A centerpiece of House Democrats’ reconciliation proposal is an increase in the corporate tax rate, from 21 percent to 26.5 percent.

The corporate income tax is among the most economically harmful ways to raise revenue. Higher corporate taxes reduce output, productivity, and wages in the long run, while making the United States less competitive. And a federal taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rate of 26.5 percent does not tell the full story, because most U.S. states impose their own corporate income taxes.

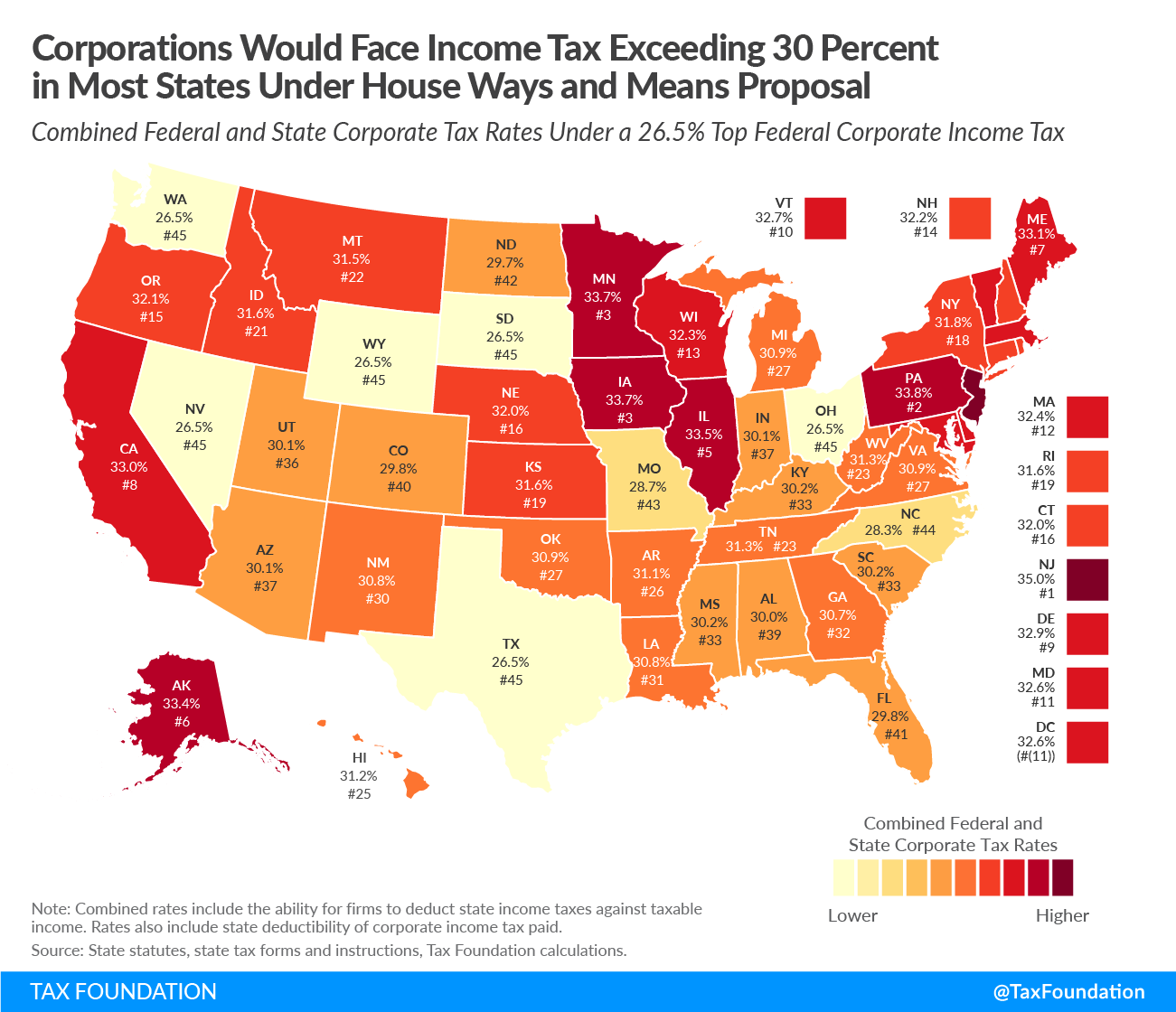

Under the proposal, the top combined corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. rate would reach 30.9 percent in the United States when including the average state-level corporate income tax. Companies in 21 states and D.C. would face a higher corporate tax rate than in any country in the Organisation for Economic Co-operation and Development (OECD), where Portugal currently levies the highest tax rate of 31.5 percent. New Jersey would see the highest combined federal-state corporate tax rate of nearly 35 percent.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe