Greece has gone through various fiscal reforms over the past several years as it has dealt with challenges associated with recessionA recession is a significant and sustained decline in the economy. Typically, a recession lasts longer than six months, but recovery from a recession can take a few years. and over-indebtedness. However, things are now at a point where the new government is considering ways to improve its taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. system. Greece ranks 30th out of 36 on our International Tax Competitiveness Index this year and has several opportunities for improving its ranking.

Last week, I had the privilege to visit Athens and participate in a discussion on Greece’s Index ranking and reform options for the Greek tax system. During the discussion, the Deputy Finance Minister for Fiscal Policy, Theodoros Skylakakis, said that he would like to make reforms that would move Greece to 22nd place or even better in the Index.

The discussion was well-timed because the Greek budget for 2020 had just received approval from the European Commission. That budget contains several reforms that will improve Greece’s ranking on the Index which can be seen as the first stage in a broader reform agenda that the current government is planning to implement over the next several years.

In total, the government expects the tax policy changes for 2020 to result in a revenue reduction of approximately €1.2 billion or about 0.7 percent of GDP. These tax cuts are being proposed in the context of economic growth and spending reforms that have helped to stabilize Greece’s debt to GDP ratio.

|

Source: “Draft Budgetary Plan 2020,” Hellenic Republic Ministry of Finance, October 2019, https://ec.europa.eu/info/sites/info/files/economy-finance/2020_dbp_el_en.pdf. |

|

| Tax Reduction in Millions of Euros | |

|---|---|

| €2,000 allowance for newborns | 123 |

| Value-added Tax (VAT) rate decrease on baby use and care articles and on safety helmets (13 percent reduced rate) | 12 |

| Reform of PIT tax scale including introductory tax rate of 9% and increase of tax-free amount for each child | 281 |

| Reduction of social security contributions for full-time employees by approximately 1% | 123 |

| Reduction of the CIT tax rate from 28% to 24% | 541 |

| Reduction of dividends tax rate from 10% to 5% | 75 |

| Suspension of VAT on new buildings for 3 years | 26 |

The key items on the agenda that will have a direct impact on Greece’s ranking on the Index are the corporate rate reduction from 28 percent to 24 percent and the halving of the dividends tax rate from 10 percent to 5 percent. The temporary suspension of VAT on new buildings (alongside the suspension of capital gains tax on property sales) could be classified a reduction in property transfer taxes. Taken together, these policies would improve Greece’s ranking on the Index from 30th to 27th, with a significant improvement in its ranking on corporate and individual taxation.

|

Includes reduction in corporate tax rate, dividends tax rate, and suspension of VAT on new buildings and capital gains on property sales. Source: Author’s calculations using the methodology in Daniel Bunn and Elke Asen, 2019 International Tax Competitiveness Index, Tax Foundation, October 2019, https://taxfoundation.org/publications/international-tax-competitiveness-index/. |

||||||

| Category | Overall Rank | Corporate Tax Rank | Individual Taxes Rank | Consumption Taxes Rank | Property Taxes Rank | International Tax Rules Rank |

