Research and development (R&D) is a crucial part of technological change, as R&D takes initial scientific discoveries and translates them into useful products that improve lives. Both the public and private sectors play important roles in R&D, but in recent years, private sector investment has become increasingly important.

In 2019, businesses performed 75 percent of all U.S. R&D and funded 72 percent of all U.S. R&D. For context, the organization conducting R&D is not necessarily the same as the funder (e.g., a government agency might pay for a military equipment company’s research on a new fighter jet design).

Federal Funding of R&D Investment Declines, Business Funding Increases

The business shares of R&D have increased considerably in recent years and preliminary data for 2020 indicates the trend continues (73 percent of all U.S. R&D in 2020 was funded by businesses). A decade prior, in 2010, businesses performed 69 percent of U.S. R&D and funded 61 percent of it. Prior to the 1980s, businesses funded less than half of R&D, though the share performed remained above 65 percent.

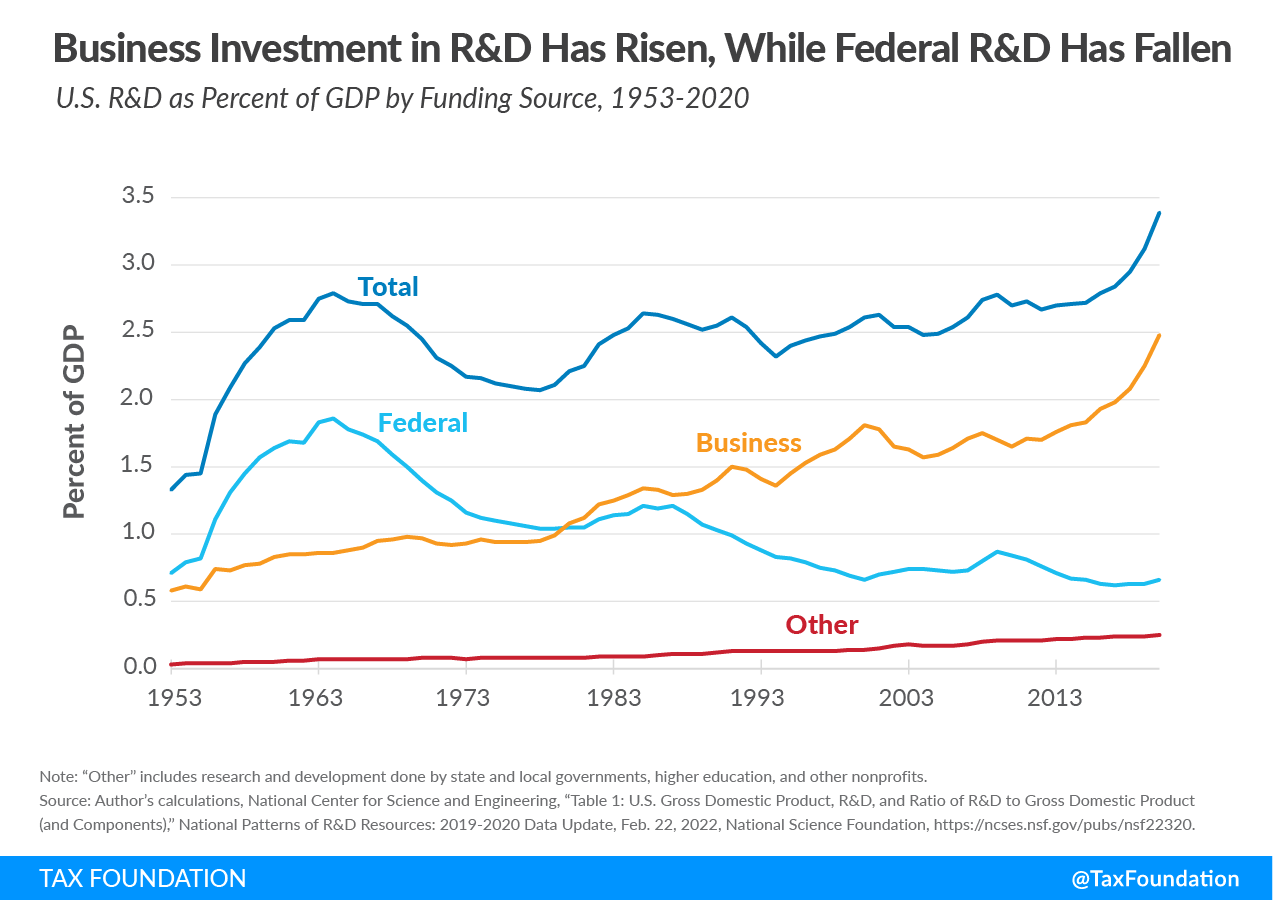

The long-term trend in funding for R&D can be seen in Figure 1 in terms of R&D as a percent of GDP by funding source. In the 1950s and 1960s, during the Space Race and the Cold War, the federal government funded the majority of R&D, peaking in 1964 at 67 percent of total R&D and 1.9 percent of GDP. Since that time, federal government funding of R&D has trended down, falling to a low of 0.6 percent of GDP in 2017 before ticking up slightly to 0.7 percent of GDP as of 2020.

Despite the relative decline in federal R&D funding, total R&D investment has remained stable (and indeed grown) thanks to private business investment in R&D. In 2020, business-funded R&D alone is estimated as 2.5 percent of GDP, higher than business and government R&D combined as a share of GDP during the 1970s. Due to the recent uptick in business R&D, total R&D spending hit an all-time high in 2017, at 2.8 percent of GDP, and has since risen higher to 3.4 percent of GDP as of 2020.

The federal government remains the primary funder of basic research, an important building block in the follow-on process of applied research and development, which is the portion of R&D most dominated by business.

