On July 10, the Taxpayer Advocate Service (TAS) released a set of recommendations to expand and simplify the Earned Income Tax Credit (EITC). This refundable credit is praised by some for its role in decreasing poverty and encouraging work among certain groups. However, the number of improper payments associated with the EITC makes legislators hesitant to expand it.

To address this improper payments issue, National Taxpayer Advocate Nina Olsen suggests decoupling the number of children a worker has from the EITC and redesigning the Child Tax Credit (CTC). These changes could help reduce improper payments associated with the EITC by making compliance easier for low-income taxpayers.

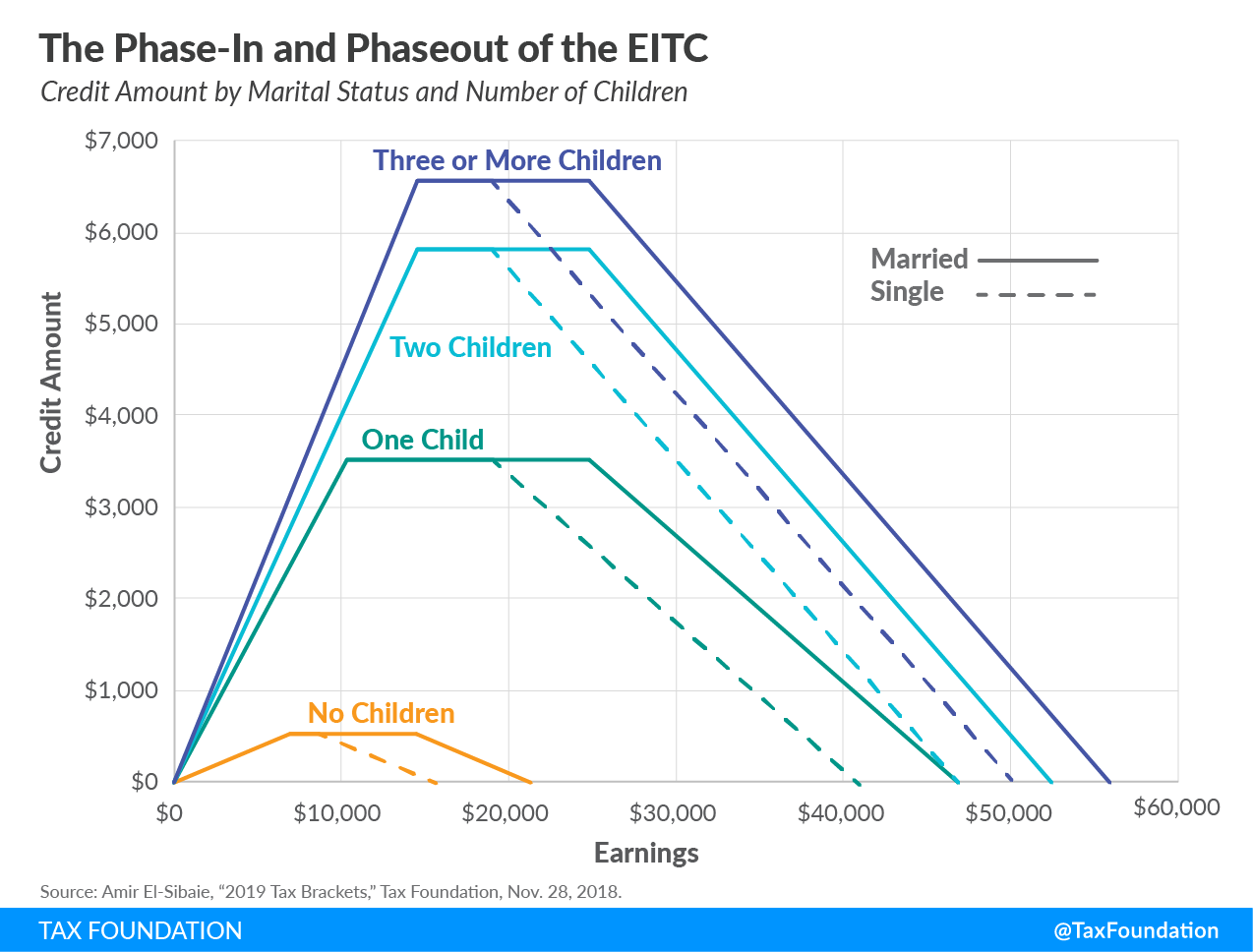

At present, improper payments are largely a result of the same child being claimed multiple times due to shared custody agreements or other complex living situations. In current law, the amount of credit a person receives from claiming the EITC is dependent on three things: AGI, marital status, and number of children. The graph below illustrates how these variables affect the amount of credit a taxpayer receives from claiming the EITC.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeWhile the earned income and marriage aspects of the credit are simple to verify within the filing season, the number of children claimed is not. Low-income families tend to have atypical structure—the TAS report cites “single parent, in a multigenerational household, a cohabiting household, or in a family with at least one non-biological child” as some examples.

Given that the number of dependents is a key determinant in how much a person receives in EITC, this presents an important administrative issue. Currently, people who claim the EITC are more likely to be audited, creating undue burden on low-income taxpayers.

Making the EITC a per-worker, rather than household, credit would assure that workers receive at least some EITC assistance without the added complexity of determining child custody. Since the credit would be based on individual workers rather than household income, it would also eliminate the “marriage penalty” in the current EITC design.

This change would be accompanied by an expansion and redesign of the CTC that pays out a set amount per child. TAS recommends the CTC program be universal or phase out only at high income levels to “acknowledge that families at all income levels need a minimum amount of resources to adequately care for children.”

TAS also recommends updating the definition and guidance of who constitutes a “primary carer.” This would include providing a checklist of duties a primary carer would perform and what follow-up documentation might be requested (i.e., school or medical records) if a child is claimed multiple times.

If lawmakers are hesitant to expand EITC benefits because of improper payments, they could consider the TAS recommendation to separate the earned income and child tax credits. These changes could help ensure that EITC and CTC funds reach their targets and reduce compliance costs for low-income taxpayers.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe