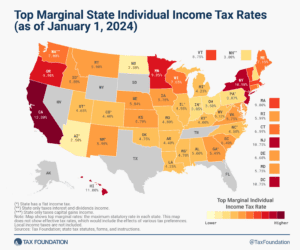

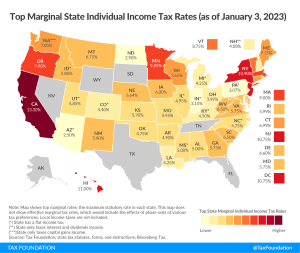

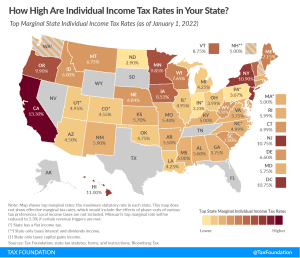

State Individual Income Tax Rates and Brackets, 2025

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections. How do income taxes compare in your state?

12 min read

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections. How do income taxes compare in your state?

12 min read

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections. How do income taxes compare in your state?

12 min read

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections. How do income taxes compare in your state?

8 min read

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections:

9 min read

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections:

28 min read

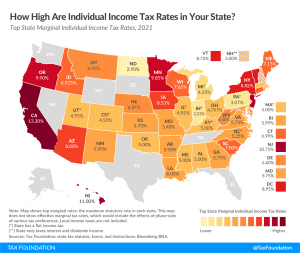

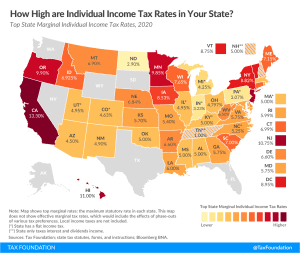

Individual income taxes are a major source of state government revenue, accounting for 37 percent of state tax collections in fiscal year (FY) 2017. Several states had notable individual income tax changes in 2020: Arizona, Arkansas, Massachusetts, Michigan, Minnesota, North Carolina, Ohio, Tennessee, Virginia, and Wisconsin.

22 min read

Individual income taxes are a major source of state government revenue, accounting for 37 percent of state tax collections in fiscal year (FY) 2017. Several states had notable individual income tax changes in 2020: Arizona, Arkansas, Massachusetts, Michigan, Minnesota, North Carolina, Ohio, Tennessee, Virginia, and Wisconsin.

9 min read

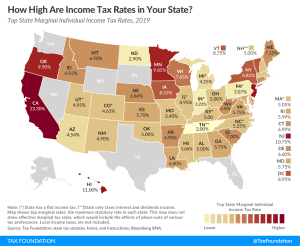

Individual income tax rates and brackets vary widely by state. Keep track of top marginal income tax rates in your state and others with our new guide.

4 min read

There’s a lot of variance in how states levy the individual income tax. In our newest study, we provide the most up-to-date data available on state individual income tax rates, brackets, standard deductions, and personal exemptions for both single and joint filers.

4 min read