Key Findings

- Full expensingFull expensing allows businesses to immediately deduct the full cost of certain investments in new or improved technology, equipment, or buildings. It alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs. recognizes two key concepts left unaddressed by depreciationDepreciation is a measurement of the “useful life” of a business asset, such as machinery or a factory, to determine the multiyear period over which the cost of that asset can be deducted from taxable income. Instead of allowing businesses to deduct the cost of investments immediately (i.e., full expensing), depreciation requires deductions to be taken over time, reducing their value and discouraging investment. deductions: opportunity cost and the time value of money.

- Immediately deducting the cost of investments aligns the cash flow of a business with the way businesses, make investment decisions, and with opportunity costs and the time value of money. Depreciation understates business costs, overstates business profits, and creates a bias against investment.

- Currently, only certain types of investments can be immediately deducted. Investments in long-lived assets, such as structures, must be deducted over long cost recoveryCost recovery is the ability of businesses to recover (deduct) the costs of their investments. It plays an important role in defining a business’ tax base and can impact investment decisions. When businesses cannot fully deduct capital expenditures, they spend less on capital, which reduces worker’s productivity and wages. periods: up to 39 years (for nonresidential buildings).

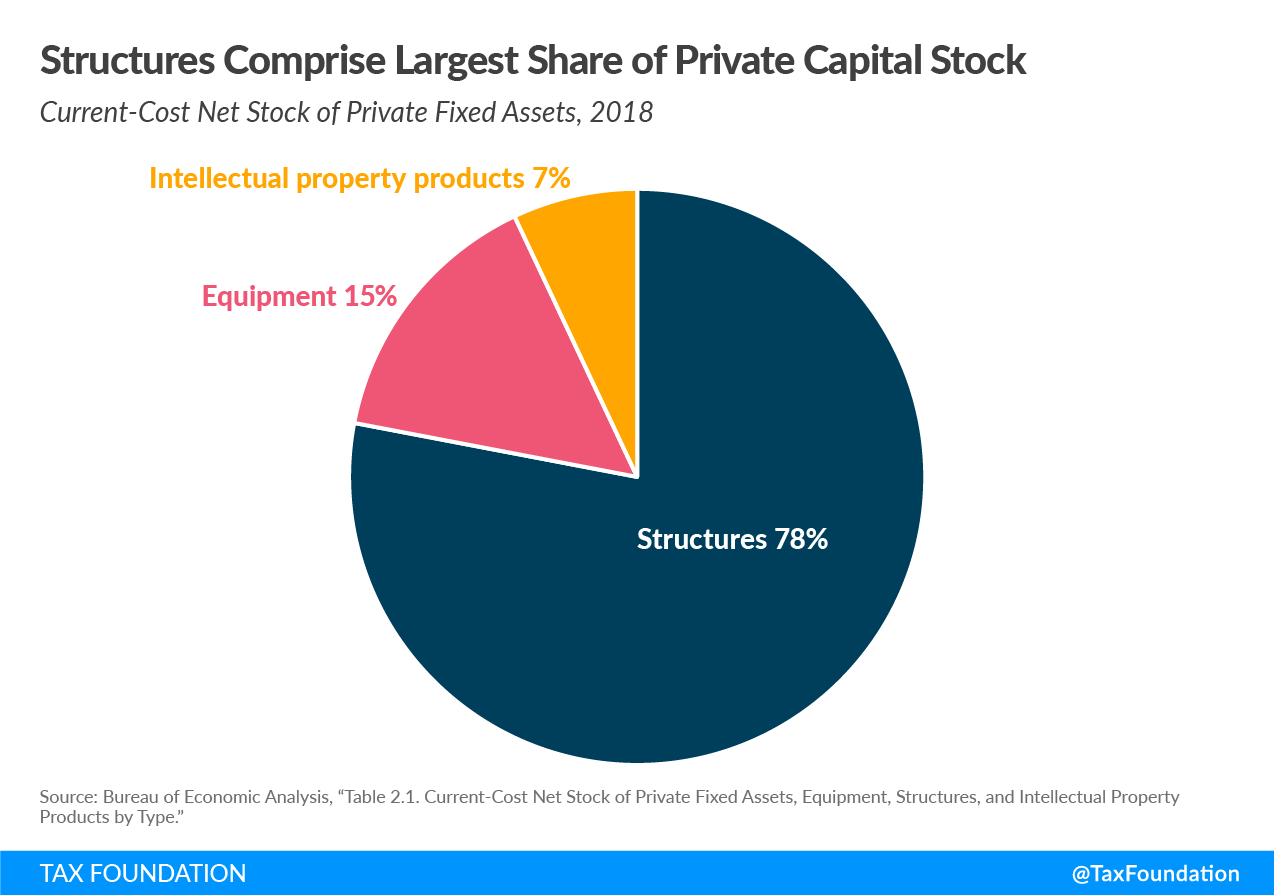

- Nonresidential structures comprise more than 30 percent of the private capital stock.

- The TaxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. Foundation model estimates that extending full expensing to structures would boost the long-run size of the economy by 1.4 percent; the capital stock would be 2.6 percent larger, wages 1.2 percent higher, and an additional 224,000 full-time equivalent jobs would be created.

- Making the transition to full expensing would come with a large upfront cost. However, we estimate the long-run annual cost would be $20.1 billion.

- Full expensing is one of the most powerful pro-growth policies in terms of revenue forgone. Given that structures comprise a large share of the private capital stock, improving their tax treatment would end a large bias against investment in the tax code.

Erratum: An earlier version of this paper noted that the economic and revenue estimates were for enacting full expensing for residential and nonresidential structures. The economic and revenue estimates are for enacting full expensing for nonresidential structures only.

Introduction

The December 2017 tax law enacted full expensing, on a temporary basis, for certain types of investments. Full expensing is a powerful, pro-growth provision because it alleviates a bias in the tax code that discourages investment in the United States. However, the tax code does not allow full expensing for all types of investments; currently, the tax code is heavily biased against investments in structures.

Nonresidential buildings must be deducted over a period of 39 years. This is problematic; due to inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. and the time value of money, a dollar in the future is worth less than a dollar today. Thus, delaying deductions for the cost of business investments means that the real value of the deductions is less than the original cost.

This paper discusses the question of how the costs of capital assets should be recovered, how structures are treated under the current tax code, and the economic and budgetary impact of extending full expensing to new nonresidential structures.

Cost Recovery of Capital Assets

The corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. is a tax on the income of a business; properly defined, income is equal to revenue less the cost of earning the revenue. Under the current tax code, businesses are generally allowed to deduct their expenses in the year they occur when figuring their income for tax purposes. However, some costs are understated, or disallowed, which incorrectly defines, overstates, and overtaxes profit.[1]

A fundamental question that must be addressed is how to recover the cost of capital assets, such as machinery, equipment, and buildings. Should capital assets be counted as costs when they are bought, or should the costs be stretched over many years?[2]

Under the current Modified Accelerated Cost Recovery System (MACRS), when businesses incur costs for long-lived capital assets like structures, they must deduct them over several years according to preset depreciation schedules rather than deducting them immediately when the outlay occurs.[3] This differs from the current treatment of short-lived assets such as machinery and equipment, which, due to changes made by the 2017 Tax Cuts and Jobs Act, can be immediately deducted in the year the expense occurs.[4]

The depreciation approach is preferred by the accounting profession and for financial reporting purposes to shareholders.[5] However, this approach does not make sense for tax calculation purposes. Depreciation does not fully reflect the cost of an asset; rather, depreciation understates costs and overstates profits.

Delaying deductions, rather than deducting the full cost in the year it occurs, means the present value of the write-offs is smaller than the original cost of the investment. This effectively shifts the tax burden forward in time as businesses face a higher tax burden today because they cannot fully deduct their costs, which decreases the after-tax return on the investment. The result is a higher cost of capital, which reduces capital formation, productivity, and wages.[6]

Alternatively, the cash flow approach allows businesses to immediately recognize the costs of acquiring capital assets when the expenditure occurs. This approach to cost recovery recognizes two important ideas that are not addressed under the depreciation approach: opportunity cost and the time value of money.[7]

First, opportunity cost acknowledges that if a business spends a dollar on a given capital asset, it cannot also spend that same dollar on something else.

Suppose that a business owner hires a contractor to make $10,000 of upgrades to her building. The business owner pays the full $10,000 cost that year; she doesn’t pay $1,000 this year, $1,000 next year, and so on until she reaches a total of $10,000.[8] The full $10,000 is unavailable for other investments, for paying bills, or for hiring more workers. The opportunity cost of the upgrades is $10,000; it is instantly incurred, and the business owner must make the decision to use the $10,000 for upgrades or for some other purpose.

The second idea is the time value of money: a dollar today is not worth the same as a dollar at any given point in the future, which is why interest rates are not normally zero.

In the previous example, the business owner would not think that $10,000 spent today was the same as spending $1,000 a year for 10 years, because a dollar tomorrow is not the same as a dollar today. Instead, we need to consider the present value: how much a dollar in the future is worth today. This requires adjusting future values by a discount rate, which reflects the opportunity cost if the business were to use the money for something else and the inflation rate.

Table 1 illustrates the present value of deductions for a variety of asset lives. Consider a business that spends $10,000 on shrubbery, classified as 15-year property.[9] At 2 percent inflation, this business would deduct just $6,900 of the initial investment cost over the life of the investment in present value terms. This is $3,100 less than the actual $10,000 cost, which means that in real terms, the business’s profits are overstated, resulting in a higher tax burden. Thus, the timing of costs matters to businesses as they make decisions about whether to invest.

| Source: Author’s calculations. Assumes half-year convention, 3 percent real discount rate, plus inflation. | |||

| 5-year asset | 15-year asset | 20-year asset | |

|---|---|---|---|

| Expensing | $100.00 | $100.00 | $100.00 |

| MACRS at 0% inflation | $92.97 | $78.64 | $75.50 |

| MACRS at 2% inflation | $88.75 | $69.32 | $63.87 |

| MACRS at 3% inflation | $86.77 | $66.69 | $59.07 |

Immediately deducting the cost of capital assets aligns with the cash flow of a business, with the way businesses make investment decisions, and with the ideas of opportunity cost and the time value of money. It fully recognizes the cost of assets. On the other hand, deducting the costs over time does not align with these ideas, because the delays reduce the present value of the deductions so that the business is unable to fully recover the cost of assets.

Full Expensing and Structures

Under a neoclassical economic framework, in which the main drivers of output are the willingness of people to work and to deploy capital,[10] taxes on capital, such as the corporate income tax, reduce the incentive to invest, the size of the long-run capital stock, and long-run output.[11] Importantly, full and immediate expensing allows for better taxation of capital income.

Full expensing is an efficient way to boost the size of the long-run economy because it is a policy aimed entirely at new investments and fixes a bias within the corporate income tax system. It does this by removing new investments from the tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. ,[12] which brings the marginal effective tax rate on new investment down to zero.[13] Under full expensing, companies would not be taxed on marginal investments, meaning the bias against investment in the corporate income tax would be removed.

Another way to think of this is that under full expensing, where companies get to fully and immediately deduct the cost of their investments, the government can be viewed as a shareholder buying a stake in the investment by offering the tax deductionA tax deduction is a provision that reduces taxable income. A standard deduction is a single deduction at a fixed amount. Itemized deductions are popular among higher-income taxpayers who often have significant deductible expenses, such as state and local taxes paid, mortgage interest, and charitable contributions. . Then, the government collects its share of the profits through tax revenue. In the absence of a full deduction, business profits are overstated, resulting in a higher tax burden that artificially increases the cost of capital.

Under the current cost recovery system, when a business purchases a structure, it has to deduct the cost over a period of up to 27.5 years (for residential buildings) or 39 years (for nonresidential buildings).[14] This system of tax depreciation, rather than full expensing, is highly unfavorable to structures; the requirement to deduct the cost of these types of investments over such a long period discourages businesses from investing in structures in the first place.[15]

Marginal effective tax rates, or the tax rate that a new investment faces, affect investment decisions at the margin, which determines how much new capital will be deployed. Currently, structures face some of the highest marginal effective tax rates, especially when compared to investments that currently receive full expensing treatment.[16]

This does not mean that no investment in structures occurs under the current system of depreciation, but that under the higher marginal effective tax rate due to deprecation, less profitable projects may not be considered worthwhile to undertake. Lowering the marginal effective tax rate by shifting to full expensing for structures would increase the number of possible projects that would be profitable after tax, and likely induce an expansion in the capital stock.

The tax treatment of structures is important because structures comprise more than three-quarters of the private capital stock.[17] In 2017, nonresidential structures made up 31.4 percent, or $14.2 trillion, of the private capital stock, while residential structures accounted for 46.5 percent, or $21.1 trillion, of the private capital stock. In comparison, equipment, which generally qualifies for full expensing treatment under the 100 percent bonus depreciationBonus depreciation allows firms to deduct a larger portion of certain “short-lived” investments in new or improved technology, equipment, or buildings in the first year. Allowing businesses to write off more investments partially alleviates a bias in the tax code and incentivizes companies to invest more, which, in the long run, raises worker productivity, boosts wages, and creates more jobs. provision of the TCJA, makes up just 15 percent of the private capital stock.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeGiven that structures comprise the largest share of the capital stock, improving the tax treatment of this asset class would likely have a large economic impact.

Economic Impact of Full Expensing for New Structures

Extending full expensing to structures would allow companies to immediately deduct the cost of new buildings. The Tax Foundation General Equilibrium Model estimates that on a dynamic basis, enacting full expensing for new nonresidential structures would boost the long-run size of the economy by 1.4 percent. Full expensing for structures would lead to a 2.6 percent larger capital stock, a 1.2 percent boost in wages, and an additional 224,000 full-time equivalent jobs.

| Source: Tax Foundation General Equilibrium Model, October 2019 | |

| Economic Impact | |

|---|---|

| GDP | 1.4% |

| Capital Stock | 2.6% |

| Wages | 1.2% |

| FTE | 224,000 |

Budgetary Impact of Full Expensing for Structures

One of the obstacles to enacting full expensing for structures is the large upfront cost to making the switch. Over the first decade, full expensing for long-life structures would reduce federal revenues by $322 billion.

| Source: Tax Foundation General Equilibrium Model, October 2019 | ||||||||||

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2019 – 2028 |

|---|---|---|---|---|---|---|---|---|---|---|

| -36.2 | -36.91 | -36.87 | -32.21 | -32.29 | -32.14 | -31.37 | -29.78 | -27.05 | -27.38 | -322.21 |

However, much of this upfront cost is transitional: when first moving to full expensing, businesses can immediately deduct the cost of their new investments while they continue taking depreciation deductions for their old investments. As deductions for the old investments age out, the cost tapers down. As such, we estimate the long-run cost of full expensing for new residential and nonresidential structures would be $20 billion a year.

Additional Considerations

Lawmakers would also need to consider how to treat old structures built before full expensing applied as well as businesses with operating losses.

Large structures are expensive, and in some cases, if a business does not make enough revenue in the year the expense occurs, the deduction for the building could result in a net operating loss (NOL). Currently, businesses can carry unused portions of NOLs forward for 20 years, and NOLs are limited to 80 percent of taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. For both individuals and corporations, taxable income differs from—and is less than—gross income. . Because NOLs are not adjusted for the time value of money, these rules reduce the tax benefit of the deduction. Instead, lawmakers could consider adjusting unused portions of the write-offs to maintain their present value, an approach called neutral cost recovery or depreciation indexing.[18] Neutral cost recovery gives a deduction the same value as full expensing regardless of timing.

Another issue that lawmakers must consider is how to treat structures purchased before full expensing. Economist Stephen J. Entin explains several solutions to this problem, including offering neutral cost recovery for the remaining basis for all buildings, including old:

A building erected the year before the tax relief would be written-off over thirty-nine years (in most cases), while a new building could be expensed. The newer building would have a clear tax advantage over the old, generating a capital loss for the owners of the older building. To avoid this loss, the old building could be sold to new owners, who could take advantage of the new expensing provision. [This assumes the turned-over property is eligible for expensing.] However, this would require some expensive and wasteful churning of property.

Several steps could be taken if it were deemed proper to ameliorate the disadvantage to old buildings, without the need to change owners. Most immediate would be to allow all remaining (undepreciated) tax bases on old buildings to be expensed, in effect a retro-active enactment. A more gradual approach would be to grant old buildings the same time value adjustment on their remaining bases that the bill gives to NOLs on new buildings.[19]

Finally, lawmakers could also consider ways to phase in the expensing of structures so that old and new buildings receive similar treatment. For example, lawmakers could enact a policy that reduced the cost recovery period of structures by a few years immediately, and thereafter by one to two years each year until depreciation was completely phased out.

Whether lawmakers allow neutral cost recovery and how they would treat existing structures would affect the economic and revenue effects of full expensing.[20] Likewise, phasing in full expensing would delay some of the potential growth.

Conclusion

Full expensing accurately reflects the costs of purchasing capital assets and accurately states business profits for the purposes of income taxes. This approach recognizes two important ideas, opportunity cost and the time value of money, that are ignored by the depreciation system. Under current law, some types of capital investments are eligible for full expensing. However, structures, which comprise the largest share of the private capital stock, are excluded from full expensing and must be deducted over especially long depreciation schedules.

Given how large a share structures comprise of the capital stock, improving the tax treatment of structures would have a powerful economic effect. Full expensing for nonresidential buildings would boost the long-run size of the economy by 1.4 percent, and lead to 1.2 percent higher wages and 224,000 additional full-time equivalent jobs. The upfront cost of switching to full expensing would be large, reducing revenues by $322.2 billion in the first 10 years of the policy. However, the long-run cost after the transition would be much lower, at $20 billion a year.

Full expensing is one of the most powerful, pro-growth policies that lawmakers can pursue. The tax code is heavily biased against investment in structures and, all else equal, extending full expensing to these capital assets would boost investment and the long-run size of the economy.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe[1] Stephen J. Entin, “The Tax Treatment of Capital Assets and Its Effect on Growth: Expensing, Depreciation, and the Concept of Cost Recovery in the Tax System,” Apr. 24, 2013, Tax Foundation, https://taxfoundation.org/article-nstax-treatment-capital-assets-and-its-effect-growth-expensing-depreciation-and-concept-cost-recovery/.

[2] Ibid.

[3] Scott Greenberg, “What is Depreciation, and Why Was it Mentioned in Sunday Night’s Debate?” Tax Foundation, Oct. 10, 2016, https://taxfoundation.org/what-depreciation-and-why-was-it-mentioned-sunday-night-s-debate/.

[4] Erica York and Alex Muresianu, “The TCJA’s Expensing Provision Alleviates the Tax Code’s Bias Against Certain Investments,” Tax Foundation, Sept. 5, 2018, https://taxfoundation.org/tcja-expensing-provision-benefits/.

[5] Entin, “The Tax Treatment of Capital Assets and Its Effect on Growth.”

[6] Greenberg, “What is Depreciation, and Why Was it Mentioned in Sunday Night’s Debate?”

[7] Entin, “The Tax Treatment of Capital Assets and Its Effect on Growth.”

[8] Note that this is a simplified illustration; under current law, interior improvements to buildings must be depreciated over 39 years.

[9] Internal Revenue Service, Publication 946 (2018), How To Depreciate Property, https://www.irs.gov/publications/p946#en_US_2017_publink1000107538.

[10] Erica York, “The Benefits of Cutting the Corporate Income Tax Rate,” Tax Foundation, Aug. 14, 2018, https://taxfoundation.org/benefits-cutting-corporate-income-tax-rate/.

[11] Alan Cole, “Fixing the Corporate Income Tax,” Tax Foundation, Feb. 4, 2016, https://taxfoundation.org/fixing-corporate-income-tax/.

[12] Gavin Ekins, “Full Expensing is the Federal Government’s Best Investment in the U.S. Economy,” Tax Foundation, Jan. 9, 2017, https://taxfoundation.org/full-expensing-federal-government-s-best-investment-us-economy/.

[13] Kyle Pomerleau, “Why Full Expensing Encourages More Investment than A Corporate Rate Cut,” Tax Foundation, May 3, 2017, https://taxfoundation.org/full-expensing-corporate-rate-investment/.

[14] Some structures are subject to shorter depreciation schedules, such as certain agricultural, utility, and improvement property; we did not model changes to the tax treatment of these assets.

[15] Scott Greenberg, “A Proven Strategy for Boosting Investment,” Tax Foundation, Feb. 17, 2016, https://taxfoundation.org/proven-strategy-boosting-investment.

[16] See generally Huaqun Li, “Measuring Marginal Tax RateThe marginal tax rate is the amount of additional tax paid for every additional dollar earned as income. The average tax rate is the total tax paid divided by total income earned. A 10 percent marginal tax rate means that 10 cents of every next dollar earned would be taken as tax. on Capital Assets,” Tax Foundation, Dec. 12, 2017, https://taxfoundation.org/measuring-marginal-tax-rate-capital-assets/.

[17] Bureau of Economic Analysis, “Table 2.1. Current-Cost Net Stock of Private Fixed Assets, Equipment, Structures, and Intellectual Property Products by Type,” Aug. 8, 2019, https://apps.bea.gov/iTable/iTable.cfm?ReqID=10&step=2.

[18] Stephen J. Entin, “Tax Treatment of Structures Under Expensing,” Tax Foundation, May 24, 2017, https://taxfoundation.org/tax-treatment-structures-expensing/.

[19] Ibid.

[20] See generally Scott Greenberg, “Options for Improving Cost Recovery for Structures,” Tax Foundation, Oct. 11, 2017, https://taxfoundation.org/options-improving-cost-recovery-structures/.

Share