The economic crisis caused by the coronavirus pandemic poses a triple challenge for tax policy in the United States. Lawmakers are tasked with crafting a policy response that will accelerate the economic recovery, reduce the mounting deficit, and protect the most vulnerable.

To assist lawmakers in navigating the challenge, and to help the American public understand the tax changes being proposed, the Tax Foundation’s Center for Federal Tax Policy modeled how 70 potential changes to the tax code would affect the U.S. economy, distribution of the tax burden, and federal revenue.

In tax policy there is an ever-present trade-off among how much revenue a tax will raise, who bears the burden of a tax, and what impact a tax will have on economic growth. Armed with the information in our new book, Options for Reforming America’s Tax Code 2.0, policymakers can debate the relative merits and trade-offs of each option to improve the tax code in a post-pandemic world.

Expensing of Machinery and Equipment Should Be Made Permanent

Making expensing permanent is especially important now, when the economy is threatened with a recession and inflation remains high.

7 min read

New Ways & Means Proposal Shows Continued Commitment to Combat Extraterritorial Taxes

The legislation follows from the bipartisan concern regarding tax policies adopted by other countries specifically targeting U.S. businesses or the U.S. tax base.

6 min read

Louisiana Considers Eliminating Corporate Franchise and Inventory Taxes

Legislation currently advancing in Louisiana—related to the franchise tax, inventory tax, and corporate rebate and exemption programs—would make the state’s tax code simpler and more competitive.

4 min read

The Commonwealth’s Case for Corporate Tax Reforms

The Pennsylvania Senate Finance Committee recently advanced two bills, SB 345 and SB 346, that would build on last year’s historic corporate net income tax (CNIT) reform.

7 min read

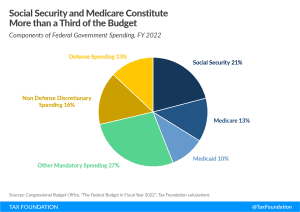

Tackling America’s Debt and Deficit Crisis Requires Social Security and Medicare Reform

Any serious proposal to tackle the emerging debt and deficit crisis must also address our largest mandatory spending programs: Social Security and Medicare. Together, these two programs will be responsible for nearly 80 percent of the deficit’s rise between 2023 and 2032, according to Congressional Budget Office (CBO) projections.

8 min read

Design Matters When Raising Taxes to Reduce the Deficit and Stabilize the Debt

Rather than continue down the path of growing debt, lawmakers should craft a comprehensive solution. International experience cautions against tax-based fiscal consolidations, but modest tax increases may be part of a successful debt reduction package.

6 min read

How America’s Debt Problem Compares to Other Countries—and Why It Matters

According to the International Monetary Fund (IMF), the U.S. federal government is among the most indebted governments in the world.

6 min read

Does the Optimal Tax System Exist?

While research on optimal taxation often focuses on the pure economic implications, it rarely considers cultural and societal differences that can lead to very different outcomes when trying to implement an optimal tax system.

4 min read

The Faulty Revenue Estimate Behind Minnesota’s Consideration of Worldwide Combined Reporting

As Minnesota lawmakers consider making theirs the first state to mandate worldwide combined reporting, they are relying on a revenue estimate that is—this may not be the technical term—completely bogus.

7 min read