The economic crisis caused by the coronavirus pandemic poses a triple challenge for tax policy in the United States. Lawmakers are tasked with crafting a policy response that will accelerate the economic recovery, reduce the mounting deficit, and protect the most vulnerable.

To assist lawmakers in navigating the challenge, and to help the American public understand the tax changes being proposed, the Tax Foundation’s Center for Federal Tax Policy modeled how 70 potential changes to the tax code would affect the U.S. economy, distribution of the tax burden, and federal revenue.

In tax policy there is an ever-present trade-off among how much revenue a tax will raise, who bears the burden of a tax, and what impact a tax will have on economic growth. Armed with the information in our new book, Options for Reforming America’s Tax Code 2.0, policymakers can debate the relative merits and trade-offs of each option to improve the tax code in a post-pandemic world.

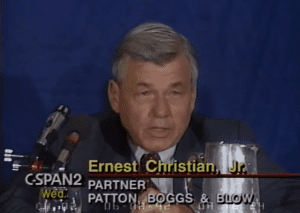

Influential Tax Reformer Ernest S. Christian, Jr., Leaves Legacy—and Blueprint

Ernest S. Christian, Jr., (1937-2022) was one of the tax policy community’s most distinguished and influential experts, showing us how effective sound tax policy can be. He passed away on September 13th, leaving behind a legacy of tax reform.

4 min read

Breaking Down the Inflation Reduction Act’s Green Energy Tax Credits

The Inflation Reduction Act created numerous tax subsidy programs intended to accelerate the transition to a greener economy.

8 min read

Ensuring Tax Rates Don’t Rise with Inflation

If ever there was a paycheck protection program, defending people from bracket creep may be the most important one ever designed.

6 min read

States That Might Tax Student Loan Debt Cancellation

Will states consider student loan forgiveness a taxable event? In some states, the answer could be yes.

5 min read

Taxes and the UK’s new Prime Minister

In an already-challenging economic environment, new UK Prime Minister Liz Truss must get tax rates correct to avoid over-burdening a population and business sector facing immense uncertainty. Focusing only on rates while ignoring the base misses an opportunity for real, pro-growth reform.

4 min read

Idaho to Consider Flat Income Tax in Special Session

As Idaho attempts to further solidify its position as a growth-oriented, taxpayer-friendly state this special session, other states should look to its example and pursue similar reforms.

6 min read

New Mexico and the Question of Tax Competitiveness

Every change to a state’s tax system makes its business tax climate more or less competitive compared to other states and makes the state more or less attractive to business.

7 min read

Missouri Should Consider Flat Income Tax in Special Session

As Missouri legislators head into a special session, they should consider making a pro-growth change that the state is already so close to achieving: creating a flat income tax.

4 min read

IRS Is Raising More with Less, But New Funding Misses the Mark

The Inflation Reduction Act focused more on enforcement and hiring more auditors rather than programs that make it easier for taxpayers to comply with the code and the IRS to administer it.

6 min read

The Tax Compliance Costs of IRS Regulations

In a pattern that has become all too common in recent decades, the newly enacted Inflation Reduction Act (IRA) added yet another layer of complexity to an already complex and burdensome federal tax code.

9 min read