Download Tax Freedom Day® 2015 (PDF)

Key Findings

- This year, TaxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. Freedom Day falls on April 24, or 114 days into the year.

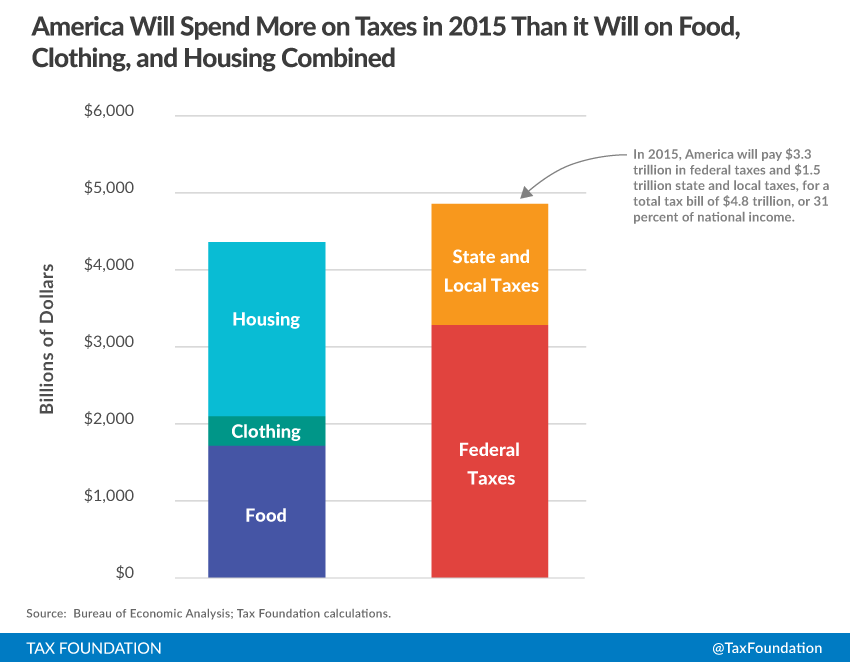

- Americans will pay $3.3 trillion in federal taxes and $1.5 trillion in state and local taxes, for a total bill of more than $4.8 trillion, or 31 percent of the nation’s income.

- Tax Freedom Day is one day later than last year due mainly to the country’s continued steady economic growth, which is expected to boost tax revenue especially from the corporate, payroll, and individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. .

- Americans will collectively spend more on taxes in 2015 than they will on food, clothing, and housing combined.

- If you include annual federal borrowing, which represents future taxes owed, Tax Freedom Day would occur 14 days later on May 8.

- Tax Freedom Day is a significant date for taxpayers and lawmakers because it represents how long Americans as a whole have to work in order to pay the nation’s tax burden.

What Is Tax Freedom Day?

Tax Freedom Day is the day when the nation as a whole has earned enough money to pay its total tax bill for the year. Tax Freedom Day takes all federal, state, and local taxes and divides them by the nation’s income. In 2015, Americans will pay $3.28 trillion in federal taxes and $1.57 trillion in state and local taxes, for a total tax bill of $4.85 trillion, or 31 percent of national income. This year, Tax Freedom Day falls on April 24, or 114 days into the year.

What Taxes Do We Pay?

This year, Americans will work the longest to pay federal, state, and local individual income taxes (43 days). Payroll taxes will take 26 days to pay, followed by sales and excise taxes (15 days), corporate income taxes (12 days), and property taxes (11 days). The remaining 7 days are spent paying estate and inheritance taxes, customs duties, and other taxes.

Why Is Tax Freedom Day Later This Year?

Tax Freedom Day is one day later than last year due mainly to the country’s continued steady economic growth. Higher wages and corporate profits are expected to boost tax revenue from the corporate, payroll, and individual income taxes.

When Is Tax Freedom Day if You Include Federal Borrowing?

Since 2002, federal expenses have surpassed federal revenues, with the budget deficit exceeding $1 trillion annually from 2009 to 2012 and over $800 billion in 2013. In 2015, the deficit will continue to decline to $580 billion. If we include this annual federal borrowing, which represents future taxes owed, Tax Freedom Day would occur on May 8, 14 days later. The latest ever deficit-inclusive Tax Freedom Day occurred during World War II on May 25, 1945.

When Is My State’s Tax Freedom Day?

The total tax burden borne by residents of different states varies considerably due to differing state tax policies and the progressivity of the federal tax system. This means a combination of higher-income and higher-tax states celebrate Tax Freedom Day later: Connecticut (May 13), New Jersey (May 13), and New York (May 8). Residents of Louisiana will bear the lowest average tax burden in 2015, with Tax Freedom Day arriving for them on April 2. Also early are Mississippi (April 4) and South Dakota (April 8).

How Has Tax Freedom Day Changed over Time?

The latest ever Tax Freedom Day was May 1, 2000, meaning Americans paid 33 percent of their total income in taxes that year. A century earlier, in 1900, Americans paid only 5.9 percent of their income in taxes, meaning Tax Freedom Day came on January 22. The last time Tax Freedom Day was this late in the year was 2007 (April 25).

Methodology

In the denominator, we count every dollar that is officially part of national income according to the Department of Commerce’s Bureau of Economic Analysis. In the numerator, we count every payment to the government that is officially considered a tax. Taxes at all levels of government—federal, state, and local—are included in the calculation. In calculating Tax Freedom Day for each state, we look at taxes borne by residents of that state, whether paid to the federal government, their own state or local governments, or governments of other states. Where possible, we allocate tax burdens to the taxpayer’s state of residence. Leap days are excluded to allow comparison across years, and any fraction of a day is rounded up to the next calendar day.