Key Findings

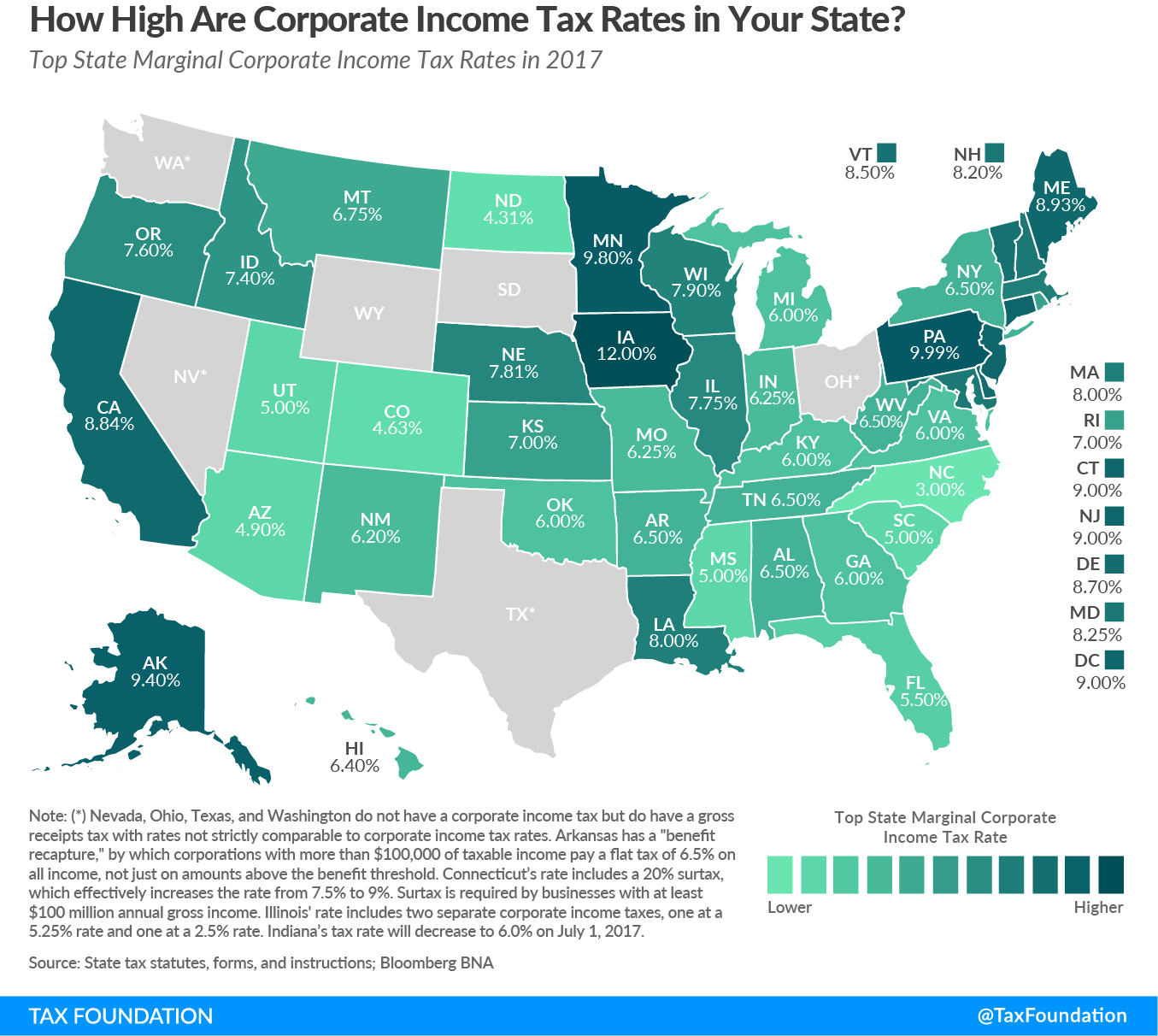

- Forty-four states levy a corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. . Rates range from 3 percent in North Carolina to 12 percent in Iowa.

- Six states — Alaska, Connecticut, Iowa, Minnesota, New Jersey, and Pennsylvania, and the District of Columbia — levy top marginal corporate income taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rates of 9 percent or higher.

- Seven states — Arizona, North Carolina, North Dakota, Colorado, Mississippi, South Carolina, and Utah — have top rates at or below 5 percent.

- Nevada, Ohio, Texas, and Washington impose gross receipts taxes instead of corporate income taxes. Gross receipts taxes are generally thought to be more economically harmful than corporate income taxes.

- South Dakota and Wyoming are the only states that do not levy a corporate income or gross receipts taxGross receipts taxes are applied to a company’s gross sales, without deductions for a firm’s business expenses, like compensation, costs of goods sold, and overhead costs. Unlike a sales tax, a gross receipts tax is assessed on businesses and applies to transactions at every stage of the production process, leading to tax pyramiding. .

Corporate income taxes are levied in 44 states. Though often thought of as a major tax type, corporate income taxes account for just 5.4 percent of state tax collections and 2.7 percent of state general revenue. [1]

Iowa levies the highest top statutory corporate tax rate at 12 percent. Iowa is closely followed by Pennsylvania (9.99 percent) and Minnesota (9.8 percent). Three other states (Alaska, Connecticut, and New Jersey) and the District of Columbia levy rates of 9 percent or higher.

Conversely, North Carolina’s flat rate of 3 percent is the lowest rate in the country, followed by rates in North Dakota (4.31 percent) and Colorado (4.63 percent). Four other states impose rates at or below 5 percent: Arizona at 4.9 percent and Mississippi, South Carolina, and Utah at 5 percent.

Nevada, Ohio, Texas, and Washington forego corporate income taxes but instead impose gross receipts taxes on businesses, which are generally thought to be more economically harmful due to tax pyramidingTax pyramiding occurs when the same final good or service is taxed multiple times along the production process. This yields vastly different effective tax rates depending on the length of the supply chain and disproportionately harms low-margin firms. Gross receipts taxes are a prime example of tax pyramiding in action. and nontransparency.[2] Delaware and Virginia impose gross receipts taxes in addition to corporate income taxes. South Dakota and Wyoming levy neither corporate income nor gross receipts taxes.

Twenty-nine states and the District of Columbia have single-rate corporate tax systems. The greater propensity toward single-rate systems for corporate tax than individual income tax is likely because there is no meaningful “ability to pay” concept in corporate taxation. Jeffrey Kwall, professor of law at Loyola University Chicago School of Law, notes that:

Graduated corporate rates are inequitable—that is, the size of a corporation bears no necessary relation to the income levels of the owners. Indeed, low-income corporations may be owned by individuals with high incomes, and high-income corporations may be owned by individuals with low incomes.[3]

A single-rate system minimizes the incentive for firms to engage in economically wasteful tax planning to mitigate the damage of higher marginal tax rates that some states levy as taxable income rises.

Notable Corporate Income Tax Changes in 2017:

Several states passed corporate income tax rate reductions and other reforms, taking effect in 2016 or 2017. Notable corporate income tax changes for 2017 include:

- North Carolina cut its corporate income tax from 4 percent to 3 percent as the final component of the multiyear phase-in of its comprehensive 2013 tax reform package. North Carolina now has the lowest rate of any state levying a corporate income tax, down from 6.9 percent in 2013.[4]

- Arizona reduced its corporate income tax rate from 5.5 to 4.9 percent.[5]

- New Mexico reduced its corporate income tax rate from 6.6 to 6.2 percent. The rate is scheduled to fall to 5.9 percent in 2018.[6]

- The District of Columbia reduced its corporate income tax rate from 9.2 to 9 percent.[7]

- Indiana will reduce its corporate income tax rate from 6.25 percent to 6 percent on July 1, 2017. The rate will be reduced further to 4.9 percent by 2021.[8]

The following table includes the most up-to-date data available on state corporate income tax rates and brackets.

| (a) Arkansas has a “benefit recapture,” by which corporations with more than $100,000 of taxable income pay a flat tax of 6.5% on all income, not just on amounts above the benefit threshold. (b) Rate includes a 20% surtax, which effectively increases the rate from 7.5% to 9%. Surtax is required by businesses with at least $100 million annual gross income. (c) Nevada, Ohio, Texas, and Washington do not have a corporate income tax but do have a gross receipts tax with rates not strictly comparable to corporate income tax rates. See Table 18 for more information. Delaware and Virginia have gross receipts taxes in addition to corporate income taxes. (d) Illinois’ rate includes two separate corporate income taxes, one at a 5.25% rate and one at a 2.5% rate. (e) The tax rate in Indiana will decrease to 6.0% on July 1, 2017. (f) Corporations with entire net income greater than $100,000 pay 9% on all taxable income, companies with entire net income greater than $50,000 and less than or equal to $100,000 pay 7.5% on all taxable income, and companies with entire net income less than or equal to $50,000 pay 6.5% on all taxable income. (g) The tax rate in New Mexico will decrease to 5.9% in 2018. Note: In addition to regular income taxes, many states impose other taxes on corporations such as gross receipts taxes and franchise taxes. Some states also impose an alternative minimum tax and special rates on financial institutions Source: Tax Foundation; state tax statutes, forms, and instructions; Bloomberg BNA |