Growth in Business R&D Investment Outpaces Growth in Overall Business Investment

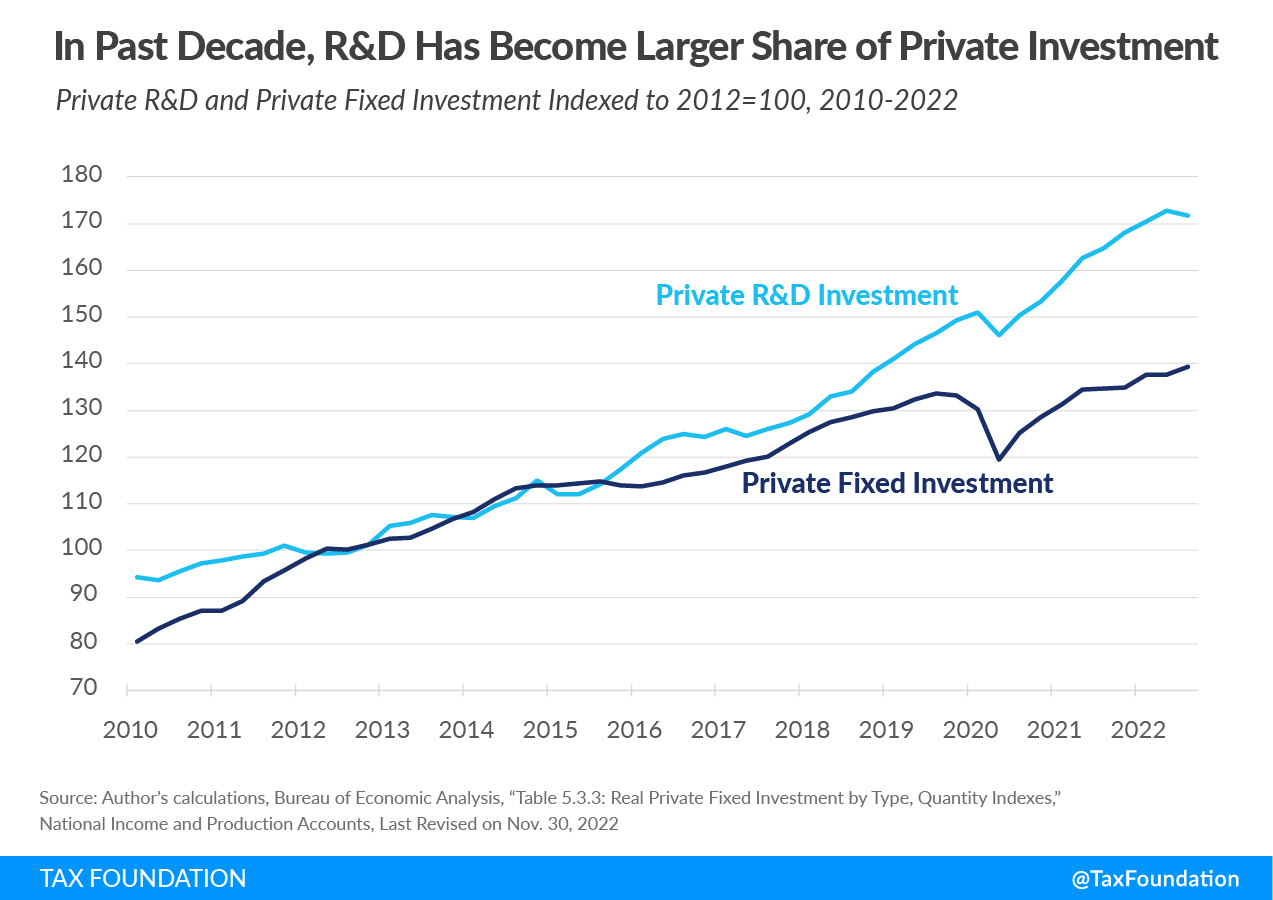

In addition to business R&D investment becoming increasingly important relative to other sources of R&D, it has also grown relative to other forms of business investment. In the past several years, growth in business R&D investment has outpaced growth in business investment overall, particularly during and after the COVID-19 pandemic. While the pandemic and its associated recessionA recession is a significant and sustained decline in the economy. Typically, a recession lasts longer than six months, but recovery from a recession can take a few years. led companies to pull back many of their physical investment plans, R&D remained robust.

Similarly, while total business investment as a share of GDP has stayed relatively flat over the last decade, business R&D as a share of GDP has grown steadily. In the third quarter of this year, business investment was 13.2 percent of GDP, similar to levels of the last decade, while business R&D was 2.7 percent of GDP in the third quarter, up from 1.9 percent a decade ago. Business R&D is now 20.6 percent of business investment, whereas it was 14.8 percent a decade ago.

The TaxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. Cuts and Jobs Act Encouraged R&D Investment

How has tax policy played into these changes? The Tax Cuts and Jobs Act (TCJA) improved incentives for businesses to invest in R&D in two ways beginning in 2018. For one, the TCJA reduced the corporate tax rate to 21 percent, which reduced the marginal tax rateThe marginal tax rate is the amount of additional tax paid for every additional dollar earned as income. The average tax rate is the total tax paid divided by total income earned. A 10 percent marginal tax rate means that 10 cents of every next dollar earned would be taken as tax. on investment in all types of assets, including intellectual property (which includes, but is not limited to, R&D). The law also reduced the tax rate further to 13.1 percent on foreign-derived intangible income (FDII), incentivizing R&D that leads to income from sales abroad.

However, the TCJA unfortunately also included a delayed tax increase on R&D beginning in 2022, requiring companies to amortize their R&D expenses over five years instead of deducting them immediately, which was the norm for several decades. Effectively, this is a tax penalty on R&D investment because deductions in the future are worth less than deductions today due to both the time value of money and inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. .

