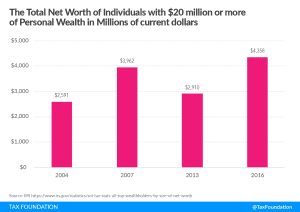

The Rich Are Not Monolithic and Taxing Their Wealth Invites Tax Collection Volatility

Congressional Democrats are reported to be weighing a special tax on the assets of billionaires to raise revenues to pay for their Build Back Better spending plan. There are two fundamental challenges to such a plan.

8 min read

How Would House Dems’ Tax Plan Change Competitiveness of U.S. Tax Code?

The legislation put forward by Democratic members of the House of Representatives would reverse many of the 2017 reforms while increasing burdens on businesses and workers.

2 min read