Sales taxes are an important revenue source for states that maintain them. All states except Alaska, Delaware, Montana, New Hampshire, and Oregon have statewide sales taxes. While the state has no such taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. , Alaska localities are permitted to implement and collect sales taxes.

Prior to the Supreme Court’s 2018 decision in South Dakota v. WayfairSouth Dakota v. Wayfair was a 2018 U.S. Supreme Court decision eliminating the requirement that a seller have physical presence in the taxing state to be able to collect and remit sales taxes to that state. It expanded states’ abilities to collect sales taxes from e-commerce and other remote transactions. , only sellers with a physical presence in a state could be required to collect and remit state sales taxes. (States sometimes got creative through ideas like “click-through nexus” or “cookie nexus” in an effort to circumvent the restriction.) The Wayfair court, however, recognized the changing nature of the economy and the rise of e-commerce and overturned decades of precedent, allowing states to begin taxing non-resident businesses selling into the state.

Following the decision, states acted quickly to begin requiring out-of-state marketplace facilitators and remote sellers to collect and remit sales taxes. This impacted both large and small sellers and increased compliance obligations that often disproportionately fall on small- and medium-sized sellers. The increased compliance costs are further compounded by the lack of uniformity among the various taxing jurisdictions.

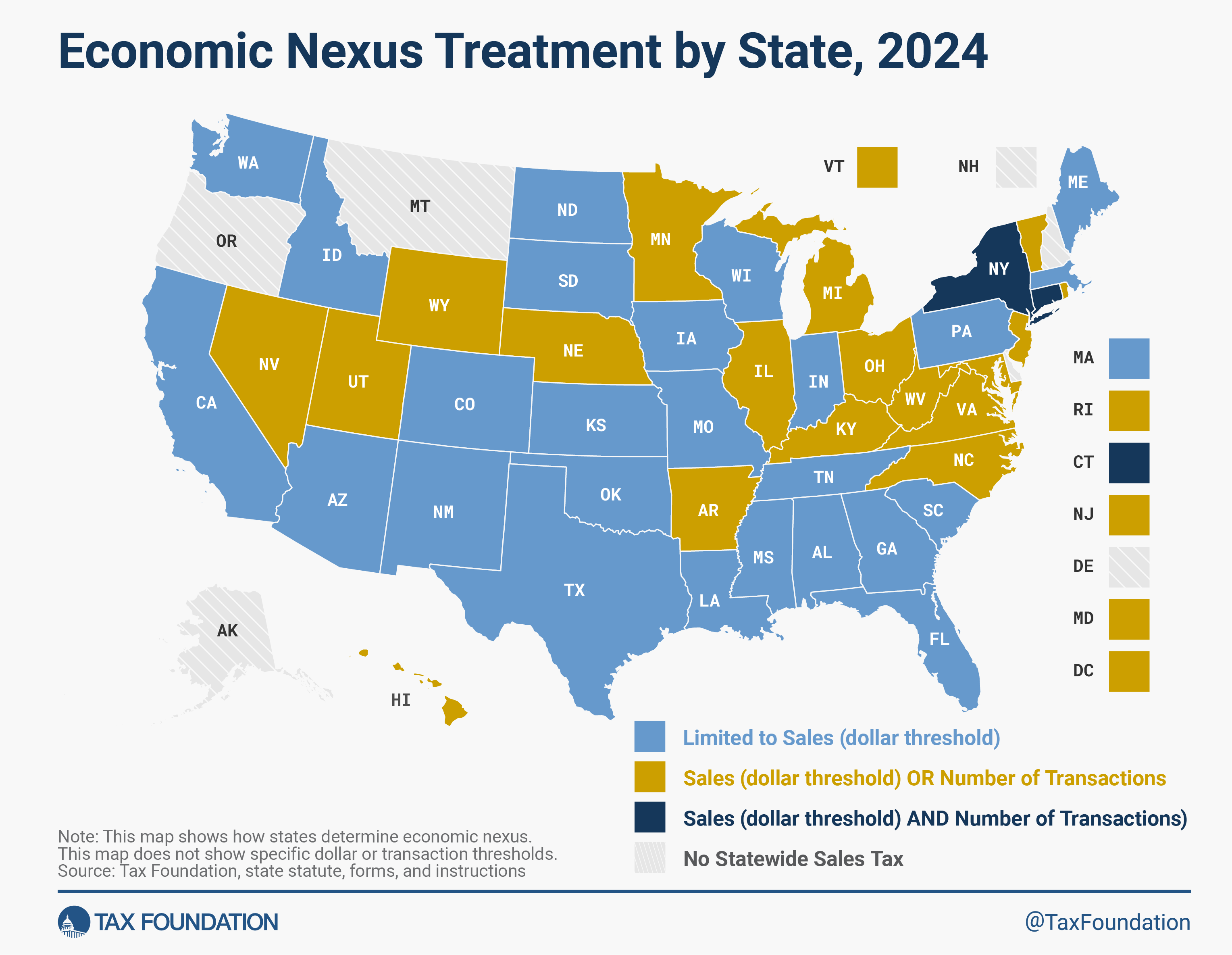

Currently, 25 states limit economic nexus to sales meeting a dollar threshold (e.g., $200,000). Others, however, require that marketplace facilitators and remote sellers collect and remit sales taxes if either a dollar threshold is met or the seller conducts a certain number of transactions in the state.

Establishing economic nexus through transactions alone is quite burdensome as compliance costs associated with collection and remittance requirements could be greater than the business transacted. For example, a marketplace facilitator or remote seller with sales in Arkansas exceeding $100,000 is required to collect and remit sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. . The same seller would also be subject to collection and remittance obligations if the seller conducted 200 or more transactions in the state. To put a finer point on this, selling 200 of the same item at a price of $5 for a total of $1,000 would be sufficient to require the seller to comply with the Arkansas sales tax collection and remittance rules, even though the total revenue was dramatically less than the $100,000 sales threshold. This hypothetical seller would almost certainly spend more complying with the law (e.g., specialized software to track sales, accounting services, etc.) than they receive in profits on these sales, making doing business in Arkansas unappealing.

