The economic crisis caused by the coronavirus pandemic poses a triple challenge for tax policy in the United States. Lawmakers are tasked with crafting a policy response that will accelerate the economic recovery, reduce the mounting deficit, and protect the most vulnerable.

To assist lawmakers in navigating the challenge, and to help the American public understand the tax changes being proposed, the Tax Foundation’s Center for Federal Tax Policy modeled how 70 potential changes to the tax code would affect the U.S. economy, distribution of the tax burden, and federal revenue.

In tax policy there is an ever-present trade-off among how much revenue a tax will raise, who bears the burden of a tax, and what impact a tax will have on economic growth. Armed with the information in our new book, Options for Reforming America’s Tax Code 2.0, policymakers can debate the relative merits and trade-offs of each option to improve the tax code in a post-pandemic world.

Chile Needs Pro-Growth Tax Reform

As Chile looks to the future, policymakers might want to follow the UK’s example. Policymakers should focus on growth-oriented tax policies that encourage private and foreign direct investment, savings, and entrepreneurial activity, increasing Chile’s international tax competitiveness.

2 min read

Kentucky Should Refrain from Expanding Its Taxation of Business Inputs

As final negotiations occur between the House and Senate, legislators should avoid adopting new policies that would jeopardize Kentucky’s business tax competitiveness.

5 min read

Oklahoma Lawmakers’ Tax Reform Plan Would Put State in Top 10

The changes put forth in a new package of bills would represent significant pro-growth change for Oklahoma that would set the state up for success in an increasingly competitive tax landscape.

7 min read

Positive Tax Reforms in Massachusetts Budget Proposal Have Broader Implications

The proposed reforms would be welcome changes to the Commonwealth’s tax code, but the economic principles behind the reforms also have important implications for the Bay State’s income tax system writ large.

6 min read

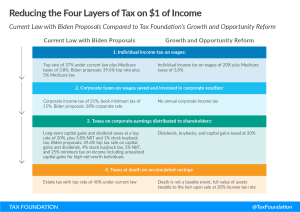

Biden’s New Tax Proposals Are Complicated and Rife with Double Taxation

Tax reform should be about increasing fairness. And the way to get there is by reducing complexity and double taxation, not by doubling down on them.

5 min read

Analyzing the Kansas Senate’s Proposed Tax Changes

As Kansas legislators consider additional tax policy changes this legislative session, they should prioritize economic growth and a structurally sound tax code.

7 min read

Biden’s FY 2024 Budget Would Result in More Than $4.5 Trillion in Gross Tax Increases

President Biden’s new budget proposal outlines several major tax increases targeted at businesses and high-income individuals that would bring U.S. income tax rates far out of step with international norms.

7 min read

Dear President von der Leyen: President Biden Can’t Fix European Competitiveness

Focusing on the “threat” to European industry caused by the Inflation Reduction Act rather than internal tax system flaws puts the EU at risk of slower economic growth and possibly losing some of its important industrial base. It is also contrary to the EU’s geopolitical goals.

4 min read

EU Taxation: Prioritizing Geopolitics over Revenue

If the EU wants to strategically compete with economic powers like the United States or China, it needs principled, pro-growth tax policy that prioritizes efficient ways to raise revenue over geopolitical ambitions.

6 min read

Careful What You Wish For: CHIPS Subsidies Require “Excess Profits” Sharing

Instead of such a complex and inefficient system, policymakers should move to full expensing as part of the effort to build.

3 min read