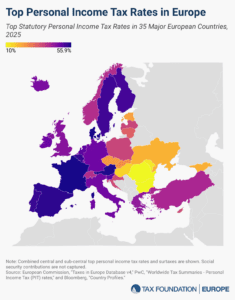

Top Personal Income Tax Rates in Europe, 2025

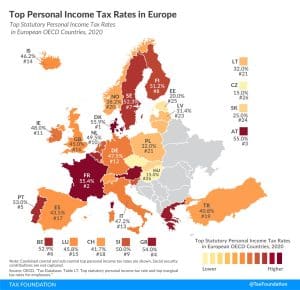

Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) levy the highest top personal income tax rates in Europe.

4 min readProviding journalists, taxpayers, and policymakers with the latest data on taxes and spending is a cornerstone of the Tax Foundation’s educational mission.

As a nonpartisan, educational organization, the Tax Foundation has earned a reputation for independence and credibility.

Our EU tax policy team regularly provides accessible, data-driven insights from sources such as the European Commission, the Organisation for Economic Co-Operation and Development (OECD), and others.

Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) levy the highest top personal income tax rates in Europe.

4 min read

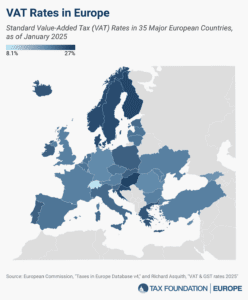

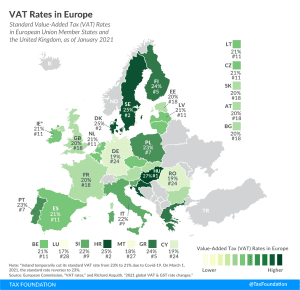

More than 175 countries worldwide—including all major European countries—levy a value-added tax (VAT) on goods and services. EU Member States’ VAT rates vary across countries, though they’re somewhat harmonized by the EU.

5 min read

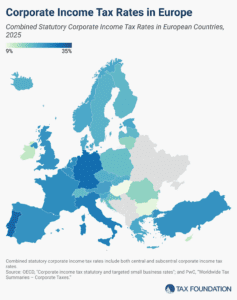

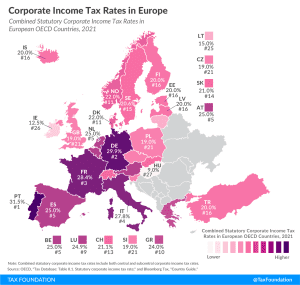

Some European countries have raised their statutory corporate rates over the past year, including Czechia, Estonia, Iceland, Lithuania, and Slovenia.

3 min read

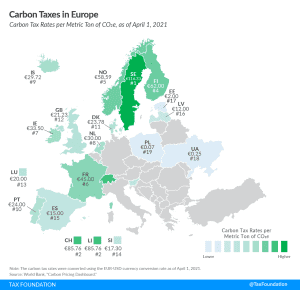

In recent years, several countries have taken measures to reduce carbon emissions, including instituting environmental regulations, emissions trading systems (ETS), and carbon taxes.

3 min read

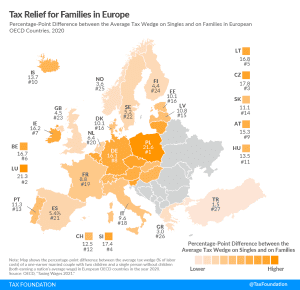

Most countries provide tax relief to families with children—typically through targeted tax breaks that lower income taxes. While all European OECD countries provide tax relief for families, its extent varies substantially across countries.

2 min read

Most countries’ personal income taxes have a progressive structure, meaning that the tax rate paid by individuals increases as they earn higher wages. The highest tax rate individuals pay differs significantly across Europe, with Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) having the highest top statutory personal income tax rates among European OECD countries.

3 min read

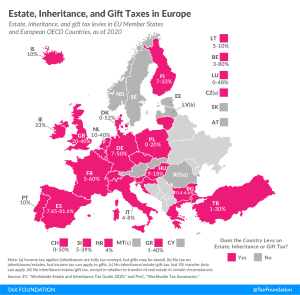

Estate tax is levied on the property of the deceased and is paid by the estate itself. Inheritance taxes, in contrast, are only levied on the value of assets transferred and are paid by the heirs. Gift taxes are levied when property is transferred by a living individual. The majority of European countries covered in today’s map currently levy estate, inheritance, or gift taxes.

3 min read

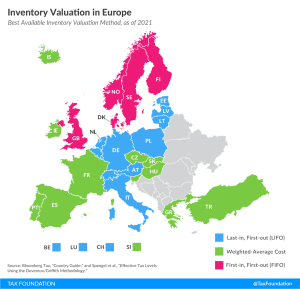

The method by which a country allows businesses to account for inventories can significantly impact a business’s taxable income. When prices are rising, as is usually the case due to factors like inflation, LIFO is the preferred method because it allows inventory costs to be closer to true costs at the time of sale.

2 min read

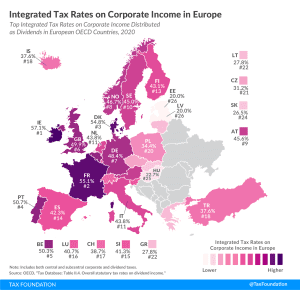

On average, European OECD countries currently levy a corporate income tax rate of 21.7 percent. This is below the worldwide average which, measured across 177 jurisdictions, was 23.9 percent in 2020.

2 min read

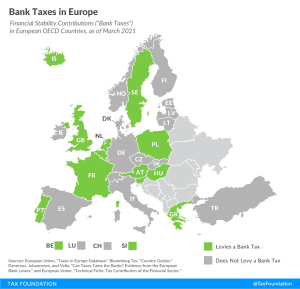

Today’s map shows which European OECD countries implemented financial stability contributions (FSCs), commonly referred to as “bank taxes.”

2 min read

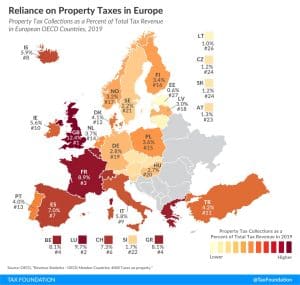

Property taxes are levied on the assets of an individual or business. There are different types of property taxes, with recurrent taxes on immovable property (such as property taxes on land and buildings) the only ones levied by all countries covered. Other types of property taxes include estate, inheritance, and gift taxes, net wealth taxes, and taxes on financial and capital transactions.

1 min read

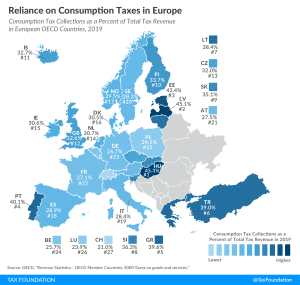

Hungary relies the most on consumption tax revenue, at 45.3 percent of total tax revenue, followed by Latvia and Estonia at 45.1 percent and 42.4 percent, respectively.

2 min read

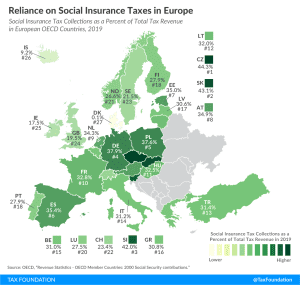

Social insurance taxes are the second largest tax revenue source in European OECD countries, at an average of 29.5 percent of total tax revenue.

2 min read

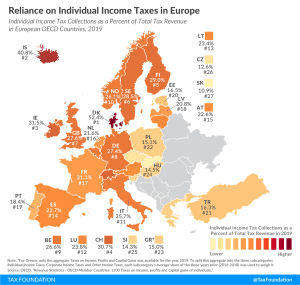

Denmark relies the most on revenue from individual income taxes, at 52.4 percent of total tax revenue, followed by Iceland and Ireland at 40.8 percent and 31.5 percent, respectively.

1 min read

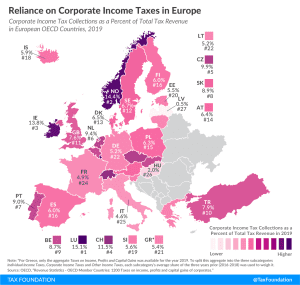

Despite declining corporate income tax rates over the last 30 years in Europe (and other parts of the world), average revenue from corporate income taxes as a share of total tax revenue has not changed significantly compared to 1990.

1 min read

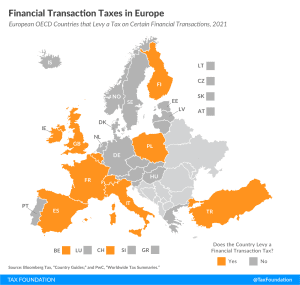

Belgium, Finland, France, Ireland, Italy, Poland, Spain, Switzerland, Turkey, and the United Kingdom currently levy a type of financial transaction tax

2 min read

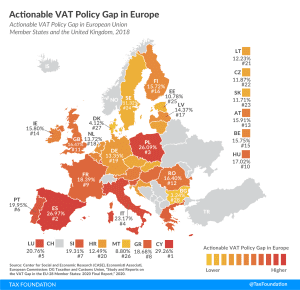

Value-added taxes (VAT) make up approximately one-fifth of total tax revenues in Europe. However, European countries differ significantly in how efficiently they raise VAT revenues. One way to measure a country’s VAT efficiency is the VAT Gap.

4 min read

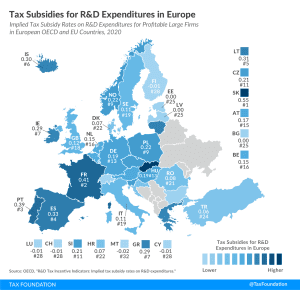

Many countries incentivize business investment in research and development (R&D), intending to foster innovation. A common approach is to provide direct government funding for R&D activity. However, a significant number of jurisdictions also offer R&D tax incentives.

4 min read

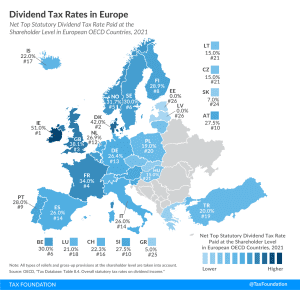

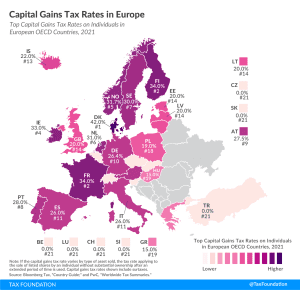

The integrated tax rate on corporate income reflects both the corporate income tax and the dividends or capital gains tax—the total tax levied on corporate income. For dividends, Ireland’s top integrated tax rate was highest among European OECD countries, followed by France and Denmark

4 min read

More than 140 countries worldwide—including all European countries—levy a Value-Added Tax (VAT) on goods and services.

4 min read

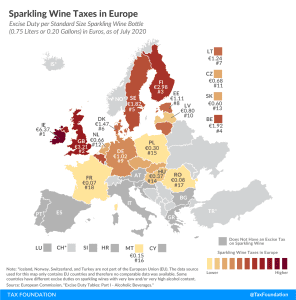

This week, people around the world will celebrate New Year’s Eve, with many opening a bottle of sparkling wine to wish farewell to—a rather consequential—2020 and offer a warm welcome to the—by many of us, long-awaited—new year 2021.

1 min read