|---|---|---|---|---|---|---|

| 2019 Index Rank | 30 | 29 | 18 | 31 | 28 | 26 |

| Rank with Reforms | 27 | 20 | 12 | 31 | 25 | 26 |

Business Tax Reform

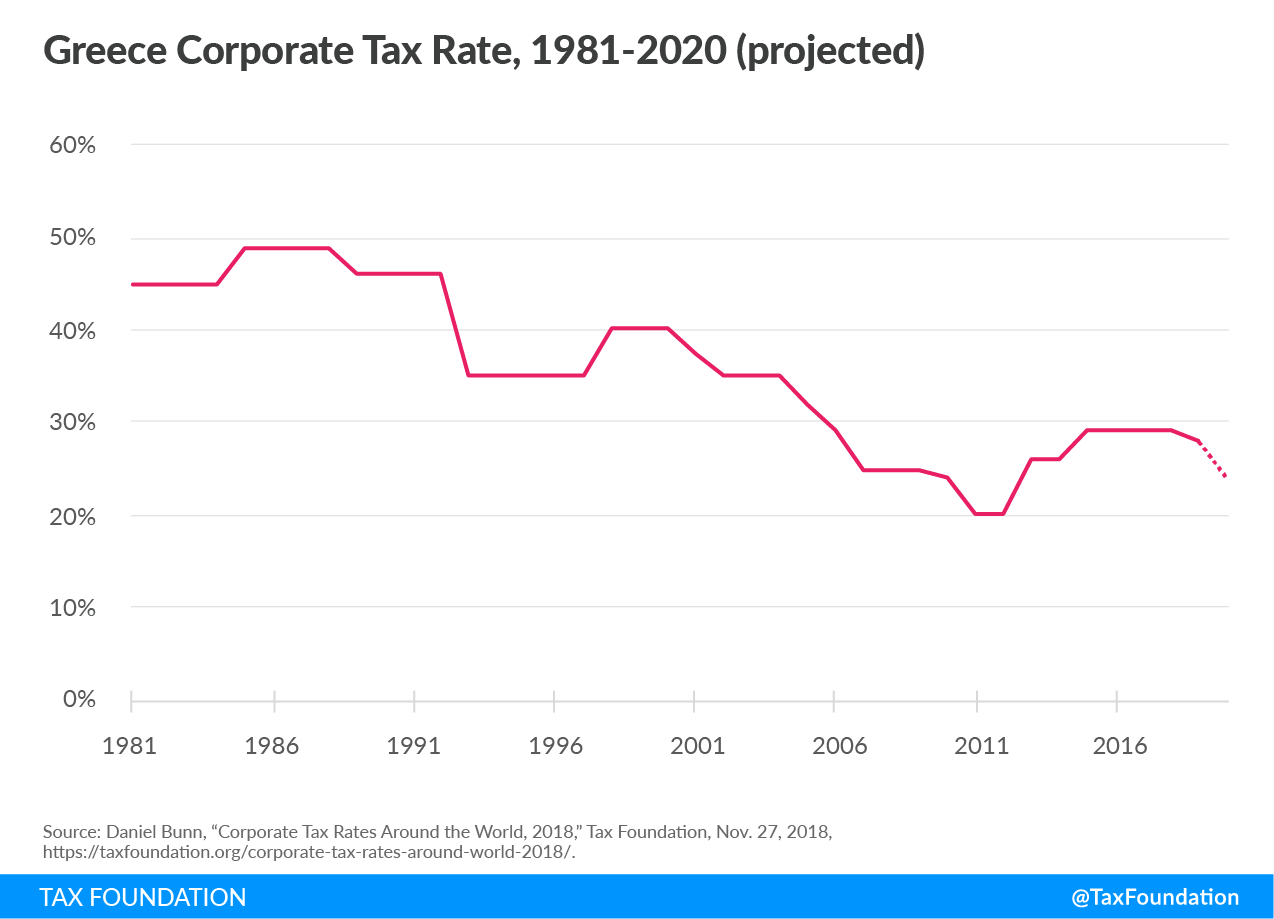

Greece’s corporate income tax rate has been on a bit of a bumpy ride over the last several years. After hitting a low point of 20 percent in 2011, the rate was hiked in two stages until it reached 29 percent in 2015. Bringing the corporate rate down from the current level of 28 percent to 24 percent would move Greece closer to the current OECD average of 23.6 percent.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeThe corporate rate is certainly an important feature of business taxation, but the tax base is also important. Greece’s allowances for capital expenditures and restrictions on deducting past losses make the current corporate tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. uncompetitive. On measures of cost recovery (including provisions on business investment, losses, and inventory), Greece ranks 27th out of the 36 OECD countries.

Currently, losses can only be carried forward for five years. This means that many businesses that accrued heavy losses during the economic crisis may not be able to deduct all those losses against current or future earnings. This is especially true for those businesses that have only recently become profitable again.

Depreciation schedules can mean that the costs of investing are not fully deductible against income. Current policy in Greece means that when businesses buy new equipment, they will only be able to deduct 74 percent of those costs in net present value terms. If a firm wants to invest in a new building or structure, they will be able to deduct just 48 percent of those costs. Both the United States and Canada have recently adopted provisions to allow 100 percent deductions for investments in assets like machinery, equipment, and software. Greece could follow their lead to improve the local climate for business investment.

Allowing businesses to immediately deduct the full cost of equipment purchases and have a longer time horizon to deduct past losses would be significant improvements to the corporate tax base.

Personal Income Tax Reform

The proposed changes in personal income taxation and the benefits connected to children will impact the tax wedgeBroadly speaking, a tax wedge is the difference between the pre-tax price or return and after-tax price or return. For labor income, it is the difference between the total labor costs to the employer and the corresponding net take-home pay of the employee. that workers with families face. In Greece, a one-earner married worker with two children who is making the average wage faces a tax wedge of 38 percent, 11 percentage points higher than the OECD average of 27 percent. Reducing social security contributions for full-time workers by approximately 1 percent and providing the €2,000 allowance for newborns will reduce some of this gap. In general, though, policies that reduce the tax wedge faced by all workers, and not just those with families, would be more neutral and competitive.

VAT Changes

The proposal outlines two changes to the VAT, one impacting baby-related items and helmets and another that would suspend the VAT on new buildings. VAT reductions are often seen as ways to alleviate costs faced by lower-income individuals or to boost demand, but they can also create complexity and distortions. It may seem like an attractive tool to use the VAT system to spur investment in new buildings or lower costs for young families, but both proposals would narrow the VAT base in a country where the base is already narrow (VAT is levied on only 43.7 percent of final consumption). The temporary nature of the VAT suspension on new buildings could also create political challenges when the government faces the expiration of that provision in a few years.

Base Broadening and Compliance

In addition to the plans for cutting taxes, the government is working to implement rules that should decrease opportunities for evading personal income taxes and VAT. In 2017, Greece had the second highest VAT gap among EU countries at 33.6 percent, resulting in a revenue loss of €7.3 billion in tax revenues. Addressing this issue through requiring more digital transactions could take some time, but there is significant revenue potential with higher rates of compliance.

To that end, the proposal specifies that taxpayers will be required to conduct more transactions via electronic payment. In 2020, electronic payments should make up 30 percent of transactions (as a share of individual income). This is pitched by the government as a base-broadening measure that, if successful in increasing compliance rates, could lead to further tax reductions.

Conclusion

The government is optimistic about the reforms and their potential to impact economic growth. But while the Greek government projects GDP growth in 2020 of 2.8 percent (partially due to the proposed reforms), the European Commission projects 2.2 percent and the IMF projects just 2 percent growth. Reaching that higher growth rate will be critical for the Greek government to continue with its reform project.

The government’s proposals are a good step forward for Greece and will improve its competitiveness, moving from 30th to 27th in the Index rankings. The Greek government will need to adopt reforms that improve not only tax rates but also the tax base if the Greek system is to become more competitive. The government should recognize how the current system creates distortions and chart a course for a more neutral and competitive policy.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe