As public support for marijuana legalization rises, policymakers are left to figure out the proper way to tax it if their state follows the trend.

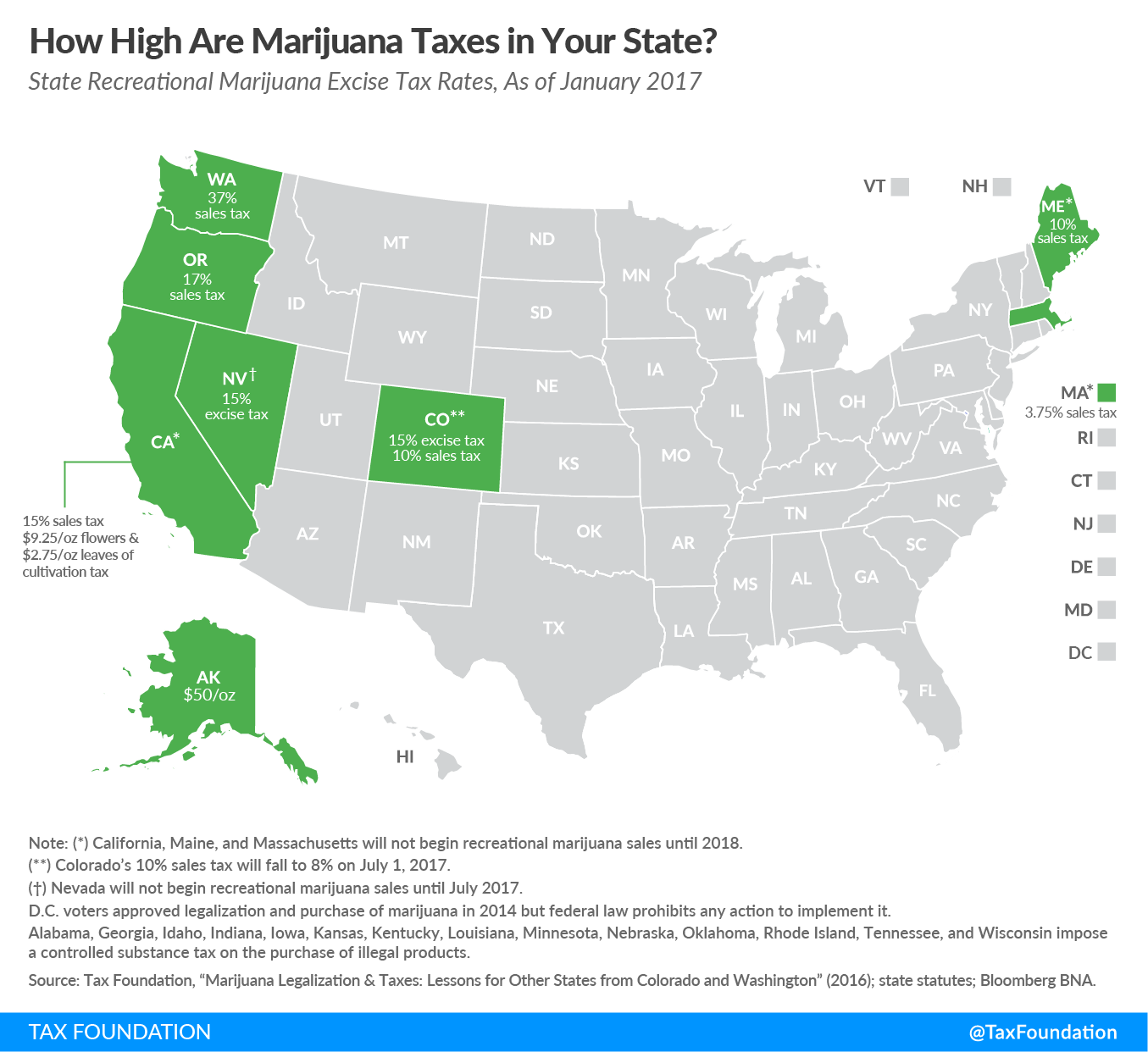

Eight states have legalized recreational marijuana, with several approaches to taxation being used. Massachusetts for example, set to begin sales in mid-2018, plans to levy an additional 3.75 percent taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. on retail sales. Washington also levies a sales tax, but at a much higher rate of 37 percent.

On the other hand, states like Alaska and California levy a flat per-unit tax. Alaska levies a $50 per ounce tax and, when sales begin, California plans to impose a 15 percent gross receipts taxGross receipts taxes are applied to a company’s gross sales, without deductions for a firm’s business expenses, like compensation, costs of goods sold, and overhead costs. Unlike a sales tax, a gross receipts tax is assessed on businesses and applies to transactions at every stage of the production process, leading to tax pyramiding. on retail sales, in addition to a flat $9.25 per ounce on flowers and $2.75 per ounce on leaves. Oregon originally planned to levy a similar flat tax, but legislators decided instead to levy a 17 percent excise tax to ease administrative burdens.

Tax rates on final retail sales are the most practical form of taxation for several reasons, including administrative simplicity and the risk of double-taxation of vertically integrated businesses. Other proposed forms of taxation, such as taxing marijuana flowers at a flat dollar amount, taxing the producer or processor instead of the retailer, or tax rates based on levels of THC (the chemical compound responsible for the user’s high), are difficult to implement.

Taxes on marijuana can add up as the excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. rate is just one component of the final purchase. Marijuana is also subject to the general sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. (except in Alaska and Oregon, where they don’t levy a state sales tax). Localities can also impose their own excise taxes – for instance, in Colorado, marijuana may face up to five taxes:

- 15 percent excise tax

- 10 percent state tax on retail marijuana sales (falling to 8 percent as of July 1, 2018)

- 2.9 percent state sales tax

- local sales taxes (the average rate in Colorado is 4.6 percent)

- local excise taxes on marijuana, such as the 3.5 percent tax in Denver

In our report on the lessons from other states that legalized and taxed marijuana, we found five key results:

- The marijuana tax rate should not be so high as to prevent elimination of the black market. Colorado, Washington, and Oregon have all taken steps to reduce their marijuana tax rates. Colorado concluded with strong evidence that its 30 percent tax rate did not sufficiently reduce the black market, and more recent ballot initiative proposals all over the country propose rates between 10 and 25 percent.

- Tax rates on final retail sales have proven the most workable form of taxation. Other forms of taxation have been proposed, as mentioned above, but those have faced implementation difficulties.

- Be conscious of the medical marijuana market. Medical marijuana is usually more loosely regulated and less taxed than recreational marijuana. In Washington, moving nonmedical sales to the retail market has proven difficult given the enormous differentials in tax rates and regulatory structure, and officials there wish the two systems had been tackled simultaneously.

- Be cautious with revenue estimates. While the revenue can be in the tens or even hundreds of millions of dollars, it takes a lead time to develop. Estimating the size of an illegal market is difficult, as is estimating how many consumers will switch to the legal market when it is available. Revenues started out slowly in Colorado and Washington, both as consumers became familiar with the new system and after state and local authorities spent time and money setting up new frameworks and regulatory infrastructure.

- Resolve health, agricultural, zoning, local enforcement, and criminal penalty issues. These important issues have generally been unaddressed in ballot initiatives and left for resolution in the implementation process.

Addendum: The original version of this post mistakenly listed Colorado’s state sales tax as 9 percent. It has been corrected. The post was also edited to add additional details about the recreational marijuana tax in California.

Share this article