|||

| State | Rates | Brackets | |

|---|---|---|---|

| Ala. | 6.50% | > | $0 |

| Alaska | 0.00% | > | $0 |

| 2.00% | > | $25,000 | |

| 3.00% | > | $49,000 | |

| 4.00% | > | $74,000 | |

| 5.00% | > | $99,000 | |

| 6.00% | > | $124,000 | |

| 7.00% | > | $148,000 | |

| 8.00% | > | $173,000 | |

| 9.00% | > | $198,000 | |

| 9.40% | > | $222,000 | |

| Ariz. | 4.90% | > | $0 |

| Ark. (a) | 1.00% | > | $0 |

| 2.00% | > | $3,000 | |

| 3.00% | > | $6,000 | |

| 5.00% | > | $11,000 | |

| 6.00% | > | $25,000 | |

| 6.50% | > | $100,000 | |

| Calif. | 8.84% | > | $0 |

| Colo. | 4.63% | > | $0 |

| Conn. (b) | 9.00% | > | $0 |

| Del. (c) | 8.70% | > | $0 |

| Fla. | 5.50% | > | $0 |

| Ga. | 6.00% | > | $0 |

| Hawaii | 4.40% | > | $0 |

| 5.40% | > | $25,000 | |

| 6.40% | > | $100,000 | |

| Idaho | 7.40% | > | $0 |

| Ill. (d) | 7.75% | > | $0 |

| Ind. (e) | 6.25% | > | $0 |

| Iowa | 6.00% | > | $0 |

| 8.00% | > | $25,000 | |

| 10.00% | > | $100,000 | |

| 12.00% | > | $250,000 | |

| Kans. | 4.00% | > | $0 |

| 7.00% | > | $50,000 | |

| Ky. | 4.00% | > | $0 |

| 5.00% | > | $50,000 | |

| 6.00% | > | $100,000 | |

| La. | 4.00% | > | $0 |

| 5.00% | > | $25,000 | |

| 6.00% | > | $50,000 | |

| 7.00% | > | $100,000 | |

| 8.00% | > | $200,000 | |

| Maine | 3.50% | > | $0 |

| 7.93% | > | $25,000 | |

| 8.33% | > | $75,000 | |

| 8.93% | > | $250,000 | |

| Md. | 8.25% | > | $0 |

| Mass. | 8.00% | > | $0 |

| Mich. | 6.00% | > | $0 |

| Minn. | 9.80% | > | $0 |

| Miss. | 3.00% | > | $0 |

| 4.00% | > | $5,000 | |

| 5.00% | > | $10,000 | |

| Mo. | 6.25% | > | $0 |

| Mont. | 6.75% | > | $0 |

| Nebr. | 5.58% | > | $0 |

| 7.81% | > | $100,000 | |

| Nev. | (c) | ||

| N.H. | 8.20% | > | $0 |

| N.J. (f) | 9.00% | > | $100,000 |

| N.M. (g) | 4.80% | > | $0 |

| 6.20% | > | $500,000 | |

| N.Y. | 6.50% | > | $0 |

| N.C. | 3.00% | > | $0 |

| N.D. | 1.41% | > | $0 |

| 3.55% | > | $25,000 | |

| 4.31% | > | $50,000 | |

| Ohio | (c) | ||

| Okla. | 6.00% | > | $0 |

| Ore. | 6.60% | > | $0 |

| 7.60% | > | 1000000 | |

| Pa. | 9.99% | > | $0 |

| R.I. | 7.00% | > | $0 |

| S.C. | 5.00% | > | $0 |

| S.D. | None | ||

| Tenn. | 6.50% | > | $0 |

| Tex. | (c) | ||

| Utah | 5.00% | > | 0 |

| Vt. | 6.00% | > | $0 |

| 7.00% | > | 10000 | |

| 8.50% | > | $25,000 | |

| Va. (c) | 6.00% | > | $0 |

| Wash. | (c) | ||

| W.Va. | 6.50% | > | $0 |

| Wis. | 7.90% | > | $0 |

| Wyo. | None | ||

| D.C. | 9.00% | > | $0 |

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe[1] “State & Local Government Finance, Fiscal Year 2014.” U.S. Census Bureau. http://www.census.gov/govs/local/.

[2] Justin Ross, “Gross Receipts Taxes: Theory and Recent Evidence.” Tax Foundation, Oct. 6, 2016. https://taxfoundation.org/gross-receipts-taxes-theory-and-recent-evidence/

[3] Jeffrey L. Kwall, “The Repeal of Graduated Corporate Tax Rates.” Tax Notes (June 27, 2011): 1395, June 27, 2011.

[4] Liz Malm, “North Carolina House, Senate, and Governor Announce Tax Agreement.” Tax Foundation, July 15, 2013. https://taxfoundation.org/north-carolina-house-senate-and-governor-announce-tax-agreement

[5] Kathryn Thurber, “Arizona legislation phases-in single sales factor apportionmentApportionment is the determination of the percentage of a business’s profits subject to a given jurisdiction’s corporate income tax or other business tax. US states apportion business profits based on some combination of the percentage of company property, payroll, and sales located within their borders. election, decreases corporate income tax rate.” PricewaterhouseCoopers, March 7, 2011. http://www.pwc.com/us/en/state-local-tax/newsletters/mysto/assets/pwc-az-sales-factor-apportionment-income-tax-rate.pdf

[6] Walczak, Jared, “Nevada Approves New Tax on Business Gross Receipts.” Tax Foundation, June 8, 2015. https://taxfoundation.org/article/nevada-approves-new-tax-business-gross-receipts.

[7] Joseph Henchman, “D.C. Council Approves Impressive Tax Reform.” Tax Foundation, May 29, 2014. https://taxfoundation.org/dc-council-approves-impressive-tax-reform

[8] Scott Drenkard, “Indiana’s 2014 Tax Package Continues State’s Pattern of Year-Over-Year Improvements.” Tax Foundation, April 7, 2014. https://taxfoundation.org/indiana-s-2014-tax-package-continues-state-s-pattern-year-over-year-improvements

Share this article