The economic crisis caused by the coronavirus pandemic poses a triple challenge for tax policy in the United States. Lawmakers are tasked with crafting a policy response that will accelerate the economic recovery, reduce the mounting deficit, and protect the most vulnerable.

To assist lawmakers in navigating the challenge, and to help the American public understand the tax changes being proposed, the Tax Foundation’s Center for Federal Tax Policy modeled how 70 potential changes to the tax code would affect the U.S. economy, distribution of the tax burden, and federal revenue.

In tax policy there is an ever-present trade-off among how much revenue a tax will raise, who bears the burden of a tax, and what impact a tax will have on economic growth. Armed with the information in our new book, Options for Reforming America’s Tax Code 2.0, policymakers can debate the relative merits and trade-offs of each option to improve the tax code in a post-pandemic world.

Lawmakers Revive Prescription Drug Pricing Policies and 1,900% Excise Tax

While the bulk of the proposed tax increases and spending programs remain under debate, Democratic lawmakers have reportedly agreed on prescription drug pricing provisions as a starting point for a revived Build Back Better package.

3 min read

Tax Files Under New Council of EU Presidency: Czechia

As the Czech EU presidency considers a plan to manage various tax-related files, it would be wise to consider principled tax policy that broadens the tax base and reduces the tax wedge on strategic investment.

4 min read

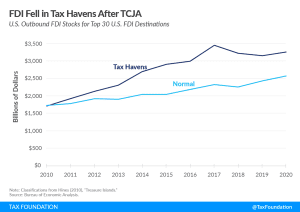

Trends in FDI Before and After the Tax Cuts and Jobs Act

Overall, the data shows outbound FDI shifted from low-tax to other jurisdictions, while inbound FDI remained largely unchanged.

3 min read

Oklahoma Becomes First State in Nation to Make Full Expensing Permanent

Gov. Stitt signed into law a pro-growth bill that will set the state apart from its peers. Other states should look to follow Oklahoma’s example and make full expensing permanent to maintain their competitiveness in an increasingly mobile economy.

3 min read

Efforts to Improve Tax Treatment of Saving Gain Traction on Hill

The proposals share a common goal of improving incentives for households to save during a time when inflation is impacting their finances.

3 min read

How FDI Adds Value to Supply Chains

Although the dispersion of our supply chains throughout the world has been scrutinized in recent years, both inbound and outbound foreign direct investment are critical to sustaining supply chain resiliency and reducing economic risks for both firms and investors.

5 min read

Carbon Taxes in the Global Market: Changes on the Way?

As policymakers on both sides of the Atlantic debate the way forward on carbon border adjustment mechanisms, it is important to keep principles of good tax policy in mind.

7 min read

Impact of Elections on French Tax Policy and EU Own Resources

The French election results are paralyzing for French pro-growth tax reforms, pessimistic for EU own resources, and dire for overall economic certainty.

5 min read

4 Things to Know About the Global Tax Debate

The Biden administration has been supportive of the negotiations, but the changes should be reviewed in the context of recent policy changes in the U.S. and elsewhere, the general landscape of business taxation in the U.S., and potential challenges and risks arising from the global tax deal.

3 min read

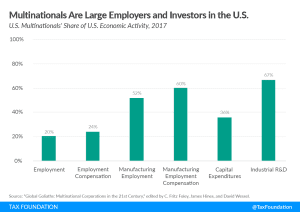

Why FDI Matters for U.S. Employment, Wages, and Productivity

Contrary to the Biden administration’s claims, raising taxes on cross-border investment would hurt U.S. economic growth and jobs. Research shows that FDI creates jobs in the U.S. and raises workers’ wages and productivity.

5 min read