Although this week’s Super Bowl festivities may be muted, with far fewer parties and celebrations, states with legalized sports betting may have something to cheer: a taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. revenue bump thanks to the accompanying excise taxes.

The American Gaming Association estimates that Americans will wager a total of $4.3 billion on the highly anticipated matchup of the defending champion Kansas City Chiefs vs. the Tampa Bay Buccaneers in Tampa. While that figure is down from last year’s estimate, it is likely to represent the largest ever legal “handle” on a single event given the increased availability of legal betting, and the most gaming tax revenue ever generated by a sporting event. One estimate suggests that around $500 million of the $4.3 billion will be wagers done through legal sportsbooks. The rest is conducted through casual betting among friends, betting pools, or through illicit operations.

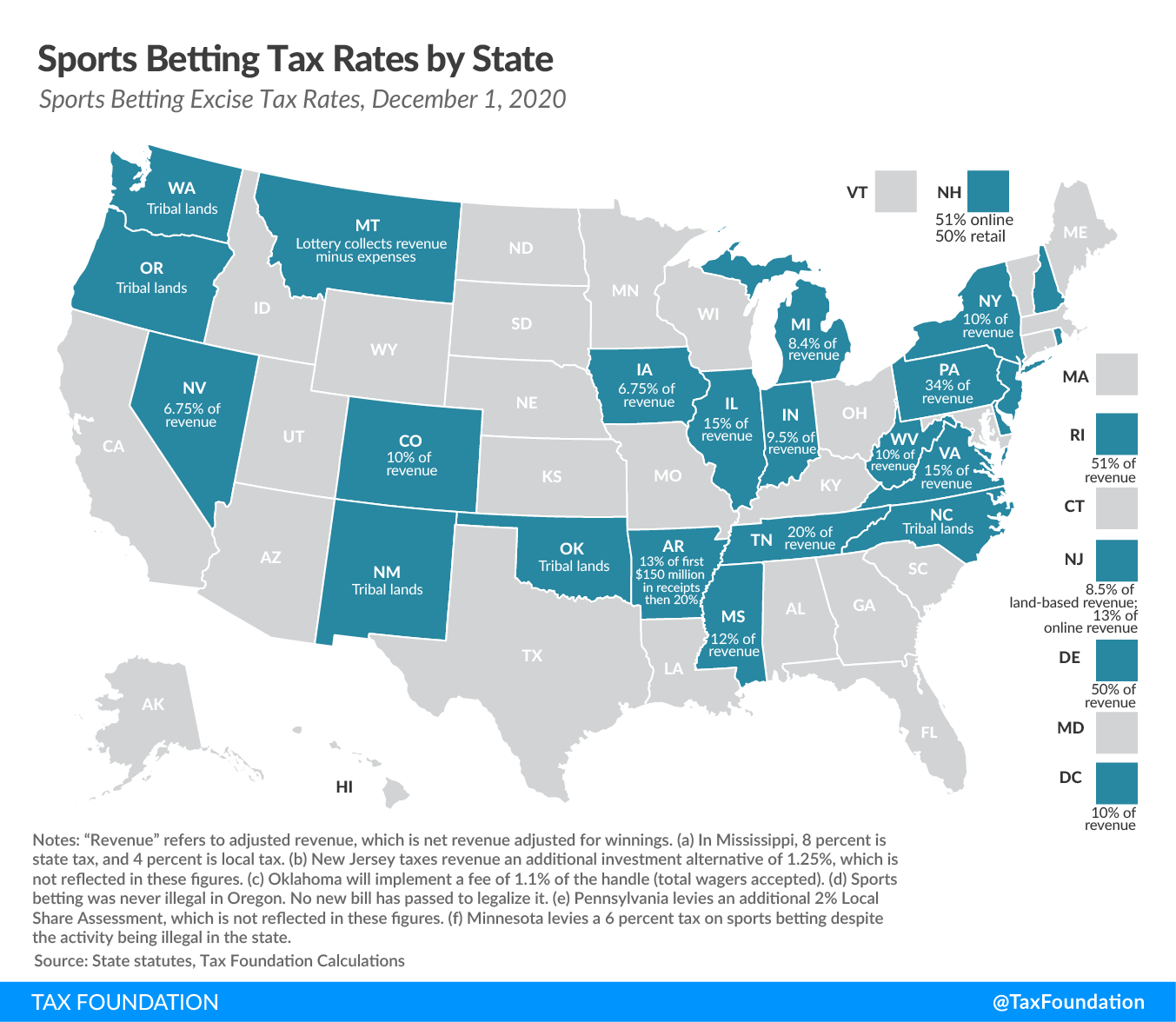

The growth is a result of more states legalizing sports betting since the Supreme Court’s 2018 decision in Murphy v. National Collegiate Athletic Association overturned the federal ban. Currently, 25 states and the District of Columbia have legalized sports betting in some form (not all are operational) and several more states are in the process of doing so.

The result of the game matters as states generally do not tax the handle, but instead tax the adjusted revenue, which is revenue after winnings are paid out. On average, this represents 5 percent of the handle (approximately 95 percent is returned as winnings). Adjusted revenue based on a $500 million handle is $25 million—a figure that can go up or down depending on how many bettors correctly predict the result.

Most of the bettors will place their bets in New Jersey, Nevada, Illinois, and Pennsylvania. An average of these four states’ tax rate is 17.6 percent. At that rate, $25 million of adjusted revenue raises $4.4 million in state tax revenue. This is a modest figure, but the Super Bowl is just one of thousands of sporting events wagered on across the world in any given year. In addition, winners should be reporting their gains, as they are subject to income taxes.

Another development of 2021 is the growth in online betting. With many sporting events taking place without spectators in light of the pandemic, online betting has become more popular than ever. In fact, more Americans are predicted to bet online this weekend than at any previous Super Bowl. Since many states still mandate social distancing, brick and mortar casinos and physical sportsbooks are not able to compete with online sports betting. This is an issue for the seven states that do not allow online betting: Arkansas, Mississippi, New Mexico, New York, North Carolina, Oklahoma, and Washington. Those states, along with states that have not legalized, are more likely to have residents turning to illegal bookies.

Despite the pandemic, 2020 was a good year for the sports betting industry. Americans spent more than $20 billion on sports betting throughout the year, with New Jersey, Nevada, and Pennsylvania as the largest markets. This activity generated over $200 million in tax revenue in the states.

In the long run, sports betting represents a real opportunity for new revenue for states—especially if they develop an appropriate regulatory and tax framework, which allows the industry to grow. However, it should be a guiding principle that excise taxes should only be levied when appropriate to capture some externalityAn externality, in economics terms, is a side effect or consequence of an activity that is not reflected in the cost of that activity, and not primarily borne by those directly involved in said activity. Externalities can be caused by either production or consumption of a good or service and can be positive or negative. or to create a “user pays” system, not as a general revenue measure. Due to their narrow base, they are not a sustainable source of revenue for general spending priorities.

Share this article