Nineteen states limit their economic threshold determinations to dollar amounts alone. This is imperfect but certainly better than requiring the smallest online businesses to collect and remit sales tax. Connecticut and New York do not impose an obligation to collect and remit sales tax unless the remote seller or marketplace facilitator meets or exceeds both a sales and transactions threshold.

The Wayfair court was correct in highlighting the changing nature of the economy and the necessity for sales tax codes to adapt. However, the decision did little to define how states should require sales tax collection and remittance from marketplace facilitators and remote sellers. As a result, there is a frustrating lack of uniformity among the states, which creates inefficiencies disproportionately borne by small and mid-sized sellers.

States should reform their marketplace facilitator and remote seller rules and remove the transaction threshold altogether. Indiana recently became the latest state to make the switch, a positive and pro-growth tax reform that others should follow. Reforming economic nexus thresholds would not only be better for businesses but for states as well. It is more cost-effective for states to focus on—and simplify—compliance for a reasonable number of sellers than to impose rules that have low compliance and are costly to administer.

Economic Nexus Treatment by State, 2024

| Limited to Dollar Amount of Sales | Dollar OR Number of Sales | Dollar AND Number of Sales (3) | No Statewide Sales Tax |

|---|---|---|---|

| Alabama | Arkansas | Connecticut | Alaska |

| Arizona | Hawaii | New York | Delaware |

| California | Illinois | Montana | |

| Colorado | Kentucky | New Hampshire | |

| Florida | Maryland | Oregon | |

| Georgia | Michigan | ||

| Idaho | Minnesota | ||

| Indiana | Nebraska | ||

| Iowa | Nevada | ||

| Kansas | New Jersey | ||

| Louisiana | North Carolina | ||

| Maine | Ohio | ||

| Massachussetts | Rhode Island | ||

| Mississippi | Utah | ||

| Missouri | Vermont | ||

| New Mexico | Virginia | ||

| North Dakota | Washington, D.C. | ||

| Oklahoma | West Virginia | ||

| Pennsylvania | Wyoming | ||

| South Carolina | |||

| South Dakota | |||

| Tennessee | |||

| Texas | |||

| Washingon | |||

| Wisconsin |

Source: Tax Foundation, state statute, forms, and instructions

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe