Introduction

Catherine the Great is supposed to have said, “A great wind is blowing, and that gives you either imagination or a headache.” In Washington, winds are stirring for corporate taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. reform. But while there is broad bipartisan agreement that tax rates should be reduced,[1] there is less consensus regarding what the tax rate should be, how to pay for a tax cut, or generally how to treat international business income. These considerations are inextricably intertwined because the U.S. assesses its corporations on worldwide income.

Beyond imposing the highest top marginal tax rateThe marginal tax rate is the amount of additional tax paid for every additional dollar earned as income. The average tax rate is the total tax paid divided by total income earned. A 10 percent marginal tax rate means that 10 cents of every next dollar earned would be taken as tax. in the developed world,[2] the U.S. tax system’s treatment of international business income is exceptionally burdensome. It inflicts tremendous compliance costs, creates enormous distortions of economic activity, deters companies from headquartering in the U.S., awards tax preferences to politically connected industries, and traps huge amounts of U.S. corporate profits overseas. To add insult to injury, despite these punitive features, the system captures a meager stream of tax revenue.

To address these structural flaws, recent years have witnessed a steady march of tax reform proposals from both sides of the aisle and from several independent advisory boards and agencies. Though reform plans vary widely in their specific provisions, they follow one of two general approaches to taxing international business income: “worldwide” basis versus “territorial” basis.

Under the worldwide approach, all income of domestically-headquartered companies is subject to tax, including income earned abroad. To avoid double taxationDouble taxation is when taxes are paid twice on the same dollar of income, regardless of whether that’s corporate or individual income. of the same income base, worldwide systems provide credits for taxes paid to foreign governments. The overarching purpose of the worldwide design is to “create equality among resident taxpayers,” so as not to distort the investment decisions of domestically headquartered companies toward low-tax countries.[3]

Figure 1. Territorial and Worldwide Systems in the OECD |

|||

|

Territorial Systems |

Transition Since 2000 |

Worldwide Systems |

Top Marginal Tax Rate[4] |

|

Australia |

Chile |

20% |

|

|

Austria |

Greece |

20% |

|

|

Belgium |

Ireland |

12.5% |

|

|

Canada |

Israel |

24% |

|

|

Czech Republic |

2004 |

Korea |

24.2% |

|

Denmark |

Mexico |

30% |

|

|

Estonia |

2005 |

United States |

39.2% |

|

Finland |

“Territorial” designation signifies broad exemption for dividends received from foreign affiliates. This includes widespread exemptions built into tax treaties (Canada) and EU conventions which exempt dividends received from affiliates within the EU (Poland and Portugal). Worldwide designation signifies relief from double-taxation with limited credits.[5]

|

||

|

France |

|||

|

Germany |

|||

|

Hungary |

|||

|

Iceland |

2003 |

||

|

Italy |

|||

|

Japan |

2009 |

||

|

Luxembourg |

|||

|

Netherlands |

|||

|

New Zealand |

2009 |

||

|

Norway |

2004 |

||

|

Poland |

2007 |

||

|

Portugal |

|||

|

Slovak Republic |

2004 |

||

|

Slovenia |

|||

|

Spain |

|||

|

Sweden |

|||

|

Switzerland |

|||

|

Turkey |

2005 |

||

|

United Kingdom |

2009 |

Under the territorial approach, a country collects tax only on income earned within its borders. This is typically accomplished by exempting from the domestic tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. the dividends received from foreign subsidiaries. The territorial design thus equalizes the tax costs between international competitors operating in the same jurisdiction, so that all firms may compete on a level playing field, and capital may flow to where it can achieve the best after-tax return on investment.[6]

The U.S. system is considered a worldwide system though like other worldwide systems it allows its companies to defer tax liability on foreign “active”[7] income until it is repatriated (i.e., returned) to the United States. Deferral has been noted as critical to the stability of the U.S. international business tax system because it enables U.S. companies to compete on a near-level playing field with companies domiciled within more favorable tax climates, as long as those companies can afford to keep the resulting earnings abroad.[8]

Overwhelmingly, developed economies are turning to the territorial approach. While as recently as 2000, worldwide systems represented 66 percent of total OECD GDP, this figure has dropped to 45 percent heavily weighted by the U.S. Now, 27 of the 34 OECD member countries employ some form of territoriality, which is up from 17 just a decade ago (Figure 1, above).[9] Additionally, every independent U.S. advisory board, working group, and federal agency tasked with exploring tax reform has recommended that the U.S. pivot toward a territorial system.[10] These include President Obama’s Economic Recovery Advisory Board, Council on Jobs and Competitiveness, and Commission on Fiscal Responsibility and Reform. The House Committee on Ways and Means last year issued a draft bill for comprehensive tax reform which includes territorial taxation.[11]

It is not by coincidence that the territorial system has gained so many adherents; it provides very real economic advantages over its worldwide counterpart. In the case of the U.S., a transition to territorial taxation would free the $1.7 trillion dollars currently locked out of the U.S,[12] place U.S.-based companies on equal footing with competitors in every market,[13] reduce complexity and compliance costs,[14] reduce the incentive to reincorporate abroad,[15] and could be accompanied by improvements to anti-abuse protections.[16]

Yet President Obama and like-minded lawmakers want to purify the worldwide elements of the U.S. system. They see foreign investment by U.S. companies as displacing investment in the U.S. and seek to increase the U.S. tax penalty for investing abroad by repealing or further limiting deferral. Accordingly, advocates of the worldwide system consider territorial taxation an egregious concession to multinational corporations and claim it would result in a transfer of jobs, investment, and tax revenue to foreign countries.

A Case Study Approach

Efforts have been made to model the effects of a transition to territorial taxation,[17] but these studies rely on complex macroeconomic models, often involving unrealistic assumptions.[18] This is not to say that they are worthless to the policy debate, but ten different economists will produce ten very different models. In addition, the merits of territorial and worldwide taxation have been presented on theoretical bases,[19] but the political establishment in Washington has not been convinced to act on comprehensive tax reform.

Another way to analyze the claims about a transition to territorial taxation is to look at the performance of major economies that use territorial systems. By examining real-world cases and looking at recent transitions, we can gauge whether the theoretical concerns about territorial taxation may be warranted. This approach, which is largely missing in the policy debate, is intended to clarify the implications of a U.S. policy change.

First we will look at the aggregate performance of the two systems, comparing the territorial and worldwide country averages among OECD members for outbound foreign direct investment, unemployment, and corporate tax revenue since 2000. This will come with some discussion of economic theory to put the numbers in context. Second, we will look at two countries that recently went through transitions from worldwide to territorial systems: Japan and the UK. Though a third case would be desirable, other countries have transitioned gradually, with exemptions first built into treaties. These two countries have the unique ability to inform a U.S. transition because their previous worldwide systems were similar to the current U.S. system. Finally, we will consider three countries that have operated territorial systems throughout the post-WWII era: Canada, Germany, and the Netherlands. These countries represent among the largest economies with relatively pure territorial systems.

It is critical to point out from the onset that correlation is not causation. A great many factors influence international investment flows, unemployment rates, and tax revenue. In addition, the selection of countries into the two tax system groups is not random; territorial systems first gained popularity in Europe, worldwide systems are now generally limited to close allies of the U.S., and countries self-select their tax system based on their own unique economic position or treaty requirements. It is therefore beyond the scope of this analysis to provide any evidence of a causal link between the tax system type and the metrics of interest. On the contrary, this analysis should demonstrate that any claims of the system’s causal influence on unemployment and tax receipts should be greeted with caution. As we shall see, the trends of recent history demonstrate no clear correlations between the system type and unemployment rates or corporate tax revenue.

Aggregate Statistics

Foreign Direct Investment (FDI)

The most common objection to territoriality is the notion that it would result in increased investment abroad and reduced domestic investment by U.S. multinational companies. As Jane Gravelle noted before the House Committee on Ways and Means, “it is pretty obvious… if you lower the tax abroad, capital is going to go abroad.”[20] The concern with greater outflows of FDI is that when corporations invest abroad, it seems logical that some investment, and jobs, might be displaced at home. Depending on the balance of U.S. investment abroad, foreign direct investment into the U.S., and domestic savings rates, great outflows of capital could lower the potential U.S. capital stock, and lower capital stock means lower worker productivity and lower wages. In other words, the idea is that after a policy change, more U.S. dollars would fuel foreign investment, which would increase foreign worker productivity and wages, and there would be no offsetting effects to promote employment and wages in the U.S.

But this is not the dominant view of foreign investment among economists. A robust literature confirms that foreign and domestic investment are complements rather than substitutes. In a survey of developed nations, Ghosh and Wang find that both outbound and inbound FDI are associated with economic growth.[21] Desai, Foley, and Hines find that “years in which American multinational firms have greater foreign capital expenditures coincide with greater domestic capital spending by the same firms.” They report that 10 percent greater foreign investment is associated with 2.6 percent greater domestic investment,[22] and one dollar of new foreign investment is associated with 3.5 dollars of new domestic investment.[23]

Desai, Foley, and Hines conclude that “[n]either firms nor economies operate on such a zero-sum basis, and the average experience of US manufacturing firms over the last two decades is inconsistent with the simple story that foreign expansions come at the cost of reduced domestic activity.”[24] Growth abroad stimulates greater demand for productive factors in the United States, particularly in management, R&D, and other high-skill capacities.

Desai, Foley, and Hines conclude that “[n]either firms nor economies operate on such a zero-sum basis, and the average experience of US manufacturing firms over the last two decades is inconsistent with the simple story that foreign expansions come at the cost of reduced domestic activity.”[24] Growth abroad stimulates greater demand for productive factors in the United States, particularly in management, R&D, and other high-skill capacities.

Many countries have embraced this philosophy. Japan, Canada, and the Netherlands, for example, promote outbound FDI as part of their economic growth strategies. In Japan, the recent transition to territorial taxation was motivated by the idea that repatriated foreign earnings would fuel investment at home.[25] In Canada, “federal trade commissioners now have an explicit mandate to facilitate investment by Canadians abroad.”[26] The Netherlands recognizes that its small domestic consumer base cannot self-sustain growth or support economies of scale; international expansion that “is good for the company…is good for the country,” and delivers a “positive impact on profits and employment” to the Dutch homeland.[27]

As evidenced by Figure 2, above, territorial systems are associated with greater outflows of foreign investment.[28] This comports with theory, because territorial systems do not impose additional home country tax costs on foreign earnings and those additional taxes discriminate against international investment opportunities for companies domiciled in worldwide systems.

Those who subscribe to populist notions of a zero-sum world, in which a dollar invested abroad means one less at home, will see this as evidence to stay away from a territorial system. But, as has been outlined, the global economy is not a zero-sum operation. Foreign investment boosts firm-wide productivity, provides access to new factors of production, and opens new markets for selling. This promotes the health of companies and the economies in which they operate.

Further, U.S. companies have historically underinvested abroad compared to their counterparts in other advanced economies. Figure 3 demonstrates that while the U.S. has caught up with the OECD weighted average since 2009, companies based in other countries have tended to be more effective at seizing growth opportunities abroad.

Further, U.S. companies have historically underinvested abroad compared to their counterparts in other advanced economies. Figure 3 demonstrates that while the U.S. has caught up with the OECD weighted average since 2009, companies based in other countries have tended to be more effective at seizing growth opportunities abroad.

Unemployment

For opponents of territorial taxation, the primary implication of increased investment abroad is that U.S. capital would go to employ foreign rather than domestic workers. However, there is no evidence of this in terms of OECD unemployment rates. Figure 4 demonstrates that the cross-country simple average unemployment rates have trended closely together since 2000. Through much of this period, the average territorial country has had a lower unemployment rate than the average worldwide country.

For opponents of territorial taxation, the primary implication of increased investment abroad is that U.S. capital would go to employ foreign rather than domestic workers. However, there is no evidence of this in terms of OECD unemployment rates. Figure 4 demonstrates that the cross-country simple average unemployment rates have trended closely together since 2000. Through much of this period, the average territorial country has had a lower unemployment rate than the average worldwide country.

The chart for average unemployment weighted by GDP (Figure 5) tells a slightly different story: territorial systems were associated with higher average unemployment until the onset of the global recession in 2008. Unemployment in worldwide countries spiked in 2009, led primarily by meltdown in the United States. Territorial systems, however, appear to have experienced relative insulation of domestic labor forces in recent years. They experienced only marginal increases in unemployment in 2008, and their figures have held relatively constant. Since 2008, the weighted average unemployment rate has favored territorial systems.

The chart for average unemployment weighted by GDP (Figure 5) tells a slightly different story: territorial systems were associated with higher average unemployment until the onset of the global recession in 2008. Unemployment in worldwide countries spiked in 2009, led primarily by meltdown in the United States. Territorial systems, however, appear to have experienced relative insulation of domestic labor forces in recent years. They experienced only marginal increases in unemployment in 2008, and their figures have held relatively constant. Since 2008, the weighted average unemployment rate has favored territorial systems.

As mentioned earlier, these trends are largely due to the selection of countries that happen to subscribe to each system and other macroeconomic factors. As European sovereign debt crises push the EU closer to the brink of Euro collapse, it is possible that the average unemployment rates in territorial systems, largely represented by European nations, will rise above unemployment rates for worldwide systems.

The economic literature can better put this in context. Contrary to popular opinion, economists are “skeptical about the ability of international investment flows to affect the total level of employment in [an] economy.” Fiscal and monetary policy may alleviate some shocks to the labor market, but “a permanent policy of discouraging the movement of U.S. firms abroad would not appreciably alter the economy’s overall level of employment.”[29] In the short run, some workers are dislocated when a factory is moved to an alternate foreign location,[30] but in the long run the economy absorbs those workers in higher-productivity capacities.[31]

The trend in the U.S. and other developed countries has been that low value-added work has been moved to developing countries, but domestic labor has developed expertise in high value-added work. Harrison and McMillan find that at the firm level, corporate employment growth abroad is correlated with employment growth at home, especially when the production process is diversified across international boundaries.[32] Surveys by both McKinsey[33] and the Brookings Institution[34] generally conclude the same: Any employment effects of foreign investment are negligible relative to the U.S. economy and its annual turnover, and the gains more than offset the costs of temporary worker dislocation. Economy-wide, overseas production does not change the aggregate level of employment, but results in “a change in composition…toward more managerial and technical employment.”[35]

It is also critical to note that foreign investment usually does not represent a factory “moving” out of the United States. When Starbucks opens a new store in the Philippines, this is not at a cost to U.S. workers. Starbucks builds where local demand is unsatisfied and this tends to be the case for larger capital-intensive investments as well. It is well documented that employment by U.S. companies abroad is closely related to the locations of sales and is therefore focused among major U.S. trading partners.[36] This is demonstrated by the latest Bureau of Economic Analysis data, presented in Figure 6. Sixty-four percent of the variation in employment across nations can be explained by sales.[37] This means that location of sales is a very strong predictor of where U.S. companies will employ foreign workers. Granted, this does not control for other factors that might affect employment abroad, such as GDP, GDP per capita, or distance from the U.S., but the simple correlation suggests that the most important factor is the location of sales.[38]

It is also critical to note that foreign investment usually does not represent a factory “moving” out of the United States. When Starbucks opens a new store in the Philippines, this is not at a cost to U.S. workers. Starbucks builds where local demand is unsatisfied and this tends to be the case for larger capital-intensive investments as well. It is well documented that employment by U.S. companies abroad is closely related to the locations of sales and is therefore focused among major U.S. trading partners.[36] This is demonstrated by the latest Bureau of Economic Analysis data, presented in Figure 6. Sixty-four percent of the variation in employment across nations can be explained by sales.[37] This means that location of sales is a very strong predictor of where U.S. companies will employ foreign workers. Granted, this does not control for other factors that might affect employment abroad, such as GDP, GDP per capita, or distance from the U.S., but the simple correlation suggests that the most important factor is the location of sales.[38]

As a final illustration, consider the case of Otis Elevator. In 2011, 15,000 elevators were sold in the U.S., but 380,000 were sold in China. To compete for new installations, control transport costs, and win maintenance contracts in the growing Chinese market, Otis must be physically present in China. Sales resulting from foreign investment fuel high-value employment at home, not only in management positions, but also in research and development capacities. In addition, the company’s intellectual property, including patents, resides in the U.S., and according to Otis management, “keeping that high-value work [in the U.S.] is highly dependent on Otis’ success around the world.”[39] Because foreign sales comprise roughly 46 percent of sales for the S&P 500,[40] companies must actively invest in these growing markets to grow payrolls back in the U.S.

Tax Revenue

Skeptics of territorial taxation are concerned that lowering the effective tax rate on foreign earnings would induce greater levels of profit shiftingProfit shifting is when multinational companies reduce their tax burden by moving the location of their profits from high-tax countries to low-tax jurisdictions and tax havens.

into low tax countries, thus avoiding U.S. tax. Profit shifting occurs when taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. Taxable income differs from—and is less than—gross income.

is “reported in a jurisdiction different from that in which it would be reported absent an action taken by management where a motive for the action taken is to reduce the overall tax burden.”[41] The most common avenues for profit shifting involve intra-firm trades (known as transfer pricing), location of debt, and the location of patents and other intangible property, which enable firms to overstate taxable income in low tax jurisdictions and understate income in high tax jurisdictions. Such activity erodes the base of income subject to domestic tax, thereby reducing domestic tax revenues.[42] It is argued that removing the repatriation tax burden would increase the incentive to shift profits.

Like unemployment, however, there is no evidence of this relationship when comparing the actual experiences of territorial and worldwide countries. The simple averages of corporate tax revenue as a share of GDP for the two systems have trended closely together in recent history, but from 2000 to 2009, territorial systems raised more revenue in nine out of ten years (Figure 7, above).

Like unemployment, however, there is no evidence of this relationship when comparing the actual experiences of territorial and worldwide countries. The simple averages of corporate tax revenue as a share of GDP for the two systems have trended closely together in recent history, but from 2000 to 2009, territorial systems raised more revenue in nine out of ten years (Figure 7, above).

Figure 8 compares the GDP-weighted average revenue (right vertical axis) to GDP-weighted average tax rates (left vertical axis) for each system. GDP-weighted average revenue for worldwide systems tends to register lower than the simple average in Figure 7 because the weighted measure gives relative importance to U.S. performance and the U.S. system has collected very little revenue in recent years. While average tax rates for territorial systems have dropped at a much quicker rate than worldwide systems (again due to the U.S. maintaining its 35 percent tax rate), according to GDP-weighted averages, territorial systems have raised more revenue in eight of the ten years.[43]

Again, economic theory sheds some light on this seemingly counterintuitive result. First, territorial systems generally do not have foreign tax creditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income rather than the taxpayer’s tax bill directly. systems like the U.S. system. Under current law, U.S. companies “shield” passive income from taxes with credits for taxes paid to foreign governments. Without such a shield in territorial systems, full taxation of global passive earnings can lead to substantial tax revenue.[44] Territorial systems differ on the extent to which passive income is brought into the tax base, but no system exempts it entirely.

Second, the current U.S. deferral regime provides very similar incentives to shift profits as experienced within dividend-exemption territorial systems.[45] Kevin Markle has observed no statistical difference in the scope of profit shifting activity between territorial and deferral-based worldwide systems.[46] Some economists estimate that profit shifting already costs the Treasury over $30 billion annually,[47] so it is not clear that removal of the repatriationRepatriation is the process by which multinational companies bring overseas earnings back to the home country. Prior to the 2017 Tax Cuts and Jobs Act (TCJA), the US tax code created major disincentives for US companies to repatriate their earnings. Changes from the TCJA eliminate these disincentives. tax would induce a substantially greater outflow of the income base.

Third, revenue from foreign sources is meager, at least in the U.S. experience. In 2008, the latest year available, U.S. revenue from foreign business activity amounted to $22.1 billion (Figure 9).[48] This represented just 7.26 percent of corporate tax receipts, 0.88 percent of total tax receipts, and 0.15 percent of GDP. Because the $22 billion figure included passive income, the total tax take from repatriated active income was even smaller.[49] In other words, the most complex and burdensome elements of the U.S. corporate tax code squeeze out just a sliver of its revenues. [50]

Figure 9. U.S. Foreign-Source Tax Revenue, 2008 |

|

|

Tax Receipts, Foreign-Source |

$22.1 billion |

|

Share of CIT Receipts |

7.26% |

|

Share of Total Receipts |

0.88% |

|

Share of Outlays |

0.74% |

|

Share of GDP |

0.15% |

Fourth, and perhaps most importantly, territorial systems protect the base of business activity and capital ownerships within a country. One academic has declared that territorial systems will necessarily collect more revenue in the long-run because companies will avoid organizing business activity within worldwide systems.[51] Despite Congressional efforts to thwart corporate inversions, there are still several simple strategies for U.S. companies to reincorporate in tax-friendly jurisdictions.[52] In recent years, numerous large U.S. corporations such as Aon, Eaton, and Ensco have moved their headquarters abroad, taking their capital ownership out of the U.S. tax base.[53] This results not only in fewer high-skill U.S. jobs, but reduces global and national welfare as productive resources are allocated inefficiently.[54]

The experience of other developed economies demonstrates that when countries attempt to poach revenue from income earned in other countries, they tend to receive no more than their territorial counterparts. Though the net revenue effect of a U.S. transition would depend greatly on specific anti-abuse rules and the extent to which passive income is brought into the tax base, there is no evidence in the experience of other countries to indicate that a U.S. transition would necessarily lead to loss of revenue.

Country Case Studies

Because the particulars matter, it makes sense to look at the experiences of individual countries and their approaches to international taxation. In terms of transition to territoriality, the two most relevant cases are Japan and the UK, which both adopted territorial designs in 2009. These cases are unique because both systems were very similar to the current U.S. system prior to the policy change, and the transitions were motivated by economic ills similar to what the U.S. is currently experiencing. While a third case would be helpful, other countries have tended to adopt territorial systems in phases over time. Particularly for EU members, countries tended to build foreign dividend exemptions into bilateral tax treaties and subsequently adopted broad exemptions either for affiliates within the EU or all foreign affiliates.

The final three case study countries are Canada, Germany, and the Netherlands. These cases serve to demonstrate the long-run performance of territorial tax systems and to highlight that these countries have overcome the theoretical pitfalls suggested by skeptics.

Territorial systems vary greatly in design. Differences include the levels of dividend exemption, threshold ownership requirements, expense allocation rules, and other stipulations that income must meet to qualify as exempt.[55] Each system also has unique base-erosion measures to guard against income shifting. All territorial countries, however, exempt from tax all (or 95 percent) of the dividend earnings associated with active engagement of its companies abroad. For each system described below, these provisions will be briefly outlined, in order to better inform the debate and highlight some of territorial taxation’s “best practices.”[56]

Japan

“Through the introduction of this system, the profits repatriated into this country are anticipated to be put to use for vitalization of the Japanese economy in the wide-ranging and various fields, such as capital investment, research and development, employment, etc.” —Japan Tax System Council, 2008[57]

Prior to 2009, “Japan’s international tax system bore a remarkable resemblance to that of the United States.”[58] It taxed on a worldwide basis, provided foreign tax credits, allowed deferral of tax on active income until repatriation, and claimed the highest corporate tax rate in the developed world. In introducing the 2009 budget, however, the Japanese Minister of Economy, Trade, and Industry (METI) announced that his country would pivot to a policy of territorial taxation as part of a “new growth strategy” designed to stimulate innovation in Japan through strengthening the competitiveness of Japanese firms in foreign markets and encouraging repatriation of overseas earnings.[59]

In the run-up to 2009, Japan’s leaders became very concerned with the accumulation of foreign earnings held overseas, which increased from ¥138 billion ($1.1 billion) in 2001 to ¥3.2 trillion ($28 billion) by 2006. Officials believed that this pool of earnings represented foregone investment in Japan, and that the barrier to repatriation increased the risk that R&D operations would be moved abroad.[60] Before the policy change, a survey by METI found that 21 of 46 companies intended that they would spend repatriated earnings on upgrading domestic production and R&D facilities.[61]

A second concern was the competitiveness of Japanese firms in the world marketplace. With an aging and shrinking population, officials recognized that sustained economic health would originate in growth of Japanese firms abroad. A simpler, territorial system, it was thought, would allow firms to grow abroad and “ultimately lead to additional investments and job creation within Japan.”[62] To further promote the competitiveness of its companies and attract investment, Japan also announced plans to lower its corporate tax rate by five percentage points, bringing its combined rate just below the U.S. combined rate. According to one Japanese tax professional, “the government concluded that the adoption of a foreign dividend exemption system itself would not unduly influence corporate decisions as to whether to establish or move operations overseas.”[63]

Japan produced an international tax system with a 95-percent exemption for foreign-source dividends, which also permits deductions of all “necessary and reasonable expenses” associated with foreign income on home country taxes.[64] To guard against erosion of the corporate tax base through income shifting, Japan enacted a series of strict transfer pricing and reporting regulations.[65] It now imposes rules based on effective tax rates of controlled foreign corporations; if any subsidiary pays an effective tax rate to foreign tax authorities of less than 20 percent and cannot prove that it is actively engaged in business, the dividend exemption does not apply.[66] The system also imposes “thin capitalization rules” to limit the ability of corporations to take on excessive debt on behalf of foreign affiliates, because the interest would otherwise be deductible for tax-exempt foreign earnings.[67]

The government reported that dividend remittances increased 20 percent from 2009 to 2010, indicating that the policy may have induced the intended effect.[68] Japanese repatriation again made the news in 2011, as Japanese firms announced they would repatriate foreign earnings to help finance the post-tsunami recovery.[69] It is also worth mentioning that the Wall Street Journal reports that “Japanese companies are in the midst of the biggest boom in overseas investment the country has ever seen.”[70] They have been aggressively acquiring foreign companies and engaging the global markets just as the policy intended.

The government reported that dividend remittances increased 20 percent from 2009 to 2010, indicating that the policy may have induced the intended effect.[68] Japanese repatriation again made the news in 2011, as Japanese firms announced they would repatriate foreign earnings to help finance the post-tsunami recovery.[69] It is also worth mentioning that the Wall Street Journal reports that “Japanese companies are in the midst of the biggest boom in overseas investment the country has ever seen.”[70] They have been aggressively acquiring foreign companies and engaging the global markets just as the policy intended.

The consequences for U.S. policy are perhaps best captured in the recent musings of Mieko Nakabayashi, a member of the Japanese House of Representatives. He observes:

With most of the world—Japan included—cutting corporate tax rates and employing territorial tax systems to remain competitive, the U.S. must surely know that its hesitancy to do these things is handing the advantage to its international competitors. They will suffer from that hesitancy while we and others outside the U.S. will benefit.[71]

Data

Since the policy change in 2009, Japan’s unemployment rate has trended downward, similar to the OECD average (Figure 10, above). Relative to ten years ago, Japan’s unemployment rate has been reduced, contrary to the U.S. or OECD averages. In addition, economy-wide wages have picked back up after a sustained drop off from 2006 to 2009 (Figure 11).[72] These phenomena are not entirely attributable to the territorial  system, particularly because of Japan’s concurrent struggle with the strength of the yen, the global recessionA recession is a significant and sustained decline in the economy. Typically, a recession lasts longer than six months, but recovery from a recession can take a few years.

, the beginning of recovery, and the 2011 tsunami, but the tax policy transition itself has certainly not dealt an obvious blow to the Japanese labor force.

system, particularly because of Japan’s concurrent struggle with the strength of the yen, the global recessionA recession is a significant and sustained decline in the economy. Typically, a recession lasts longer than six months, but recovery from a recession can take a few years.

, the beginning of recovery, and the 2011 tsunami, but the tax policy transition itself has certainly not dealt an obvious blow to the Japanese labor force.

Regarding corporate tax receipts, the Japanese government reports that it increased collections in 2010 and projects that receipts will remain stable  for fiscal years 2011-2012 (Figure 12).[73] The OECD also reports that receipts ticked up as a share of GDP in 2010, and Japan’s score remains higher than the OECD GDP-weighted average (Figure 13).[74] Though corporate tax receipts are sensitive to a host of factors, particularly growth in the economy, it appears that the territorial system has not caused immediate erosion of the tax base.

for fiscal years 2011-2012 (Figure 12).[73] The OECD also reports that receipts ticked up as a share of GDP in 2010, and Japan’s score remains higher than the OECD GDP-weighted average (Figure 13).[74] Though corporate tax receipts are sensitive to a host of factors, particularly growth in the economy, it appears that the territorial system has not caused immediate erosion of the tax base.

What do these data tell us? In the first three years of the new territorial taxation policy in Japan, not one of the popular fears has become a reality. While outbound FDI is up from 2009,[75] this is by the design of Japanese policymakers; foreign investment represents new growth opportunities for the domestic Japanese economy as its companies engage the world marketplace. The unemployment rate is down, wages are up, and corporate tax revenues have remained stable. This is antithetical to what opponents of the territorial system might expect.

United Kingdom

“Let it be heard clearly around the world—from Shanghai to Seattle, and from Stuttgart to Sao Paolo: Britain is open for business.” —Chancellor George Osborne, 2011[76]

Like Japan, the United Kingdom’s international tax system looked very similar to the U.S. model until very recently. Whereas Japan was primarily concerned with the trapped foreign earnings problem, the UK was more concerned with issues directly related to its firms’ competitiveness. In 2006, Her Majesty’s Treasury opened talks with business leaders with the express purpose of developing a more competitive international tax system. Though competitiveness remained the chief aim of tax reform throughout the process, other motivations included steep compliance costs and ineffective anti-avoidance measures of the older system.[77]

In 2008, a string of business emigrations prompted “intense discussions among lawmakers and businesses about the competitiveness of Britain’s tax system.” The New York Times described three particular outgoing firms as just part of the “exodus of British companies fleeing the tax system.”[78] This publicity breathed life into tax reform efforts, which came to fruition in 2009. In the wake of the new legislation, the Financial Times reported that more than half of companies had considered leaving the UK but that the “exodus has slowed down, partly because of Treasury reforms.”[79]

The UK system now features a full exemption for various classes of foreign-source dividends[80] and allows domestic tax deductions for foreign-source expenses, similar to most other territorial systems. Among key anti-avoidance measures are limits on the deductibility of interest payments (“thin capitalization rules,” as described for Japan), rules that enforce tax on controlled foreign affiliates based in low-tax jurisdictions (where effective tax rates are less than three-quarters of corresponding UK liability), and regulations which qualify diverted intellectual property income as taxable. To provide favorable treatment to intangible property income and guard against the outflow of intangible property, the UK operates a “patent boxA patent box—also referred to as intellectual property (IP) regime—taxes business income earned from IP at a rate below the statutory corporate income tax rate, aiming to encourage local research and development. Many patent boxes around the world have undergone substantial reforms due to profit shifting concerns. ” regime that lowers the tax to just 10 percent on profits attributed to qualifying patents.[81] While the system is already comparatively generous to foreign income, UK officials have announced intentions to narrow their controlled foreign company rules to target only profits artificially diverted from the UK.[82]

For the 2011 budget, Chancellor George Osborne proclaimed that the highest ambitions for the British economy were to “have the most competitive tax system in the G20,” and “be the best place in Europe to start, finance and grow a business.”[83] Along with tax rate reductions, the transition to a territorial system has served British ambitions. Within days of the announcement, two of the twenty-two recently inverted companies announced that they would consider a move back to the UK.[84]

For the 2011 budget, Chancellor George Osborne proclaimed that the highest ambitions for the British economy were to “have the most competitive tax system in the G20,” and “be the best place in Europe to start, finance and grow a business.”[83] Along with tax rate reductions, the transition to a territorial system has served British ambitions. Within days of the announcement, two of the twenty-two recently inverted companies announced that they would consider a move back to the UK.[84]

Data

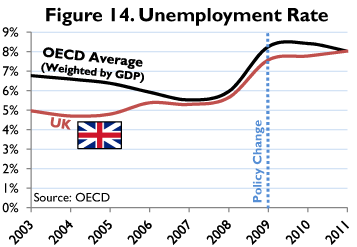

According to the OECD, the unemployment rate ticked up slightly in 2010 and 2011, rising to meet the OECD average (Figure 14, right). However, if we look closer at the latest data from the British government, we see that unemployment has generally leveled off since the July 2009 policy change (Figure 15, right).[85] The worsening Euro crisis has stalled economic growth for the UK and its trading partners, but labor outcomes in the UK have not appreciably deteriorated since the inception of territorial treatment of foreign income.

According to the OECD, the unemployment rate ticked up slightly in 2010 and 2011, rising to meet the OECD average (Figure 14, right). However, if we look closer at the latest data from the British government, we see that unemployment has generally leveled off since the July 2009 policy change (Figure 15, right).[85] The worsening Euro crisis has stalled economic growth for the UK and its trading partners, but labor outcomes in the UK have not appreciably deteriorated since the inception of territorial treatment of foreign income.

Since the policy change in 2009, corporate tax receipts have increased despite a tax rate cut in 2011 (Figure 16). Again, this is not to suggest that the territorial system caused the revenue increase—particularly because the policy change was concurrent with GDP growth recovery. Nonetheless, revenue has only increased since the transition to territorial taxation. OECD statistics on revenue as a share of GDP also confirm that it increased in 2010, the first year after the policy changed,

Since the policy change in 2009, corporate tax receipts have increased despite a tax rate cut in 2011 (Figure 16). Again, this is not to suggest that the territorial system caused the revenue increase—particularly because the policy change was concurrent with GDP growth recovery. Nonetheless, revenue has only increased since the transition to territorial taxation. OECD statistics on revenue as a share of GDP also confirm that it increased in 2010, the first year after the policy changed, in line with the OECD trend (Figure 17).[86]

in line with the OECD trend (Figure 17).[86]

While outbound FDI as a share of GDP picked up slightly in 2011, just surpassing the total OECD figure[87] (not shown), it does not appear that the infant territorial system in the UK has created problems for British workers or government coffers. Again, the popular fears about territorial taxation have not come to fruition in the case of the UK.

Canada

“It is important to ensure that Canada’s system of international taxation continues to promote the competitiveness of Canadian businesses internationally and to attract new foreign investment to Canada.”—Advisory Panel on Canada’s System of International Taxation, 2008

Canada generally exempted all foreign source income from tax until 1976,[88] when it adopted foreign affiliate rules that exist, though modified, to this day. These rules fully exempt from tax all dividends derived from active income earned by an affiliate if the affiliate resides in a country with which Canada maintains a tax treaty.[89] Because the treaty network now encompasses 91 countries and all major trading partners, the Canadian system is, in practice, a territorial system. It is often referred to as a “hybrid system,” however, because income earned in non-treaty countries is taxed on a current basis.[90]

All passive income is treated as Foreign Accrued Property Income (FAPI), which is a classification modeled after U.S. Subpart F. As the primary base-erosion measure, FAPI rules classify interest, royalties, rent, other passive investment income, and income of unincorporated foreign branches[91] as taxable. Regardless of whether the profits are repatriated, FAPI income is taxed on a current basis, in order to mitigate the tax advantage of shifting domestic income to low-tax jurisdictions.[92] The other major anti-erosion measures are the typical limits on the deductibility of interest paid by a Canadian corporation to foreign affiliates and transfer pricing rules.[93]

Despite its very competitive system, Canada has not slowed its efforts to continually improve its tax competitiveness. Since 1998, its combined corporate tax rate has been lowered from 42.9 percent to 27.6 percent.[94] In 2007, it adopted rules to apply the dividend exemption to affiliates in countries with a bilateral Tax Information Exchange Agreement (TIEA),[95] and the government’s 2008 “Advisory Panel on Canada’s System of International Taxation” recommended that the existing exemption system be expanded further to cover all active foreign business income.[96] Further, recognizing that foreign investment yields benefits to the home economy, Canadian officials actively facilitate foreign investment by Canadian companies.[97]

Data

In spite of fears that foreign investment displaces domestic investment to the detriment of the home economy, the case of Canada demonstrates that foreign engagement, territorial taxation, and competitive tax rates can promote better economic performance. Canada’s economy has grown at an average real rate of 2.61 percent since 1995, which is 0.2 points stronger than the U.S. average and 0.4 point stronger than the OECD average.[98]

In spite of fears that foreign investment displaces domestic investment to the detriment of the home economy, the case of Canada demonstrates that foreign engagement, territorial taxation, and competitive tax rates can promote better economic performance. Canada’s economy has grown at an average real rate of 2.61 percent since 1995, which is 0.2 points stronger than the U.S. average and 0.4 point stronger than the OECD average.[98]

This has translated into more jobs in the Canadian economy. Unemployment has trended downward since the 1980s, and the Canadian labor force was not as affected by the global recession as was the U.S. labor force. As of 2011, the unemployment rate in Canada sat 1.5 points below the U.S. rate (Figure 18, above).

This has translated into more jobs in the Canadian economy. Unemployment has trended downward since the 1980s, and the Canadian labor force was not as affected by the global recession as was the U.S. labor force. As of 2011, the unemployment rate in Canada sat 1.5 points below the U.S. rate (Figure 18, above).

The most remarkable lesson from Canada is that territorial systems are capable of yielding substantial and consistent tax revenues, even through periods of recurring tax cuts (Figure 19). Canada has lowered its tax rate from 42 percent to 27.6 percent since 2000, yet tax revenues have tended to grow faster than GDP. The Canadian territorial system has consistently out-collected the U.S. worldwide system despite higher tax rates in the U.S.

Germany

Germany has successfully implemented a system of taxation of foreign earnings, which is driven by two principles: competitive neutrality and simplicity. —Jorg Menger, German tax professional, 2011[99]

Since 1920, the German corporate tax system has exempted foreign dividend income to some degree. In 1954, Germany initiated a tax treaty system whereby dividends originating within treaty-partner countries became fully exempt. To simplify this regime and to comport with rulings of the EU Court of Justice, in 2001 Germany reformed its system to terminate international expense allocation requirements and to allow deductions for all expenses related to exempt foreign income. To compensate the government for allowing deductions for costs related to tax-exempt foreign income, Germany reduced the exemption for foreign income to 95 percent, allowing tax on the residual five percent.[100]

Active income generated by controlled foreign corporations and passive income that is subject to tax rates greater than 25 percent in the original jurisdiction are eligible for exemption.[101] Also, income generated by foreign branches of German companies is exempt from German tax as long as the branch resides in a treaty country.[102] Anti-erosion measures limit the deductibility of interest surplus, ensure that losses on the sale of subsidiary corporate stock are not deductible, and levy tax on all passive income in low-tax jurisdictions.[103]

To make the tax system more competitive for its companies in the international marketplace, Germany has recently engaged in a series of tax rate reductions. Since 1998, Germany has reduced its combined tax rate on corporate income from 56 percent to 30.2 percent.[104]

Data

While operating a territorial system throughout the modern era, Germany has emerged as one of the most robust economies in the world and is considered the European continent’s “economic giant.”[105] Its GDP per capita is $40,116, ranking in the top decile of all countries, and it is the third-leading exporter in the world. [106]

While operating a territorial system throughout the modern era, Germany has emerged as one of the most robust economies in the world and is considered the European continent’s “economic giant.”[105] Its GDP per capita is $40,116, ranking in the top decile of all countries, and it is the third-leading exporter in the world. [106]

Regarding unemployment, there has been much volatility since the reunification of West and East Germany in 1990. While unemployment trended upward for several periods and reached a high exceeding 11 percent in 2005, the rate has been cut in half since that time, due in part to labor market reforms.[107] By 2011, it registered at 5.9 percent (Figure 20, above) and Eurostat reports that it is now down to 5.4 percent.[108] While much of the developed world experienced spikes in unemployment as a result of the global recession, Germany experienced only a hiccup before its rate continued downward.

Germany traditionally has not relied heavily on corporate tax revenue (Figure 21). German policymakers have recognized the tradeoffs inherent to international taxation and as one of the world’s leading exporters, have chosen to promote the competitiveness of their companies. While the German government may be leaving a lot of potential revenue on the table, it recognizes that foreign earnings are a fugitive base from which to extract revenues.

Germany traditionally has not relied heavily on corporate tax revenue (Figure 21). German policymakers have recognized the tradeoffs inherent to international taxation and as one of the world’s leading exporters, have chosen to promote the competitiveness of their companies. While the German government may be leaving a lot of potential revenue on the table, it recognizes that foreign earnings are a fugitive base from which to extract revenues.

The Netherlands

Companies that are healthy and grow internationally will be able to capitalize on opportunities that solely domestically operating companies will not be able to seize on. This will have a positive impact on profits and employment in the residence state. In that sense one can say that if international expansion is good for the company, it is good for the country. –Paul Vlaanderen, Director of International Tax Policy and Legislation, Netherlands Ministry of Finance, 2002[109]

The origins of the Dutch dividend exemption go back to 1893, when it became “one of the pillars” of the tax system.[110] According to Paul Vlaanderen, former director of Dutch international tax policy, there are two reasons that the Netherlands has always exempted foreign profits. First, the country respects the fiscal sovereignty of other nations to tax the business profits realized within their own jurisdictions (the “benefit principle”). Second, the Netherlands recognizes that its domestic market of 16 million people is too small to sustain growth for its innovative companies. To penetrate foreign markets and gain global market share, companies must be able to compete with other multinationals on “a level playing field” and from “an equal tax position.”[111]

The exemption for active income applies to a broad swath of investment types, including some portfolio investment and financing activity. While investment institutions specifically are not eligible for the exemption, passive investment income may be exempt if it passes a “subordination requirement,” meaning that it was taxed at an effective rate of at least 10 percent in its source jurisdiction.[112] This provision denotes that “only so-called ‘low taxed investment companies’ are disqualified from the participation exemption.”[113] Likewise, profits derived from permanent establishments of foreign branches are exempted as long as the income has met the same 10 percent test.[114]

For foreign dividends that are not exempt, double-taxation is mitigated with a foreign tax credit and a deferral regime. However, if a Dutch company holds 25 percent or greater of the stock in a foreign passive or low-tax asset, “the annual change in the value of the holding forms part of the Dutch taxable income.” This reevaluation approach differs from most other territorial jurisdictions.[115]

The Netherlands permits deductions for costs associated with exempt foreign earnings against domestic taxable income, but there are limits on deductibility of interest payments. For a firm to deduct the costs associated with external financing, it must prove that the debt issue is relevant to the gain of taxable domestic income. The same scrutiny is applied to loan costs associated with foreign acquisitions.[116] If ever debts are deemed “excessive” by tax authorities, the interest costs are not deductible.[117]

To stimulate job creation and innovation in the Netherlands, the “innovation box” regime subjects qualifying income from intangible assets to a tax rate of just five percent. This regime, similar to the UK “patent box,” is aimed to eliminate the incentive to shift intangible property and income into tax havens. In addition, the Dutch system is noted by tax professionals to offer “ample possibilities for deducting expenses from gross incomeFor individuals, gross income is the total of all income received from any source before taxes or deductions. It includes wages, salaries, tips, interest, dividends, capital gains, rental income, alimony, pensions, and other forms of income. For businesses, gross income (or gross profit) is the sum of total receipts or sales minus the cost of goods sold (COGS)—the direct costs of producing goods, including inventory and certain labor costs. and a favourable treatment of losses.”[118] Due to its taxpayer-friendly approach and low tax burdens, the Netherlands is the registered home to many holding companies, and KPMG has ranked the Dutch corporate tax system as the most attractive in Europe.[119]

Data

The unemployment rate in the Netherlands has trended downward since the early 1980s. Particularly since 1998, Dutch employment figures have consistently scored better marks than the U.S., and in 2011, unemployment in the Netherlands was half of the U.S. figure (Figure 22, above). This occurred while the Dutch pursued a policy of foreign engagement and outbound investment. This is not to suggest that the territorial tax systemTerritorial taxation is a system that excludes foreign earnings from a country’s domestic tax base. This is common throughout the world and is the opposite of worldwide taxation, where foreign earnings are included in the domestic tax base.

is the primary driver of positive labor market outcomes in the Netherlands, but the territorial system has clearly not prevented these outcomes.

The unemployment rate in the Netherlands has trended downward since the early 1980s. Particularly since 1998, Dutch employment figures have consistently scored better marks than the U.S., and in 2011, unemployment in the Netherlands was half of the U.S. figure (Figure 22, above). This occurred while the Dutch pursued a policy of foreign engagement and outbound investment. This is not to suggest that the territorial tax systemTerritorial taxation is a system that excludes foreign earnings from a country’s domestic tax base. This is common throughout the world and is the opposite of worldwide taxation, where foreign earnings are included in the domestic tax base.

is the primary driver of positive labor market outcomes in the Netherlands, but the territorial system has clearly not prevented these outcomes.

Perhaps just as shocking is the Dutch system’s tax revenue performance. It has consistently out-yielded the U.S. system, as well as the OECD average, until very recently (Figure 23). In only one of the last thirty years did the U.S. worldwide system collect more tax revenue as a share of GDP than its Dutch counterpart. And like Canada, this has occurred in the context of ever-decreasing tax rates; the top marginal rate has been lowered five times since 2001, moving from 35 percent to 25 percent. In sum, the Netherlands has operated a competitive territorial system with substantially lower corporate tax rates than in the U.S. and it has experienced better labor outcomes and greater levels of corporate tax revenue. The Dutch case specifically rebuts each of the fears associated with territorial taxation and may be held up as an international tax exemplar.

Perhaps just as shocking is the Dutch system’s tax revenue performance. It has consistently out-yielded the U.S. system, as well as the OECD average, until very recently (Figure 23). In only one of the last thirty years did the U.S. worldwide system collect more tax revenue as a share of GDP than its Dutch counterpart. And like Canada, this has occurred in the context of ever-decreasing tax rates; the top marginal rate has been lowered five times since 2001, moving from 35 percent to 25 percent. In sum, the Netherlands has operated a competitive territorial system with substantially lower corporate tax rates than in the U.S. and it has experienced better labor outcomes and greater levels of corporate tax revenue. The Dutch case specifically rebuts each of the fears associated with territorial taxation and may be held up as an international tax exemplar.

Lessons for the U.S.

The U.S. finds itself in similar circumstances to each of the transitional case studies. Like Japan before 2009, American companies’ foreign profits are stockpiling abroad, locked out by a secondary tax penalty. Like the UK before 2009, many U.S. companies have explored or gone forward with moving legal residence into business-friendly tax systems. Like both countries before reform, the U.S. system is complex, out of sync with its major trading partners, and imposes heavy, uncompetitive burdens. As demonstrated, territorial systems in Japan and the UK were implemented to address these problems; preliminary evidence indicates that efforts have been successful.

Canada, Germany, and the Netherlands demonstrate that territorial tax systems can yield sufficient revenues while minimizing the distortions of corporate behavior. In addition, their experiences reveal that home labor markets are not harmed by territorial taxation; all real-world evidence points to the contrary. Importantly, these cases are not the few successful “cherry-picked” outliers of the territorial experience, as evidenced by the aggregate statistics reported previously. The dramatic upsides of territorial taxation come with minimal or potentially nonexistent downsides.

Best Practices

This case study analysis also highlights the variable approaches countries have taken to territorial taxation. Some countries, like Japan, have emphasized protection of the corporate tax base, to minimize incentives for profit-shifting and to promote robust tax yields. Other countries, like the Netherlands and Canada, have emphasized the competitiveness of their companies and defined narrowly what income is not eligible for exemption. Nonetheless, common themes emerge, and the following “best practices” typify competitive territorial tax systems:

- Transitions to territorial taxation have been accompanied by reductions in tax rates. Though rate reductions have been a global trend in their own right, lowering the tax rate is arguably instrumental in attenuating the risks for increased profit shifting.

- They narrowly define passive income, which remains subject to tax. This means that legitimate active business activity is not drawn into the passive income tax base (as happens in the U.S.[120]), and passive income tax provisions are narrowly tailored to capture income artificially shifted overseas.

- They provide preferential treatment for intellectual property, with so-called “patent box” or “innovation box” regimes, to minimize the incentive to shift intangible property into low-tax jurisdictions.

- They permit deductibility of expenses associated with foreign income, to ensure no disincentive for locating R&D or management activity at home. Though U.S. policymakers have considered a territorial system with expense allocation rules,[121] no other territorial system is designed in such a manner.

- They limit the deductibility of foreign interest costs with “thin capitalization rules” in order to guard against abusive income stripping, but not to the extent that deductibility of legitimate borrowing costs is disallowed.

- They limit profit shifting with transfer pricing rules based on the “arm’s length” standard, like the U.S. system.[122]

The key point is that the U.S. could adopt a system with some mix of these basic features. Such a change would represent an improvement in terms of neutrality, efficiency, and simplicity as compared to the current worldwide system.

The Real Effects of A U.S. Transition to Territorial Taxation

If territorial taxation seems to have little influence on labor market outcomes or corporate tax revenue, what real effects could we expect from a U.S. policy change? As mentioned earlier, eliminating the tax on repatriation would invite vast sums of foreign-held earnings back into the U.S. Though it is unrealistic to expect all $1.7 trillion to return, there is evidence that a very sizable portion would flow back into the U.S. In the 2004 repatriation holiday, U.S. companies brought home $360 billion of the roughly $800 billion held abroad.[123] Following the same ratio, $765 billion could be poised for return under similar conditions.

Larry Summers, the former chief economic advisor to President Obama, appreciates the benefits of letting trapped foreign earnings return to the U.S.:

Right now the U.S. tax system, it’s like a library, we’re running a library. The single dumbest thing you can do is announce that you’re going to have everybody think that there’s going to be an amnesty on overdue books, but then not actually ever have the amnesty, because then you assure that no books are ever going to come back, and they’re always not bringing back the book waiting for the amnesty which never comes, and so you never get the money. And that’s what the U.S. debate is right now. Nobody in their right mind would bring in money right now with people thinking that who knows what’s going to happen after the election and who knows what’s going to happen next, there will be some kind or repatriation. Even if you thought you ultimately had to bring the money home, you surely would be waiting right now.[124]

In addition, territorial tax reform could substantially reduce the compliance costs for both firms and the government. Such costs now tally over $40 billion annually,[125] with a disproportionate share associated with the international requirements of the tax code.[126] If the code was simplified, particularly regarding the foreign tax credit and expense allocation regimes, tax planning expenditures would be diverted to productive uses, rather than sunk into the deadweight loss of regulatory compliance. Finally, pursuing a policy of capital ownership neutrality, by ensuring equal tax costs between U.S. firms and their competitors on foreign investment, would minimize distortions of investment and asset ownership[127] and reduce the incentive for companies to leave the U.S.[128]

The Tax Rate

Though this analysis has focused on the international tax system design, the more pressing policy concern is the U.S. top marginal corporate tax rate of 35 percent. While there are tradeoffs in moving toward either territorial or worldwide taxation, “the theme that emerges is that the harmful economic effects of either approach can be addressed by lowering the U.S. corporate tax rate.”[129] Thirty of thirty-four OECD members have reduced tax rates since 2000, and the U.S. rate now exceeds the simple average of other OECD nations by 14.1 points and the GDP-weighted average by 10 points.[130] The U.S. cannot afford to be this far out of step in the face of a changing world and expect to attract investment or foster economic growth.

Conclusion

It is not by accident that 27 of 34 OECD members have territorial systems, and that every independent government tax advisory group has encouraged Congress to discard the current worldwide system in favor of a sleeker territorial model. Even two of the most outspoken critics of territoriality have recently expressed that “there is a lot to like” about the House Republicans’ draft legislation for a territorial system, and that “it is worthwhile to adopt.”[131]

Territorial taxation has been called “a pragmatic response to the practicalities in a world where competition is fast moving and truly global.”[132] The system itself is no silver bullet to heal the economy and bring balance to the budget, but its gains come at little to no cost. The distortions associated with trapped income and the system’s punitive compliance costs greatly outweigh the potential revenue concerns. As evidenced by the fact that the U.S. is now home to 43 fewer companies of the Global 500 than in 2005,[133] the competitiveness of U.S. companies is waning.

Policy should be designed to promote the free flow of capital back into the U.S. rather than to prevent companies from investing abroad. Firms should invest where they can achieve the greatest return; this is good for American investors, American consumers in terms of lower prices, and American workers in terms of greater productivity and correspondingly higher wages. Putting up barriers to growth abroad ultimately slows growth at home.

While some have argued that territorial taxation would be detrimental to the U.S. workforce, economy, and public sector, the evidence here indicates otherwise. The real-world experience of territorial taxation is that it outperforms worldwide taxation on the metrics of concern, specifically unemployment and corporate tax revenue. These lessons should contribute to the sense of urgency now building behind corporate tax reform. A great wind is blowing, and a well-designed territorial system just may alleviate the proverbial headaches.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe[1] President Obama’s tax proposal would lower the top marginal tax rate from 35 to 28 percent to “help encourage greater investment in the United States, and reduce the tax-related economic distortions.” See The White House & Department of the Treasury, The President’s Framework for Business Tax Reform, (Feb. 2012), at 9, http://www.treasury.gov/resource-center/tax-policy/Documents/The-Presidents-Framework-for-Business-Tax-Reform-02-22-2012.pdf.

[2] Scott A. Hodge, The Countdown is Over. We’re #1, Tax Foundation Tax Policy Blog, Apr. 1, 2012, https://taxfoundation.org/article/countdown-over-were-1.

[3] William B. Barker, International Tax Reform Should Begin at Home: Replace the Corporate Income Tax with a Territorial Expenditure Tax, 30 Northwestern Journal of International Law & Business 680 (2010).

[4] Tax Foundation, OECD Corporate Income TaxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. Rates, 1981-2011, June 29, 2012, https://taxfoundation.org/article/oecd-corporate-income-tax-rates-1981-2011.

[5] Various sources. For EU members see Michael P. Devereux et al., Final Report: Project for the EU Commission (TAXUD/2005/DE/3 10) (Sept. 2008), at A-18 (Table A-9), http://ec.europa.eu/taxation_customs/resources/documents/taxation/gen_info/economic_analysis/economic_studies/effective_levels_report.pdf.

[6] See Barker, supra note 3, at 656.

[7] To be eligible for deferral, income must meet a “stringent ‘active trade or business test’ requiring active engagement by the U.S. corporation in the actual development, creation, or production activities.” See Joseph Henchman, Rethinking U.S. Taxation of Overseas Operations: Subpart F, Territoriality, and the Exception for Active Royalties, Tax Foundation Special Report No. 197 (Nov. 22, 2011), https://taxfoundation.org/article/rethinking-us-taxation-overseas-operations-subpart-f-territoriality-and-exception-active-royalties.

[8] Robert Carroll, The Importance of Tax Deferral and A Lower Corporate Tax Rate, Tax Foundation Special Report No. 174 (Feb. 19, 2010), https://taxfoundation.org/article/importance-tax-deferral-and-lower-corporate-tax-rate.

[9] Europe has led this trend as many countries have used territorial tax reform to improve compliance with EU regulations regarding parent-affiliate relationships. However, the EU does not dictate that foreign source dividends, even those from within the EU, must be exempted. Several European countries have held out, including the UK until 2009. See European Commission, Taxation and Customs Union, Parent companies and their subsidiaries in the European Union, http://ec.europa.eu/taxation_customs/taxation/company_tax/parents-subsidiary_directive/index_en.htm (last updated July 25, 2012).

[10] See President’s Council on Jobs and Competitiveness, 2011 Year-End Report, Roadmap to Renewal: Invest in Our Future, Build on Our Strengths, Play to Win, http://files.jobs-council.com/files/2012/01/JobsCouncil_2011YearEndReportWeb.pdf; The President’s Economic Recovery Advisory Board, The Report on Tax Reform Options: Simplification, Compliance, and Corporate Taxation (Aug. 2010), http://www.whitehouse.gov/sites/default/files/microsites/PERAB_Tax_Reform_Report.pdf; National Commission on Fiscal Responsibility and Reform, Report of the National Commission on Fiscal Responsibility and Reform: The Moment of Truth (Dec. 1, 2010), http://www.fiscalcommission.gov/sites/fiscalcommission.gov/files/documents/TheMomentofTruth12_1_2010.pdf; Senators Richard Durbin, Kent Conrad, Mark Warner, Mike Crapo, Saxby Chambliss, & Tom Coburn, A Bipartisan Plan to Reduce our Nation’s Deficits (July 19, 2011), http://thehill.com/images/stories/gangofsix_plan.pdf; Joint Committee on Taxation, Options to Improve Tax Compliance and Reform Tax Expenditures (Jan. 25, 2005), https://www.jct.gov/publications.html?func=startdown&id=1524; President’s Advisory Panel on Federal Tax Reform, Simple, Fair, and Pro-Growth: Proposals to Fix America’s Tax System (Nov. 2005), http://www.treasury.gov/resource-center/tax-policy/Documents/Simple-Fair-and-Pro-Growth-Proposals-to-Fix-Americas-Tax-System-11-2005.pdf; U.S. Department of the Treasury, Office of Tax Policy, Approaches to Improve the Competitiveness of the U.S. Business Tax System for the 21st Century (Dec. 20, 2007), http://www.treasury.gov/resource-center/tax-policy/Documents/Approaches-to-Improve-Business-Tax-Competitiveness-12-20-2007.pdf.

[11] U.S. House of Representatives, Committee on Ways and Means, Camp Releases International Tax Reform Discussion Draft, Oct. 26, 2011, http://waysandmeans.house.gov/News/DocumentSingle.aspx?DocumentID=266168.

[12] Dane Mott, Amy Schmidt, Kapil Dhingra, & Amyn Bharwani, J.P. Morgan, North America Equity Research, “Global Tax Rate Makers: Undistributed Foreign Earnings Top $1.7 trillion; At Least 60% of Multinational Cash is Abroad,” May 16, 2011.

[13] The additional tax burden faced by U.S. companies to bring profits home is not experienced by competitors, which greatly hinders the ability of U.S. firms to compete in the global marketplace. U.S. companies face some of the highest average effective tax rates in the world. See Philip Dittmer, U.S. Corporations Suffer High Effective Tax Rates by International Standards, Tax Foundation Special Report No. 195 (Sept. 2011), https://files.taxfoundation.org/docs/sr195.pdf.

[14] In 2010, the President’s Economic Recovery Advisory Board reported that compliance with the corporate tax code costs businesses $40 billion annually. See The President’s Economic Recovery Advisory Board, The Report on Tax Reform Options: Simplification, Compliance, and Corporate Taxation (Aug. 2010), at 65, http://www.whitehouse.gov/sites/default/files/microsites/PERAB_Tax_Reform_Report.pdf.

[15] Corporate inversions are alive and well in the U.S. See Bret Wells, Cant and the Inconvenient Truth About Corporate Inversions, 136 Tax Notes 429 (July 23, 2012).

[16] One innovative idea is to replace Subpart F with a “base protecting surtax” to backstop base erosion. See Bret Wells, ‘Territorial’ Tax Reform: Homeless Income is the Achilles Heel, 12 Houston Business and Tax Law Journal 1 (2012).

[17] Harry Grubert & Rosanne Altshuler, Fixing the System: An Analysis of Alternative Proposals for the Reform of International Tax, paper presented at Tax Policy Colloquium and Seminar, New York University School of Law, May 1, 2012, available online at http://www.sbs.ox.ac.uk/centres/tax/symposia/Documents/2012/Grubert%20Altshuler%20Fixing%20the%20System%20Oxford%20Version.pdf; Kimberly A. Clausing, A Challenging Time for International Tax Policy, 136 Tax Notes 281 (July 16, 2012).

[18] Philip Dittmer, Would Territorial Taxation Create 800,000 Jobs Abroad at the Expense of U.S. Jobs?, Tax Foundation Tax Policy Blog, July 16, 2012, https://taxfoundation.org/blog/would-territorial-taxation-create-800000-jobs-abroad-expense-us-jobs.

[19] Proponents of worldwide taxation also point to the guiding principle of “capital export neutrality” (CEN), which describes a policy that results in equal worldwide tax burdens between investments at home and abroad. Territorial taxation alternatively satisfies other welfare and neutrality principles, including capital import neutrality (CIN), capital ownership neutrality (CON), and national ownership neutrality (NON). For more on these benchmarks of evaluation, see Mihir A. Desai & James R. Hines, Jr., Evaluating International Tax Reform, (Harvard NOM Research Paper No. 03-48, June 2003), http://papers.ssrn.com/sol3/papers.cfm?abstract_id=425943. CEN has been described as an obsolete framework because firms can self-finance foreign investment or invert the location of their capital ownership and as a practical matter, the U.S. can only enforce equal tax treatment within its borders. See Scott A. Hodge, Ten Reasons the U.S. Should Move to a Territorial System of Taxing Foreign Earnings, Tax Foundation Special Report No. 191 (May 2011), at 4, https://files.taxfoundation.org/docs/sr191.pdf.

[20] The Need for Comprehensive Tax Reform to Help American Companies Compete in the Global Market and Create Jobs for American Workers: Hearing Before the H. Comm. of Ways and Means, 112th Cong. (2011) (statement of Jane G. Gravelle, Senior Specialist in Economic Policy, Congressional Research Service), available online at http://waysandmeans.house.gov/news/documentsingle.aspx?DocumentID=249192.

[21] Madanmohan Ghosh & Weimin Wang, Does FDI Accelerate Economic Growth? The OECD Experience Based on Panel Data Estimates for the Period 1980-2004, 9 Global Economy Journal no. 4 (2009).

[22] Mihir A. Desai, C. Fritz Foley, & James R. Hines, Jr., Domestic Effects of the Foreign Activities of U.S. Multinationals, 1 American Economic Journal: Economic Policy 181 (2009).

[23] Mihir A. Desai, C. Fritz Foley, & James R. Hines, Jr., Foreign Direct Investment and the Domestic Capital Stock (Ross School of Business, Working Paper No. 1023, Jan. 2005), http://deepblue.lib.umich.edu/bitstream/2027.42/41220/1/1023.pdf.

[24] Desai, Foley, & Hines, Jr., Domestic Effects, supra note 22.