The economic crisis caused by the coronavirus pandemic poses a triple challenge for tax policy in the United States. Lawmakers are tasked with crafting a policy response that will accelerate the economic recovery, reduce the mounting deficit, and protect the most vulnerable.

To assist lawmakers in navigating the challenge, and to help the American public understand the tax changes being proposed, the Tax Foundation’s Center for Federal Tax Policy modeled how 70 potential changes to the tax code would affect the U.S. economy, distribution of the tax burden, and federal revenue.

In tax policy there is an ever-present trade-off among how much revenue a tax will raise, who bears the burden of a tax, and what impact a tax will have on economic growth. Armed with the information in our new book, Options for Reforming America’s Tax Code 2.0, policymakers can debate the relative merits and trade-offs of each option to improve the tax code in a post-pandemic world.

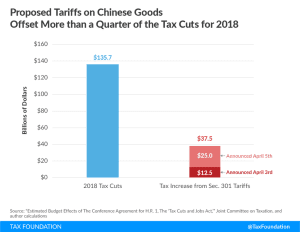

Modeling the Impact of President Trump’s Proposed Tariffs

The Trump administration’s proposed tariffs would lead to job losses and a reduction in economic growth, as the Tax Foundation’s updated Tax and Growth model shows.

4 min read

Lawmakers May Vote on Making Key Provisions of the TCJA Permanent

The Tax Cuts and Jobs Act improved the US tax code, but key provisions are only temporary. Now Congress may vote to ensure those tax breaks are permanent.

3 min read

Gross Receipts Taxes in the Marijuana Industry Found to Cause Distortionary Effects

States considering legalizing and taxing marijuana should pay attention to natural experiments occurring in states across the country.

4 min read