One month following California’s implementation of a state-wide flavored cigarette ban, tax-paid cigarette sales dropped 17.3 percent. More than 5.6 million fewer packs were sold in January 2023 than in January 2022. On an annual basis, California will likely see revenues fall by more than $300 million.

We previously estimated that a menthol ban in California would decrease annual state revenues by $329 million when combining the revenue losses from cigarette excise taxes, decreased sales taxes, and fewer Master Settlement Agreement payments. The original estimates by the California Department of TaxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. Fee Administration estimated the decline in revenue from the flavor ban at $218 million. Based on the initial sales data, however, the state will likely exceed $218 million in lost revenue by August.

The results from the flavor bans in California and Massachusetts should serve as a cautionary tale to policymakers in other states. If the state lost revenue primarily because people were giving up tobacco products, some policymakers might regard that as a win—but to a significant degree, that’s not what’s happening. The state is losing revenue while consumers turn to cross-border purchases or, often, illicit trade, which makes everyone worse off.

Massachusetts was the first state to ban the sale of flavored cigarettes. Their menthol ban took effect in June 2020. In the first fiscal year following the ban, revenues fell by $120 million (26 percent of cigarette excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. revenue). The decline of sales in Massachusetts was almost entirely offset by an increase in purchases in neighboring states, including a 34 percent increase in sales in New Hampshire and a 25 percent increase in sales in Rhode Island. In other words, Massachusetts sacrificed $120 million in annual revenue to have no significant effect on smoking.

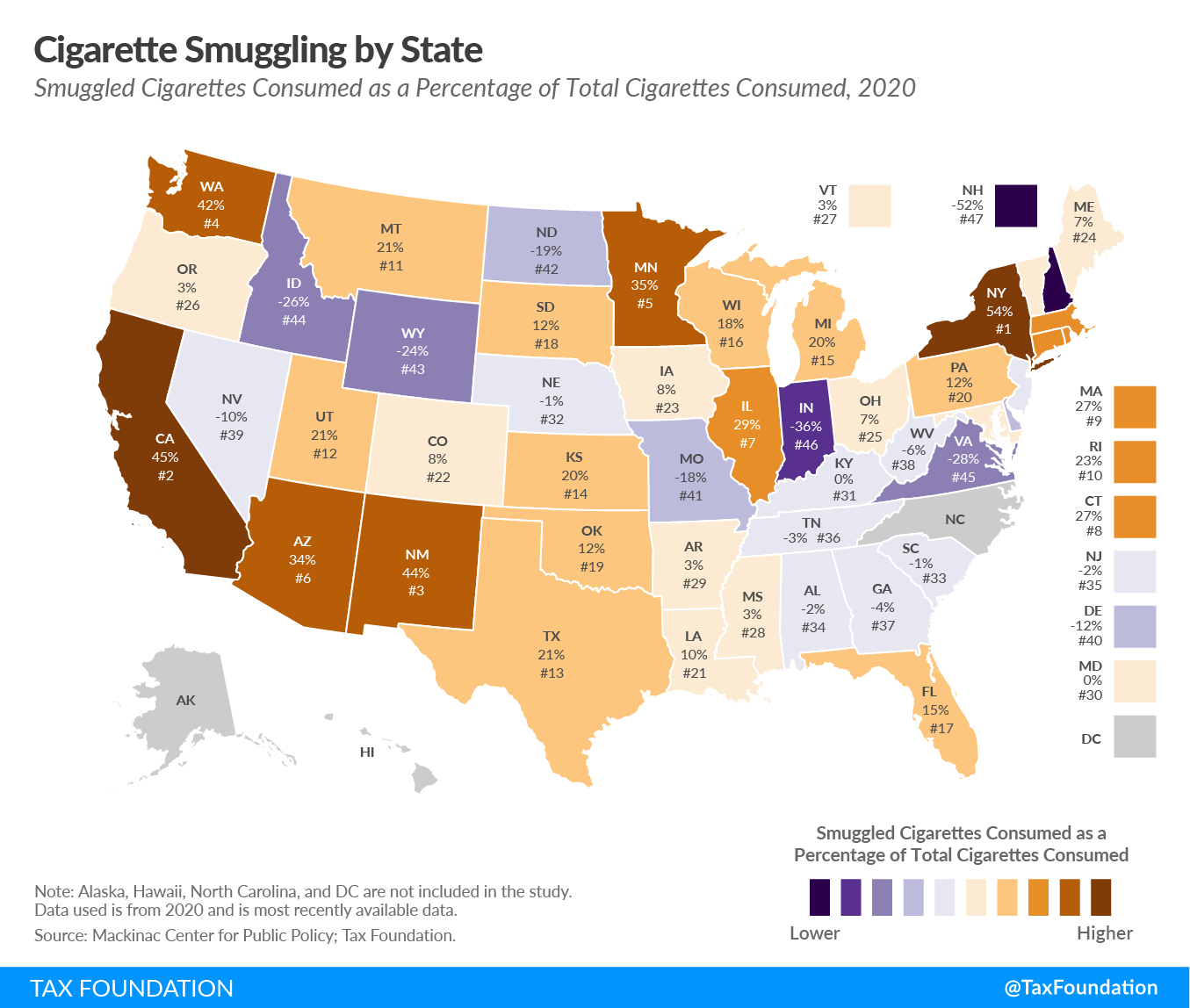

Worse, Massachusetts introduced significant incentives for smuggling and participating in black markets. In 2020, with the flavor ban in place for only half of the year, Massachusetts saw cigarette smuggling increase by an estimated 6.6 percentage points. Roughly 11.2 million more packs were smuggled into Massachusetts in 2020 than in 2019. The smuggling problem in California will likely be much worse.

California is uniquely disadvantaged when it comes to smuggling and illicit markets. Not only does the state have a large geographic border with Oregon, Nevada, and Arizona, but the state also shares a land border with Mexico and hosts two of the largest shipping destinations in the country—the Port of Los Angeles and the Port of Long Beach.

California has the second-highest smuggling rate in the country. Roughly 45 percent of all cigarette packs consumed in the state are not purchased in California. In 2020, 47 million packs of cigarettes were either purchased across state lines or smuggled across the border. Those foregone sales cost the state $1.4 billion in tax revenue, the highest figure for any state. The flavor ban will exacerbate that lost revenue, while further propping up a dangerous illicit trade.

While the Massachusetts flavor ban encouraged consumers to head across state lines to shop for menthol cigarettes, the state had no existing discernable market for internationally smuggled cigarettes. In 2019 and 2020, all smuggling into Massachusetts was estimated to come from other U.S. states.

California, on the other hand, has an established, robust market already in place for smuggled international cigarettes. In 2020, roughly 1 in 6 packs of cigarettes smoked in the Golden State were smuggled from an international outlet.

“Cheap whites” or “illicit whites” are a staple of the international counterfeit market. These generic-looking white cigarettes are produced legally in low-tax jurisdictions but are often intended for smuggling, with Chinese production leading the international counterfeit market. Academic studies link the consumption of cheap whites to areas with high cigarette tax rates and prohibitive purchase restrictions like California.

As the flavor ban in California enters its third month, the costly consequences of the policy are just beginning to mount. Declining revenue and stronger incentives for consumers and producers to head to the black market will increase criminal activity and make it harder and less attractive for Californians to operate in a safe and regulated marketplace. Policymakers should carefully consider the unintended consequences as they set rates and regulatory regimes for all tobacco and nicotine products.

Share this article