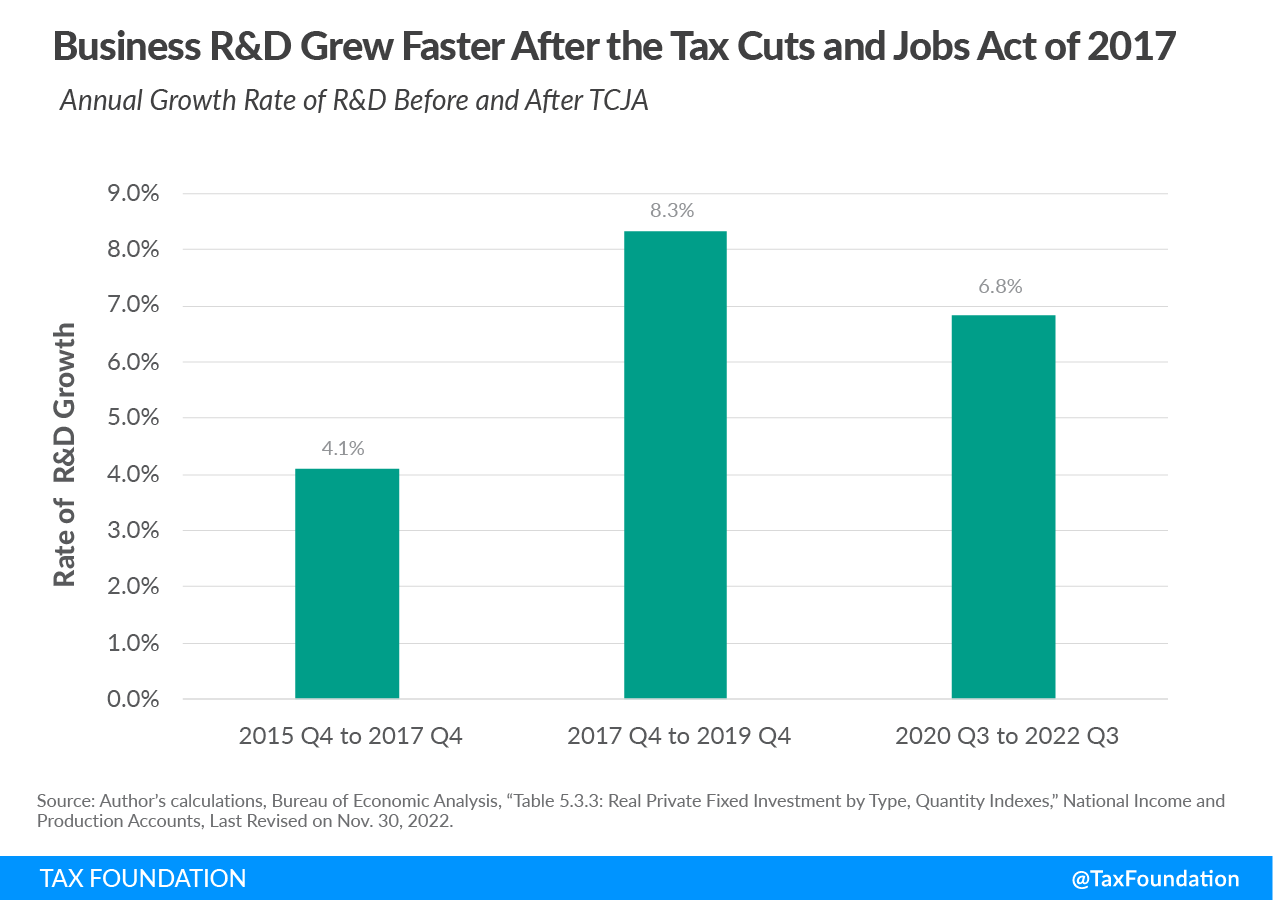

While there are also several non-tax factors at play, the historical record clearly shows that business R&D investment shifted into a higher gear after the TCJA, both before and after the pandemic. In the two years following the TCJA and before the pandemic, real business R&D investment grew at an 8.3 percent annual rate, compared to 4.1 percent in the two years prior to the TCJA (over a longer period, in the five years prior to the TCJA, annualized growth in R&D averaged 4.7 percent).

Following the initial pandemic downturn in the second quarter of 2020, real business R&D investment continued at a rapid pace of growth of 6.8 percent annually. The average pace of growth would have been faster if not for a marked slowdown in 2022, coincident with R&D amortization. Real R&D investment in the third quarter is only 2.1 percent higher than it was in the fourth quarter of last year, and about 0.7 percent lower than it was in the second quarter of this year—the first drop since the TCJA outside of the initial pandemic downturn. This compares to continuing growth for business investment as a whole this year, which is up 1.3 percent in the third quarter relative to the second quarter and up 3.2 percent since the fourth quarter of last year.

These results are consistent with the economic theory and the forecasted effects of the TCJA, as explained by the Congressional Budget Office in 2018: “Investment in IP products is boosted by changes in the user cost of capital through 2021. However, in contrast to its treatment of equipment, the tax act makes depreciationDepreciation is a measurement of the “useful life” of a business asset, such as machinery or a factory, to determine the multiyear period over which the cost of that asset can be deducted from taxable income. Instead of allowing businesses to deduct the cost of investments immediately (i.e., full expensing), depreciation requires deductions to be taken over time, reducing their value and discouraging investment. less generous for R&D and for software development beginning in 2022. Consequently, starting in that year, investment in IP products is lower than it would otherwise have been.”

Broadly, there has been an upward trend in business R&D investment, particularly since the TCJA—a welcome result contributing to record-high levels of R&D as a share of GDP. However, preliminary data through the third quarter of 2022 indicates business R&D is slowing down, likely due in part to R&D amortization and the weakening economic environment. Lawmakers should recognize both the growing importance of business R&D and the need to support it through a commonsense tax policy, namely a return to full and immediate expensing for R&D.

Share