The House Ways and Means Democrats’ just-released proposal to expand the child tax creditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income rather than the taxpayer’s tax bill directly. for one year represents a significant expansion of benefits but comes with several administrative challenges. It would be included in President Biden’s larger $1.9 trillion in economic relief package moving through the budget reconciliation process.

The Child Tax Credit (CTC) would be expanded from $2,000 today to $3,000 for children 6 and older and $3,600 for children under 6. The credit would be advanced to families monthly, at $250/month for older children and $300/month for younger children. It would be fully available and refundable to households with no income, unlike the Child TaxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. Credit’s current design.

The expanded credit shares similarities with a proposal released by Sen. Mitt Romney (R-UT) last week. Both proposals would make the Child Tax Credit more generous, eliminate the phase-in and minimum income requirement of $2,500, and make the CTC fully refundable to households. Under current law, households with no income tax to offset are limited to $1,400 in refundability. Both plans would also expand eligibility to children aged 17.

There are several places where the Democratic proposal differs from Romney’s proposal. It has a lower maximum amount for younger children at $3,600, compared to $4,200 under the Romney plan. Unlike Romney’s plan, which would be administered by the Social Security Administration, the Child Tax Credit would continue to be administered through the Internal Revenue Service (IRS) as part of the tax code. Keeping the increased credit amount and monthly payments within the tax code would likely maintain the administrative complexity that arises from using the tax code to provide benefits.

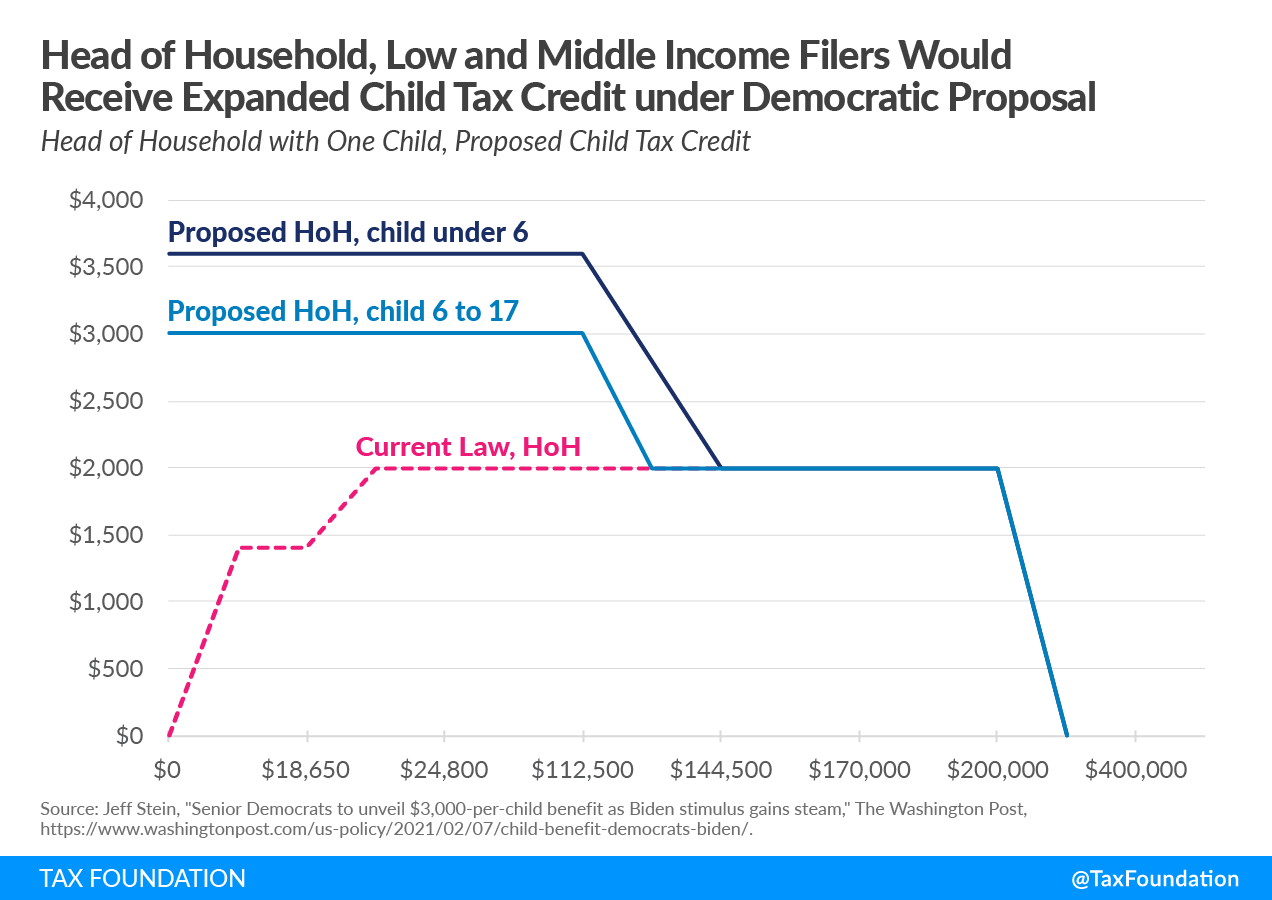

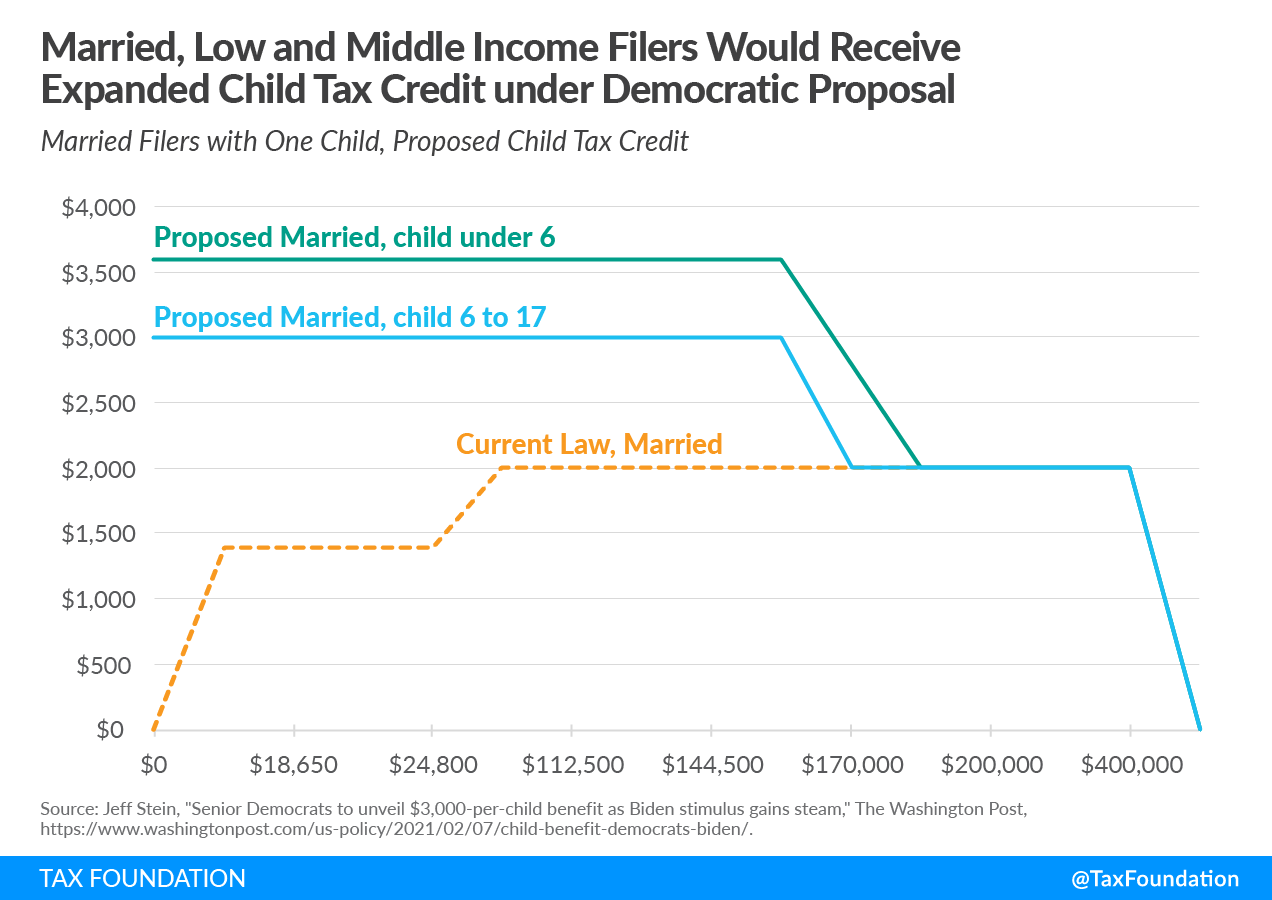

Biden and congressional Democrats want to phase out the increased benefit at a lower threshold than the current Child Tax Credit but without increasing the tax burden on current Child Tax Credit beneficiaries. The more generous credit would begin to phase out at $112,500 for head of household filers and $150,000 for joint filers, which is lower than the existing benefit thresholds of $200,000 for heads of household and $400,000 for joint filers.

Doing so means the proposal creates a new plateau in the phaseout of the expanded Child Tax Credit: the expanded benefit would phase out until reaching the current benefit amount of $2,000 and would continue at $2,000 until filers hit the regular thresholds under current law (see Charts 1 and 2).

The Child Tax Credit would be advanced to households on a monthly basis, which requires the IRS to have information about a filers’ income, filing status, and number of eligible dependents. The Democratic proposal would direct the IRS to use the information provided on prior-year tax returns to project the advanced payment amount.

However, if any information changes over the year, e.g., due to divorce or other change in child custody, a filer may be subject to overpayment or underpayment of the benefit. Differences would require either an additional credit paid during the tax season for underpayments, or a clawback of benefits if the IRS overpaid through the year. The proposal tries to limit the potential for clawbacks by creating a safe harbor. It would offset up to $2,000 of overpayment per eligible dependent for households that received overpayment due to having fewer qualifying dependents. The proposal does not have a safe harbor related to miscalculations in income or a change in filing status. The lower phaseout threshold for the expanded Child Tax Credit also means the clawback problem may affect more filers under the Democratic plan than it would under Romney’s plan (which phases out at $200,000 for single filers and $400,000 for joint filers, identical to current law).

The IRS may create an online tool for beneficiaries to update their income projections, filing status, or number of dependents. But such a tool may have challenges related to take-up as the IRS found with the “Find my Payment” tool established for direct payments last year.

Advocates of the proposal aim to begin advanced monthly payments as soon as July, but former National Taxpayer Advocate Nina Olson argues that the process may take up to 18 months. The process for advancing Premium Tax Credits for the Affordable Care Act took years for the IRS to establish, for example. A slower rollout of monthly payments would mean the expanded Child Tax Credit would not be a timely tool for providing pandemic relief.

The details of the Democratic Child Tax Credit plan suggest more work needs to be done to ensure taxpayers are not saddled with surprise tax bills after receiving advanced CTC payments. Requiring the IRS to know in real-time the marital status and number of dependents for millions of filers is not a reasonable expectation of a tax agency, especially for one that has performed under immense pressure over the past year.

Rationalizing the maze of benefits provided in the tax code for social and family policy is a worthy goal. Balancing the need for simplicity and support for families with children and considering the full effects of several policy changes at once are among the many items for policymakers to consider as they evaluate different proposals to reform and expand the Child Tax Credit.