The United States’ statutory corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. rate is now more aligned with the rates of other nations. However, taxes on capital income, or corporate investment, are more than just the corporate income taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. . Shareholder-level taxes, such as those on dividends and capital gains, also affect incentives to save and invest.

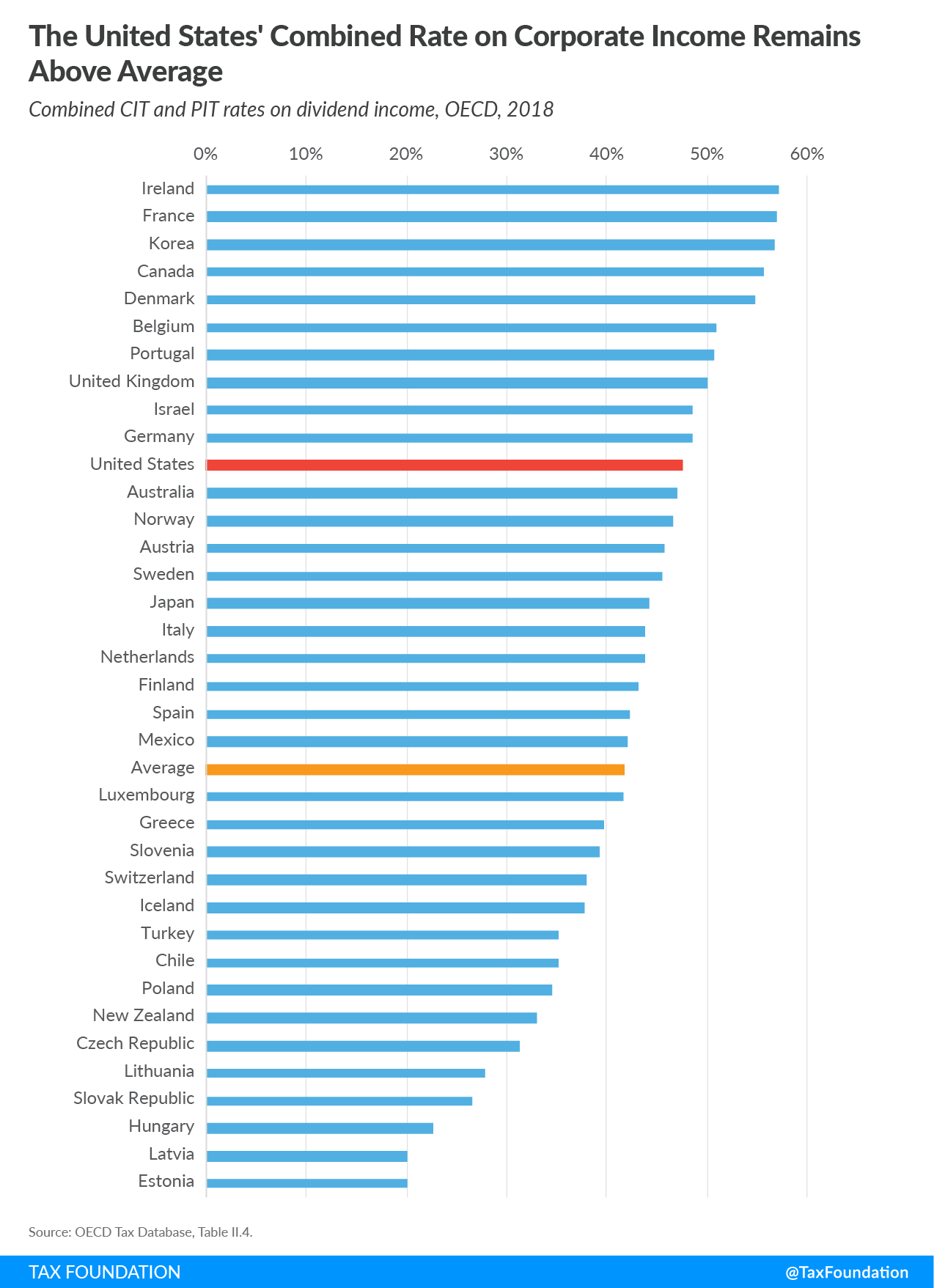

The combined tax rate on corporate profits in the United States is above the average across Organisation for Economic Co-operation and Development (OECD) countries. For example, in 2018, the first tax year after passage of the Tax Cuts and Jobs Act, the U.S. combined rate was 47.25, compared to the OECD average of 41.7 percent. However, the U.S. rate has markedly improved since the Tax Cuts and Jobs Act passed—in 2017, the combined tax rate on corporate profits in the United States was 56.32 percent.

The combined rate shown above takes into consideration corporate income taxes and personal income taxes that apply to profits at the federal and state level.

After a corporation pays the corporate income tax on its profits, the corporation can either distribute those after-tax profits to its shareholders or retain its after-tax earnings. When the corporation chooses to distribute its after-tax profits, the shareholders must pay income taxes on their dividend income. In cases where the corporation chooses to retain its earnings, it can boost the value of its stock. This gives shareholders the opportunity to realize a capital gain by selling the stock for a profit, which again results in shareholder-level taxes.

In the United States, ordinary income tax rates apply to ordinary dividends and to short-term capital gains (assets held less than one year). Currently, the top marginal income tax rate is 37 percent. Long-term capital gains and qualified dividends are taxed using different brackets and rates than ordinary income, with a top rate of 23.8 percent.

|

Source: “2019 Tax Brackets,” Tax Foundation, and IRS Topic Number 559 |

|||

| For Unmarried Individuals | For Married Individuals Filing Joint Returns | For Heads of Households | |

|---|---|---|---|

|

Taxable Income Over |

|||

| 0% | $0 | $0 | $0 |

| 15% | $39,375 | $78,750 | $52,750 |

| 20% | $434,550 | $488,850 | $461,700 |

|

Additional Net Investment Income Tax |

|||

| 3.8% | MAGI above $200,000 | MAGI above $250,000 | MAGI above $200,000 |

Additionally, most states levy both their own corporate income taxes and capital gain taxes. At the state level, income taxes on capital gains vary from 0 percent to 13.3 percent.

These multiple layers of taxation at the federal and state level lead to a combined statutory rate, or an integrated corporate income tax rate, of 47.25 percent, according to the OECD. The cost of all taxes, not just the corporate income tax, factors into a business’s decision about whether to make an investment. Thus, it’s important to consider the total burden of taxes that apply to capital income, not just the corporate income tax.

Note: This is part of our “Business in America” blog series

- The Lowered Corporate Income Tax Rate Makes the U.S. More Competitive Abroad

- Corporate and Pass-through Business Income and Returns Since 1980

- Firm Variation by Employment and Taxes

- 2017 GDP and Employment by Industry

- Pass-Through Businesses Q&A

- State Corporate Income Taxes Increase Tax Burden on Corporate Profits

- Marginal Tax Rates for Pass-through Businesses Vary by State

- Depreciation Requires Businesses to Pay Tax on Income That Doesn’t Exist

- Not All Tax Expenditures Are Equal