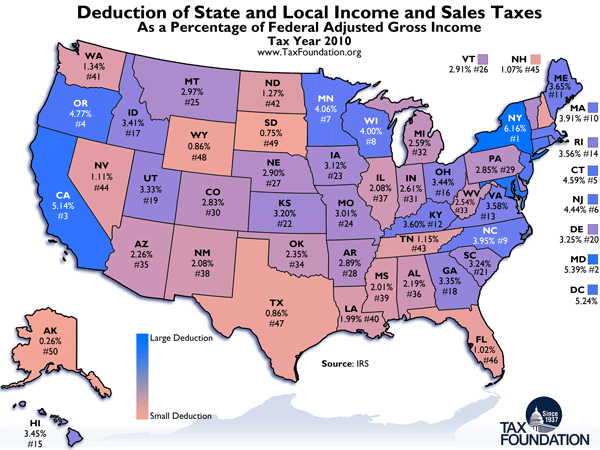

Today's Monday Map focuses on the deduction of state and local income or sales taxes from federal taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. Taxable income differs from—and is less than—gross income. . New York State benefits the most from this deduction – its residents deducted an average of 6.16% of their income in state taxes. Alaska benefits least, having neither an income taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. nor a statewide sales tax; the small average of 0.26% most likely comes from local sales taxes.

Click on the map to enlarge it.

View previous Monday Maps here.

Share this article