In his State of the Union address, President Biden made clear his plans to raise taxes on the rich so they “finally pay their fair share.” The unspoken argument: the rich don’t pay their fair share already.

While two-thirds of Americans would agree, what do the data say?

The data can’t answer the question, but they can help inform the question. They can tell us who pays and how much, revealing whether the U.S. tax system privileges the wealthy . . . or relies on them.

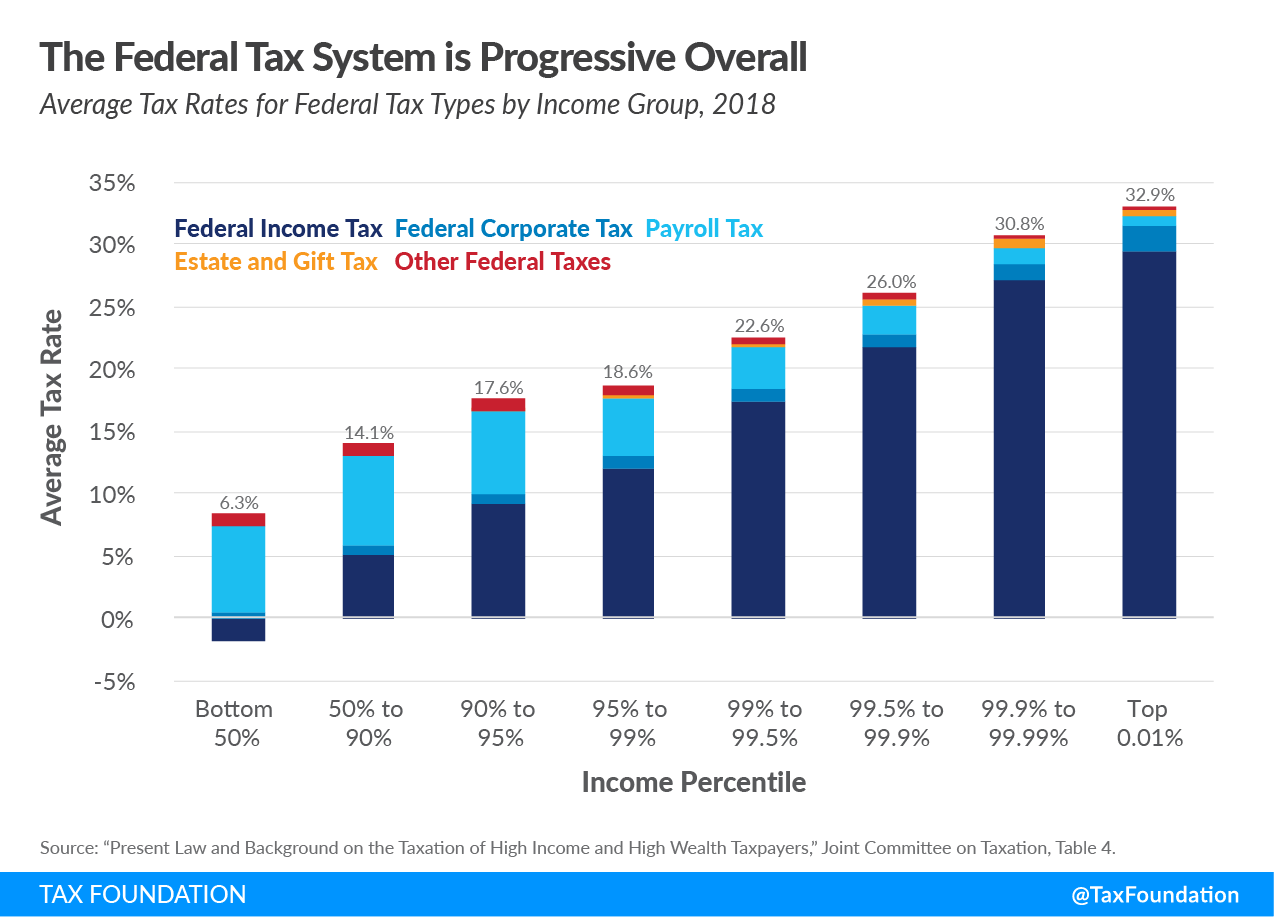

The Overall Federal Tax System Is Progressive

The federal tax system consists of individual, corporate, payroll, excise, and estate taxes. Some tax types are progressive (meaning people with higher incomes pay higher rates) while others are regressive (people with lower incomes pay higher rates). But taken together, the overall federal tax system is progressive.

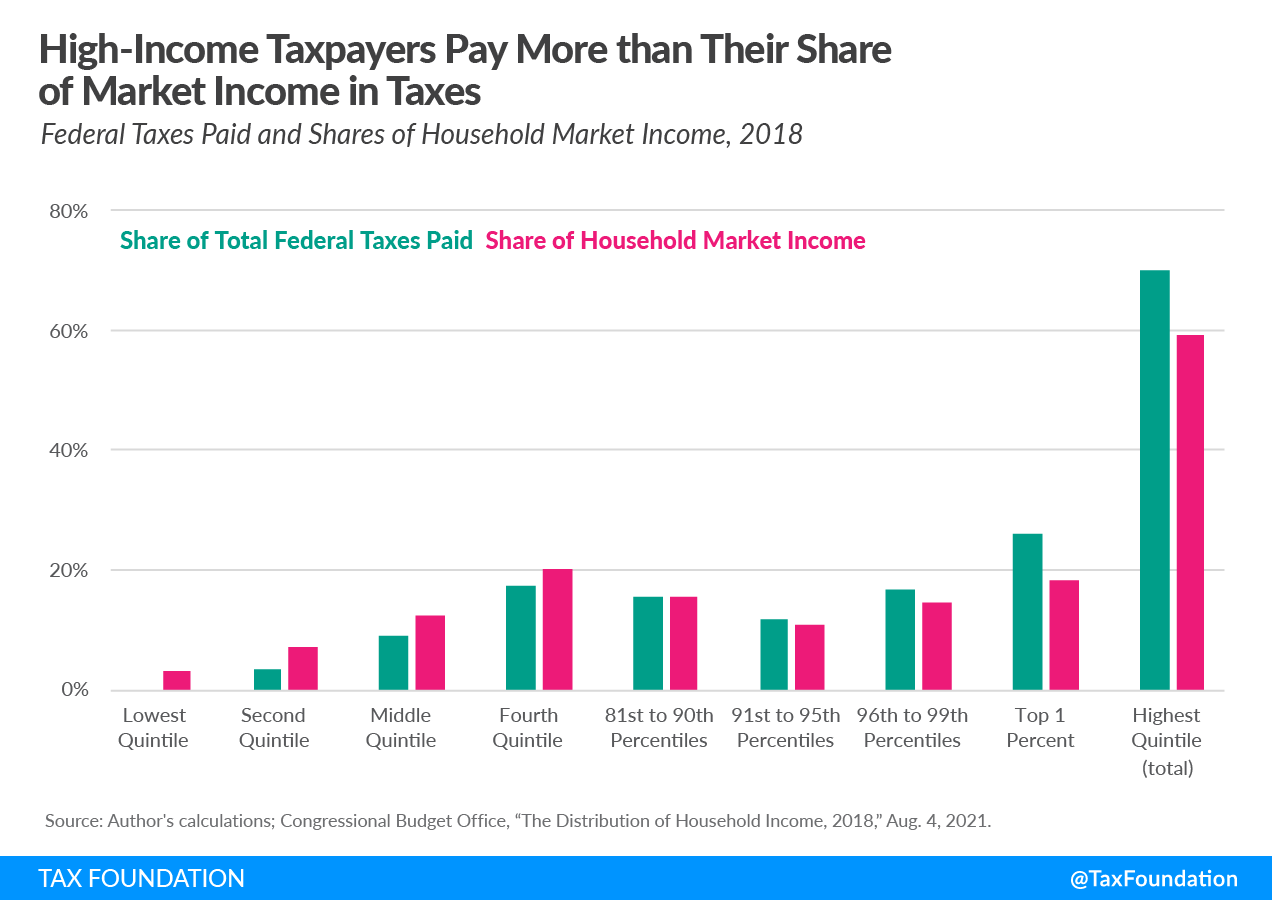

This is because the rich have more of the country’s income, right? Not exactly. High earners actually pay more in taxes than their share of the country’s income and are subject to higher tax rates on their income.

For example, in 2018, the top 1 percent of earners took home 18.3 percent of market income but paid 25.9 percent of all federal taxes. Similarly, the top 20 percent of earners received 59.1 percent of market income yet paid 68.9 percent of federal taxes. Their slice of the tax pie exceeded their slice of the income pie.

What’s the Trend?

The U.S. federal tax system has gotten more progressive over the past few decades, but especially so in the last few years. During the pandemic, the federal government passed relief policies to get people through tough times, but these programs also increased the tax and transfer system’s progressivity. The bottom one-fifth of earners, for example, saw their average tax rate fall by 17 percentage points, while the top fifth’s average rate decreased by less than one percentage point.

