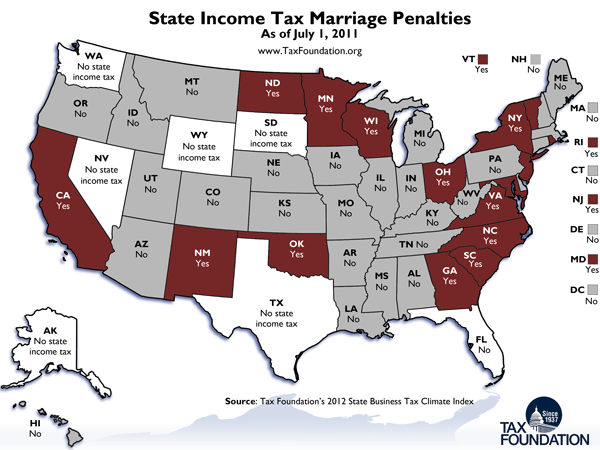

Today's Monday Map looks at the "marriage penaltyA marriage penalty is when a household’s overall tax bill increases due to a couple marrying and filing taxes jointly. A marriage penalty typically occurs when two individuals with similar incomes marry; this is true for both high- and low-income couples. " aspect of state income tax systems. In a progressive taxA progressive tax is one where the average tax burden increases with income. High-income families pay a disproportionate share of the tax burden, while low- and middle-income taxpayers shoulder a relatively small tax burden. system, higher incomes are taxed at higher rates, and in states where the same tax brackets apply to both single and married filers, the effective taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rate on the combined income of two earners can be significantly more than if the two incomes were taxed separately. In 2011, sixteen states had some form of marriage penalty in their income tax system.

Click on the map to enlarge it.

View previous Monday Maps here.

Share this article