Last week, the OECD released an impact assessment alongside blueprints for Pillar 1 and Pillar 2 proposals for changing international tax rules. Pillar 1 would change where highly profitable companies pay taxes and Pillar 2 would bring about a global minimum tax. The impact assessment estimates revenue effects from both pillars as well as effects on business investment and global GDP.

On net, Pillar 1 and Pillar 2 are estimated to raise between $50 billion and $80 billion in new corporate tax revenues annually. Up to $100 billion in profits would be taxed in a different jurisdiction than under current rules.

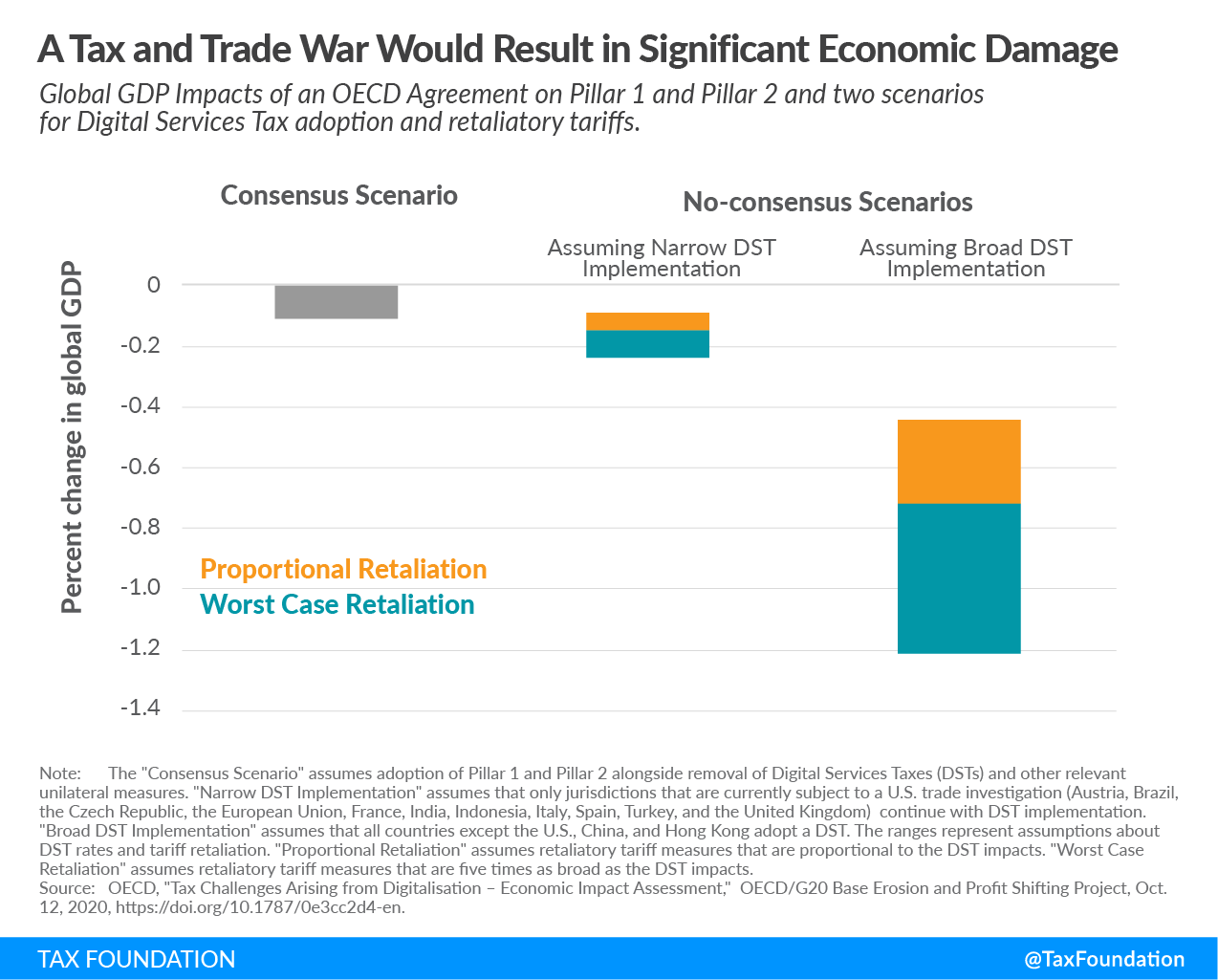

The report contrasts its estimate of a minimal impact on global GDP under an OECD agreement against a scenario in which digital services taxes and retaliatory tariffs proliferate. In a consensus situation where the OECD reaches agreement and unilateral measures are removed the negative impact on global GDP is estimated to be less than 0.1 percent. Absent such an agreement, countries will be likely to continue adopting digital services taxes and countries like the United States are expected to retaliate with trade measures. The OECD estimates that a worst-case taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. and trade war could reduce global GDP by more than 1 percent.

The impact assessment generally relies on data from 2016 and 2017, which makes the results somewhat tenuous considering economic and policy changes that have taken place since that time. Anti-avoidance policies have been adopted and implemented in numerous countries across the globe and the coronavirus pandemic has significantly damaged the global economy. The OECD admits that both developments will change the actual impact of the policies if Pillars 1 and 2 are adopted and implemented.