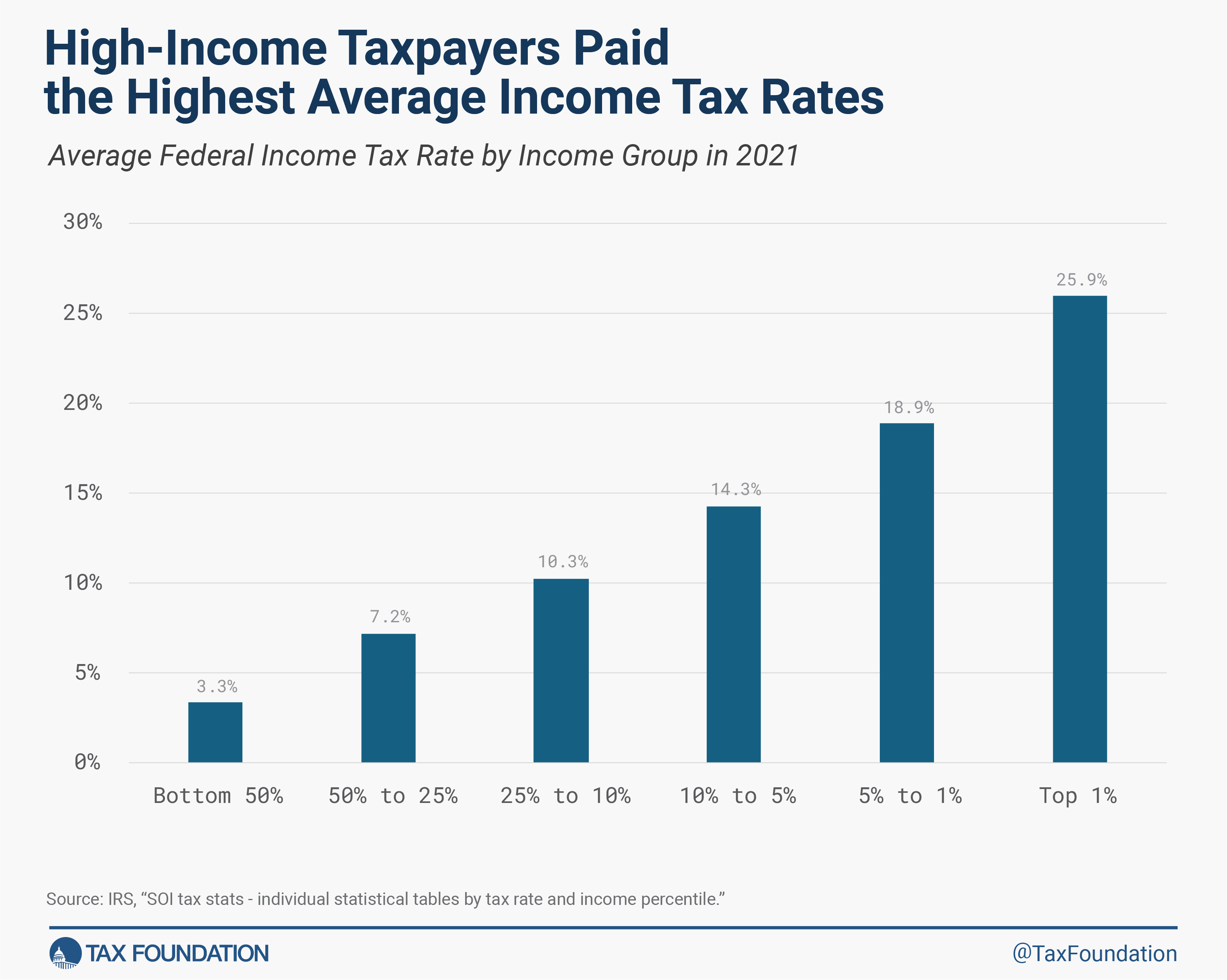

What Drives the Federal Tax Code’s Progressivity?

The federal income tax drives the tax code’s progressivity. In 2021, taxpayers with higher incomes paid much higher average income tax rates than taxpayers with lower incomes.

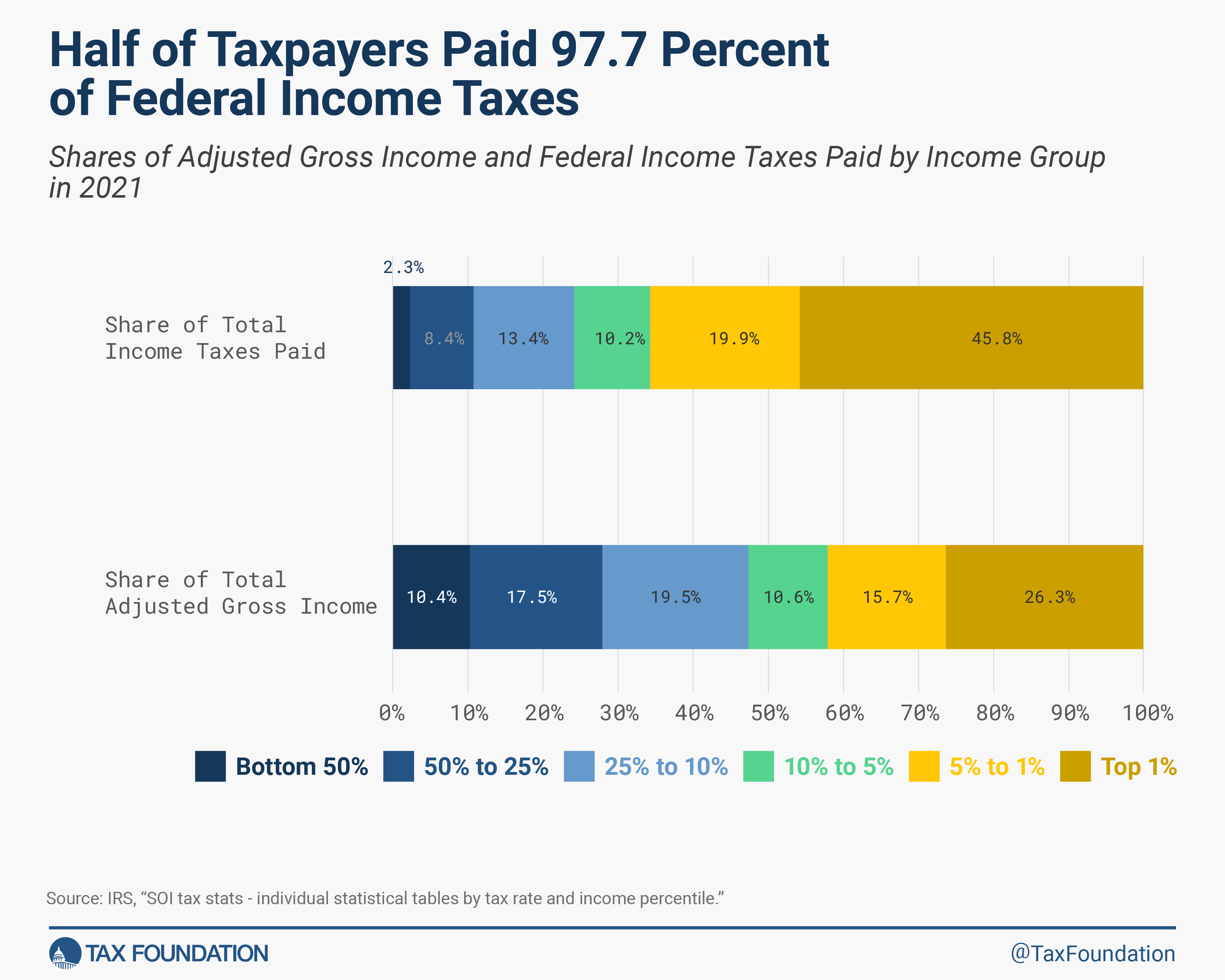

And, like the system overall, high earners’ slice of the income tax pie exceeded their slice of the income pie.

In 2021, the top 1 percent paid 45.8 percent of all federal income taxes, yet their share of the country’s income was 26.3 percent. The top 50 percent of all taxpayers paid 97.7 percent of all federal individual income taxes, while the bottom 50 percent paid the remaining 2.3 percent.

Pros and Cons of a Progressive TaxA progressive tax is one where the average tax burden increases with income. High-income families pay a disproportionate share of the tax burden, while low- and middle-income taxpayers shoulder a relatively small tax burden. Code

A progressive tax system tries to align taxes with people’s spending power (i.e., their ability to pay). Someone making $1 million per year, for example, can afford to pay more in taxes than someone making $50,000 per year. A progressive tax system, therefore, reduces the burden on people who can least afford it.

But a progressive tax code comes with trade-offs, the most prominent being lower economic growth. Higher marginal tax rates change the incentives to work, invest, and innovate, which can negatively impact jobs, wages, and people’s standards of living.

Stay updated on the latest educational resources.

Level-up your tax knowledge with free educational resources—primers, glossary terms, videos, and more—delivered monthly.

Subscribe