The economic crisis caused by the coronavirus pandemic poses a triple challenge for tax policy in the United States. Lawmakers are tasked with crafting a policy response that will accelerate the economic recovery, reduce the mounting deficit, and protect the most vulnerable.

To assist lawmakers in navigating the challenge, and to help the American public understand the tax changes being proposed, the Tax Foundation’s Center for Federal Tax Policy modeled how 70 potential changes to the tax code would affect the U.S. economy, distribution of the tax burden, and federal revenue.

In tax policy there is an ever-present trade-off among how much revenue a tax will raise, who bears the burden of a tax, and what impact a tax will have on economic growth. Armed with the information in our new book, Options for Reforming America’s Tax Code 2.0, policymakers can debate the relative merits and trade-offs of each option to improve the tax code in a post-pandemic world.

The Biden Administration’s Misguided Approach to Defining “American” Companies

What does it mean to be an American company?

4 min read

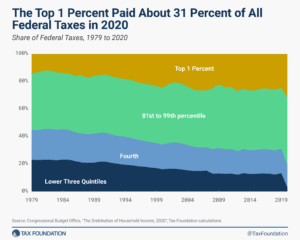

New CBO Report Shows Pandemic Response Sharply Reduced Inequality, Increased Progressivity in 2020

The pandemic led to one of the largest fiscal responses in U.S. history, impacting households across the income distribution.

4 min read

How Are Remote and Hybrid Workers Taxed?

Working from home is great. The tax complications? Not so much.

4 min read

Tax Foundation Europe Launches Website and Prepares Brussels Office

The landscape of tax policy is changing—and we at the Tax Foundation are changing with it.

3 min read

Major Takeaways from CBO’s Updated Long-Term Outlook

The CBO projects deficits will be higher than historical levels, largely due to growth in mandatory spending programs While some recent legislation has reduced the deficit, the Inflation Reduction Act is proving to be more expensive than originally promised.

5 min read

Canada’s Tax-Free Savings Accounts Are a Huge Success. U.S. Lawmakers Should Take Note

For most Americans, saving is a taxing experience. Our neighbors to the north have found a better solution—and U.S. lawmakers should take note.

5 min read

Proposed “Junk Fee” Rule Would Create Inadvertent Tax Headaches

One particular provision of the Biden administration’s proposal to ban so-called “junk fees” would have unintended consequences.

5 min read

Treasury Finds TCJA Interest Limitations Had Small Impact on Corporate Activity

Limiting interest deductibility continues to be a worthwhile policy goal, but given the current climate, policymakers should opt to pair any further limitations with other pro-growth policies such as full expensing to ensure firms’ incentives to invest are preserved.

3 min read

Latest SALT Deduction Cap Proposal Increases Budget Deficit, Creates New Tax Cliffs, and is Regressive

From a revenue standpoint, about $9 billion of the $11.7 billion in lost revenue would accrue to joint filers earning more than $200,000.

5 min read

Five Facts to Know about the Bipartisan Tax Deal

The U.S. House of Representatives has passed a highly anticipated bipartisan tax deal. The Tax Relief for American Workers and Families Act now awaits action in the Senate.

6 min read