Accounting for the recent implementation of the Base Erosion and Profit Shifting (BEPS) anti-avoidance would likely to reduce the impact of new proposals directed at tax avoidance, particularly Pillar 2. This means that Pillar 2 would raise less revenue and have a less significant impact overall than the OECD estimates. The impact of the pandemic could change the profits that would be subject to Pillar 1. For multinationals that have grown their profitability during the pandemic, more of their profits could be captured by Pillar 1. For companies that are accumulating losses during the downturn, the opposite would be true.

However, even taking the policy context for the data in mind, the results of the impact assessment reveal a stark contrast between the potential for an agreement versus continuation and expansion of current disputes.

Digital Services Taxes (DSTs) are becoming more common in Europe, and the African Tax Administration Forum has released a suggested approach to DST legislation. Countries in Asia have also been implementing digital tax measures recently.

In response, the United States has threatened tariffs against France and opened trade investigations into nine other countries and the European Union. The retaliation against the French DST would amount to 25 percent tariffs on $1.3 billion of trade. The potential is high for a tax and trade war to cause economic damage in addition to the current uncertainty around digital taxation.

The OECD estimates two scenarios for no consensus. One assumes that only the jurisdictions currently subject to U.S. trade investigations implement DSTs. The scenario assumes tariffTariffs are taxes imposed by one country on goods imported from another country. Tariffs are trade barriers that raise prices, reduce available quantities of goods and services for US businesses and consumers, and create an economic burden on foreign exporters. retaliation from the U.S. and countermeasures from the targeted countries ranging from a proportional retaliation to retaliation five times as large as the initial DST impact. That scenario suggests a global GDP contraction of as much as 0.24 percent of global GDP under retaliation five times greater than initial impacts.

The worst-case scenario assumes DST implementation by every country in the world apart from the U.S., China, and Hong Kong. In this scenario, global GDP could be reduced by as much as 1.21 percent if trade retaliation to near-global DST adoption is five times the impact of the DST policies themselves.

The OECD also estimates that global imports could fall between 0.17 percent and 2.04 percent depending on the exact scenario.

The rosier scenario is clearly the one that the OECD paints for an agreement that leads to the removal of DSTs and other relevant unilateral measures. Underlying its estimate that global GDP will shrink less than 0.1 percent under a consensus approach is a new OECD study of how effective tax rates might change under Pillar 1 and Pillar 2.

Tax policy can impact business investment decisions through the effective tax rate on business investment. The OECD estimates that effective tax rates would rise under Pillar 1 and Pillar 2. The OECD estimates a GDP-weighted average increase in effective marginal tax rates of 1.4 percentage points. This translates into the estimated range of impact on global growth of -0.07 and -0.11 percent.

The range of the estimated GDP impact arises from an assumption based on new empirical evidence from the OECD on the tax sensitivity of multinationals to increases in effective tax rates. The research suggests that firms with higher profit margins are less sensitive to changes in effective tax rates. The study identifies a few possibilities as to why this may be the case. These include higher profitable firms facing fewer liquidity constraints than less profitable firms and concentration of market power and economic rents among firms with higher profitability. The research also suggests that the ability to shift profits may make higher profitable firms less sensitive to increases in effective tax rates.

That final point is a curious one in the context of Pillars 1 and 2. If corporate taxes are less salient for highly profitable multinational companies partially because of profit shifting opportunities, then closing off some of those shifting avenues would tend to increase the impact of tax changes on investment decisions by those companies.

Loosening the assumption that highly profitable companies are less sensitive to effective marginal tax rateThe marginal tax rate is the amount of additional tax paid for every additional dollar earned as income. The average tax rate is the total tax paid divided by total income earned. A 10 percent marginal tax rate means that 10 cents of every next dollar earned would be taken as tax. changes still results in a rather small impact of -0.11 percent on global GDP.

Beyond the global economic impact, the estimated revenue resulting from the policies would not be spread evenly. High-tax countries are estimated to gain more revenue than lower tax jurisdictions under Pillar 1. Pillar 2 benefits are more uncertain as reactions by countries and businesses must both be assumed. High-income countries could stand to gain the most revenue as a share of corporate tax revenues from Pillar 2 unless other countries react by increasing taxes to meet the minimum rate. In such a case, a jurisdiction that currently has no corporate tax or a low corporate tax rate could claim the revenue from Pillar 2 rather than it accruing to another jurisdiction.

Predicting a specific reaction by a particular business or tax jurisdiction is highly uncertain, and the OECD provides a range of estimates for various reactions.

Pillar 1 revenue effects could ultimately be driven by whether the OECD proposal applies only to automated digital services or whether it also includes a broader set of consumer-facing businesses. At thresholds of 20 percent profitability and company revenues of €750 million (US $888 million), the potential profits in the scope of Pillar 1 for consumer-facing businesses is 3.7 times that of automated digital services.

The impact assessment provides a thorough analysis of the multiple layers of Pillar 1 and Pillar 2 while bringing significant data resources to bear on complex questions. The difference that the OECD presents between the potential impact in the context of agreement compared to a harmful tax and trade war should show policymakers the value of continuing multilateral discussions. The global economy is at a weak moment and policy decisions can directly impact when and whether recovery happens.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe